International Frontier signs financial partnership with Export Development Canada

Calgary-based International Frontier Resources Corp. [IFR-TSXV; IFRTF-OTCQB] reported the closing of an Account Performance Security Guarantee (APSG) facility of US $882,050 with Export Development Canada (EDC). The APSG facility is provided as 50% of a performance bond issued by joint venture company Tonalli Energia.

Calgary-based International Frontier Resources Corp. [IFR-TSXV; IFRTF-OTCQB] reported the closing of an Account Performance Security Guarantee (APSG) facility of US $882,050 with Export Development Canada (EDC). The APSG facility is provided as 50% of a performance bond issued by joint venture company Tonalli Energia.

“Having EDC as a financial partner is an important step in the ongoing growth of IFR and we look forward to building on this strategic relationship,” said Steve Hanson, IFR’s President and CEO. “IFR is honored to be the first Canadian oil and gas exploration and production company to be backed by EDC in Mexico.”

Mexico denationalized its oil and gas sector in 2014.

“IFR’s early success in Mexico provides a great example of the world-class expertise that Canada’s junior oil and gas companies have to offer in emerging markets,” said Mark Senn, regional Vice-President, Western region, EDC. “With the energy reforms taking place in Mexico right now, we believe there are tremendous opportunities to be had in that sector, and IFR has just proven that Canadian companies have what it takes to compete and win in the market.”

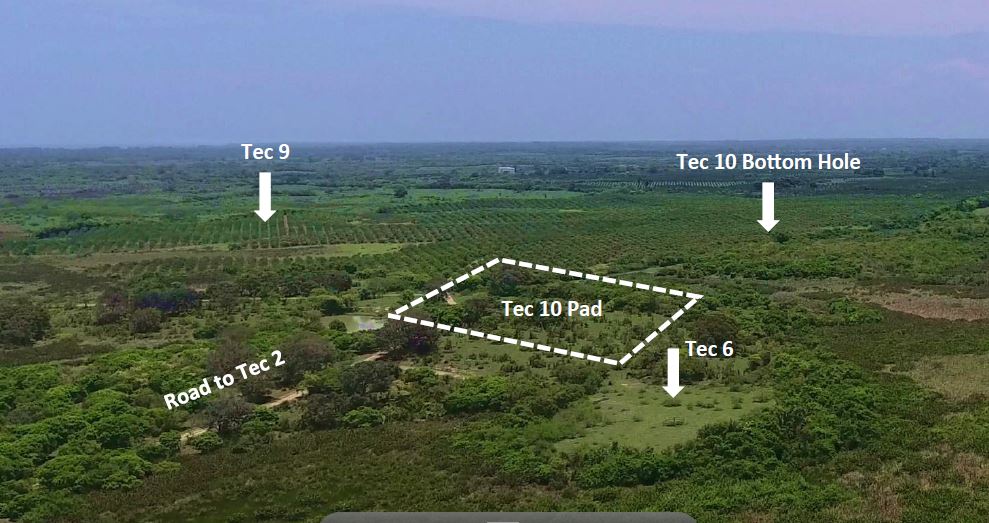

On Aug. 25, 2016 Tonalli met all the terms and conditions and signed a licence contract with the Mexico Comision Nacional de Hidrocarburos (CNH) for the onshore oil and gas development block 24 (Tecolutla), granting Tonalli the right to develop and produce hydrocarbons. Tonalli is a Mexican company with the share ownership split equally between IFR and Mexican petrochemical leader Grupo Idesa.

As required by the CNH, Tonalli had secured from a Mexican institution a US $1,764,100 performance bond toward the guarantee of performance of the minimum work programs. Upon completion of the minimum work program, the performance bond will be returned.

The Tecolutla block was awarded to Tonalli as part of the first round and third call of Mexico’s oil and natural gas “mature fields” bid round (Round 1.3), the first in almost 80 years. Each of the blocks offered in Round 1.3 attracted multiple bids.

Through its Mexican subsidiary, Petro Frontera S.A.P.I de CV (Frontera) and strategic joint ventures, International Frontier is advancing the development of petroleum and natural gas assets in Mexico.