Honey Badger up 24% on private placement news

SHOWING Honey Badger's Thunder Bay Silver Project, northwest Ontario. Source: Honey Badger Exploration Ltd.

Honey Badger Exploration Ltd. [TUF-TSXV; HBEIF-OTC] shares jumped 24% on Friday May 18 after the company said it had closed the first tranche of a previously announced non-brokered private placement, generating gross proceeds of $1.6 million. The shares were up $0.025 to 13 cents on active volume of 561,400.

Honey Badger said funds managed by Goodman & Company Investment Counsel Inc., a subsidiary of Dundee Corp., have subscribed for a total of $1.15 million in both units and flow through shares to be issued in the offering.

“Goodman & Company’s investment is a testament to the potential of our Thunder Bay Polymetallic Silver Camp,” said Honey Badger’s President and CEO Quentin Yarie. “We’ve made some significant discoveries already and we will continue to carry out an aggressive exploration program to develop the project further.”

Each unit under the offering is priced at 10 cents. Net proceeds of the offering will be primarily used for exploration and general working capital purposes.

Honey Badger’s recently completed a 1,500-metre drill program that tested structural traps where the likelihood of finding polymetallic silver mineralization is the highest. Assays are pending.

Honey Badger recently said it has substantially increased its land position near its flagship Thunder Bay Silver Project in the Lakehead Region west of Thunder Bay, Ontario.

Based on the company’s early exploration success in the Beaver Mine area, Honey Badger has strategically staked an additional 1,077 claims covering more than 23,400 hectares to cover the southern extension of the main structures that are interpreted to control polymetallic silver mineralization in the district.

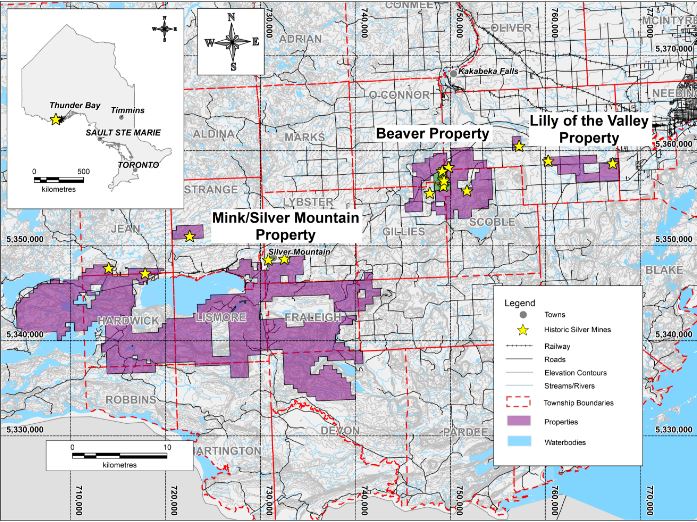

The Thunder Bay Silver Project is comprised of the Beaver Silver, Silver Mountain and Mink Mountain Silver properties, which are located between 25 and 70 km southwest of Thunder Bay, northwestern Ontario.

The respective name of each property refers to the name of the main historical silver mine within or near the property boundaries. Over 5 million ounces of silver were produced in the region, mostly before 1900, and well before the advent of modern exploration techniques and mining practises.

Honey Badger is the early mover in consolidating key ground in this historic silver camp that has strong potential for polymetallic mineralization, the company has said.

There are two main vein groups in the Lakehead Region, the Mainland and Island Vein Groups. These vein groups are polymetallic veins, historically mined for silver, cobalt, copper, nickel, lead and zinc; hence, the term Five-Element Veins. Some of the veins also produced gold.

The geological setting in the region parallels the other major silver district in Ontario, the Cobalt Silver District in and around the town of Cobalt. Historic grades from the Mainland vein groups include up to 1.4% cobalt and 25% nickel, according to historic assay results from Geological Survey of Canada Report, 1889).

The company has said the geology of the newly acquired land package is very similar to the geology of the Cobalt Camp, and a review of historical records has already identified several exploration targets for additional polymetallic, five-element silver veins on the newly acquired claims.

With the land expansion, Honey Badger also secured an additional three historic mines, including:

The Lily of the Valley Mine, the Federal and Gopher mines. The Lily of the Valley Mine was developed on a vein reported to contain zones of very high-grade silver mineralization. Historically, a 5,060-pound bulk sample taken from the Lily of the Valley Mine graded 2.98% silver, according to historic records. Little information exists for both the Gopher and Federal mines.