Northwestern U.S. Remains Attractive to Canadian Explorers

By David Duval

Canadian miners and explorers have worked both sides of the U.S./Canada border for generations and, in fact, have been responsible for many of the largest mineral discoveries in U.S. history. Indeed, you need look no farther than the prolific Carlin Gold Belt in Nevada and the northwestern U.S. for examples.

The proximity of Vancouver and its venture capital market to the northwestern U.S. in particular has benefited the region’s mineral sector enormously; and Canadian explorers continue to account for a large portion of the exploration funding being expended there.

The Fraser Institute of Mining Companies annual survey puts Utah and Idaho among the most progressive jurisdictions in the region and their favorable geology and supportive policies continues to attract Canadian exploration companies.

Similar to Canada, some U.S. jurisdictions have a mining culture and are more receptive to mine development while others, including Washington State, rank among the more difficult jurisdictions. Nevertheless, there is exploration activity. For example, Adamera Minerals and partner Hochschild Mining are currently drilling the Cooke Mountain project near Republic.

In Oregon, Paramount Gold Nevada has filed a positive NI-43-101 Technical Report on the Feasibility Study for the proposed high-grade, underground gold and silver mining operation at Grassy Mountain in the high desert of eastern Oregon. Annual production is envisaged of approximately 47,000 ounces of gold and 55,000 ounces of silver over an initial eight-year mine life with a 3.1-year after-tax payback period.

In the prevailing ESG (Environmental, Social, and Governance) mindset of governments, financiers, investors and people in general, exploration and mining companies are eager to demonstrate that they can be good environmental stewards.

Not so many years ago some mining analysts concluded that being a good environmental steward would have a negative effect on a company. Fortunately, that has been proven wrong and exploration and mining companies now routinely include ESG programs in their business plans.

Montana is a politically conservative, historically pro-mining state with a prevailing environmental awareness. It also happens to be one of the few jurisdictions in the world with significant platinum group element deposits.

Platinum is 30 times more rare than gold. Palladium is nearly 50% more expensive than gold and rhodium spot price is currently over $20,000 per ounce. The Stillwater Igneous Complex in southern Montana is one of the top regions in the world for platinum group elements, plus credits in nickel and copper that is comparable to the Bushveld Igneous Complex and Great Dyke in southern Africa.

South Africa accounts for 80% of the world platinum production with the remainder taken up by Russia, Zimbabwe, Canada and the U.S. Because it is so rare, only a few hundred tonnes are produced each year making the metal highly valuable.

Sibanye-Stillwater has two operating underground PGM mines – the Stillwater and East Boulder – where the J-M Reef hosts enough PGM ore to last until 2045. Group Ten Metals is currently drilling its prospective exploration-stage Stillwater West project adjacent to the north and parallel to the Sibanye-Stillwater land position.

There are other states in the northwestern U.S. that are supportive and receptive to foreign mining companies operating within their generally strict legislative frameworks.

The Coeur d’Alene district of northern Idaho has been an important producer of lead, silver, and zinc since the 19th century. In fact, the discovery of gold caused the Idaho territory to be established in 1863. Idaho and Utah were the great silver-lead producing states, accounting for over 40% of the country’s total output during the period 1907-30, with most of Idaho’s output coming from the Coeur d’Alene District of Shoshone County. The district extended over an area of only 200 square miles and was first developed for large scale mining in the 1890s, becoming one of the world’s premier fields.

Hecla Mining operates the Lucky Friday mine, a deep underground silver, lead, and zinc mine in the Coeur d’Alene Mining District. The mine began producing in 1942 and celebrated its 75th anniversary in 2017. The #4 Shaft project is expected to add another 20-30 years of mine life.

Idaho is also one of the world’s few places hosting a major cobalt deposit. The board of Jervois Mining recently approved final construction of its Idaho cobalt operations (ICO) approximately 40 km west of the town of Salmon in east-central Idaho.

Railroad connections branched into the district from the Northern Pacific and Union Pacific Railroad lines, providing access to smelting areas and consumers on both coasts. Capital was supplied due to the promise of rich rewards-a high silver content in Coeur ores was attractive to investors-and because the Coeur d’Alene was one of the last American mining fields to be developed.

