Cardinal gold project could yield US$1.4 billion cash

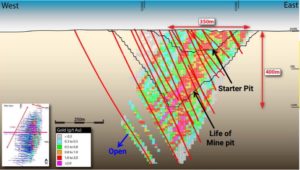

Cross-section of the Namdini gold project in Ghana showing proposed open pits. Source: Cardinal Resources Ltd.

Cardinal Resources Ltd. [CDV-TSX, ASX; OTC-CRDNF] on Tuesday September 18 released the results of a Preliminary Feasibility Study (PFS) for its Namdini gold project in Ghana, West Africa.

The PFS study offers confirmation that Namdini is one of Ghana and Africa’s most promising undeveloped large gold assets, the company said in a press release. “The financial modelling of the project shows it to be technically sound and financially viable and could generate US$1.4 billion free cash flow (pre-tax) utilizing the 9.5 million tonnes per annum (Mtpa) throughput model,” the company said.

Cardinal shares were unchanged at 44 cents on the news. The stock is currently trading in a 52-week range of $1.05 and 36.5 cents.

Ranking high among the more politically stable countries on the African continent, Ghana has been a happy hunting ground for gold explorers, developers and producers for over 120 years.

Most of that activity has centred on southern Ghana, which remains one of the world’s most prolific areas for gold exploration and production, producing 4.13 million ounces of gold in 2016, up from 2.8 million ounces the previous year.

Namdini is located is in the upper northeastern region of Ghana, approximately 30 km southeast of the regional centre of Bolgatanga.

Namdini is a “brand new discovery,” and ranks as one of the biggest West African gold discoveries in the past decade, Cardinal Resources CEO Archie Koimtsidis has said.

Indeed, there is clear potential for an interim resource in excess of 6 million ounces, according to Toronto-based Clarus Securities Inc. and Hartleys Ltd. of Perth Australia.

The Namdini deposit is a structurally controlled orogenic deposit with numerous features similar to deposits found elsewhere in late Proterozoic Birminian terranes of West Africa.

Highlights from the PFS included an estimated probable ore reserve of 4.76 million ounces from 129.6 million tonnes, at 1.14 g/t gold. The study also foresees an all-in sustaining cost for the first 2.5 years of US$599 an ounce.

The development cost for the 9.5 Mtpa throughput plant is estimated at US$414 million, down from an earlier estimate of US$424 million.

“We now have a compelling business case to move into the Definitive Feasibility Study phase for the 9.5 Mtpa throughput processing facility based upon the optimum return on capital employed,” said Koimtsidis in the press release, Tuesday.

“The feasibility study is fully funded and will form the basis for the development of our Namdini Project in Ghana with completion anticipated in the third quarter of 2019,” he said.

The company has also been actively engaged in exploration activities on its extensive land holdings. They include the company’s Bolgatanga Project, which is close to Namdini.