Marathon Gold rallies on Franco-Nevada financing news

Marathon Gold Corp. [MOZ-TSX, OTC-MGDPF] on Thursday announced the sale of an additional 1.5% net smelter return royalty on its Valentine Gold Project in Newfoundland to Franco Nevada Mining Corp. [FNV-TSX, NYSE] for US$45 million.

As a result, Franco-Nevada will hold a 3.0% NSR on the project. In addition, Franco-Nevada has offered to purchase Marathon Gold shares consisting of the entire back end of a $6.9 million non-brokered charity flow-through offering for which Marathon has firm commitments of $1.04 per share. Marathon intends to use the proceeds of the offering for eligible exploration expenses at the project.

Marathon Gold shares advanced on the news, rising to 5.3% to 79 cents on volume of 272,140. The shares are currently trading in a 52-week range of $2.18 and 73 cents.

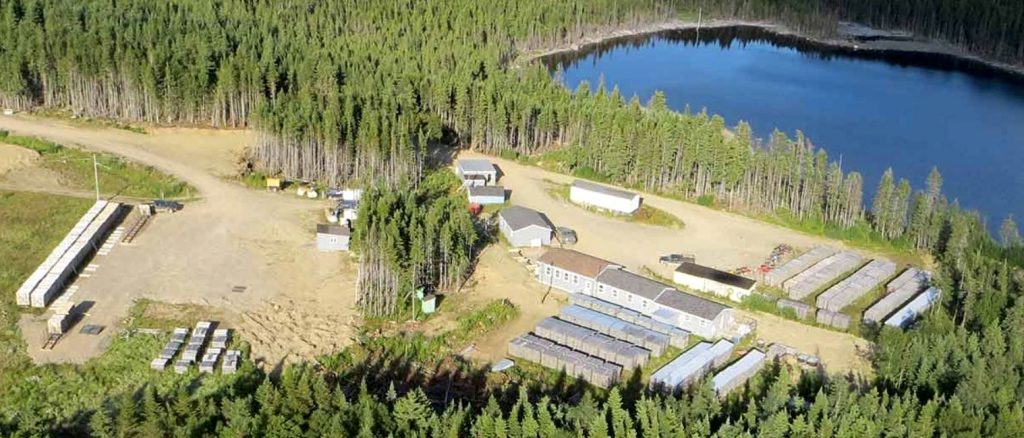

The Valentine project consists of a series of five mineralized deposits located along a 32-kilometre system.

A December 2022, updated feasibility study for the project outlined an open pit conventional mining operation, producing 195,000 ounces of gold annually for 12 years within a 14.3-year mine-life.

The project was released from federal and provincial environmental assessments in 2022 and construction commenced in October, 2022. The project has an estimated proven mineral reserve of 1.43 million ounces (23.36 million tonnes at 1.89 g/t) and a probable reserve of 1.27 million ounces (28.22 million tonnes at 1.40 g/t). Total measured resources (including mineral reserves) stand at 2.06 million ounces.

“Franco-Nevada has been a royalty holder since 2019, and we welcome their continuing strong support for the project,’’ said Marathon Gold President and CEO Matt Manson. “The associated offering of flow-through shares, by which Franco-Nevada also increases its share ownership in the corporation, will be used to fund our discovery-oriented exploration programs in 2023 and 2024, including exploration at the encouraging and underexplored Eastern Arm Prospect.’’

Marathon Gold recently released positive infill drill results from the Berry deposit at the Valentine project.

Last year, Marathon completed 20,931 metres of infill drilling at Berry, none of which was included in the project’s June 2022 mineral resource estimate. This in-fill drill program targeted gaps within the existing Berry drill hole dataset that are assumed to be un-mineralized waste in the Berry geological model, but are within the conceptual pit shells used in the resource estimate.

Success within this program has the potential to add mineable ounces to the project’s mine plan, the company said.

Drilling highlights included hole VL-22-1258 which returned 5.01 g/t gold over 18 metres, including 23.02 g/t gold over 1.0 metre and 17.90 g/t over 1.0 metre, and 4.28 g/t gold over 9.0 metres, including 23.43 g/t gold over 1 metre and 2.78 g/t gold over 6.0 metres including 11.72 g/t gold over 1.0 metres.