The production of zinc, a supplement to the relatively low grade of lead ores, was also rapidly developed in the area. The new technologies of electric power and the combustion engine were large consumers of non-ferrous metals, establishing the strong links between technical progress, national economic growth, and the non-ferrous metals industry.

Utah is the third largest metal producing state in the U.S., behind Arizona and Nevada in terms of total historical production. For the major base and precious metals, Utah ranks second in the U.S. in the historical production of copper and silver, third in lead, fifth in gold, and ninth in zinc.

Historically, Utah is the largest beryllium and magnesium producing state in the U.S., as well as second largest vanadium, third largest molybdenum and uranium, and fourth largest iron producer. Utah’s total historical metal production value, at recent estimated metal prices, is approximately $217 billion.

Utah’s most valuable metals in decreasing order of importance are copper, gold, molybdenum, silver, lead, iron, zinc, uranium, beryllium, vanadium, manganese, and tungsten.

The Bingham mining district in the Oquirrh Mountains of southwestern Salt Lake County is by far Utah’s most significant mining district. The Bingham Canyon open-pit mine is recognized as the first open-pit porphyry copper mine in the world, and porphyry copper mines are currently the world’s most important copper producers. Bingham is also the most productive mining district in the U.S. The district has sustained production for over 150 years, and Bingham’s total historical production value is approximately $174 billion and accounts for about 80 percent of Utah’s total historical production value.

Currently, the Bingham, Spor Mountain, Lisbon Valley, and Rocky districts all have mines in production. In addition, districts having significant ore reserves or subeconomic resources include the Bingham, Southwest Tintic, Pine Grove, Spor Mountain, Stockton, Iron Springs, Goldstrike, Tecoma, Gold Springs, Fish Springs, East Tintic, Rocky, Lisbon Valley, La Sal, and South Henry Mountain districts. Furthermore, Bingham, Goldstrike, Gold Springs, Rocky, San Francisco, Fish Springs, Southwest Tintic, and Gold Hill all have ongoing mineral exploration programs.

Another significant fact about Utah mining is that the Spor Mountain district in Juab County currently accounts for about 70%Â of the world’s beryllium production, as it has for the past three or four decades. This fact is particularly notable because beryllium is on the U.S. Department of the Interior’s list of 35 mineral commodities deemed critical to the U.S.

Other metals found in Utah on the Interior’s critical minerals list include rhenium, platinum, palladium, uranium, and vanadium. Bingham is the U.S.’s second largest producer of rhenium and also produces minor amounts of platinum and palladium. Utah has historically been an important producer of uranium and vanadium from sandstone-hosted deposits on the Colorado Plateau in southeastern Utah; however, these operations are currently on standby due to low prices. Recent increases in vanadium prices due to rapidly rising demand may change this situation.

Group Ten Metals Inc. [PGE-TSXV; PGEZF-OTC; 5D32-FSE] is conducting a 10,000-metre, multi-rig drilling campaign at its 100%-owned flagship Stillwater West platinum group element, nickel, copper, cobalt and gold project in Montana.

Group Ten Metals Inc. [PGE-TSXV; PGEZF-OTC; 5D32-FSE] is conducting a 10,000-metre, multi-rig drilling campaign at its 100%-owned flagship Stillwater West platinum group element, nickel, copper, cobalt and gold project in Montana.

The 54 km2 battery and precious metals project is located adjacent to parallel to Sibanye-Stillwater’s [SBSW-NYSE; SSW-JSE] high-grade PGE mines that have produced over 14 million ounces of platinum and palladium from the J-M Reef – the highest-grade PGE deposit in the world.

Group Ten’s project is situated in the Stillwater Igneous Complex, one of the top regions in the world for platinum group elements, nickel and copper comparable to the Bushveld Igneous Complex and Great Dyke in southern Africa that are similarly layered magmatic intrusions.

Priorities for 2021 include converting mineralized zones to formal 43-101 resources (initial resource estimate expected summer 2021), expanding known mineralization into untested areas and identifying and prioritizing new targets. Group Ten has focused its exploration efforts on the lower portion of the magmatic layers of Stillwater. It is the first company to systematically explore for Platreef-style deposits that refer to geologic models developed at the world’s biggest and most economic platinum, nickel and copper mines in the North Bushveld and Platreef District of South Africa.

