Rubicon remains on track for updated resource estimate

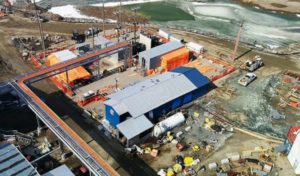

Rubicon's Phoenix Gold Project in northern Ontario. Source: Rubicon Minerals Corp.

Rubicon Minerals Corp. [RMX-TSX; RBYCF-OTC] on Monday March 12 released an updated preliminary interpretation of the structural geology of the F2 gold deposit at its Phoenix Gold Project in northwestern Ontario.

The Pheonix Gold Project is an underground exploration project located in the district of Red Lake located 265 km northeast of Winnipeg, Manitoba.

Rubicon owns 100% of the Phoenix Gold Project which consists of the high-grade F2 gold deposit, more than 9,000 metres of underground development, including a commissioned shaft that goes down approximately 730 metres below surface and surface infrastructure that includes a 1,250 tonne-per-day mill (currently on care and maintenance), a completed tailings management facility, electric power supply and substation.

The property is centred on the historical McFinley Shaft (now called the Phoenix Shaft) and hosts a 200-person camp.

Since acquiring the Phoenix gold project in 2002, Rubicon has conducted an extensive exploration program, which includes geological mapping, re-logging of selected historic boreholes, digital complication of available historical data, ground and airborne magnetic surveys, mechanical trenching, channel sampling, along with numerous drilling programs.

“We are half way through the 18 to 24-month plan that we outlined when we completed the restructuring of the company in December 2016 and are encouraged by our progress to date,” Â said Rubicon President and CEO George Ogilvie.

“We successfully completed our 2017 exploration program (23,500 metres of oriented diamond drilling) under budget and have collected important observations and data, including more substantial information on the structural geology,” he said.

This has helped to advance the company’s understanding of the F2 Gold Deposit, he said.

On Monday, Rubicon released an updated preliminary interpretation of the structural geology of the F2 gold deposit.

Key takeaways are as follows:

- In the 2016 structural interpretation, the discrete D2 east-west shear zones (previously termed as the D2 structures) were interpreted as the main controls of high-grade gold mineralization. However, in the preliminary structural interpretation, these discrete D2 east-west zones appear to be localized, discontinuous and not seen as having significant controls on the gold mineralization at the deposit.

- The preliminary structural interpretation has simplified and improved future modelling and allows for the elevation of bulk mining methods.

“We will continue to refine and support the preliminary structural interpretation from the data and observations we plan to collect from our 2018 exploration program,” said Ogilvie.

He said underground development at the site is progressing well, and the company is continuing to stockpile low-grade material on surface, which will be used for bedding for the mill before the company processes higher-grade mineralized material from test stopes.

Ogilvie said the company remains on track to deliver an updated mineral resource estimate during the second half of 2018.

On Monday, Rubicon shares rose 1.63% or $0.02 to $1.25. The 52-week range is $1.99 and $1.13.