Pan American execs taking 20% pay cut

Pan American Silver Corp. [PAAS-TSX, NASDAQ] said Thursday April 2 that it is suspending operations at two Mexican mines, reducing throughput in Canada, and implementing a 20% executive pay cut.

The move comes after Mexico’s Ministry of Health issued an Executive Order calling for the immediate suspension of non-essential activities, including mining, until April 30, 2020.

The government decree aims to stem the impact of the COVID-19 pandemic.

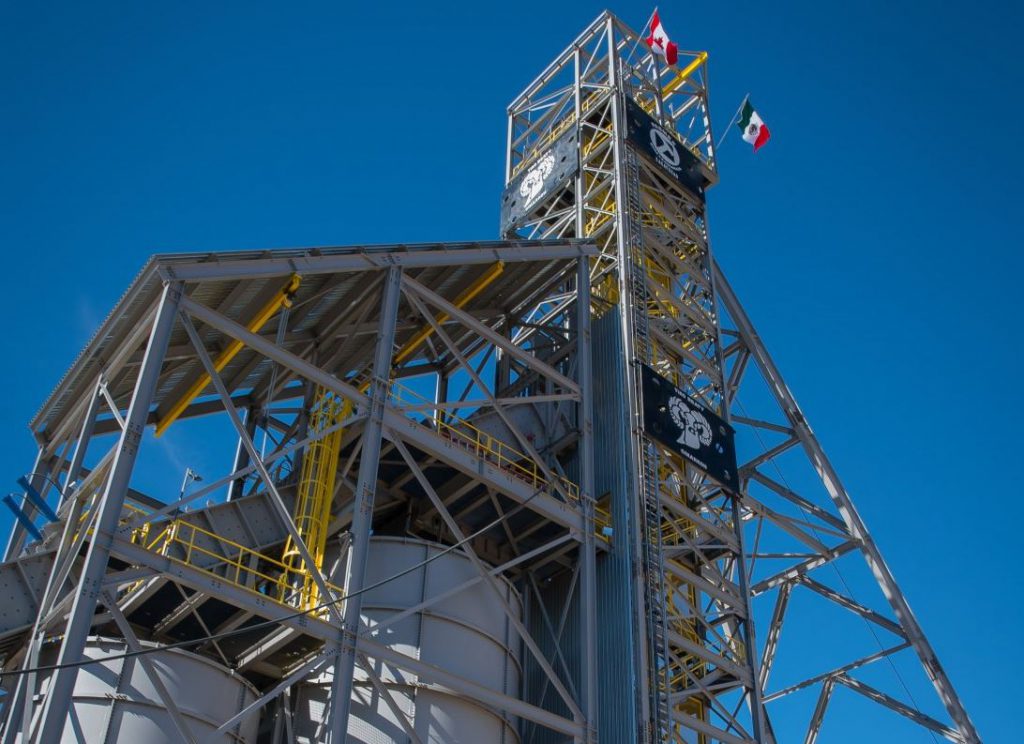

“Following an initiative of reducing the number of people on site to increase the physical distancing, Pan American will now expand this program in order to bring its La Colorada and Delores operations into compliance with the Executive Order,” Pan American said.

The company said it has also begun to voluntarily reduce throughput by approximately 10% to 20% at its Timmins operation in Canada in order to further enhance physical distancing throughout the operation, offices and personnel transport systems.

“We are carefully monitoring new developments regarding the pandemic, implementing the preventative measures recommended by health authorities and adapting our operations to government or company-led directives,” said Pan American President and CEO Michael Steinmann.

Pan American recently acquired Tahoe Resources Inc. in a US$1 billion transaction that created the world’s second largest primary silver producer. The company owns and operates mines in Mexico, Peru, Canada, Argentina and Bolivia. Its portfolio includes the Escobal Mine in Guatemala, which is not operating right now.

Last year, Pan American reported consolidated annual silver and gold production of 25.9 million ounces and 559,200 ounces respectively.

The company recently said its Timmins West and Bell Creek (together Timmins) operations are no longer up for sale.

As previously announced, Pan American has suspended normal operations at its mines in Peru, Argentina and Bolivia in order to comply with mandatory national quarantines. However, on Thursday the company said there are currently no confirmed cases of COVID-19 at any of Pan America’s operations.

Pan American shares advanced on the news, rising 5.6% or $1.17 to $21.88. The shares are currently trading in a 52-week range of $13.83 and $34.80.

“Pan American is in a strong financial position to manage the current business environment,” the company said in a press release on Thursday. “Cash and cash equivalents at December 31, 2019 totaled $120.6 million. In addition, Pan American has a credit facility in the amount of $500 million that matures on February 1, 2023,” the company said.

At the end of 2019, $275 million was drawn on the credit facility, of which $15 million was repaid in early 2020. In order to provide additional flexibility and liquidity, Pan American has deferred certain capital expenditures and exploration spending.

Pan American’s senior management team has voluntarily agreed to a salary reduction until the situation normalizes, including a 20% reduction for the executive management team.