Continental Gold Drilling Extends BMZ1 to more than 400 Vertical Metres with High-Grade Gold intercepts at the Buriticá Project, Colombia

Highlights:

- Broad Mineralized Zone 1 (“BMZ1”) has been successfully extended vertically through drilling to the elevation of the Higabra Tunnel, which is located at the base of the mountain at the same elevation of the future mine-related facilities. High-grades of gold and silver intersected over broad intervals include:

- 16.20 metres @ 10.27 g/t gold equivalent (BUUY401D)

- 7.15 metres @ 35.00 g/t gold equivalent (BUUY401D01)

- 24.40 metres @ 10.66 g/t gold Equivalent (BUUY401D03).

- BMZ1’s total vertical extent now totals more than 400 metres and it remains open at depth for expansion.

- Short-length definition drill-holes covering only the eastern portion of the lateral extent of BMZ1 have intercepted high-grade gold over broad intervals, including:

- 11.50 metres @ 52.80 g/t gold equivalent (DYR0085)

- 15.50 metres @ 20.47 g/t gold equivalent (DYR0086).

- Two drill holes intercepted the Murcielagos vein family approximately 100 metres below the elevation of the Higabra Tunnel, with results as follows:

- 2.20 metres @ 86.71 g/t gold equivalent (BUUY401D02)

- 0.50 metres @ 57.46 g/t gold equivalent (BUUY401D01).

- These results, coupled with earlier results announced in 2018, confirm that much higher grades of gold and silver versus the current mineral resource model are present in this vein family at these elevations along more than 300 metres of strike extent (and open).

Continental Gold Inc. [TSX:CNL; OTCQX:CGOOF] is pleased to announce additional high-grade assay results from seven definition holes and 11 expansion and infill holes drilled into the Yaraguá system as part of its 2018 definition and exploration drilling program at its 100%-owned Buriticá project in Antioquia, Colombia. The Company presently has 11 diamond drill rigs in operation; four rigs are being utilized for the ongoing stope definition drilling program and the other seven rigs are conducting infill and mineral resource expansion drilling at the Yaraguá and Veta Sur deposits.

“BMZ1 results continue to impress both in terms of grades and widths and will undoubtedly lead to greater flexibility for mining. We also continue to encounter high-grades in the Murcielagos vein family as these intercepts are located close to our existing tunnel development from the Higabra Valley and, as a result, will be accessed early in the mine life,” commented Ari Sussman, CEO. “Our planned updated mineral resource estimate remains on track for completion in Q1 2018.”

Detail Summary (see Table 1 and Figures 1, 2 and 3)

