Marathon Gold Announces Positive PEA for the Valentine Lake Gold Camp, Newfoundland

Marathon Gold Corporation (TSX: MOZ) is pleased to announce the excellent results of an independent Preliminary Economic Assessment study (“PEA”) on its 100% owned Valentine Lake Gold Camp, central Newfoundland. The PEA provides a base case assessment of developing the Valentine Lake Gold Camp mineral resource by open pit mining, and gold recovery by a combination of a milling circuit and heap leaching, incorporating gravity and flotation circuits with leaching of the concentrate and tails.

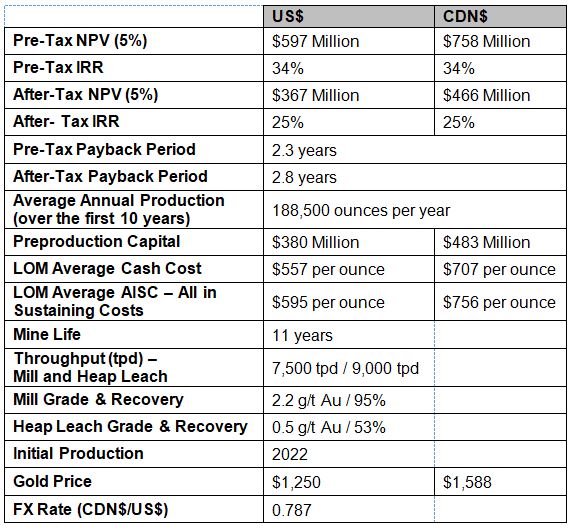

Table 1 – PEA Summary

Phillip Walford, President and CEO of Marathon commented, “The study is an exciting milestone in the development of the Valentine Lake Gold Camp in mining friendly Newfoundland. The results demonstrate that a very robust, low cost operation is possible. The study has also identified several opportunities to enhance the mine plan and economics of the project as well as to extend mine life. There is exploration potential for additional open pit resources at the Sprite Deposit including the bog extension area, the Marathon Deposit to the southwest, the Victory Deposit and other mineralized zones such as the Frank Zone and the Rainbow Zone. There is also a large underground resource at the Marathon Deposit that is not at present drilled off in sufficient detail to develop into a mine plan. Additional drilling in 2018 is planned to further define this underground resource in time for the next economic study. The cost of finding a new ounce of gold on the property remains at $10 per new ounce so our exploration program continues to be highly cost-effective.”

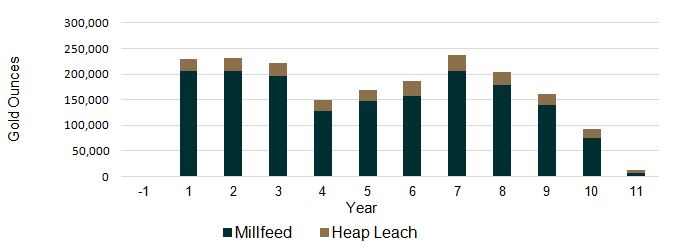

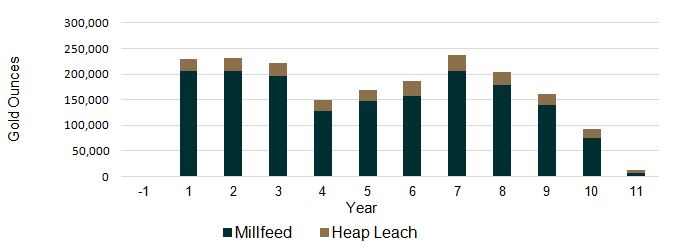

Figure 1 – Valentine Lake Gold Camp Annual Gold Production

Description of the Valentine Lake Project and PEA

The PEA was developed by a team of independent consultants consisting of Lycopodium Minerals Canada Ltd. (“Lycopodium”), John T Boyd Company (“Boyd”), Apex Geoscience Ltd. and Stantec Consulting Ltd. (“Stantec”).

The Valentine Lake Project (“The Project”) is composed of four deposits: Marathon, Leprechaun, Victory and Sprite. The mineral resource estimate was updated on May 1st, 2018 and the results are shown in Table 9. Following initial pit optimization, the Sprite deposit was excluded from mine development until additional exploration drilling has increased the resource. For the Marathon, Leprechaun and Victory deposits, standard surface mining techniques will be utilized to develop three open pit mining areas.

