Copper Mountain acquiring Australian Altona Mining

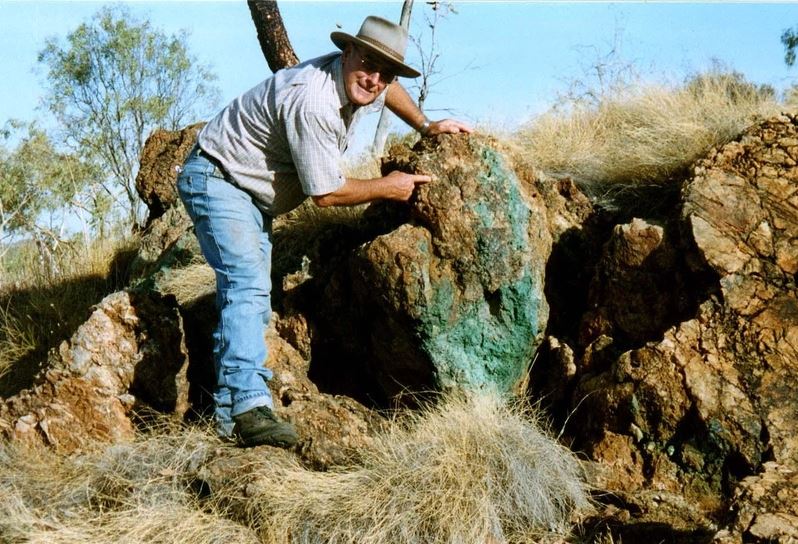

Lady Clayre, high grade copper outcrop

Copper Mountain Mining Corp. [CMMC-TSX] has agreed to acquire the entire issued capital of Altona Mining Ltd. [AOH-ASX]. The merger would result in Altona becoming a wholly owned subsidiary of Copper Mountain.

Under the transaction, each share of Altona will be exchanged for 0.0974 of either a CHESS depositary interest of Copper Mountain, which will trade on the Australian Securities Exchange (ASX), or, if elected, a Copper Mountain common share, which trades on the TSX. Total consideration offered for all of the outstanding shares of Altona is valued at approximately $93-million (Australian) and represents 17 Australian cents per share, a 41.7% premium to 12 Australian cents, the closing price of Altona shares on the day prior to the execution of the merger.

Altona’s key asset is the 100%-owned undeveloped open-pit Cloncurry copper project in Queensland, Australia. Cloncurry currently has a measured and indicated mineral resource containing over 2 billion pounds (950,000 tonnes) of copper and an inferred resource of 1.6 billion pounds (720,000 tonnes) of copper. There is potential to add resources at depth and along strike in each of the deposits, and through exploration at numerous prospective targets within Altona’s approximate 397,000-hectare (3,970 km2) land package.

Copper Mountain’s principal asset is the 75%-owned, large, open-pit Copper Mountain mine located near Princeton, southwest British Co;umbia. Copper Mountain has a strategic alliance with Mitsubishi Materials Corp. which owns 25% of the Copper Mountain Mine and purchases 100% of the copper concentrate produced under a life-of-mine offtake agreement.

Copper Mountain is on track to achieve production guidance for 2017 of 75 million to 85 million pounds (34,000 to 38,500 tonnes) of copper. The Copper Mountain mine has a large resource that remains open laterally and at depth.

Directors and senior management of Altona have agreed to vote in favour of the scheme in the absence of a superior proposal, subject to the independent expert concluding the scheme is in the best interest of shareholders. Directors and senior management of Altona have provided voting intention statements in favour of the scheme.

Highlights of the proposed combination

- A multijurisdictional, mid-tier copper producer;

- Annual potential copper production of approximately 160 million pounds (73,000 tonnes) of copper by 2020;

- Combined proven and probable reserves of 2.1 billion pounds (920,000 tonnes) of copper;

- Combined measured and indicated resources over 4.1 billion pounds (1.8 million tonnes) of copper and an additional 3.6 billion pounds (1.5 million tonnes) of copper in inferred resources;

- One of the leading Toronto Stock Exchange-/Australian Securities Exchange-listed copper production companies, with significant production growth and exploration potential in two tier one mining jurisdictions;

- The combined company will have approximately $78-million in cash;

- Enhanced trading liquidity in both Canada (TSX) and Australia (ASX);

- Pro forma market cap of approximately $300-million, with Copper Mountain shareholders owning 71.5% and Altona shareholders owning 28.5% of the combined entity;

- The strength and complementary nature of Altona’s assets, management team, regional operating experience and exploration expertise give Copper Mountain a stronger platform to grow;

- Copper Mountain’s construction and operational experience are well positioned to bring Cloncurry into production;

- Offer represents a 41.7% premium to Altona’s price of 12 Australian cents per share, being the closing price on the day prior to the execution of the MID;

- Major Altona shareholder (Matchpoint) has indicated support for the scheme.

Jim O’Rourke, President and CEO of Copper Mountain, said, “Our Copper Mountain Mine is an efficient, stable operation with a long life ahead of it. At current copper prices, it is generating significant cash flow. For some time, Copper Mountain has patiently been evaluating cost competitive opportunities to achieve a step change in copper production. Cloncurry exemplifies the criteria of low risk, near term and high quality for which we have been seeking. We intend to progress Cloncurry into production with the aim of doubling Copper Mountain’s copper production profile to the range of 160 million pounds (73,000 tonnes) of copper per annum with significant precious metals credits. This additional copper production is timely to capitalize on the projected strong copper cycle.”

Dr. Alistair Cowden, Managing Director of Altona, added, “We are delighted to join Copper Mountain to form a new high-growth copper producer. We are excited to bring Copper Mountain’s depth of experience in constructing and operating a large-scale, open-pit copper mine to bear upon the Cloncurry copper project. Altona’s shareholders will receive a premium and will also gain immediate exposure to copper production just as copper prices have recovered and market shortfalls are predicted over the near term. This is a great opportunity for our shareholders to participate in the creation of a leading mid-sized copper producer.”

Copper Mountain will continue to be headquartered in Vancouver, B.C., and plans to retain a regional office in Perth, Australia, on implementation of the scheme. Dr. Cowden will remain in his position until the scheme closes, after which he will be appointed to join the board of directors of Copper Mountain and will continue in an executive role in Australia.