GoGold Resources shares up on Mexican drill results

GoGold Resources Inc. [GGD-TSX] shares rallied Wednesday November 20 on news of drilling results from the company’s Los Ricos Project in Jalisco State, Mexico.

The latest results are from 10 new diamond drill holes. Highlights include drill hole LRGG-19-056, which returned 26 metres of 2.97 g/t gold equivalent, including 4.0 metres of 14.16 g/t gold equivalent from 296.0 to 325.0 metres. This is the second deepest hole to be drilled at Los Ricos to date, the company said.

GoGold shares advanced on the news, rising almost 7% or $0.04 to 64 cents. The shares are currently trading in a 52-week range of 19 cents and 80 cents.

GoGold is a Canadian-based silver and gold producer with operations in Mexico. Having recently sold a 2% royalty on the Santa Gertrudis Mine for US$12 million to Metalla Royalty & Streaming Ltd. [MTA-CSE; MTAFF-OTCQB; X9CP-FSE], GoGold’s key asset is the Parral Tailings Project in Chihuahua, Mexico.

Back in March, 2019, the junior acquired the rights to an agreement that provides it with the option to acquire a 100% interest in Los Ricos, which consists of 29 concessions and covers over 22,000 hectares. The property is home to several historical mining operations and is located roughly 100 km northwest of Guadalajara.

GoGold has said 65 historical drill holes were completed between 2003 and 2004. The majority intercepted mineralization near surface. The numerous historical workings date as far back a Spanish colonial times, but mainly date back to the early 20th century when Marcus Daly Jr., the son of the founder of Anaconda Copper Co., and James Watson Gerhard developed it into a modern mine, producing up to 500 tonnes of ore per day. The mine closed in 1930, about a year after the stock market crash.

On August 22, 2019, GoGold entered into various agreements worth $7.1 million to accelerate the acquisition of the 29 concessions, replacing a previous option deal that has been terminated. Under the concession agreements, 5 of the 29 concessions were to be transferred to GoGold, the remaining concessions were to be transferred at a rate of 5 concessions every five months.

The new option agreements required GoGold to pay $500,000 in cash upon signing, and pay $3.2 million cash in installments over 24 months. It must also deliver over 9 million common shares in equal numbers over 24 months.

It is on the first five acquired concessions that GoGold is current conducting its drill program.

On Wednesday, GoGold said results from drill holes 56 and 61 (LRGG-19-061), which intersected 18 metres of 0.80 g/t gold equivalent from 324.4 to 349.2 metres, shows the project continues to be open at depth with strong mineralization.

“We still see a broader mineralized zone of over 20 metres at these depths which may be amenable to deeper bulk mining and also shows a high-grade core within these broader zones which may represent underground mining targets,” said GoGold President and CEO Brad Langille.

In mid-October, 2019, GoGold said it completed the Phase I diamond drilling program consisting of 10,000 metres of HQ size diamond drill core. The program began in March 2019. Phase II has started and a third drill machine was added to the program.

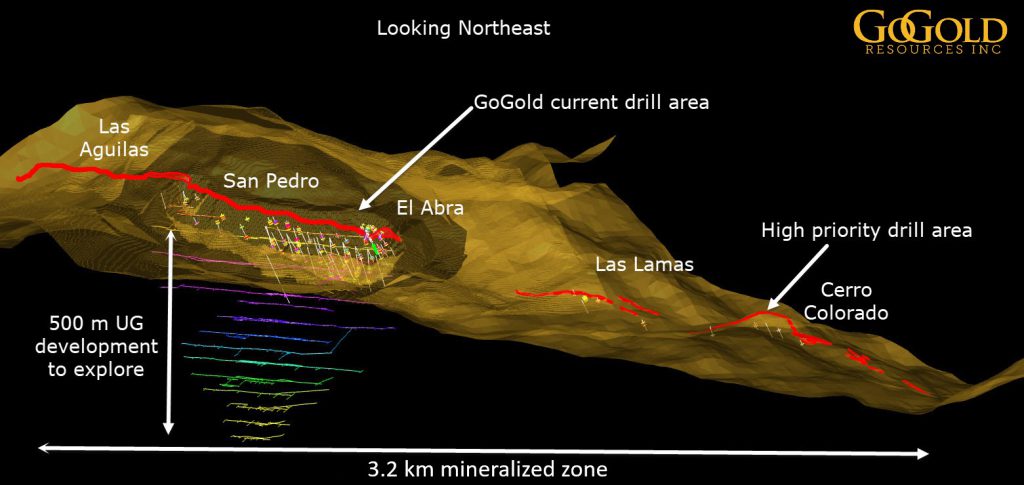

The core drilling program is focused on defining the mineralized halo around the historical high-grade ore shoots as defined by the underground workings and the 65 historical reverse circulation drill holes on the property. The program has now been expanded for additional testing along the 3.2 km of the Los Ricos mineralized zone.