Tahoe Resources to acquire Lake Shore Gold

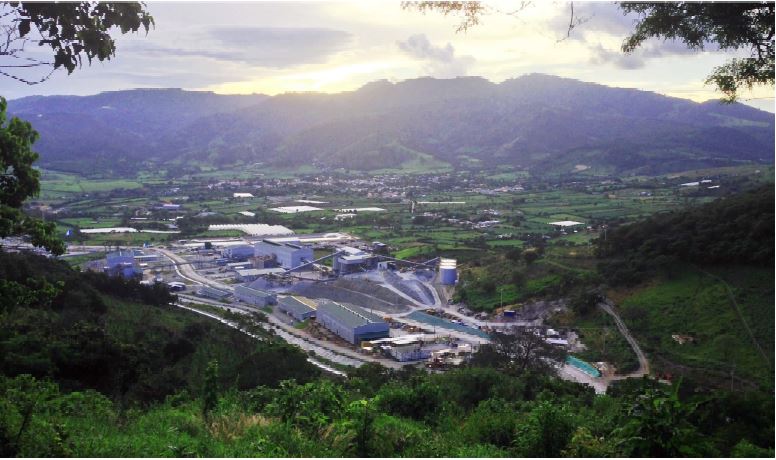

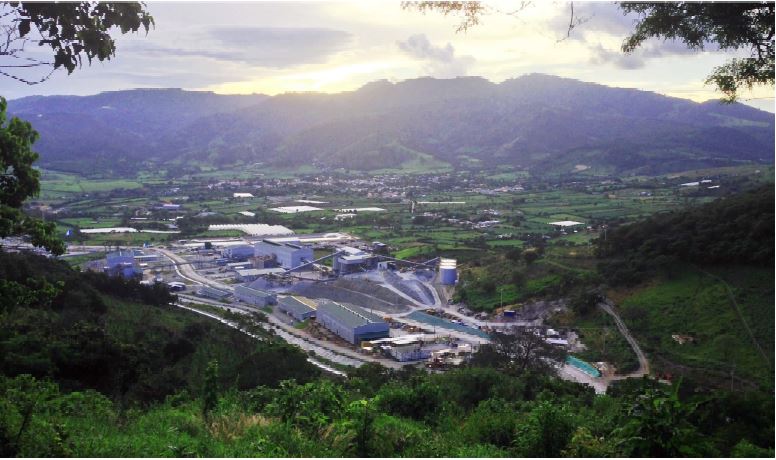

The 100%-owned Escobal silver-gold-lead-zinc mine of Tahoe Resources in Guatemala. Source Tahoe Resources Inc.

Tahoe Resources Inc. [THO-TSX; TAHO-NYSE] and Lake Shore Gold Corp. [LSG-TSX] have signed a definitive agreement whereby Tahoe will acquire all of the issued and outstanding shares of Lake Shore Gold. Under the terms of the agreement, all of the Lake Shore Gold issued and outstanding common shares will be exchanged on the basis of 0.1467 of a Tahoe common share per each Lake Shore Gold common share. Upon completion, existing Tahoe and Lake Shore Gold shareholders will own approximately 74% and 26% of the pro forma company, respectively, on a fully-diluted in-the-money basis.

The exchange ratio implies a consideration of C$1.71 per Lake Shore Gold common share, based on the closing price of Tahoe common shares on the TSX on February 5, 2016, representing a 14.8% premium to the closing price of Lake Shore Gold on February 5, 2016 and a 28.6% premium to the closing share of Lake Shore Gold on February 4, 2016.

Based on each company’s 20-day volume weighted average price on the TSX, the Exchange Ratio implies a premium of 25.7% and 30.4% to Lake Shore Gold common shares for the periods ending February 5, 2016 and February 4, 2016, respectively. The implied equity value (assuming the conversion of in-the-money convertible debentures) is equal to C$945 million.

Lake Shore Gold operates the low-cost Timmins West and Bell Creek mines in Timmins, Ontario. Together with Tahoe’s world class Escobal Mine in Guatemala and its low-cost La Arena and Shahuindo mines in Peru, the combined company is firmly established as a premier Americas-based precious metals producer. With a diversified suite of low-cost, highly prospective assets and a quality pipeline of new development opportunities, Tahoe is well positioned to sustain and grow its production base. Further, with zero net debt, sector leading operating margins, and moderate capital requirements, the combined company will continue to generate strong free cash flows. Accordingly, following completion of the Transaction, Tahoe intends to continue its dividend of US$0.02 cents per share per month.

Kevin McArthur, Executive Chair of Tahoe, said, “The combination with Lake Shore Gold enhances Tahoe’s position as the new leader in precious etals by adding another low-cost operation in Timmins, one of the most prolific gold camps in the world. We are impressed by the long-term presence and see tremendous regional opportunities going forward. We look forward to continuing the strong relationships that Lake Shore Gold has fostered in Timmins with local stakeholders. Finally, I am very pleased to welcome Alan Moon, the current Chair of Lake Shore Gold, to our Board of Directors upon completion of the Transaction, as well as Tony Makuch, the current CEO of Lake Shore Gold, to Tahoe’s management team as President of Canadian Operations.”

Tony Makuch, President and CEO of Lake Shore Gold, stated, “The combination with Tahoe represents a unique opportunity for our shareholders to gain exposure to a high-quality portfolio of long life producing mines with substantial mineral reserves. Today’s announcement of an initial resource at our 144 Gap Deposit is a perfect example of the long-term growth potential of our Timmins portfolio. Tahoe’s strong balance sheet and superior cash generating capabilities will provide Lake Shore Gold with the financial resources to unlock the enormous growth potential of our asset base.”