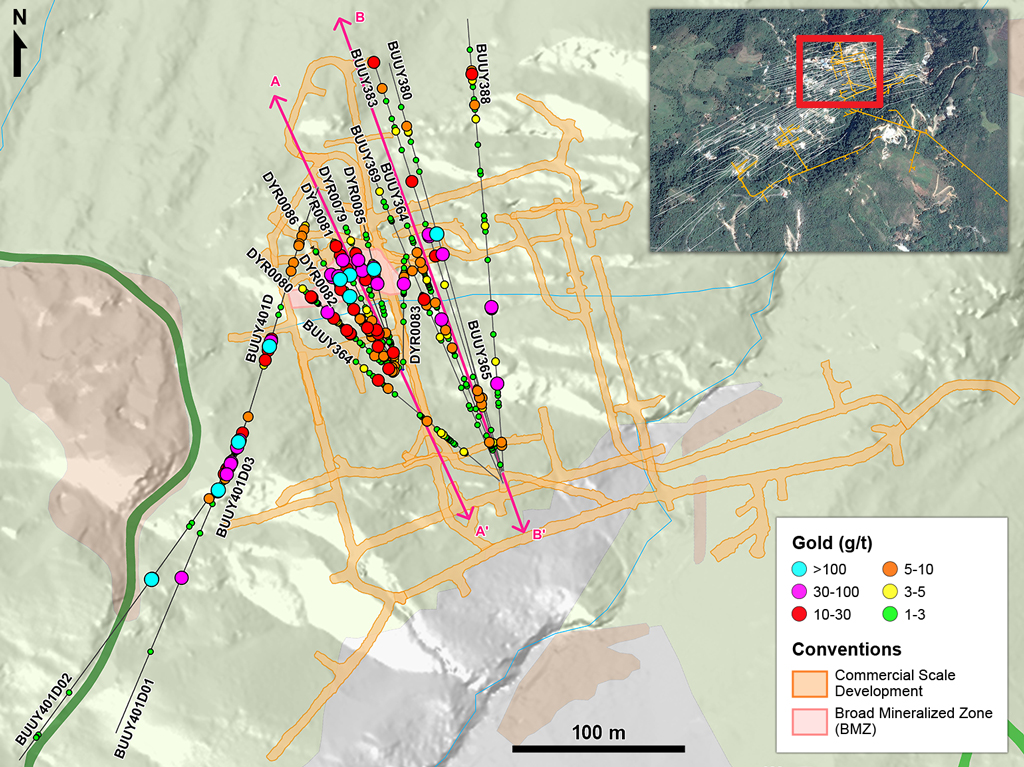

Definition holes DYR0079-DYR0086 were drilled to the north-northwest from a chamber located along the main access ramp in the central portion of the Yaraguá system located slightly east of BMZ1. Results to date are being used to verify and finalize stope designs and schedule production from this area, anticipated in 2020. Definition drilling into BMZ1 is anticipated to continue throughout 2019 as development advances vertically and new chambers are constructed.

Definition drill holes DYR0079-DYR0086 were designed to define the eastern lateral portion of BMZ1 at elevations ranging from 1,492-1,455 RL. The western lateral portion at similar elevations of BMZ1 will be tested at a later date from a drill chamber located west of BMZ1. Each of the definition holes intercepted broad zones of medium to high-grade gold at or near true widths, demonstrating the robust continuity of this zone with key results including:

- 12.05 metres @ 7.47 g/t gold and 12.4 g/t silver (DYR0079, 1,488 RL)

- 13.40 metres @ 8.04 g/t gold and 18.2 g/t silver (DYR0081, 1,489 RL)

- 11.50 metres @ 52.35 g/t gold and 33.5 g/t silver (DYR0085, 1,465 RL)

- 15.50 metres @ 20.27 g/t gold and 15.5 g/ t silver (DYR0086, 1,473 RL)

The BUUY401 deviation drill hole series consisted of four drill holes (including the mother hole) and were designed to both infill and extend BMZ1 to the elevation of the Higabra tunnel. The drill holes were successful in extending the vertical extent of BMZ1 by an additional 63 metres and now reaches the elevation of the Higabra tunnel at 1,195Â RL. Importantly, the zone-which now covers over 400 metres in vertical extent-remains open in high grade for expansion with future drilling. Broad and high-grade intercepts from this series of holes are as follows:

- 16.20 metres @ 10.11 g/t gold and 11.9 g/t silver (BUUY401D, 1,337 RL)

- 7.15 metres @ 34.80 g/t gold and 15.6 g/t silver (BUUY401D01, 1,225 RL)

- 7.10 metres @ 13.52 g/t gold and 29 g/t silver (BUUY401D02, 1,224 RL)

- 24.40 metres @ 10.20 g/t gold and 32.5 g/t silver (BUUY401D03, 1,224 RL)

- 22.25 metres @ 9.30 g/t gold and 18.1 g/t silver (BUUY401D03, 1,195 RL)

Both drill hole BUUY401D01 and BUUY401D02 continued through BMZ1 to the south and intercepted high-grade gold in the Murcielagos vein family at an elevation approximately 100 metres below the elevation of the Higabra tunnel, with results as follows:

- 0.50 metres @ 51.90 g/t gold and 417 g/t silver (BUUY401D01, Vein MU51, 1,095 RL)

- 2.20 metres @ 85.20 g/t gold and 113.7 g/t silver (BUUY401D02, Vein MU51, 1,091 RL)

These results, coupled with earlier results announced on April 16, 2018 (i.e. BUUY370D01: 4.25 metres @ 83.65 g/t gold and 29.3 g/t silver) confirm the pervasive nature of this high-grade shoot and warrants infill and definition drilling in 2019 to outline stope designs for future mining.

