Exploration heating up in Quebec’s Chicobi Gold Belt

By Ellsworth Dickson

Most of us are aware of the tremendous gold mining history (190 million oz) of the Abitibi Gold Belt that straddles the Ontario-Quebec border and encompasses the Timmins and Kirkland Lake, Ontario mining camps in the west, through the Val d’Or camp to the east and all the way to Chibougamau at the far eastern end.

However, within that gold belt, which is the major gold-producing region in Canada, lies another discrete gold belt – the Chicobi Gold Belt.

In an interview, Kelly Malcolm, Vice President Exploration for Amex Exploration, provided an insight into this gold-rich region.

He explained that the Chicobi Gold Belt is right in the centre of the much larger Abitibi Greenstone Gold Belt. “At the north would be the Sunday Lake Deformation Zone, and heading south would be the Casa Berardi Deformation Zone and below that would be the Chicobi Deformation Zone,” Malcolm noted. “South of that would be the Kirkland-Larder Lake Break and the Cadillac Break.” Breaks are faults that aided gold emplacement.

Geologically, the Chicobi Gold Belt is comparable to the other major deformation zones. It features Timiskaming-aged conglomerates, marking the major extensional portion of the basin. There are older volcanic rocks – dominantly mafic – as well as rhyolite. There is a 2.7-billion year old gold emplacement event which is comparable to the Timmins camp and also to the north at the Detour Lake camp.

“In our eyes, it is the same style and structure as the major breaks,” said Malcolm.

Originally, the Chicobi Gold Belt was thought to be a base metal belt following the discovery of the Normetal copper-zinc-gold-silver mine that was found in the 1920s and was in production from 1938 to 1975. “This was a cigar-shaped VMS deposit that started at surface and went down 2.4 kilometres vertically,” said Malcolm. “It basically built the town of Normétal and led to a great deal of base metal exploration in the area.”

“More recently, we have had great success in finding gold in what is now called the Chicobi Gold Belt and that has resulted in the entire region being staked for gold prospects,” said Malcolm. “Amex has Canada’s largest drilling program. That’s 150,000 metres this year with 10 drills turning 24/7. And there are a number of other juniors active along the trend.”

Amex Exploration Inc. [TSXV-AMX; OTCQX-AMXEF; FRA-MX0] is drilling the 100%-owned Perron gold project beside the former mining town of Normetal. A number of high-grade gold discoveries have been made on the Perron property, including 56.75 g/t gold over 8.50 metres with higher grade sections in the Eastern Gold Zone.

Generic Gold Corp.‘s [GGC-CSE; GGCPF-OTCQB; 1WD-FSE] exploration portfolio consists of three properties collectively known as the Belvais Project that cover 8,148 hectares proximal to the town of Normetal and east of Amex Exploration’s Perron Project where drilling is planned for H2 2021. Generic holds one of the largest land packages in the Chicobi Belt.

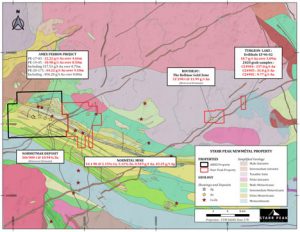

Starr Peak Exploration Ltd. [STE-TSXV] is exploring three properties in northwestern Quebec near the Ontario border: the NewMetal, Rousseau and Turgeon Lake prospects. The recently acquired NewMetal property is contiguous to the east of Amex Exploration’s gold discovery at their Perron property. Drilling is underway on the NewMetal property.

Vanstar Mining Resources Inc. [VSR-TSXV] has five gold projects in Quebec: Nelligan, Felix, Amanda, Frida and Eva. The Felix property is on the Chicobi belt and drilling has commenced. The Nelligan Gold Project 45 km south of Chapais is held under an earn-in option/joint venture agreement as to Vanstar 25% and IAMGOLD 75%.

BMEXÂ Gold Inc. [BMEX-TSXV; 8M0-FSE] holds options to earn 100% interests in two flagship properties – the King Tut and Dunlop Bay, located in two highly prospective regions, the Chicobi Gold Belt and the Matagami Gold Camp. Drilling is underway at the King Tut prospect.