The ultimate pit designs developed for the Valentine Lake Project are based on the results of Whittle pit optimization work. The three mining areas will be developed using a total of 15 distinct mining phases designed to approximate the optimal extraction sequence. Pit design parameters, such as wall slope angles and bench dimensions, were provided by Stantec. A mine production schedule for the entire complex was prepared by Boyd using Maptek’s Chronos scheduling software.

The Valentine Lake Project consists of two gold recovery operations: a Milling/Flotation/Carbon in Leach plant (“Mill”) and a Heap Leach plant. The Mill will process 2.5 Mtpa of high grade ore. The plant will consist of crushing, milling, gravity recovery, flotation of gravity tails, flotation concentrate regrind, cyanidation leaching of both flotation concentrate and flotation tailings via a CIL circuit, carbon elution and gold recovery circuit. CIL tails will be treated for cyanide destruction and disposed of as tails in the tailings storage facility.

The Heap Leach pad will process 3.0 Mtpa of low grade ore from open pit operations and will consist of crushing, heap leaching and carbon-in-column gold adsorption. The loaded carbon from the Heap Leach facility will be sent to the Mill facility for gold recovery.

Table 2 – Production Schedule

Cashflow Analysis

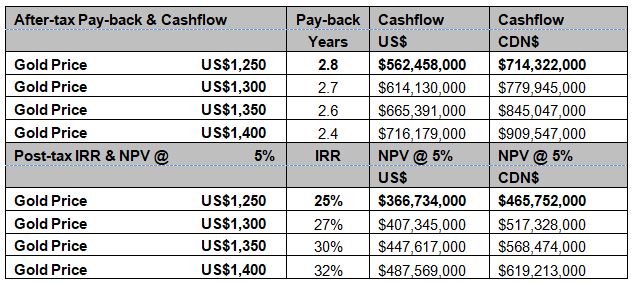

The results of the discounted cash flow analysis are presented in Tables 3 and 4. NPV, IRR and payback values for the Project are estimated on a pre-tax and after-tax basis. The base case scenario assumes a long-term gold price of US$1,250 per ounce and a discount rate of 5%. The gold price sensitivity on a pre-tax and after-tax basis demonstrates the significant potential increase in the NPV and IRR of the Project should the gold price continue to trade in a range of US$1,300 to US$1,400 per ounce.

Table 3 – Pre-tax Cashflow and NPV Gold Price Sensitivity

Table 4 – After-tax Cashflow and NPV Gold Price Sensitivity

After-tax cash flows reflect the impact of the Newfoundland Mining Tax, calculated based on 15% of net income from mine operations and a combined Federal and Provincial income tax rate of 30%.

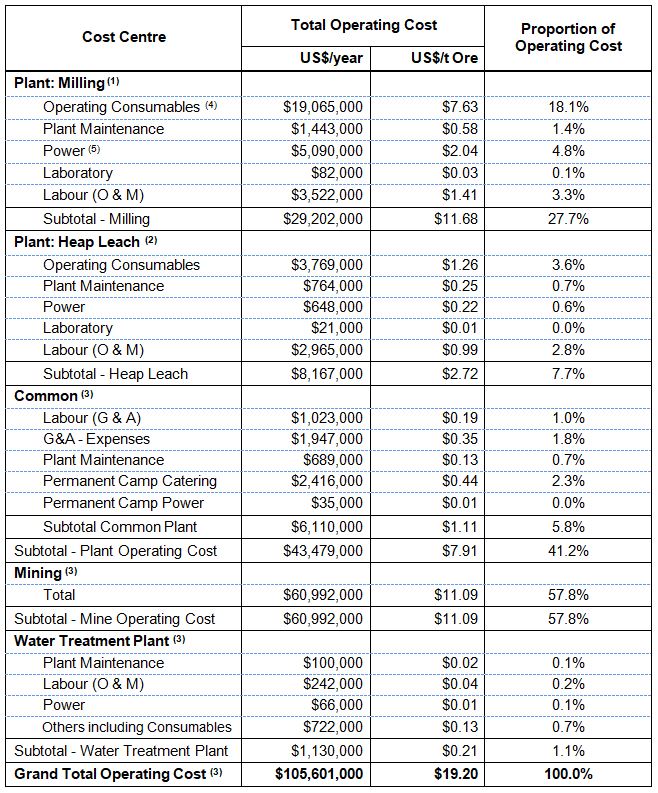

Operating Cost

The PEA estimates that the Project will produce approximately 1,896,000 ounces of gold during the life of the Project, or an average of 188,500 ounces per year for years 1 to 10.