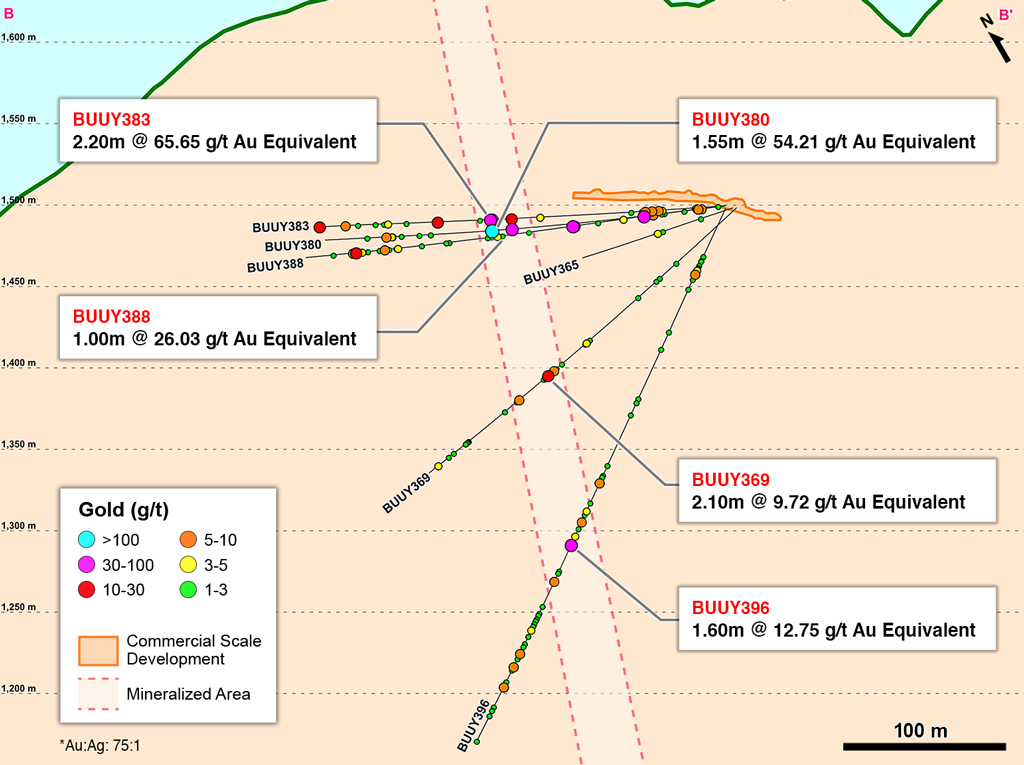

Infill drilling into a central-east portion of the Yaraguá system have intercepted narrow veins containing high-grade gold and have confirmed the mineral resource block model estimate for this area with results including:

- 3.30 metres @ 77 g/t gold and 23.6 g/t silver (BUUY401D01, Vein PRE20, 1,178 RL)

- 1.55 metres @ 53.56 g/t gold and 48.6 g/t silver (BUUY380, Vein SA, 1,484 RL)

- 2.20 metres @ 64.37 g/t gold and 95.9 g/t silver (BUUY383, Vein SA, 1,491 RL)

