Trevali Mining ups Namibia zinc mine interest to 90%

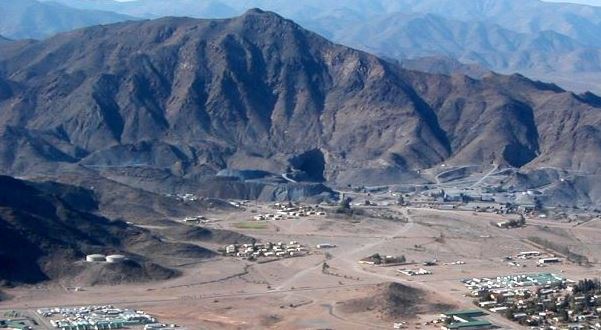

The Rosh Pinah zinc mine in Namibian, Africa. Source: Trevali Mining Corp.

Trevali Mining Corp. [TV-TSX, Lima; TREVF-OTCQX, 4T1-FSE] said Tuesday May 1 its majority-owned Rosh Pinah Zinc Corp. (Proprietary) Ltd. (RPZC) in Namibia will, subject to receipt of Companies Registration Office and Registrar approval, undertake a partial share buyback of issued RPZC shares under agreements with Namibian shareholders.

RPZC will acquire issued shares tendered under the agreements for an aggregate amount of approximately $24.2 million. Following the cancellation of the tendered shares, Trevali’s effective beneficial ownership in RPZC will increase from approximately 80% to 90%.

Trevali is a zinc-focused, base metals mining company. It operates the wholly-owned Santander Mine in Peru, the wholly-owned Caribou Mine in the Bathurst Mining Camp of northern New Brunswick, the Rosh Pinah Mine and its 90%-owned Perkoa Mine in Burkina Faso, West Africa.

Trevali bought the Rosh Pinah and Perkoa mines, in addition to a basket of other assets last year, from Swiss metals trading giant Glencore Plc [GLEN-LSE]. The US$417.86 million acquisition was completed in August, 2017.

“We welcome this opportunity to strengthen our involvement in Rosh Pinah, which globally is an upper-quartile zinc deposit in terms of grade and tonnage,” said Trevali President and CEO Mark Cruise.

“Following our recent mineral reserve and resource updates at Rosh Pinah, which remains open for expansion, we have commissioned an independent engineering study examining potential production optionality given the deposit’s almost 50-year history of resource-reserve replacement and growth,” said Cruise. “Trevali views its operations and investment in Namibia as a long-term relationship to the mutual benefit of all groups involved.”

Trevali said Rosh Pinah remains on track for its 2018 production guidance of 105-115 million pounds of payable zinc, 5.7-6.0 million pounds of payable lead, and 123,000-129,000 ounces of payable silver, on a 100% basis.

Key strategic investments started in late 2017 produced significant improvements in overall performance and has positioned the site well for the year with increasing metal output planned for the second half of 2018 as higher-grade stopes are sequenced.

Trevali shares reacted to the news by falling 2.52% or $0.03 to $1.16 on volume of 458,677. The 52-week range is $1.03 and $1.75.

Trevali recently signed a preliminary deal with Puma Exploration Inc. for the option to acquire an interest in the Murray Brook Deposit and to form a proposed strategic alliance in the northern portion of the Bathurst Mining Camp in New Brunswick.

Trevali is already a big player in the Bathurst Mining Camp through its ownership of the operating Caribou Zinc Mine, which is comprised of an underground mine and 3,000 tonne-per-day processing mill, flotation recovery plant, metallurgical and geochemical laboratories and a tailings management facility.

The Murray Brook deposit is located approximately 10 km west of the Caribou Mine along Provincial Highway 180 and is comprised of 484 hectares under Mining Lease 252. Geologically, it is formed from a large, low-to-moderate grade massive sulphide body within which higher grade zones occur.