Mine operating costs were calculated from first principles using vendor-supplied estimates and Boyd’s experience with similar mining operations. Fuel costs were calculated based on vendor-provided fuel consumption and a vendor quote for diesel of US$0.846/l. Over the life of the Project, overall mining operating costs, excluding rehandle, are estimated to be US$1.613/tonne mined.

The process plant operating costs were developed by Lycopodium based on a design processing rate of 2.5 Mtpa of ore for the milling circuit and 3.0 Mtpa of ore for the heap leach circuit. Both circuits will normally operate 24 hours/day, and 365 days/year with 75% (6,570 hours/year) crushing plant availability and 91.3% plant utilization (nominal 8,000 hours/year operation). The process operating costs for the Project have been developed in detail according to typical industry standards applicable to gold ore processing plants.

The operating cost estimates are expressed in US$ in Q1 2018 terms and have an overall accuracy of +/-25%.

Contingency

No contingency was specified for the operating cost estimate as most costs were derived from first principles, based on metallurgical test work, reagent and consumable pricing, and industry standards.

Details of the estimated operating costs and other charges are presented in Tables 5 and 6.

Table 5 – Operating Cost

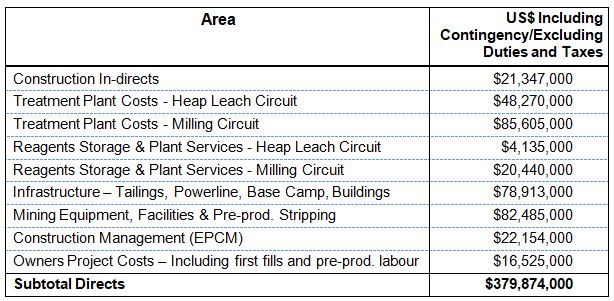

Capital Cost

The capital cost estimate was based on an engineering, procurement and construction management (“EPCM”) implementation approach and typical construction contract packaging.

Equipment pricing was based on quotations and actual equipment costs from recent similar Lycopodium projects considered representative of the Project.

All costs are expressed in US$ unless otherwise stated and are based on the Q1 2018 pricing. The estimate is deemed to have an accuracy of +/- 35%. The capital cost estimate conforms to AACEI (Association for the Advancement of Cost Engineering International) Class 4 estimate standards as prescribed in recommended practice 47R11.

Contingency

Contingencies were applied to the capital cost estimate on a line-by-line basis as an allowance by assessing the level of confidence in the engineering, estimate basis and vendor or contractor information. The contingencies do not cover scope changes, design growth, or the listed qualifications and exclusions. The resultant contingency for the capital estimate is 15% before taxes and duties.

Table 7 – Capital Estimate Summary by Area

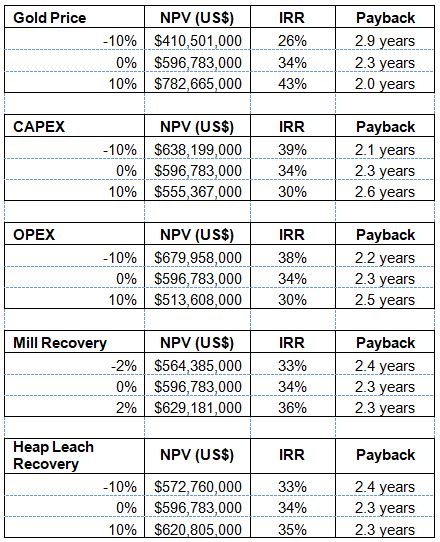

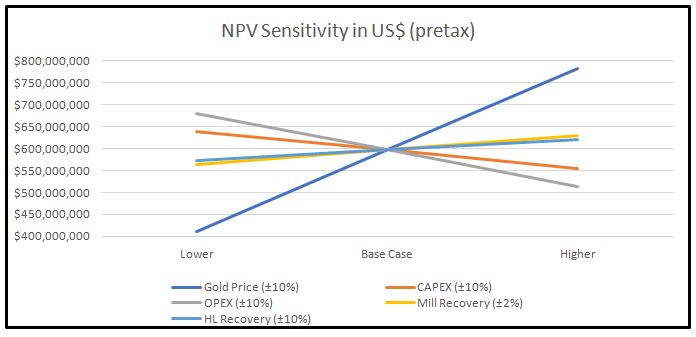

Sensitivities

As indicated in Table 8 and Figure 2, project cashflow and NPV are particularly sensitive to changes in the price of gold while relatively less sensitive to changes in recovery, operating costs and capital expenditures. The table below shows the effect on the pre-tax economics of the Project increasing or decreasing the price of gold, capital expenditures, operating costs and mill and heap leach recovery estimates by up to +/- 10%.