Table I: Drill Hole Results

| Hole ID | From (m) |

To (m) |

Intercept Interval* (m) |

Gold** (g/t) |

Silver** (g/t) |

Gold Equivalent** (g/t) |

Mid Point Elevation (m) |

Vein |

| BUUY364 | 26.25 | 28.20 | 1.95 | 2.67 | 6.1 | 2.76 | 1492 | MU06 |

| 37.20 | 42.00 | 4.80 | 1.28 | 7.5 | 1.38 | 1489 | MU07 | |

| 43.00 | 48.60 | 5.60 | 2.08 | 12.5 | 2.24 | 1487 | VNE30 | |

| 55.60 | 58.20 | 2.00 | 3.14 | 9.8 | 3.27 | 1485 | vne31 | |

| 60.00 | 63.10 | 3.10 | 1.56 | 7.0 | 1.65 | 1484 | pre20 | |

| 86.00 | 87.70 | 1.70 | 2.88 | 7.4 | 2.98 | 1478 | VNC18_V | |

| 94.10 | 95.70 | 1.60 | 5.86 | 11.2 | 6.01 | 1476 | C40_V | |

| incl | 94.10 | 94.65 | 0.55 | 13.95 | 25.0 | 14.28 | ||

| BUUY365 | Did not reach target | |||||||

| BUUY369 | 149.90 | 150.90 | 1.00 | 4.16 | 6.5 | 4.25 | 1398 | SOF10 |

| 154.40 | 156.50 | 2.10 | 9.48 | 17.6 | 9.72 | 1395 | NW2 | |

| incl | 154.90 | 155.50 | 0.60 | 22.80 | 52.2 | 23.50 | ||

| 177.90 | 180.80 | 2.90 | 2.74 | 1.4 | 2.76 | 1379 | HWV2 | |

| 218.60 | 221.50 | 2.90 | 1.56 | 3.3 | 1.60 | 1354 | VND10 | |

| BUUY380 | 16.00 | 18.35 | 2.35 | 1.96 | 10.4 | 2.10 | 1497 | MU06+MU07 |

| 44.10 | 45.10 | 1.00 | 5.43 | 19.7 | 5.69 | 1494 | VNE1 | |

| 131.20 | 131.70 | 0.50 | 55.60 | 31.2 | 56.02 | 1485 | HWV2 | |

| 143.55 | 145.10 | 1.55 | 53.56 | 48.6 | 54.21 | 1484 | SA | |

| incl | 143.55 | 144.05 | 0.50 | 138.00 | 81.8 | 139.09 | ||

| 204.90 | 206.00 | 1.10 | 3.84 | 20.5 | 4.11 | 1481 | VNA8 | |

| 208.60 | 209.10 | 0.50 | 5.05 | 7.3 | 5.15 | 1480 | New | |

| 228.90 | 231.70 | 2.80 | 12.85 | 53.3 | 13.56 | 1479 | N20 | |

| 242.70 | 243.80 | 1.10 | 21.95 | 83.9 | 23.07 | 1479 | CNT | |

| BUUY383 | 16.70 | 18.75 | 2.05 | 2.24 | 12.0 | 2.40 | 1498 | MU6+MU7 |

| 44.50 | 45.50 | 1.00 | 3.82 | 27.1 | 4.18 | 1496 | VNE31 | |

| 48.70 | 51.30 | 2.60 | 2.12 | 2.3 | 2.15 | 1496 | PRE20 | |

| 130.80 | 131.40 | 0.60 | 26.10 | 30.6 | 26.51 | 1492 | HWV2 | |

| 142.20 | 144.40 | 2.20 | 64.37 | 95.9 | 65.65 | 1491 | SA | |

| incl | 142.80 | 143.40 | 0.60 | 63.90 | 305.0 | 67.97 | ||

| and | 143.90 | 144.40 | 0.50 | 204.00 | 45.7 | 204.61 | ||

| 176.10 | 180.50 | 4.40 | 4.51 | 5.9 | 4.58 | 1490 | VNAD9 | |

| 208.70 | 210.20 | 1.50 | 2.75 | 7.4 | 2.85 | 1488 | VNA8 | |

| 232.50 | 233.50 | 1.00 | 3.76 | 27.2 | 4.12 | 1487 | N20 | |

| 248.80 | 249.50 | 0.70 | 14.35 | 75.4 | 15.36 | 1487 | CNT | |

| BUUY388 | 51.10 | 51.60 | 0.50 | 34.30 | 15.9 | 34.51 | 1493 | VNE31 |

| 95.00 | 97.10 | 2.10 | 21.18 | 7.0 | 21.27 | 1487 | NW2 | |