The Chicobi Gold Belt has excellent infrastructure with highway access and logging and bush roads throughout the region as well as the town of Normetal.

The Chicobi Gold Belt has already seen gold discovery success and with the high level of exploration underway, investors can look forward to more discoveries.

Amex Exploration Inc. [TSXV-AMX; OTCQX-AMXEF; FRA-MX0] is continuing its exploration of the 100%-owned Perron gold project located 110 kilometres north of Rouyn-Noranda and just beside the past mining town of Normetal. Several high-grade gold discoveries have been made on the 4,518-hectare Perron property, including the Eastern Gold Zone, the Gratien Gold Zone, the Grey Cat Zone, and the Central Polymetallic Zone.

Amex Exploration Inc. [TSXV-AMX; OTCQX-AMXEF; FRA-MX0] is continuing its exploration of the 100%-owned Perron gold project located 110 kilometres north of Rouyn-Noranda and just beside the past mining town of Normetal. Several high-grade gold discoveries have been made on the 4,518-hectare Perron property, including the Eastern Gold Zone, the Gratien Gold Zone, the Grey Cat Zone, and the Central Polymetallic Zone.

The Perron Project has become the bright star of the Chicobi Deformation Zone which was thought to be a base metals belt until Amex made these gold discoveries. Perron has proven the belt has the potential to host very high-grade gold typically seen elsewhere in the Abitibi. The Chicobi Deformation Zone, or Chicobi Gold Belt, is within the much larger Abitibi Greenstone Belt.

These discreet gold deposits open up the potential for the Perron property to host several gold mines or drilling may prove that some of the gold zones actually link up to form larger gold deposits.

Following an $11.7 million financing in September, Amex is increasing its fully-funded drill program from 200,000 metres to 300,000 metres. The objective of exploration along strike of the 3+ km Perron Gold Corridor is to possibly link up the gold zones and generate a bulk tonnage target as well as high-grade underground targets such as the Eastern Gold Zone and the Grey Cat Zone.

The Eastern Gold Zone has several parallel mineralized zones, including the Denise Zone and the High Grade Zone which are open along strike and to depth. Drilling at the High Grade Zone has intersected more than 1.1 kilometres of high-grade gold mineralization starting from near surface. Over 100 drill holes have intersected gold mineralization grading over 10 g/t gold over variable widths. Infill as well as step-out drilling is underway.

The Eastern Gold Zone has several parallel mineralized zones, including the Denise Zone and the High Grade Zone which are open along strike and to depth. Drilling at the High Grade Zone has intersected more than 1.1 kilometres of high-grade gold mineralization starting from near surface. Over 100 drill holes have intersected gold mineralization grading over 10 g/t gold over variable widths. Infill as well as step-out drilling is underway.

At the Denise Zone, which is a broad gold-bearing system approximately 50 to 100 metres south of the High Grade Zone, drill hole PE-20-192 intersected 39.55 metres of 9.36 g/t gold, including 21.90 metres of 16.55 g/t gold which includes 0.50 metres of 428.42 g/t gold, 0.50 metres of 135.87 g/t gold, and 0.50 metres of 131.85 g/t gold at a vertical depth of approximately 225 metres.

There are too many high-grade gold intersections to list; however, for example, drilling in the Eastern Gold Zone returned 56.75 g/t gold over 8.50 metres with higher grade sections. Gratien Gold Zone highlights include 16.48 g/t gold over 14.60 metres with higher grade sections. Grey Cat drilling returned 23.95 g/t gold over 2.70 metres. Near-surface mineralization at Grey Cat of over a 20-metre width has the potential for open pitting. Drilling on all zones is ongoing.

The objective of the current drilling program is to provide a basis for preparing a maiden NI 43-101 compliant mineral resource estimate. A significant portion of the property remains underexplored. Visible gold has been intersected in drill holes on multiple days since drilling resumed on January 4, 2021.

