Barkerville Gold raises $11 million for development of British Columbia mine

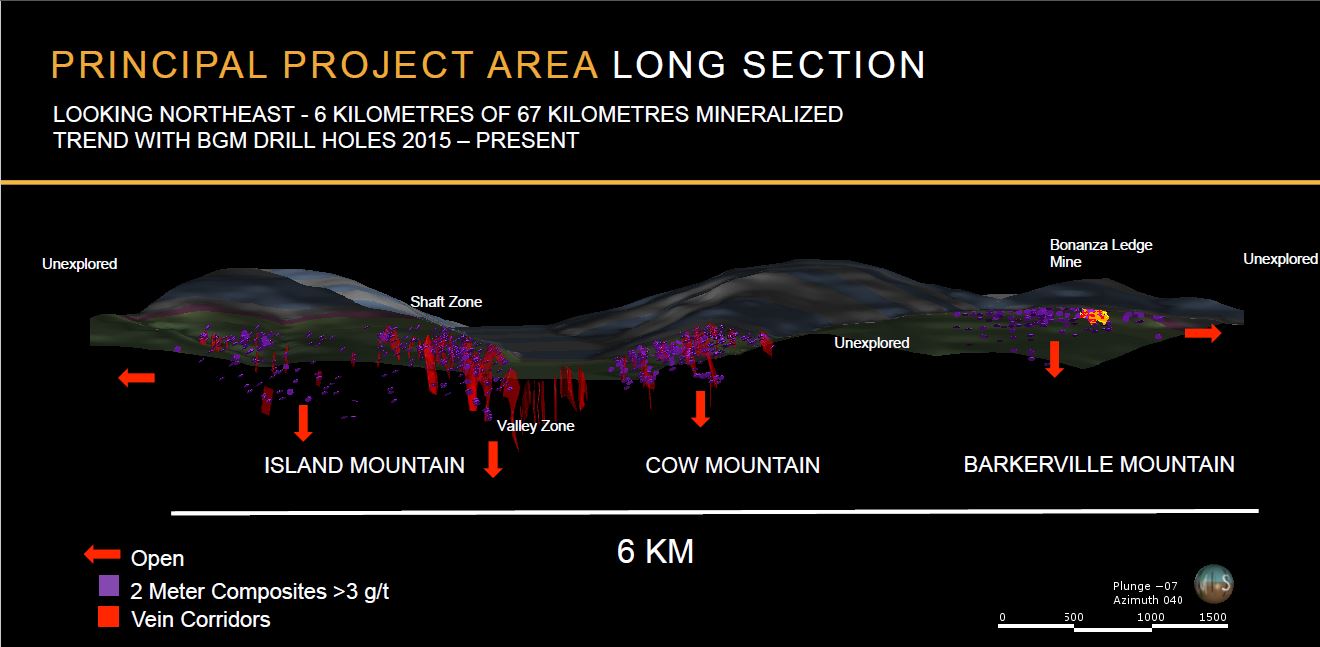

A cross section of the Barkerville Gold Mines properties. Source: Barkerville Gold Mines Ltd.

Barkerville Gold Mines Ltd. [BGM-TSXV; BGMZF; IWUB-FSE] said Thursday December 28 that it has raised $11 million for the purpose of financing ongoing exploration and development at the company’s flagship Cariboo gold project in central British Columbia.

Backed by Osisko Gold Royalties Ltd. (OR-TSX, NYSE) and Osisko Mining Inc. [OSK-TSX], Barkerville is moving ahead with big plans to develop an underground mine and milling operation on the company’s extensive land package, which covers 2,100 km2.

During an interview that is posted on Barkerville’s website, President and CEO Chris Lodder said he envisages initial production of 150,000 ounces of gold annually from an operation that might cost between $300 million and $400 million to develop.

The development timetable includes the announcement of a new underground resource estimate in early 2018 and the launching of a feasibility study by mid-2018. That would be followed by the launch of a permitting process and possible mine commissioning in 2021, Lodder said.

To help fund those plans, the company is processing about 30,000 tonnes of ore this year, material that is being processed at a milling facility near Wells, B.C., about 110 km from the mine site.

“We are taking this seriously. We are building a mining company. It is a company that is basically going to be a platform for [Osisko in] western Canada,” said Lodder.

Meanwhile, the company has been carrying out lot of drilling and plans to complete an additional 120,000 metres in 2018, Lodder said.

Needing to fund that work, the company said Thursday it has completed a bought deal brokered private placement of 10.9 million common shares that will qualify as flow-through shares at $1 per share. The offering was co-led by Haywood Securities Inc. and Canaccord Genuity Corp. In consideration for their services, the underwriters received a cash commission equal to $289,400.

Barkerville’s land package includes several past producing hard rock mines in the Barkerville Gold Mining Camp. The portfolio also includes a fully-permitted 900 tonne-per-day gold milling and tailings facility, known as the QR Project. Lodder said previous management did a good job of assembling the existing land package. But he said the company has been unable to verify rosy resource estimates by the former management team.

Barkerville shares eased 1.4% or $0.01 to 72 cents Thursday.