| incl | 96.10 | 97.10 | 1.00 | 35.65 | 8.3 | 35.76 | ||

| 130.40 | 131.60 | 1.20 | 4.32 | 10.8 | 4.46 | 1482 | HWV2 | |

| 146.80 | 147.80 | 1.00 | 24.71 | 98.7 | 26.03 | 1480 | SA12_V+FWV11 | |

| incl | 146.80 | 147.50 | 0.70 | 34.50 | 139.6 | 36.36 | ||

| 213.90 | 215.40 | 1.50 | 3.08 | 18.4 | 3.32 | 1473 | CNT1 | |

| 232.00 | 235.50 | 4.00 | 4.48 | 37.5 | 4.98 | 1470 | N20 | |

| incl | 233.00 | 233.50 | 0.50 | 16.10 | 213.0 | 18.94 | ||

| BUUY396 | 41.50 | 44.80 | 3.30 | 2.19 | 6.9 | 2.28 | 1458 | MU6 |

| 211.10 | 212.10 | 1.00 | 4.76 | 31.7 | 5.18 | 1306 | C30 | |

| 227.10 | 228.70 | 1.60 | 12.43 | 23.8 | 12.75 | 1291 | C11 | |

| incl | 227.10 | 227.70 | 0.60 | 31.10 | 55.6 | 31.84 | ||

| 251.90 | 252.40 | 0.50 | 8.46 | 96.0 | 9.74 | 1269 | SOF10 | |

| 310.00 | 310.50 | 0.50 | 7.39 | 66.9 | 8.28 | 1217 | HWV2 | |

| 323.80 | 324.85 | 1.05 | 4.62 | 17.0 | 4.85 | 1203 | SA12 | |

| BUUY401D | 65.00 | 67.35 | 2.35 | 4.35 | 3.8 | 4.40 | 1469 | NWSE3 |

| 76.30 | 77.80 | 1.50 | 3.65 | 6.0 | 3.73 | 1459 | NW2 | |

| 205.50 | 221.70 | 16.20 | 10.11 | 11.9 | 10.27 | 1337 | BMZ1 | |

| incl | 209.30 | 209.80 | 0.50 | 48.60 | 121.0 | 50.21 | ||

| and | 215.30 | 216.30 | 1.00 | 69.55 | 44.3 | 70.14 | ||

| 232.80 | 234.80 | 2.00 | 7.77 | 9.5 | 7.90 | 1319 | C11 | |

| incl | 234.30 | 234.80 | 0.50 | 15.20 | 9.8 | 15.33 | ||

| BUUY401D01 | 31.50 | 38.65 | 7.15 | 34.80 | 15.6 | 35.00 | 1225 | BMZ1 |

| incl | 37.00 | 38.65 | 1.65 | 111.74 | 37.6 | 112.24 | ||

| 56.30 | 57.60 | 1.30 | 3.75 | 2.2 | 3.78 | 1209 | CB18 | |

| 76.40 | 77.00 | 0.60 | 8.85 | 3.7 | 8.90 | 1193 | VNB19 | |

| 92.40 | 95.70 | 3.30 | 77.00 | 23.6 | 77.32 | 1178 | PRE20 | |

| incl | 6.00 | 93.90 | 0.50 | 314.00 | 70.5 | 314.94 | ||

| 193.15 | 193.65 | 0.50 | 51.90 | 417.0 | 57.46 | 1095 | MU51 | |

| BUUY401D02 | 3.60 | 10.70 | 7.10 | 13.52 | 29.0 | 13.91 | 1224 | BMZ1 |

| and | 8.90 | 9.70 | 0.80 | 57.10 | 21.2 | 57.38 | ||

| 40.95 | 48.70 | 7.75 | 5.83 | 7.8 | 5.93 | 1195 | CB18 | |

| incl | 41.45 | 42.55 | 1.10 | 17.56 | 15.4 | 17.77 | ||

| and | 47.70 | 48.20 | 0.50 | 26.10 | 16.9 | 26.33 | ||

| 172.30 | 174.50 | 2.20 | 85.20 | 113.7 | 86.71 | 1091 | MU51 | |

| incl | 172.30 | 173.50 | 1.20 | 154.26 | 120.2 | 155.86 | ||

| and | 173.00 | 173.50 | 0.50 | 311.00 | 232.0 | 314.09 | ||

| BUUY401D03 | 16.30 | 40.70 | 24.40 | 10.20 | 32.5 | 10.66 | 1224 | BMZ1 |

| incl | 26.70 | 28.30 | 1.60 | 60.60 | 85.6 | 61.82 | ||