In addition to 10 rigs turning 24 hours a day, Amex has also conducted metallurgical studies at the High Grade Zone. The Phase 2 metallurgy program determined that very high gold (99%) and silver (89.5%) recoveries are attainable using a simplified two-stage process that eliminates flotation, thereby lowering projected processing costs as well as capital costs.

Amex also holds a portfolio of two other properties focused on gold and base metals in the Abitibi region elsewhere in Quebec.

Amex Exploration is headed by Victor Cantore, President and CEO. His management team has extensive experience in exploration and capital markets. The company has 83,145,502 shares outstanding and approximately $32 million in cash. Amex has a number of major shareholders including mining financier Eric Sprott and various Quebec, European, Canadian and US institutions.

The company is currently awaiting assay results from 9,000 samples completed in 2020.

The Perron Gold Project has already proven that it represents an outstanding exploration opportunity in one of the world’s most prospective and mining-friendly regions.

Generic Gold Corp.‘s [GGC-CSE; GGCPF-OTCQB; 1WD-FSE] Québec exploration portfolio consists of four 100%-owned properties covering 12,563 hectares, proximal to the town of Normétal and east of Amex Exploration’s Perron Project (with drill results including 56.75 g/t gold over 8.5 metres and the past-producing Normétal Mine).

Generic Gold Corp.‘s [GGC-CSE; GGCPF-OTCQB; 1WD-FSE] Québec exploration portfolio consists of four 100%-owned properties covering 12,563 hectares, proximal to the town of Normétal and east of Amex Exploration’s Perron Project (with drill results including 56.75 g/t gold over 8.5 metres and the past-producing Normétal Mine).

Collectively known as the Belvais Project, the West, North, Centre and East Blocks contain more than 20 km of the East-West striking Normétal thrust fault in the Chicobi Deformation Zone. Thrust faults can be important geological features related to gold emplacement. The Chicobi Deformation Zone of the Chicobi Gold Belt is within the larger Abitibi Gold Belt. The eastern extent of the Belvais Project is adjacent to IAMGOLD and Osisko Metals properties.

The West Block and Centre Block surround the former Normétal Mine on three sides, which produced approximately 10 million tonnes grading 2.2% copper, 5.4% zinc, 0.5 g/t gold and 44.5 g/t silver.

The groundwork for the B-horizon soil sampling program has been completed and samples have been sent for analysis. The objective was to identify targets for drilling. Results are expected by late January. A VTEM airborne geophysical program is also nearing completion.

A total of 369 samples were taken spread out across the four blocks of the Belvais Project, with line spacings between 120 and 150 metres. Assays are pending. The team of six geologists and technicians also took advantage of the opportunity in the field to complete mapping of a number of outcrops and to note all access ways. Follow-up sampling work on these mapped outcrops is planned for the next field season.

A total of 369 samples were taken spread out across the four blocks of the Belvais Project, with line spacings between 120 and 150 metres. Assays are pending. The team of six geologists and technicians also took advantage of the opportunity in the field to complete mapping of a number of outcrops and to note all access ways. Follow-up sampling work on these mapped outcrops is planned for the next field season.

In addition, the company is seeking more mineral tenures to increase its land position in the Normétal Camp or elsewhere along the Chicobi Deformation Zone through staking of M&A transactions.

Diamond drilling is planned for Q2/Q3 2021 to follow up on results of the 2020 field program.

Headed by Richard Patricio, President and CEO, who has 15 years’ experience building mining companies with global operations, the Generic Gold management team is led by experienced mining industry professionals, with expertise in exploration, geology, finance, capital markets, and mine development.

Multiple major roads run through the Belvais properties, making access for all exploration activities extremely easy. With the towns of Normétal and La Sarre in close proximity, low-cost housing for its workers is always available as well as other amenities and infrastructure that greatly lowers the cost of exploration.

The company also has mineral projects in the Yukon Territory. Strategic shareholders include mine financier Eric Sprott. Generic Gold has 59,669,063 shares outstanding and approximately $6.5 million in its treasury.

