Wesdome poised to restart Quebec gold mine

Wesdome Gold Mines Ltd. [WDO-TSX] says it is planning to restart production at its 100%-owned Kiena Mine Complex in Val d’Or, Quebec.

The move comes after the company released positive results from an independent NI 43-101-compliant pre-feasibility study (PFS) which is based on a reserve mine life of approximately seven years and indicated mineral resources as of October, 2020 (average grade 11.9 g/t gold).

The PFS envisages annual gold production of approximately 84,000 ounces, with peak production of 115,000 ounces in 2025.

The restart decision was announced after the close of trading on May 26, 2021.

On Thursday, Wesdome shares declined on the news, falling 1.9% or 22 cents to $11.26, on volume of 280,490. The shares currently trade in a 52-week range of $15 and $5.85. Sierra Madre shares were unchanged at 11 cents.

Wesdome is a Canada-focused company with a pipeline of projects in various stages of development. Its aim is to become Canada’s next intermediate gold producer, with output of 200,000 plus ounces annually from two mines located in Ontario and Quebec.

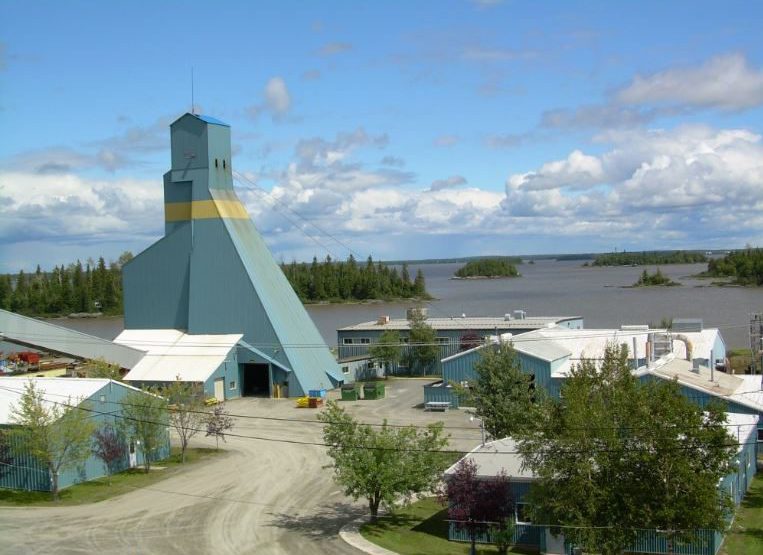

Utilizing a central mill, Wesdome’s Eagle River Complex in Wawa, Ontario is currently producing from two gold mines, the Eagle Underground mine and the Mishi Open pit.

The company recently said it remains on track to achieve production guidance of 92,000 to 105,000 ounces at the Eagle River mine this year.

Wesdome President and CEO Duncan Middlemiss has said 2021 is a pivotal year as the company expects to deliver the Kiena Mine into commercial production, expand operations at the Eagle River as well as move forward on aggressive surface and underground exploration at both sites.

The Kiena Complex is a fully permitted former mine with a 930-metre shaft and 2,000 tonne-per-day mill.

Production there was suspended in 2013 after it was determined that the Kiena mine as not economically feasible to operate.

However, back in May, 2020, the company released the results of a preliminary economic assessment. It indicates that the Kiena Complex in Val d’Or, Quebec could produce 687,449 ounces of gold or 85,931 ounces annually over a lifespan of eight years.

In its May 26 press release, the company said production activities will utilize existing mine infrastructure such as the shaft and the existing 2,000 tonne-per-day mill.

The operation is expected to generate annual free cash flow (2022-2027) of $85.5 million at US$1,600 per ounce or $109.5 million at US$1,900 an ounce.

Life of mine capital is estimated at $230 million, including $60 million spent in 2021. Life of mine all-in-sustaining costs are expected to be US$676 an ounce.

Probable mineral reserves at the Kiena Mine Complex stand at 601,780 ounces of gold at a grade of 11.89 g/t.