| and | 35.00 | 36.20 | 1.20 | 31.90 | 51.7 | 32.64 | ||

| 52.75 | 75.00 | 22.25 | 9.30 | 18.1 | 9.56 | 1195 | BMZ1 | |

| incl | 53.80 | 54.35 | 0.55 | 89.10 | 69.2 | 90.09 | ||

| and | 55.50 | 56.10 | 0.60 | 40.90 | 19.1 | 41.17 | ||

| and | 68.20 | 68.75 | 0.55 | 67.10 | 4.0 | 67.16 | ||

| DYR0079 | 55.80 | 56.90 | 1.10 | 4.92 | 9.0 | 5.04 | 1486 | |

| 61.35 | 73.40 | 12.05 | 7.47 | 12.4 | 7.64 | 1488 | Partial BMZ1 | |

| incl | 62.24 | 62.81 | 0.57 | 38.60 | 36.1 | 39.08 | ||

| and | 67.70 | 69.43 | 1.73 | 19.92 | 38.2 | 20.43 | ||

| DYR0080 | 16.65 | 21.90 | 5.25 | 2.80 | 5.8 | 2.87 | 1467 | C20_V |

| 40.00 | 48.60 | 8.60 | 4.22 | 7.5 | 4.32 | 1451 | C11_V | |

| incl | 42.25 | 43.20 | 0.95 | 13.22 | 18.4 | 13.46 | ||

| 65.50 | 66.30 | 0.80 | 17.97 | 15.2 | 18.17 | 1440 | HWV1 | |

| 78.90 | 82.60 | 3.70 | 6.60 | 22.2 | 6.90 | 1431 | Partial BMZ1 | |

| incl | 80.90 | 81.40 | 0.50 | 18.08 | 36.8 | 18.57 | ||

| DYR0081 | 22.00 | 28.00 | 6.00 | 5.95 | 2.6 | 5.98 | 1484 | C11_V |

| incl | 24.00 | 25.00 | 1.00 | 24.04 | 3.5 | 24.09 | ||

| 30.68 | 34.65 | 3.97 | 2.71 | 7.2 | 2.81 | 1485 | SOF10 | |

| 62.60 | 76.00 | 13.40 | 8.04 | 18.2 | 8.29 | 1489 | Partial BMZ1 | |

| and | 65.60 | 67.00 | 1.40 | 14.64 | 53.0 | 15.35 | ||

| and | 71.60 | 73.25 | 1.65 | 20.14 | 30.6 | 20.55 | ||

| 81.00 | 84.00 | 3.00 | 8.17 | 3.3 | 8.21 | 1492 | FWV11 | |

| incl | 81.00 | 82.00 | 1.00 | 21.13 | 6.0 | 21.21 | ||

| DYR0082 | 34.10 | 38.00 | 3.90 | 2.89 | 9.6 | 3.02 | 1486 | C11_V |

| 57.30 | 68.20 | 10.90 | 5.88 | 12.6 | 6.05 | 1488 | Partial BMZ1 | |

| incl | 66.00 | 66.60 | 0.60 | 60.70 | 131.0 | 62.45 | ||

| DYR0083 | 54.85 | 60.60 | 5.75 | 8.05 | 12.4 | 8.21 | 1455 | Partial BMZ1 |

| incl | 55.77 | 56.07 | 0.30 | 88.91 | 131.1 | 90.66 | ||

| DYR0085 | 53.70 | 65.20 | 11.50 | 52.35 | 33.5 | 52.80 | 1465 | Partial BMZ1 |

| incl | 62.78 | 65.00 | 2.22 | 253.54 | 127.6 | 255.24 | ||

| incl | 62.78 | 63.60 | 0.82 | 615.26 | 331.5 | 619.68 | ||

| DYR0086 | 10.40 | 11.40 | 1.00 | 5.05 | 6.5 | 5.13 | 1480 | C30 |

| 26.35 | 30.25 | 3.90 | 3.40 | 9.7 | 3.53 | 1477 | C11_V | |

| 50.30 | 65.80 | 15.50 | 20.27 | 15.5 | 20.47 | 1473 | BMZ1 | |

| incl | 62.54 | 65.10 | 2.56 | 89.91 | 54.2 | 90.63 | ||

* Intercepts calculated for minimum intervals of 0.5 metres. DYR series of drill holes are between 95-100% true widths while BUUY holes are between 65-100% true widths. Internal dilution within reported intervals generally does not exceed 20%