Table 8 – Sensitivities, Pre-Tax

Figure 2 – NPV Sensitivity, Pre-Tax

Opportunities for Project Enhancement

The PEA identified several areas where additional work will advance the Project and reduce risk. The major focus of the work planned this year is summarized below:

- Drilling is planned to expand and upgrade the Valentine Lake Gold Camp resources. The deposits are open at depth and along strike. Geological and geophysical studies indicate the structure hosting gold mineralization may continue both east and west of the current resources as well as down plunge. Addition of further resources through drilling has the potential to increase the life of mine and resulting economics.

- The underground resource has not been utilized in the PEA. Infill drilling could contribute an additional 800,000 ounces or more to be extracted using underground mining methods.

- Additional hydrogeological and geotechnical work will enable better open pit and underground designs.

- Further metallurgical testing for the mill and the heap leach may result in improved recoveries. Options such as high-pressure grinding rolls (“HPGR”) ahead of the heap leach and a coarser grind in the mill could also have the potential to reduce operating costs with little impact on process recovery.

Table 9 – Mineral Resource Estimate

1. The effective date for this mineral resource estimate for Leprechaun, Sprite, and Victory is November 27, 2017 and is reported on a 100% ownership basis. The effective date for the mineral resource estimate for Marathon is March 5, 2018. The resources have been restated using the updated PEA economics. All material tonnes and gold values are undiluted.

2. Mineral Resources are calculated at a gold price of US$1,250 per troy ounce.

3. The open pit mineral resources presented above uses a PEA level open pit design. The underground mineral resources are that material outside of the in-pit mineral resources above the stated underground cut-off grade.

4. Mineral resources which are not mineral reserves do not have demonstrated economic viability. The estimate of mineral resources may be materially affected by environmental, permitting, legal, title, socio-political, marketing, or other relevant issues.

5. The mineral resources presented here were estimated using a block model with a block size of 6 m by 6 m by 6 m sub-blocked to a minimum block size of 2 m by 2 m by 2 m using ID3 methods for grade estimation. Mineral resources for the Leprechaun and Sprite deposits are reported using an open pit gold cut-off of 0.267 g/t Au and an underground gold cut-off of 1.840 g/t Au. Material between a 0.267 Au g/t value and 1.055 Au g/t is assumed to be processed on a heap leach. Material above a 1.055 Au g/t is assumed to be processed in a mill. Higher gold grades were given a limited area of influence and was applied during grade estimation by mineralized domain. Mineral resources for the Marathon deposit are reported using an open pit gold cut-off of 0.312 g/t Au and an underground gold cut-off of 1.619 g/t Au. Material between a 0.312 Au g/t value and 0.707 Au g/t is assumed to be processed on a heap leach. Material above a 0.707 Au g/t is assumed to be processed in a mill. Higher gold grades were given a limited area of influence and was applied during grade estimation by mineralized domain. Mineral resources for the Victory deposit are reported using an open pit gold cut-off of 0.328 g/t Au and an underground gold cut-off of 1.803 g/t Au. Material between a 0.328 Au g/t value and 0.707 Au g/t is assumed to be processed on a heap leach. Material above a 0.707 Au g/t is assumed to be processed in a mill. Higher gold grades were given a limited area of influence and was applied during grade estimation by mineralized domain.

6. The mineral resources presented here were estimated using the Canadian Institute of Mining, Metallurgy and Petroleum (CIM), CIM Standards on Mineral Resources and Reserves, Definitions and Guidelines prepared by the CIM Standing Committee on Reserve Definitions and adopted by CIM Council May 10, 2014.

7. Figures are rounded, and totals may not add correctly.

Report Filing

The technical report prepared in accordance with National Instrument 43-101 will be filed on SEDAR and the Company’s website within two weeks of this news release.

Qualified Persons

This news release has been reviewed and approved by the Qualified Persons noted below. The Qualified Persons have reviewed or verified all information for which they are individually responsible, including sampling, analytical, and test results underlying the information or opinions contained herein.

