Royal Road shares up 19% as Barrick Gold takes bigger stake

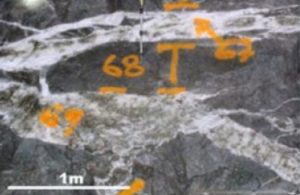

Typical stacked gold-bearing quartz-carbonate veins at the Royal Road La Golondrina property in Narino Province, Colombia. Source: Royal Road Minerals Ltd.

Barrick Gold Corp. [ABX-TSX, NYSE] has agreed to acquire a 12.5% stake in Royal Road Minerals Ltd. [RYR-TSXV] in a share exchange deal worth about $1.6 million. Under the agreement, Toronto-based Barrick will acquire 9.8 million Royal Road shares in a non-brokered private placement, priced at $0.16 per share. The purchased shares, together with the 11.1 million ordinary shares already owned by Barrick, amount to a 12.5% stake in Royal Road once the private placement is completed.

“We were pleased when Barrick made its initial investment in the company and are now even more pleased that Barrick will participate in our current financing as a strategic shareholder,” said Royal Road President and CEO Tim Coughlin.

“Barrick’s additional investment represents a strong endorsement of our efforts in Colombia and reflects the exploration and development potential of our company,” he said.

Royal Road shares advance on the news, rising 18.5% or $0.02 to 16 cents in afternoon trading Wednesday, after earlier touching a 52-week high of 17 cents.

Royal Road Minerals was founded in 2010 by the original founders and shareholders of Lydian International Ltd. Whilst at Lydian, the team discovered, financed and developed the five million ounce Amulsar Gold deposit in Armenia.

Royal Road said it is currently the largest license application owner in the highly prospective province of Narino in Colombia, which is close to Colombia’s southern border with Ecuador, and widely known for its gold and porphyry copper-gold potential. The company said it has in excess of 400,000 hectares in the application to concession contract process.

Of those applications, Royal Road said roughly 200,000 hectares have passed the initial phase of conversion to concession contracts, meaning that they have been approved by local majors and counselors.

Narino hosts numerous gold occurrences and one of the largest alluvial goldfields in Colombia. Narino is also widely considered to be one of the last remaining highly prospective and underexplored regions of the Andes.

Royal Road is also active in Nicaragua after acquiring the interests of Caza Gold Corp. [CZY-TSXV] in that country, including the Los Andes porphyry copper-gold and Piedra Iman iron-oxide copper-gold prospects.

The company has executed a 50-50 strategic exploration alliance with Hemco/Mineros, in which both companies combine exploration assets and explore in Nicaragua on the 50-50 basis. This arrangement also provides Royal Road with access to the highly prospective Golden Triangle region of Northeastern Nicaragua.