** Grades herein are reported as uncapped values

*** Gold equivalent in this release and table was calculated at Au:Ag ratio of 1:75 with no assumptions made for metallurgical recovery rates

Figure 1 – Plan View of Infill and Definition Drilling in the Yaraguá System

Figure 2 – Cross Section A-A’ of Extension and Definition Drilling in BMZ1

Figure 3 – Cross Section B-B’ of Infill Drilling in Central-Eastern Yaraguá

Geological Description of the Buriticá Project

Continental’s 100%-owned, 75,023-hectare project, Buriticá, contains several known areas of high-grade gold and silver mineralization, of base metal carbonate-style (“Stage I”) variably overprinted by texturally and chemically distinctive high-grade (“Stage II”) mineralization. The two most extensively explored of these areas (the Yaraguá and Veta Sur systems) are central to this land package. The Yaraguá system has been drill-outlined along 1,350 metres of strike and 1,800 vertical metres and partially sampled in underground developments. The Veta Sur system has been drill-outlined along 1,000+ metres of strike and 1,800 vertical metres and has been partially sampled in underground developments. Both systems are characterized by multiple, steeply-dipping veins and broader, more disseminated mineralization and both remain open at depth and along strike, at high grades.

BMZ Details

The broad mineralized zone (“BMZ”) consists of a group of modelled precious metal-bearing veins in the current mineral resource estimate block model with mineralization occurring between these veins, generally in the form of veinlets at oblique angles to strike. The majority of the mineralization between modelled veins is not in the current mineral resource estimate, providing potential upside both in terms of identifying significantly broader and more productive zones for mining and increased mineral resources. To date, the Company has identified up to seven BMZ targets for testing and will systematically drill each target zone as underground mine development advances. BMZ1 encompasses a matrix of the east-west trending FW, San Antonio and HW veins as well as a package of a NW‑SE vein and subsidiary veinlets.

Technical Information

Mauricio Castañeda, Vice-President, Exploration of the Company and a Qualified Person for the purpose of NI 43‑101, has prepared or supervised the preparation of, or approved, as applicable, the technical information contained in this press release.

Reported intervals include minimum weighted averages of 3 g/t gold equivalent (75:1 Au/Ag) over core lengths of at least 1.0 metres. Assays are uncut except where indicated.

Besides rigorous chain-of-custody procedures, the Company utilized a comprehensive quality control/quality assurance program for the channel samples. All quality control anomalies were addressed and/or corrected as necessary to assure reliable assay results; no material quality control issues were encountered in the course of the program. Crush rejects and pulps are kept and stored in a secured storage facility for future assay verification. Although historic correlation between analytical results from the Company’s internal laboratory and certified independent laboratories for gold and silver analysis have been within acceptable limits, the Company’s internal laboratory is neither independent nor certified under NI 43-101 guidelines and, as such, channel sampling results in this release should only be taken by the reader as indicative of future potential.

For exploration and infill core drilling, the Company applied its standard protocols for sampling and assay. HQ and NQ core is sawn or split with one-half shipped to a sample preparation lab in MedellÃn run by ALS Colombia Limited (“ALS”) in Colombia, whereas BQ core samples are full core. Samples are then shipped for analysis to an ALS-certified assay laboratory in Lima, Peru. The remainder of the core is stored in a secured storage facility for future assay verification. Blanks, duplicates and certified reference standards are inserted into the sample stream to monitor laboratory performance and a portion of the samples are periodically check assayed at SGS Colombia S.A., a certified assay laboratory in MedellÃn, Colombia.

For stope definition core drilling, the Company applied its standard protocols for sampling and assay. The HQ3 samples were full core and provided sample widths between 0.2 to 1.0 metres weighing approximately 2 to 8 kilograms. Custody of the Samples were transferred at the mine site to Actlabs Colombia using rigorous chain-of-custody procedures. Full-core HQ3 samples are prepped and analyzed at Actlabs Colombia’s ISO 9001 accredited assay in MedellÃn, Colombia. The remainder of crushed rejects and pulps are stored in a secured storage facility for future assay verification. Blanks, pulps duplicates, coarse duplicates and purchased certified reference standards are inserted into the sample stream to monitor laboratory performance. A portion of the samples are periodically check-assayed at ALS Peru’s ISO 9001 accredited assay laboratory in Lima, Peru.