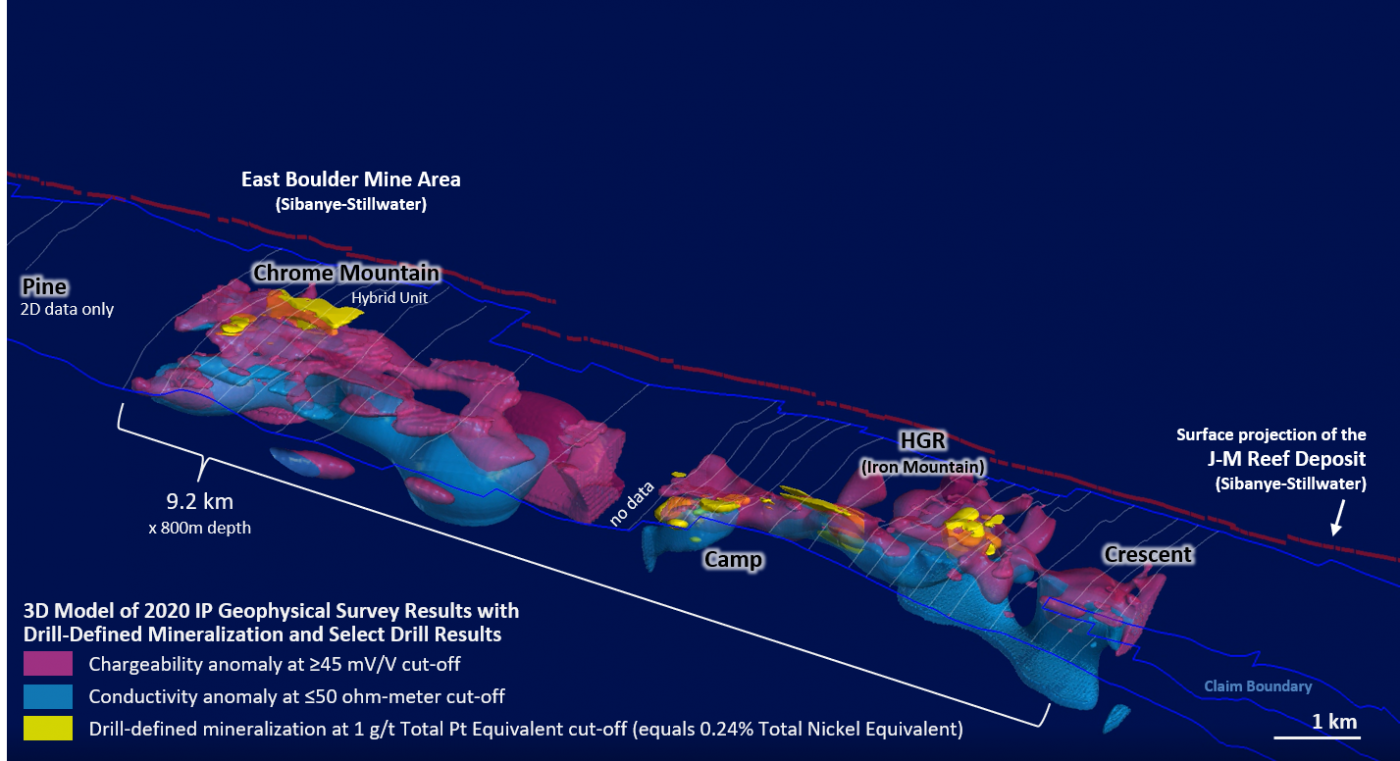

The aim of the current drilling program is to expand drill-defined mineralization at the three most advanced areas and test adjacent high priority targets which were identified and fine-tuned via a 2020 induced polarization geophysical survey along 14-multi-kilometre-scale exploration target areas over a 25-kilometre strike length. The company expects these drill results to significantly increase the inaugural mineral resource estimates in a subsequent update.

The aim of the current drilling program is to expand drill-defined mineralization at the three most advanced areas and test adjacent high priority targets which were identified and fine-tuned via a 2020 induced polarization geophysical survey along 14-multi-kilometre-scale exploration target areas over a 25-kilometre strike length. The company expects these drill results to significantly increase the inaugural mineral resource estimates in a subsequent update.