Starr Peak Exploration Ltd. [STE-TSXV] is exploring three properties in northwestern Quebec near the Ontario border: the NewMétal, Rousseau and Turgeon Lake prospects. The NewMétal property is located in the Abitibi Greenstone Belt along the Chicobi Deformation Zone. The recently acquired 2,279.53-hectare NewMétal property located contiguous to the east of Amex Exploration’s gold discovery at their Perron property where recent drill results returned 32.2 g/t gold over 5.90 metres and 30.98 g/t gold over 8.50 metres. Both the Amex Perron property and Starr Peak’s NewMétal property are located in the Chicobi Gold Belt which is within the larger Abitibi Gold Belt.

Starr Peak Exploration Ltd. [STE-TSXV] is exploring three properties in northwestern Quebec near the Ontario border: the NewMétal, Rousseau and Turgeon Lake prospects. The NewMétal property is located in the Abitibi Greenstone Belt along the Chicobi Deformation Zone. The recently acquired 2,279.53-hectare NewMétal property located contiguous to the east of Amex Exploration’s gold discovery at their Perron property where recent drill results returned 32.2 g/t gold over 5.90 metres and 30.98 g/t gold over 8.50 metres. Both the Amex Perron property and Starr Peak’s NewMétal property are located in the Chicobi Gold Belt which is within the larger Abitibi Gold Belt.

The road-accessible NewMétal property, adjacent to the town of Normétal, is characterized by previous encouraging sampling and drill results for both precious and base metals and also hosts the past-producing Normétal Mine that produced ~10.1 million tonnes grading 5.12% zinc, 2.15% copper, 45.25 g/t silver and 0.549 g/t gold between 1926 and 1975. In 2007, drill hole GN-07-05 returned 5.89%, 0.94% copper, 76.03 g/t silver and 1.16 g/t gold over 2.12 metres.

To the northwest on the claim block, there is a non-43-101 compliant historical resource of the Normetmar deposit totalling 158,447 tonnes grading 12.06% zinc and 39.0 g/t silver. In 1996, drill hole 96-30-14 returned 9.91% zinc, 2.04% copper and 38.4 g/t silver over 11.3 metres.

The NewMétal property is underlain by favourable geology comprised of felsic and intermediate volcanic and felsic plutonic rocks of the Normétal formation and is highly prospective for gold-rich VMS mineralization and orogenic gold mineralization. The property straddles a section of the Normétal Fault, a major structural corridor associated with significant polymetallic occurrences along strike, most notably, the past-producing Normétal Mine.

The NewMétal property is underlain by favourable geology comprised of felsic and intermediate volcanic and felsic plutonic rocks of the Normétal formation and is highly prospective for gold-rich VMS mineralization and orogenic gold mineralization. The property straddles a section of the Normétal Fault, a major structural corridor associated with significant polymetallic occurrences along strike, most notably, the past-producing Normétal Mine.

Compilation work, completed by Starr Peak’s geological consulting firm, Laurentia Exploration Inc., has identified significant and numerous exploration targets in close proximity to the historical mine and resource.

A VTEM (versatile time-domain electromagnetic) survey has been completed over the company’s Newmétal property. A 5,000-metre diamond drilling program will commence shortly. Numerous targets have been identified both vertically within existing areas of mineralization as well as on strike and at depth of historical drill intercepts at both the Normétal Mine and the Normetmar deposit.

While Starr Peak’s main focus is on the Newmétal property, to the east, a high-resolution drone magnetic airborne survey has been completed over its Rousseau and Turgeon Lake properties.

The company has received high gold results from grab samples taken on a field visit carried out in September 2020 to the Turgeon property. Highlight assay results sampled on Turgeon Lake shoreline returned 157, 31.8 and 9.77 g/t gold, which confirm closely the historical grab samples at Turgeon Lake gold showing.

Johnathan More, CEO, has over 20 years’ experience in North American and European capital markets and the company is well served by seasoned directors.

Starr Peak Exploration’s three projects are located in an extremely prolific mineralized region in mine-friendly Quebec and offer opportunities to build upon historic resources as well as making new precious and base metal discoveries.

In November 2020, the company completed a flow-through share financing of $2,650,000. Starr Peak has 29,941,051 shares outstanding.