The Company does not receive assay results for drill holes in sequential order; however, all significant assay results are publicly reported.

For information on the Buriticá project, please refer to the technical report, prepared in accordance with NI 43 101, entitled “Buriticá Project NI 43-101 Technical Report Feasibility Study, Antioquia, Colombia” and dated March 29, 2016 with an effective date of February 24, 2016, led by independent consultants JDS Energy & Mining Inc. The technical report is available on SEDAR at www.sedar.com, on the OTCQX at www.otcmarkets.com and on the Company website at www.continentalgold.com.

About Continental Gold

Continental Gold is the leading large-scale gold mining company in Colombia and is presently developing it’s 100% owned Buriticá project in Antioquia. Buriticá is one of the largest and highest-grade gold projects in the world and is being advanced utilizing best practices for mine construction, environmental care and community inclusion. Led by an international management team with a successful record of discovering, financing and developing large high-grade gold deposits in Latin America, the Buriticá project is on schedule with first gold pour anticipated during the first half of 2020. Additional details on Continental Gold’s suite of gold exploration properties are also available at www.continentalgold.com.

Forward-Looking Statements

This press release contains or refers to forward-looking information under Canadian securities legislation-including statements regarding: timing of drill results, an updated mineral resource estimate and mine plan and commercial production; advancing the Buriticá project; exploration results; potential mineralization; potential development of mine openings; potential improvement of mining dilution grades; reducing start-up risks; and exploration and mine development plans-and is based on current expectations that involve a number of significant business risks and uncertainties. Forward-looking statements are subject to other factors that could cause actual results to differ materially from expected results. Readers should not place undue reliance on forward-looking statements. Factors that could cause actual results to differ materially from any forward-looking statement include, but are not limited to, an inability to advance the Buriticá project to the next level, failure to convert estimated mineral resources to reserves, capital and operating costs varying significantly from estimates, the preliminary nature of metallurgical test results, delays in obtaining or failures to obtain required governmental, environmental or other project approvals, political risks, uncertainties relating to the availability and costs of financing needed in the future, changes in equity markets, inflation, changes in exchange rates, fluctuations in commodity prices, delays in the development of projects and the other risks involved in the mineral exploration and development industry. Specific reference is made to the most recent Annual Information Form on file with Canadian provincial securities regulatory authorities for a discussion of some of the factors underlying forward-looking statements. All the forward-looking statements made in this press release are qualified by these cautionary statements and are made as of the date hereof. The Company assumes no responsibility to update them or revise them to reflect new events or circumstances other than as required by law.

Differences in Reporting of Resource Estimates

This press release was prepared in accordance with Canadian standards, which differ in some respects from United States standards. In particular, and without limiting the generality of the foregoing, the terms “inferred mineral resources,” “indicated mineral resources,” “measured mineral resources” and “mineral resources” that may be used or referenced in this press release are Canadian mining terms as defined in accordance with National Instrument 43‑101 – Standards of Disclosure for Mineral Projects under the guidelines set out in the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) Standards on Mineral Resources and Mineral Reserves (the “CIM Standards”). The CIM Standards differ significantly from standards in the United States. While the terms “mineral resource,” “measured mineral resources,” “indicated mineral resources,” and “inferred mineral resources” are recognized and required by Canadian regulations, they are not defined terms under standards in the United States. “Inferred mineral resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Under Canadian securities laws, estimates of inferred mineral resources may not form the basis of feasibility or other economic studies. Readers are cautioned not to assume that all or any part of measured or indicated mineral resources will ever be converted into reserves. Readers are also cautioned not to assume that all or any part of an inferred mineral resource exists or is economically or legally mineable. Disclosure of “contained ounces” in a resource is permitted disclosure under Canadian regulations; however, United States companies are only permitted to report mineralization that does not constitute “reserves” by standards in the United States as in place tonnage and grade without reference to unit measures. Accordingly, information regarding resources contained or referenced in this press release containing descriptions of our mineral deposits may not be comparable to similar information made public by United States companies.