LiCo Energy says Ontario cobalt deal was best option

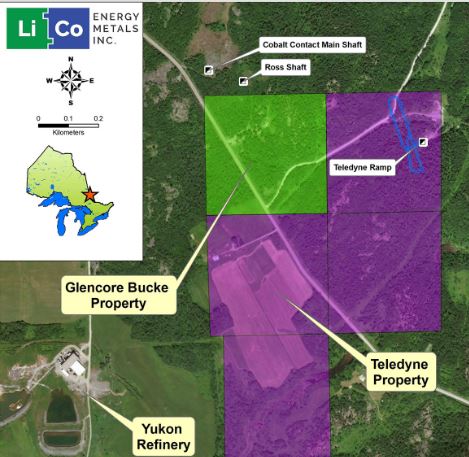

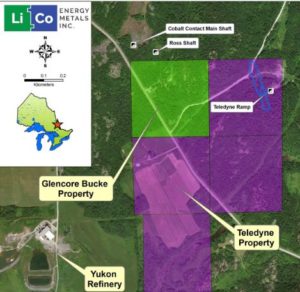

Location Map of LiCo Energy's Glencore Bucke and Teledyne properties near Cobalt, northeast Ontario. Source LiCo Energy Metals Inc.

LiCo Energy Metals Inc. [LIC-TSXV, WCTXF-OTCQB] shares were active Monday May 14 after the company released a shareholder update to provide additional information relating to an option agreement with Surge Exploration Inc. [SUR-TSXV, CKVLF-OTCQB].

Under the agreement, which was announced on May 8, 2018, Surge an earn a 60% interest in LiCo’s Glencore Buck and Teledyne cobalt properties, which are located in Cobalt, northeast Ontario.

Surge agreed to pay LiCo $240,000 and issue 1 million fully paid and non-assessable common shares to LiCo. In addition, Surge will incur $1.53 million in exploration expenditures.

Having completed its obligations to Glencore Canada Corp. under a mineral property acquisition agreement dated August 31, 2017, LiCo holds a 100% in interest in the mining rights for the Glencore Bucke property in Bucke Twp., 6 km east of the town of Cobalt.

The purchase agreement included a back-in provision, production royalty and an off-take agreement in favour of Glencore, which ranks as one of the world’s largest producers of cobalt. Glencore Canada is a subsidiary of Glencore Plc of Baar, Switzerland

Strategically, the Glencore Bucke property consists of 16.2 hectares and sits along the west boundary of LiCo’s 100%-owned Teledyne cobalt project. Teledyne covers the southern extension of the former producing 15 Vein on the past producing Aguanico Mine property.

Historically, the Aguanico Mine produced 4,350,000 pounds of cobalt and 980,000 ounces of silver during the mining boom of the early 1900s.

In the early 1980s, Glencore Bucke was explored by 38 surface diamond drill holes, totaling 3,323 metres. The drilling program outlined two separate vein systems hosting significant cobalt and silver values. The two zones are known as the Main Zone, measuring 152.4 metres in length, and the Northwest Zone, measuring 70 metres in length.

During the fall of 2017, the LiCo completed 21 diamond drill holes, totalling 1,900 metres at Glencore Bucke. This drill program, along with the Phase 1 diamond drilling program completed on the Teledyne cobalt property satisfied LiCo’s flow-through financing obligations as well as the contractual obligations to Glencore.

Since the completion of LiCo’s Phase 1 diamond drilling programs at the end of the 2017 calendar year, company management has been reviewing various financing options that will allow it to continue to move forward its promising lithium projects in Nevada and Chile as well as its cobalt projects in Canada, the company said in a press release on Monday.

“Given the continued softening/deterioration of junior mining equity financing markets and the relatively large number of company common shares already issued and outstanding, management believed that seeking project specific option agreements would be the company’s most readily available financing strategy option,” LiCo said.

On Monday LiCo Energy shares rose 20% or $0.01 to $0.06 on active volume of 777,900. The stock is trading in a range of 20 cents and $0.045.

Surge Exploration shares eased 2.22% or $0.005 to 22 cents.