La Mancha takes 30% stake in Golden Star

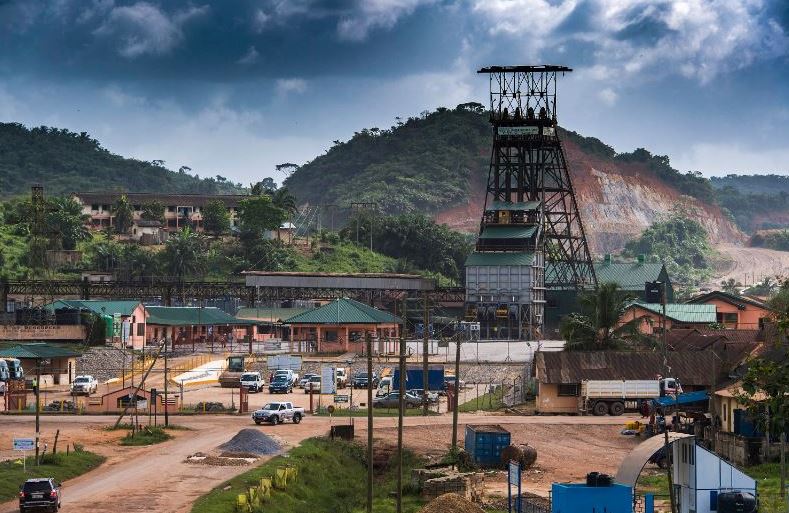

Golden Star's Prestea Complex in Ghana. West Africa. Source: Golden Star Resources Inc.

Golden Star Resources Inc. [GSC-TSX; GSS-NYSE American; GSR-GSE] said it has entered into a long term strategic relationship with La Mancha Holding S.a.r.l, a Luxenbourg-incorporated private gold investment company.

The announcement comes after La Mancha said it has agreed to take a 30% equity stake in Golden Star by way of a US$125.7 million equity investment.

Golden Star is an established gold mining company with two producing mines on the Ashanti Gold Belt in Ghana.

The company was recently in the news when it won the 2018 Environmental & Social Responsibility Award at this year’s Prospectors and Developers Association of Canada (PDAC) conference for exceptional community relations, commitment to sustainable development, and support for employees and local businesses at its two mines.

The Toronto-based company is committed to minimizing its environmental footprint at the Wassa and Prestea mines, especially in areas of water management, and rehabilitation, PDAC said.

Wassa is located in southwestern Ghana, approximately 40 km from the Prestea Gold Mine.

Since operations commenced in 1999, the company has installed more than 200 clean water supply systems to serve local communities, doubling the proportion of households with access to clean, pipe-born water to at least 30%.

La Mancha said the transaction announced on Wednesday builds on its already strong portfolio of gold mining investments with a track record of creating value through its stakes in Endeavour Mining Corp. [EDV-TSX] in Africa and Evolution Mining Co. [EVN-ASX] in Australia.

With both of these investments, La Mancha said it has actively supported meaningful organic acquisition led growth which has driven substantial industrial synergies. “We see significant opportunity to build on these achievements through our investment in Golden Star,” La Mancha said.

Following completion of the investment in Golden Star, La Mancha said it will be the major shareholder in a rapidly growing gold producer in Ghana, with 2018 forecast annual production of 230,000 to 255,000 ounces at an all-in-sustaining cost of US$850 to US$950/oz from its two underground operations.

Golden Star owns 90% of Prestea. The Government of Ghana owns the other 10% interest.

Currently, production is being delivered from the Prestea Open Pits and Prestea Undergound Gold Mine. In the second half of 2018, Prestea is expected to become an underground-focused operation.

Wassa is also held 90% by Golden Star and 10% by the Government of Ghana. Golden Star commenced production from the surface operation in 2005 and commercial production was achieved at Wassa Underground in January, 2017. In early 2018, Wassa transitioned into an underground-focused operation.

Recently, Golden Star announced an increase of 147% to the Wassa Deeps inferred underground resource to more than five million ounces of gold.

La Mancha said its investment will support Golden Star in accelerating exploration and resource definition drilling at both operations to determine the optimum mining plans to realise the most value for shareholders.

“We have worked closely with Golden Star to understand the potential of its asset base and to agree this transaction which will help to unlock the value of the world class Wassa and Prestea orebodies, through accelerated exploration and resource definition drilling and the injection of development capital to fast-track the expansion of high-margin production at both operations” said La Mancha CEO Andrew Wray.

“Over time, we could expect to see significant organic production growth, the potential to substantially extend mine life and a resulting drop in unit costs,” La Mancha said in a press release. “This will create a strong platform for the business to target further growth from its existing asset base as well as through potential acquisitions,” it said.

Golden Star shares were down 2.11% or $0.02 to 93 cents in early trading, Thursday. The 52-week range is $1.17 and 70 cents.