Medallion active on financing news

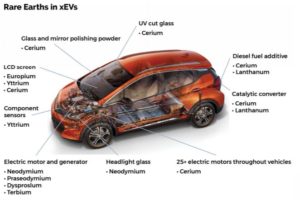

The many automotive applications for rare earths. Source: Medallion Resources Ltd.

Medallion Resources Ltd. [MDL-TSXV; MLLOF-OTCQX], a company that is pursuing the production of magnet metals, said Friday March 15 that it is raising $495,000 by way of a private placement financing. The news sparked active trading in the shares, sending them down 16.67% or $0.02 to 10 cents on volume of 3.7 million. The shares trade in a 52-week range of $0.08 and 18 cents.

Medallion said the non-brokered private placement will consist of 5.5 million units priced at $0.09 each. The units will consist of one common share in the company and one transferable share purchase warrant entitling the holder to acquire an additional share at an exercise price of $0.15 per share for 36 months after the closing of the private placement.

Medallion is focused on becoming a low-cost producer of industrially important rare earth elements, the critical components of virtually all computing and mobile electronic products, as well as electric and hybrid vehicles.

Rare earth elements are a group of 15 elements with tongue-twisting names like neodymium, terbium and dysprosium, which are vital to green technology and high tech applications. They fall into two sub-groups: light and heavy, with the heavies being scarcer. Since 90% of the rare earths used in the world come from China, security of supply became an issue at the beginning of this decade when China imposed export restrictions, a move that sparked renewed investor interest in the sector.

Specific uses for rare earths include magnets, metal alloys, aerospace, electronics, ceramics and glass. Neodymium magnets are often used in cars and trucks as well as speakers.

Medallion is taking a different approach to competitors who extract rare earths using conventional mining and processing techniques and therefore must deal with complex metallurgy, huge investments for infrastructure and long time lines from exploration to production.

Instead, Medallion is aiming to produce rare earths from monazite, an igneous intrusive rock that is readily available as a by-product of existing mineral sands operations, primarily in the Indian Ocean Basin.

Monazite is a phosphate mineral containing 60% rare earths. It is also the world’s original commercial rare earth source. The U.S. Geological Survey, in its annual commodity reports, regularly states that monazite is one of the world’s most important available rare earth resources. Monazite and bastnaesite (the main rare-earth mineral in Chinese production and at Molycorp’s Mountain Pass mine in California) are only two rare-earth minerals to have ever successfully produced large commercial quantities of rare earths.

“We’re taking a different approach to rare earth production than our peers. We are not focused on exploration and developing metallurgical techniques to get to production. Rather, we are exploiting a well-known resource,” said Medallion Resources President and CEO Don Lay. “Our objective is to import that resource into North America to a processing plant and create a rare earth chemical concentrate product,” he said.

“We note that there has been little progress from current rare-earth resource developers over the last number of years and the marketplace is now looking for new feedstock sources.”

Lay recently upped his stake in the company to 12.23% or 3.8 million shares.

Subject to securing funding, the company has been moving forward with pilot plant scale tests of its monazite-based rare earth extraction process. These tests mark the last major technical confirmation prior to building a continuous-flow integrated pilot plant. An integrated pilot plant operation can form the basis of an engineering study confirming the viability of the process.

As a result, Medallion has been seeking equity capital and government-sponsored programs to have a qualified mineral lab conduct the pilot-scale tests.

Recently, the company said its commercial partner Rare Earth Salts Separations & Refining LLC (RES) has completed separation tests of Medallion’s rare earth concentrate into commercial-ready rare earth oxides.

“With these tests complete, Medallion is well positioned with RES to build-out a North American rare earth supply chain to provide non-Chinese supplies to the marketplace,” Lay said.

On Friday, Medallion said the 495,000 raised from the private placement will be used to further metallurgical test programs, for customer and feedstock supply development work and for general working capital.

In a January 31, 2019 press release, Medallion said it will receive $50,000 in funding from the Canadian government through the National Research Council of Canada Industrial Research Assistance Program (NRC IRAP) to support the final major test work of its rare earth element extraction process development.

The test work project, with a total budget of about $80,000, will be carried out by the Saskatchewan Research Council and focus on processing routes and analysis of major waste streams, especially those containing radioactive elements.

The non-dilutive NRC IRAP funding is projected to cover 60% of project costs.