4 Mining Stocks to Watch

By Ellsworth Dickson

Despite the volatility in the price of gold, the share value of select gold explorers has been rising, namely those with a great mineral project, good management and cash on hand or the ability to raise it. While the stocks detailed below have already done well, it appears there is still lots of rocket fuel left.

However, the fledging rebound after a four-year downturn is not limited to gold stocks. As such, I included one uranium explorer. As a disclaimer, I don’t own any of the stocks below.

Integra Gold Corp. [ICG-TSXV; ICGQF-OTCQX]

Integra Gold Lamaque Gold Project is located in one of the world’s best gold camps – Val d’Or, Quebec. The company has already delineated 872,850 ounces of gold (@ a healthy 9.04 g/t) in the indicated category and 800,620 ounces (@ 9.08 g/t) inferred.

There is also the 2,200 tpd Sigman-Lamaque mill and tailings facility. Val d’Or is also home to many experienced underground gold miners. Permitting is well ahead of schedule but what is really impressive are the robust economics. There is a 77% Pre-tax IRR and a CDN $184.3 million Pre-tax NPV. Post-tax, there is a 59% IRR and a CDN $113.5 million NPV.

Expected production will be over 100,000 ounces of gold per year. Capex is estimated to be CDN 62 million with an AISC of CDN $731/oz. Gold resources continue to expand in the Triangle Zone and this year there is a 90,000-metre drilling program using seven rigs. Eldorado Gold owns 15% of Integra.

Integra may have 466.2 million shares outstanding but for a company so advanced with a mill in place, a low Capex and $33 million in the treasury, it’s not much of a negative factor.

Sirios Resources Inc. [SOI-TSXV; SIREF-OTC]

Sirios Resources has been reporting excellent drill results from the Cheechoo Gold Project in the James Bay region about 120 km north of Matagami, Quebec. Sirios holds a 45% interest in the project with Golden Valley Mines owning the remaining 55% which Sirios can acquire.

One recent drill result of interest was a section grading 12.08 g/t Au over 20.3 metres including 48.38 g/t over 4.4 metres (uncut grades, true width unknown). Previous assays included 15.04 g/t gold over 12.35 metres and 15.71 g/t gold over 9.70 metres. The richest assays in the three gold zones graded 177.5 g/t gold.

Goldcorp’s 600,000 oz/year Éléonore gold mine is only 10 km away. Goldcorp likes what it sees at Chhchoo and bought a $962,000 private placement in Sirios for a 9.9% interest. Goldcorp’s mill can accommodate more throughput.

Sirios has a permanent exploration camp at Cheechoo. The company has about 75 million shares outstanding and several other mineral projects.

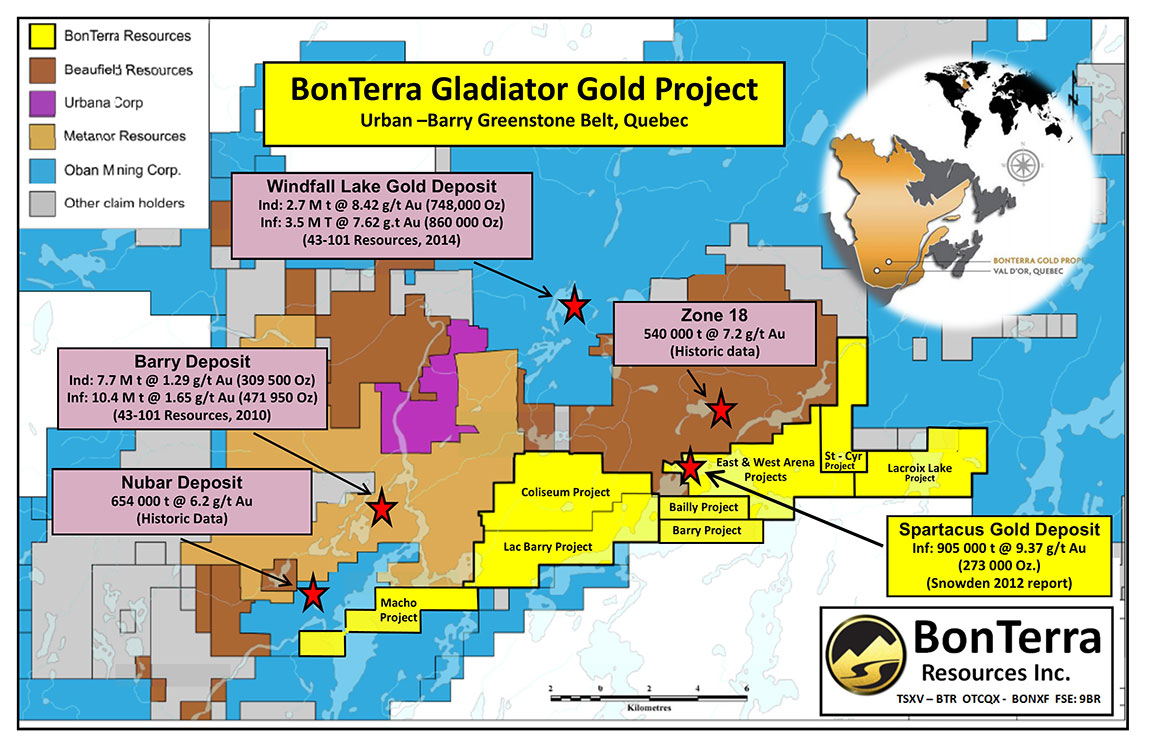

Bonterra Resources Inc. [BTR-TSXV; BONXF-OTC; 9BR-FSE]

