Resource Stocks are Rockin’

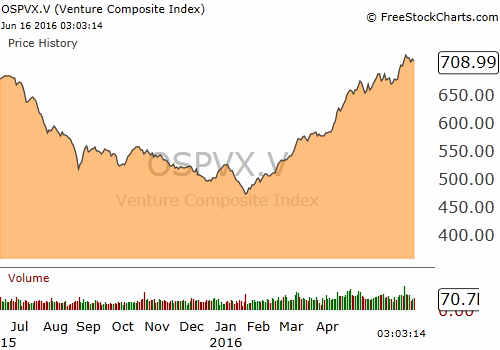

TSX Venture Exchange Composite Index Chart

By Ellsworth Dickson

Is the resource stock recovery really under way or is this just a dead cat bounce? Just how much confirmation do you need? We didn’t know it at the time when the TSX Venture Exchange Composite Index hit its record low of 474 on January 20, 2016 – it was just another ugly day for the mining-stock heavy TSXV.

Many investors were wary when the Index started to climb; after all, there had been a number of false starts for the gold price. Maybe the rising Venture Exchange Index was a short-lived recovery. However, it has survived both the “PDAC Curse” when mining stocks have often fallen after the big conference in Toronto as well as survived the old adage of “sell in May and go away”.

Today, we are looking at a Venture Exchange Index of about 714 and a gold price that has blasted through US $1,300/oz. Here at Resource World Magazine, for some time we have been providing readers with articles covering the activities of what could truly be called undervalued companies. Yes, it takes nerve to buy mining stocks that have been out of favour for years, but those that did are seeing great capital gains.

Check out the stock charts of the following resource companies and see for yourself: Pretium Resources, Pilot Gold, Oban Mining, Lithium Americas, Exeter Resource, OceanaGold, Detour Gold, B2Gold, Eastmain Resources, Asanko Gold, Brixton Metals and Colorado Resources. These are only a few of high-performing mining stocks.

As noted mining analyst John Kaiser pointed out at a recent commodities conference in Vancouver, “Many quality gold stocks have seen price increases of 200 to 300%.” In his presentation, Kaiser remarked that, besides quality gold stocks, he sees a coming demand for specialty metals (strategic and critical) in the near future.

In addition, we have a lithium staking rush underway by many junior explorers hoping to benefit from the expected demand for lithium-ion batteries. Many are lithium brine projects in Nevada, Argentina and Alberta but some are hard rock (spodumene) lithium projects.

And in a recent interview in Resource World Magazine, Sprott Global Resource Investments Chairman Rick Rule noted that, “The bull market in gold is closer to the beginning than the end.”

So, despite the great gains in mining stocks, it is still not too late to participate in the new bull market in this sector. It’s time for resource stock investors to do their homework.