Vanstar Mining Resources Inc. [VSR-TSXV] is totally focused on mineral-rich Quebec with five gold projects in La Belle Province: Nelligan, Felix, Amanda, Frida and Eva.

Vanstar Mining Resources Inc. [VSR-TSXV] is totally focused on mineral-rich Quebec with five gold projects in La Belle Province: Nelligan, Felix, Amanda, Frida and Eva.

The Nelligan Gold Project, located 45 km south of Chapais and 280 km northeast of Val d’Or, is held under an earn-in option/joint venture agreement as to Vanstar 25% and IAMGOLD 75%. IAMGOLD can acquire an additional 5% interest by completing and delivering a Feasibility Study. Vanstar would then retain a 20% undivided non-contributory carried interest until start of commercial production, after which time the 20% undivided interest becomes participating; and Vanstar will pay its attributable portion of the total development and construction costs to the commencement of commercial production. Vanstar will also retain a 1% NSR royalty on selected claims of the project.

The Nelligan Project saw an 8,000-metre drilling campaign to verify the western and deep extension of the Renard Zone as well as to improve resource classification. The first results, reported in June included 10.5 metres grading 10.5 g/t gold confirming the west extension of the mineralization. August assays included 39.1 metres grading 2.14 g/t gold and recent assays included 17.3 metres of 7.62 g/t gold.

Drilling extended the Nelligan deposit to the west by approximately 700 metres, representing a sizable step-out and extension of the known deposit area. Partner IAMGOLD noted that the mineralization and associated alteration intersected appears similar to that observed in the current estimated resource. The next drilling campaign is expected to begin in Q1, 2021.

Drilling extended the Nelligan deposit to the west by approximately 700 metres, representing a sizable step-out and extension of the known deposit area. Partner IAMGOLD noted that the mineralization and associated alteration intersected appears similar to that observed in the current estimated resource. The next drilling campaign is expected to begin in Q1, 2021.

The 5,806.6-hectare Nelligan property hosts four major gold zones: the Renard, Liam, Dan and 36. Initial Inferred Resources stand at 3.2 million ounces, 96.9 million tonnes grading 1.02 g/t gold with the deposit still open for expansion. Visible gold is evident in the Renard Zone where drilling has returned 5.04 g/t gold over 12.12 metres.

For Q1 2021, a winter drill program is planned as well as geochemical and geological surveys and metallurgical studies. Over $15 million has been spent at Nelligan since 2013.

Vanstar’s 100%-owned Felix property is in the Abitibi mining camp of Quebec, 86 km northeast of Rouyn-Noranda along the trend of Amex Exploration’s Perron property along the Chicobi Gold Belt, a prospective gold belt within the larger Abitibi Gold Belt. Felix is also adjacent to the south of BMEX Gold’s King Tut property on which it was recently announced that visible gold was intersected in two drill holes. The property has been explored intermittently since the 1940s. Past exploration included a gold discovery by Amax in the 1980s. Various geophysical surveys were also completed.

Current work includes a high-resolution Mag survey and compilation of previous exploration results. A 2,500-metre drill program is underway. Vanstar recently acquired 31 mining claims from Osisko Metals to expand the Felix property to 3,259.6 hectares. The claims cover the Chicobi Group formation along the Abitibi Gold Belt.

The objective of the current drill program is to verify gold mineralization in a historical drill hole that intersected nine intervals of 1.5 metres each, taken along a of 70 metres section , which reported gold grades ranging from 0.9 to 1.8 g/t gold.

At the 100%-owned Amanda Project, located 275 km northeast of Chibougamau, this past summer’s sampling program has discovered a number of gold showings. A total of 576 samples were taken from the 7,677-hectare property. Four new showings – the Raphy, Marko, Jako and Rock Hammer – returned sample assays up to 3.43 g/t gold in mineralized sediments during this first-pass geological survey.

Vanstar plans to conduct a high-resolution aerial Mag survey in the near future to map the property and uncover structural discontinuities in iron formations that may prove to be the site of gold deposits. The company also plans to carry out stripping and sampling work next summer followed by a drill program in fall 2021.