Bonterra Resources has seen its stock more than double since January; however, good assay results just keep on coming from its drill program on its 100%-owned Gladiator Gold Project located 170 km northeast of Val d’Or, Québec, a region that hosts numerous large gold deposits.   Here are the 2016 drilling highlights:

- Drilled 0 m of 15.3 g/t gold in Hole BA-16-02 in a new zone (North Shear 1);

- Drilled 0 m of 10.4 g/t gold in Hole BA-16-04;

- Drilled 3 m of 29.0 g/t gold in Hole BA-16-05 in a new zone (South);

- Drilled 7 m of 24.3 g/t gold in Hole BA-16-09.

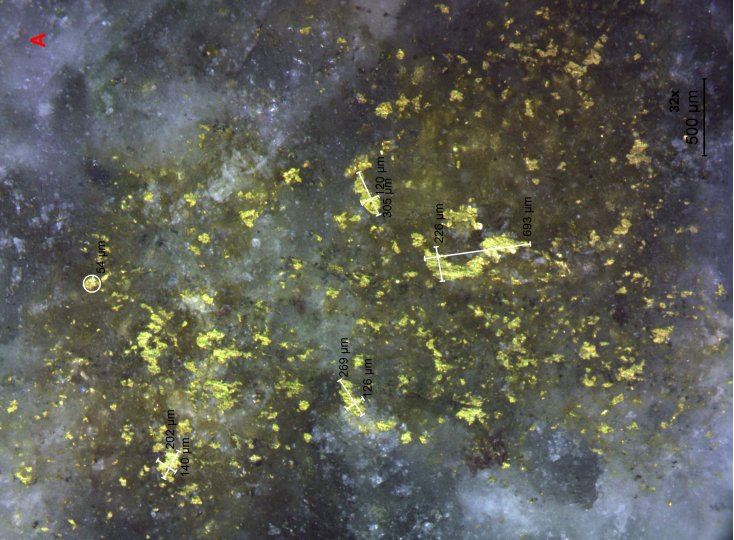

To date, about 8,300 metres have been drilled in 19 holes on western extension of Gladiator Deposit. More drill results are pending and drilling continues. Always encouraging, visible gold was identified in 16 of the 19 holes.

Nav Dhaliwal, President and CEO of BonTerra, said, “We now have extended the zone of mineralization approximately 200 metres to the west of our existing deposit, and we continue to intersect grades higher than the existing resource model completed in 2012. Our technical team’s review of the geological system continues to be validated with recent drilling, with much data in process. Our recent strategic acquisition of key land positions along strike were completed to ensure we control what we believe to be one of the more interesting discoveries in the Abitibi Greenstone Belt.”

Part of the large Gladiator land position, the West Arena property hosts 973,000 ounces of gold inferred grading 9.37 g/t gold. The company has other mineral projects, including the recently acquired Larder Gold Project in northeast Ontario which hosts 917,000 ounces of gold inferred grading 5.5 g/t gold. Bonterra has about 56.3 million shares outstanding.

NexGen Energy Ltd. [NXE-TSXV; NXGEF-OTCQX]

NexGen Energy holds a number of uranium prospects in the high-grade and prolific Athabasca Basin of northern Saskatchewan. The company’s efforts are focusing on its southwestern Athabasca Basin projects (+259,000 hectares) and its 100% owned, flagship Rook I property which hosts the Arrow uranium deposit.

Inferred resources at Arrow are pegged at 3.48 million tonnes containing 201.9 million pounds of U3O8 grading 2.68% U3O8 including a high-grade core of 0.410 million tonnes containing 120.5 million pounds grading 13.26% U3O8.

Resaults were recently released from eight angled holes from its continuing winter drilling program on the Rook I property. Step-out drilling 180 metres southwest along strike from the Arrow deposit has intersected extensive mineralization including off-scale radioactivity (greater than 10,000 counts per second). Hole AR-16-77c2, a follow-up from hole AR-16-75, intersected 109.5 metres of total composite mineralization, including 2.3 metres of off-scale radioactivity and encountered local concentrations of semi-massive pitchblende associated with extensive dravite alteration southwest along strike from the A4 shear, within an area that is untested.

This newly discovered mineralized area will be the focus of immediate follow-up drilling. The footprint of Arrow has extended along strike by an additional 25 to 865 metres and laterally by 40 to 275 metres.

The Rook I property keeps getting better as more drilling is completed and it will be interesting to see just how big this uranium deposit is; it is already looking like a major discovery. The company has 301.9 million shares outstanding and $33 million in the treasury.