Fortuitously, the road-accessible, brownfields project has an extensive database – including almost 12,000 metres of diamond drill core – to which Group Ten is applying modern geological models it has developed and approaches successfully utilized in the northern Bushveld. Compilation and analysis by company geologists has demonstrated the potential for much larger mineralized systems than have been previously recognized.

The prospectivity of Group Ten’s Stillwater West project is underscored by the adjacent Sibanye-Stillwater J-M Reef deposit that hosts reserves of 25.6 million ounces of platinum and palladium grading 13.4Â g/t Pd and 3.8Â g/t Pt. Resources are 34.1 million Measured and Indicated ounces grading 12.8Â g/t Pd and 3.6Â g/t Pt plus 45.9 million Inferred ounces grading 12.75Â g/t Pd and 3.6Â g/t Pt.

In the Stillwater Complex, as in the Bushveld, which is similarly famous for its narrow “reef-style” PGE deposits, very large, disseminated PGE-Ni mineralization occurs below these prolific structures and can be of world-class scale and grade. Group Ten is targeting deposits of 10 million ounces and larger, based on the known parallels with the Bushveld Complex, its IP surveying and the extensive drilling to date. To that end, based on existing assay data, the company plans to soon deliver a maiden NI 43-101 compliant resource estimate at the three most advanced target areas at Stillwater West – Chrome Mountain (Discovery), Camp and Iron Mountain – with an update to follow, based on 2021 drilling.

In the Stillwater Complex, as in the Bushveld, which is similarly famous for its narrow “reef-style” PGE deposits, very large, disseminated PGE-Ni mineralization occurs below these prolific structures and can be of world-class scale and grade. Group Ten is targeting deposits of 10 million ounces and larger, based on the known parallels with the Bushveld Complex, its IP surveying and the extensive drilling to date. To that end, based on existing assay data, the company plans to soon deliver a maiden NI 43-101 compliant resource estimate at the three most advanced target areas at Stillwater West – Chrome Mountain (Discovery), Camp and Iron Mountain – with an update to follow, based on 2021 drilling.

Group Ten Metals is also keenly interested in rhodium, a member of the PGE family that currently trades for US$18,000/oz. Rhodium is a very valuable co-product with other platinum group metals that is particularly rare in North American deposits. The company has confirmed widespread rhodium in drill results at potentially significant co-product grades of 0.03 to 0.1 g/t rhodium in all three of the target areas noted above. Given its value being 6x that of palladium and 16x that of platinum, the company plans to include a rhodium component in the maiden resource estimate.

Group Ten is focused at Stillwater West but also holds additional 100%-owned district-scale projects, including the high-grade Black Lake-Drayton Gold project adjacent to Treasury Metals Inc.’s [TML-TSX] development-stage Goliath-Goldlund project in northwest Ontario, and the Kluane PGE-nickel-copper-cobalt project on trend with Nickel Creek Platinum Ltd.’s [NCP-TSX, NCPCF-OTCQX] Wellgreen deposit in the Yukon. The Company is in discussions with respect to potential deals on these secondary projects.

Group Ten is focused at Stillwater West but also holds additional 100%-owned district-scale projects, including the high-grade Black Lake-Drayton Gold project adjacent to Treasury Metals Inc.’s [TML-TSX] development-stage Goliath-Goldlund project in northwest Ontario, and the Kluane PGE-nickel-copper-cobalt project on trend with Nickel Creek Platinum Ltd.’s [NCP-TSX, NCPCF-OTCQX] Wellgreen deposit in the Yukon. The Company is in discussions with respect to potential deals on these secondary projects.

To finance its exploration programs, the company recently raised $6 million from a private placement of 15 million units priced at 40 cents per unit. Each until consisted of one common share and one-half of one warrant. Each whole warrant is exercisable for one common share for a period of 24 months at 55 cents.

On July 19, 2021, Group Ten Metals shares were trading at 32 cents in a 52-week range of 51 cents and 20 cents, leaving the junior with a market cap of $52.4 million, based on 154,365,706 million shares outstanding.