At the 100%-owned Frida and Eva properties in the James Bay area of Northern Quebec, the company is planning exploration to follow up on earlier encouraging gold values.

Vanstar Mining Resources has a new President and CEO – J.C. St-Amour. Most of the management team has decades of exploration and development experience. The company has 55,416,318 shares outstanding and approximately $5,800,000 in the treasury.

Vanstar`s projects are located in one of the world`s most prospective and pro-mining jurisdictions and the company is well on its way to grow existing gold resources and expand its discoveries.

BMEXÂ Gold Inc. [BMEX-TSXV; 8M0-FSE], formerly Meridius Resources Ltd., holds options to earn 100% interests in two flagship properties – the 5,206-hectare King Tut and the 4,226-hectare Dunlop Bay, located in two highly prospective regions, the Chicobi Gold Belt and the Matagami Gold Camp, both in the prolific Abitibi Greenstone Belt of northwestern Quebec. This is an established gold mining district having produced over 100 mines, and 190 million ounces of gold since 1901.

BMEXÂ Gold Inc. [BMEX-TSXV; 8M0-FSE], formerly Meridius Resources Ltd., holds options to earn 100% interests in two flagship properties – the 5,206-hectare King Tut and the 4,226-hectare Dunlop Bay, located in two highly prospective regions, the Chicobi Gold Belt and the Matagami Gold Camp, both in the prolific Abitibi Greenstone Belt of northwestern Quebec. This is an established gold mining district having produced over 100 mines, and 190 million ounces of gold since 1901.

The King Tut prospect is located in the emerging Chicobi Gold Belt which is within the larger Abitibi Gold Belt. It is 65 km east of Amex Exploration’s Perron property where a high-grade gold discovery has been made. IAMGOLD’s property is 5 km west of King Tut and to the east is Vior/Ethos with its Ligneris Project showing high-grade gold.

The current King Tut drill program will continue through the first quarter of 2021, with about 2,000 metres still to be completed in 10 to 15 holes. As of early January 2021, 11 holes have been completed over a strike length of approximately 200 metres, which includes two holes containing visible gold intercepts. Assays are expected shortly. Drilling is focusing on the Authier East target and its extensions covering a strike length of about 500 metres. The objective is to cross-cut the entire width of this high potential structure. Interpretation to date of the first holes has demonstrated that the potential width of Authier East exceeds 250 metres.

The current King Tut drill program will continue through the first quarter of 2021, with about 2,000 metres still to be completed in 10 to 15 holes. As of early January 2021, 11 holes have been completed over a strike length of approximately 200 metres, which includes two holes containing visible gold intercepts. Assays are expected shortly. Drilling is focusing on the Authier East target and its extensions covering a strike length of about 500 metres. The objective is to cross-cut the entire width of this high potential structure. Interpretation to date of the first holes has demonstrated that the potential width of Authier East exceeds 250 metres.

The Dunlop Bay property is located immediately north of the Matagami Gold and Base Metals District, 15 km northeast from Glencore’s Matagami Lake Mine Plant, processing zinc, copper, silver and gold material from the Bracemac-McLeod Mine. Over 60 gold-bearing veins and veinlets have been located (by Minière du Nord) in the central part of the property since 1956.

At the Dunlop Bay property, the company has completed site access. BMEX Gold has also been compiling and reviewing historical work that included some 30,000 metres of drilling. The objective was to establish an exploration model and identify high potential targets.

BMEX Gold is planning a first drilling program on the Dunlop Bay property during the second quarter of 2021 with approximately 4,000 metres of drilling. The main objective is to validate the continuity of the historical vein system, and to test the intrusive contact which was barely touched during historical phases of drilling.

In addition to its name change, BMEX Gold recently strengthened the management team, diversified its Board of Directors and created a strong Advisory Team. The company’s management team, headed by Amrik Virk, President and CEO, has held senior positions in Canadian government and has extensive executive experience in a variety of sectors.

The company recently raised $7.3 million and ended 2020 in a strong financial position with $4.2 million in its treasury. BMEX Gold has 42,967,000 shares outstanding.

We seek safe harbor.