Monarch Gold Intersects 50.94 g/t Au Over 2.70 Metres And 40.50 g/t Au Over 4.86 Metres at its Newly Acquired Fayolle Project

• Results from the 2019 diamond drilling program on Fayolle confirm the deposit’s high-grade near-surface potential.

• Visible gold observed in many holes, such as hole FA-19-107, which intersected 50.94 g/t Au over 2.70 metres, including 124.08 g/t Au over 1.00 metre, and hole FA-19-103, which intersected 40.50 g/t Au over 4.86 metres, including 132.01 g/t Au over 1.00 metre.

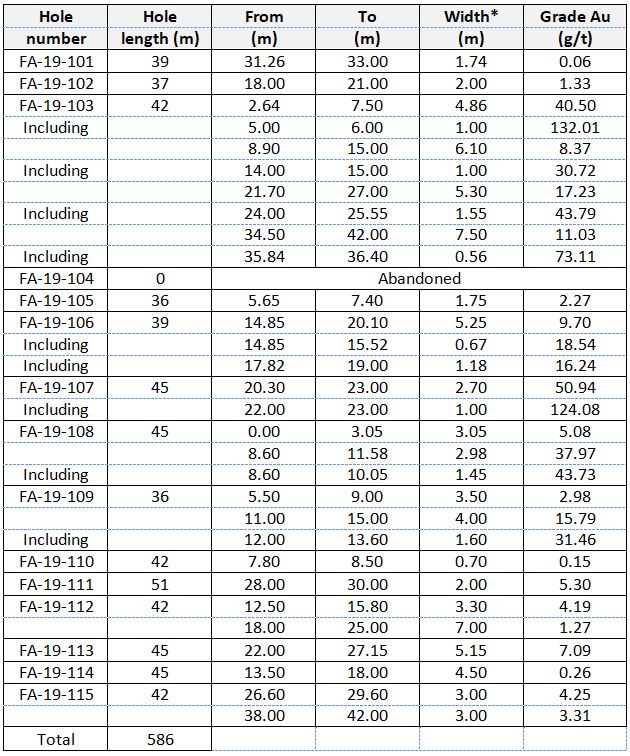

• Other results from the 586-metre drilling program include:

– Hole FA-19-103: 8.37 g/t Au over 6.10 metres, including 30.72 g/t Au over 1.00 metre, 17.23 g/t Au over 5.30 metres, including 43.79 g/t Au over 1.55 metres and 11.03 g/t Au over 7.50 metres, including 73.11 g/t Au over 0.56 metres.

– Hole FA-19-108: 37.97 g/t Au over 2.98 metres, including 43.73 g/t Au over 1.45 metres.

– Hole FA-19-109: 15.79 g/t Au over 4.00 metres, including 31.46 g/t Au over 1.60 metres.

Monarch Gold Corporation (“Monarch” or the “Corporation”) [TSX: MQR, OTCMKTS: MRQRF, FRANKFURT: MR7] is pleased to report the assay results from the 2019 diamond drilling program at its newly acquired, wholly owned Fayolle gold project 35 kilometres north east of Rouyn-Noranda, near its Camflo mill. A total of 586 metres were drilled in 14 holes. The purpose of the program was to drill infill holes in the centre of the deposit and around the known limits of the mineralization.

Hole FA-19-107, which was drilled to intersect the southern part of the deposit, returned 50.94 g/t Au over 2.70 metres, including 124.08 g/t Au over 1.00 metre. Specks of gold were visible throughout the sample interval.

Hole FA-19-103, drilled in the centre of the deposit, 25 metres northeast of hole FA-19-107, returned 40.50 g/t Au over 4.86 metres, including 132.01 g/t Au over 1.00 metre, with multiple grains of visible gold in the sample interval. Sampling started at 2.64 metres down the hole, confirming the near-surface mineralization.

Hole FA-19-103 also returned an assay of 8.37 g/t Au over 6.10 metres (from 8.90 to 15.00 metres), including 30.72 g/t Au over 1.00 metre. The hole intersected two other economic intervals as well, returning 17.23 g/t Au over 5.3 metres (from 21.70 to 27.00 metres), including 43.79 g/t Au over 1.55 metres, and 11.03 g/t Au over 7.5 metres (from 34.5 to 42.0 metres), including 73.11 g/t Au over 0.56 metres.

“These results continue to confirm Fayolle’s high grade status and near surface potential,” said Jean-Marc Lacoste, President and Chief Executive Officer of Monarch. “We are very enthusiastic about this acquisition, which fits perfectly with our strategy of developing near-surface gold deposits to feed our Camflo and Beacon mills. As such, we believe that Fayolle could become a very valuable asset for Monarch.”

2019 drill results for the Fayolle property:

The Fayolle deposit is a high-grade folded gold deposit hosted in ultramafics, injected with syenite and lamprophyre dykes. The mineralization is hosted where the ultramafics are brecciated and in the syenite dykes. Narrow lamprophyre dykes, 10 to 20 cm, which crosscut the ultramafics seem to play a role in the precipitation of the gold adjacent to the dykes.

Sampling normally consists of sawing the core into equal halves along its main axis and shipping one of the halves to the Bourlamaque Assays Laboratories Ltd. in Val-d’Or, Quebec for assaying. The samples are crushed, pulverized and assayed by a standard fire assay procedure on 30-gram subsamples, with atomic absorption spectrometry finish. Results exceeding 10.0 g/t Au are re-assayed using the gravimetric finish method. A comprehensive QA/QC protocol, including the insertion of standards, blanks and duplicates, was used.

The technical and scientific content of this press release has been reviewed and approved by Ronald G. Leber, P.Geo., the Corporation’s qualified person under National Instrument 43-101.

ABOUT MONARCH GOLD CORPORATION

Monarch Gold Corporation (TSX: MQR) is an emerging gold mining company focused on pursuing growth through its large portfolio of high-quality projects in the Abitibi mining camp in Quebec, Canada. The Corporation currently owns over 300 km² of gold properties (see map), including the Wasamac deposit (measured and indicated resource of 2.6 million ounces of gold), the Beaufor mine, Croinor Gold (see video), Fayolle, McKenzie Break and Swanson advanced projects and the Camflo and Beacon mills, as well as other promising exploration projects. It also offers custom milling services out of its 1,600 tonne-per-day Camflo mill.

Forward-Looking Statements

The forward-looking statements in this press release involve known and unknown risks, uncertainties and other factors that may cause Monarch’s actual results, performance and achievements to be materially different from the results, performance or achievements expressed or implied therein. Neither TSX nor its Regulation Services Provider (as that term is defined in the policies of the TSX accepts responsibility for the adequacy or accuracy of this press release.

FOR MORE INFORMATION:

Jean-Marc Lacoste                                                                         1-888-994-4465

President and Chief Executive Officer                                   jm.lacoste@monarquesgold.com

Mathieu Séguin                                                                          1-888-994-4465

Vice President, Corporate Development                              m.seguin@monarquesgold.com

Elisabeth Tremblay                                                                   1-888-994-4465

Senior Geologist – Communications Specialist                   e.tremblay@monarquesgold.com