- Neil Lincoln, P.Eng. – Lycopodium Minerals Canada Ltd.: processing, infrastructure, capital and operating cost estimates, economic evaluation and report compilation.

- Ryda Peung, P.Eng. – Lycopodium Minerals Canada Ltd.: mineral processing, metallurgical testing and recovery methods.

- Robert Farmer, P.Eng. – John T Boyd Company: mineral resource estimates, mining methods, mining capital and mining operating costs.

- Roy Eccles, P.Geo. – Apex Geoscience Ltd.: geology, exploration, drilling, sample preparation and data verification.

- Paul Deering, P.Eng. – Stantec Consulting Ltd. – environmental & social studies, geotechnical, tailings storage facility and heap leach pad design.

Cautionary Statement

The PEA was prepared in accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”). Readers are cautioned that the PEA is preliminary in nature. It includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the PEA will be realized. Mineral resources that are not mineral reserves do not have demonstrated economic viability.

Conference Call Details

Marathon Gold is hosting a live Q&A conference call on May 17, 2018 at 10:00 am Eastern time (11:30 pm Newfoundland time and 7:00 am Pacific time) with the Marathon Gold executive team.

Toll-free number (Canada/US): 1-800-952-5114

Local dial-in number: 416-641-6104

International dial-in numbers: https://www.confsolutions.ca/ILT?oss=7P1R8009525114

Passcode: 4667468#

About Marathon

Marathon is a Toronto based gold exploration company rapidly advancing its 100% owned Valentine Lake Gold Camp located in Newfoundland, one of the top mining jurisdictions in the world. The Valentine Lake Gold Camp currently hosts four near-surface, mainly pit-shell constrained, deposits with measured and indicated resources totaling 2,137,400 oz. of gold at 1.99 g/t and inferred resources totaling 1,104,700 oz. of gold at 1.99 g/t. The majority of the resources occur in the Marathon and Leprechaun deposits, which also have resources below the pit shell. Both deposits are open to depth and on strike. Gold mineralization has been traced down over 350 metres vertically at Leprechaun and almost a kilometer at Marathon. The four deposits outlined to date occur over a 20-kilometer system of gold bearing veins, with much of the 24,000-hectare property having had little detailed exploration activity to date. Drilling in winter 2018 is continuing to focus on expanding the Marathon Deposit at surface and to depth as well as exploration drilling along the boggy covered area between the Marathon and Sprite Deposits.

The Valentine Lake Gold Camp is accessible by year-round road and is in close proximity to Newfoundland’s electrical grid. Marathon maintains a 50-person all-season camp at the property. Recent metallurgical tests have demonstrated 93% to 98% recoveries via conventional milling and 50% to 70% recoveries via low cost heap leaching at both the Leprechaun and Marathon Deposits.

To find out more information on the Valentine Lake Gold Camp please visit www.marathon-gold.com.

For more information, please contact:

Christopher Haldane                                                  Phillip Walford

Investor Relations Manager                                       President and Chief Executive Officer

Tel: 1-416-987-0714Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Tel:Â 1-416-987-0711

E-mail: chaldane@marathon-gold.com                    E-mail: pwalford@marathon-gold.com

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

Except for statements of historical fact relating to Marathon Gold Corporation, certain information contained herein constitutes “forward-looking statements”. Forward-looking statements include statements that are predictive in nature, depend upon or refer to future events or conditions, or include words such as “expects”, “anticipates”, “plans”, “believes”, “considers”, “intends”, “targets”, or negative versions thereof and other similar expressions, or future or conditional verbs such as “may”, “will”, “should”, “would” and “could”. We provide forward-looking statements for the purpose of conveying information about our current expectations and plans relating to the future and readers are cautioned that such statements may not be appropriate for other purposes. By its nature, this information is subject to inherent risks and uncertainties that may be general or specific and which give rise to the possibility that expectations, forecasts, predictions, projections or conclusions will not prove to be accurate, that assumptions may not be correct, and that objectives, strategic goals and priorities will not be achieved. These risks and uncertainties include but are not limited to those identified and reported in Marathon Gold Corporation’s public filings, which may be accessed at www.sedar.com. Other than as specifically required by law, we undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which such statement is made, or to reflect the occurrence of unanticipated events, whether as a result of new information, future events, results or otherwise.