Azincourt set for Saskatchewan uranium drilling

By Peter Kennedy

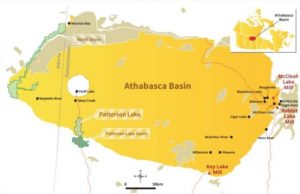

Azincourt Energy Corp. [AAZ-TSXV; AZURF-OTC], said Wednesday March 20 that it has launched a Phase one drilling program at its East Preston uranium project in the western Athabasca Basin of northern Saskatchewan.

Azincourt is currently earning towards a 70% interest in the 25,000-hectare Eastern portion of the Preston project as part of a joint venture agreement with Skyharbour Resources Ltd. [SYH-TSXV; SYHBF-OTCQB] and Clean Commodities Corp. [CLE-TSXV].

East Preston is near the southern edge of the western Athabasca Basin, where targets are a near surface environment without Athabasca sandstone cover. Therefore, they are relatively shallow targets but can have great depth extent when discovered.

The Preston Project is one of the largest tenure land positions in the Paterson Lake region and is strategically located near NexGen Energy Ltd.‘s [NXE-TSX, NYSE] high-grade Arrow deposit, Fission Uranium Corp.‘s [FCU-TSE] Triple R deposit and the Spitfire high-grade discovery on the Hook Lake project, which is owned jointly by Cameco Corp. [CCO-TSX; CCJ-NYSE], Orano Canada Inc. (formerly known as Areva Canada Inc.) and Purepoint Uranium Group Inc. [PTU.V-TSX].

Orano recently optioned 49,635 hectares of the Preston Project for up to $7.3 million in exploration spending.

The Athabasca Basin is best known as the world’s leading source of high-grade uranium and contributes 20% of the world’s supply.

Extensive regional exploration work at East Preston was completed in 2013-14, including airborne electromagnetic (VTEM), magnetic and radiometric surveys. Three prospective conductive, low magnetic signature corridors have been discovered on the property. The three distinct corridors have a total strike length of over 25 km, each with multiple EM conductor trends identified.

Ground prospecting and sampling work completed to date has identified outcrop, soil, biogeochemical and radon anomalies, which are key pathfinder elements for unconformity uranium deposit discovery.

Only one of the corridors has been drill tested so far, successfully intersecting structurally disrupted graphitic metasedimentary rocks and anomalous pathfinder elements (including uranium) at the Swoosh S6 target using a combination of horizontal loop EM and gravity as primary targeting tools.

The company completed a winter geophysical program in January-February 2018 that generated a significant amount of new drill targets within the previously untested corridors while refining additional targets near previous drilling along the Swoosh corridor.

Over $2 million has been spent on exploration on the East Preston project over the past three years.

On Wednesday, Azincourt said a crew is on site and has completed construction of the first two drill pads.

Meanwhile, the company said it has closed a $362,650 second tranche of its non-brokered private placement, generating proceeds of $1.2 million. In connection with the second tranche closing, the company issued 1.6 million flow-through units and 5.4 million non-flow-through units at a price of $0.05 per unit.

Each flow-through unit consists of one flow-through common share and one common share purchase warrant. Each warrant will entitle the holder to purchase one additional common share for a period of five years at $0.07 per common share.

On Wednesday, Azincourt Energy shares were unchanged at $0.05 on volume of 1.7 million. The 52-week range is $0.045 and 15 cents.

Before a powerful earthquake and tsunami disabled three reactors at the Fukushima nuclear plant in Japan, spot uranium was priced at US$72.63 a pound.

The radioactive metal lost 70% of its value in the wake of the Fukushima disaster. In spite of the recent rebound to US$27 a pound from a low of US$18.50 in late 2016, spot prices remain at levels that are too low to incentivize the development of new mines.

However, hopes for uranium price recovery are driven by recent production cuts by two of the world’s leading producers, Cameco and Kazakh state-owned Kazatomprom, as well as by forecasts of rising nuclear industry consumption in the next four years.

Optimists point out that 55 nuclear reactors are currently being constructed around the world, a scenario that will require a steady supply of nuclear fuel.

Aside from uranium, Azincourt is currently active at its joint venture lithium exploration projects in the Winnipeg River Pegmatite Field in Manitoba. It is also engaged in the Esalera Group uranium-lithium project on the Picotani Plateau in southeastern Peru.