Casa Minerals encouraged by initial returns from Congress

By Ian Foreman

Farshad Shirvani, president and CEO of Casa Minerals [TSX-V: CASA; OTC: CASXF; GER: 0CM], is a determined individual; and he loves difficult transactions. And he found exactly that with the complicated ownership situation of the Congress gold property in Arizona.

He first became aware of the property, host to a historic high-grade gold mine, back in 2018. Where many others turned the other way, he rolled up his sleeves and got to work. He was ultimately successful in getting a diverse ownership group together in 2021 that sold Casa Minerals a 90 percent interest in the Congress Gold Mine property.

He first became aware of the property, host to a historic high-grade gold mine, back in 2018. Where many others turned the other way, he rolled up his sleeves and got to work. He was ultimately successful in getting a diverse ownership group together in 2021 that sold Casa Minerals a 90 percent interest in the Congress Gold Mine property.

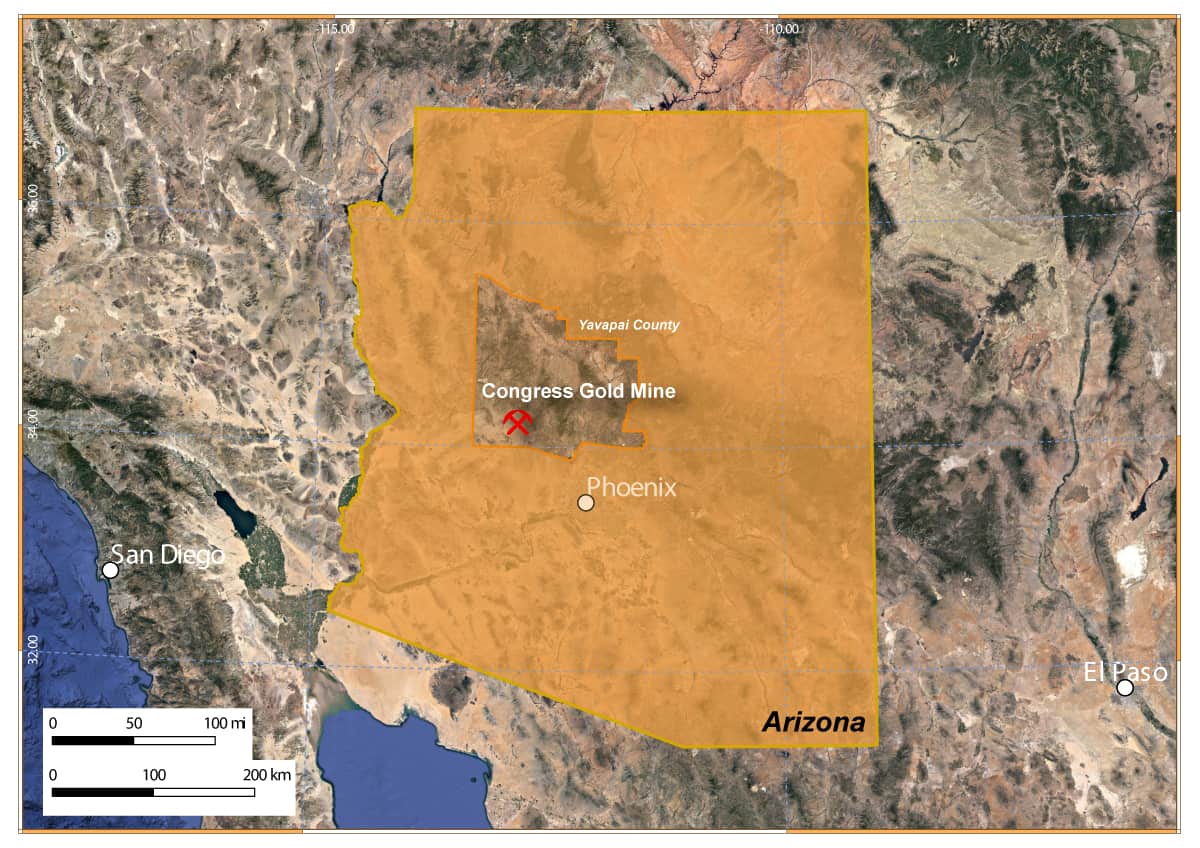

The eponymously named Congress Gold Mine is located near the town of Congress, north of Phoenix, in the Martinez Mining District of Yavapai County, Arizona. The company recently increased the size of the property, which now consists of a contiguous area of 14 patented claims (app. 306 acres) and 25 mineral claims (app. 494 acres).

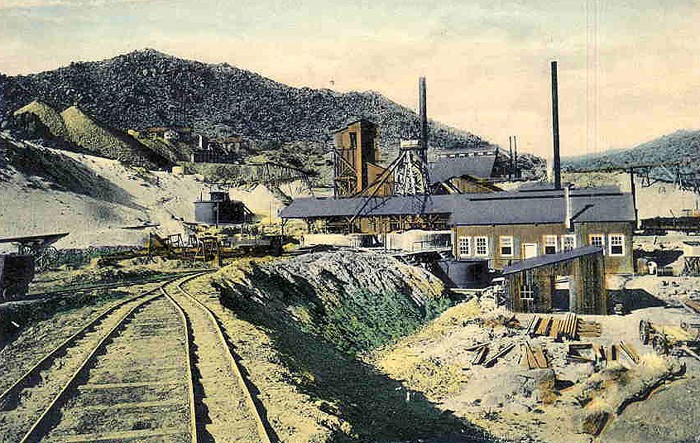

The Congress Mine was put into production in 1887 and was worked at various intervals over several decades. The mine reached its zenith between 1906 and 1910 when the mine reached depths of 4,000 feet, or 1,219 metres, and primarily exploited high grade gold, which locally graded up to 7 ounces per ton, from the Congress, Niagara and Queen of the Hills veins. Workings include 6 shafts with three on the Congress vein, three on the Niagara vein, and the Queen of the Hills vein. These shafts were sunk at an approximate incline of 22-25 degrees from the horizontal with drifts that were up to 12 to 15 feet in size.

Ore was brought to surface utilizing a combination of 12 steam powered lifts. This full-scale mining operation processed its ore utilizing a reduction plant, concentrating plant and a cyanide plant that included a roasting furnace and leach tanks. Various reports indicate that the mine produced between 388,000 and 426,000 ounces of gold in these early years, which would make the Congress Mine one of the Arizona’s more productive historic gold mines.

Ore was brought to surface utilizing a combination of 12 steam powered lifts. This full-scale mining operation processed its ore utilizing a reduction plant, concentrating plant and a cyanide plant that included a roasting furnace and leach tanks. Various reports indicate that the mine produced between 388,000 and 426,000 ounces of gold in these early years, which would make the Congress Mine one of the Arizona’s more productive historic gold mines.

The veins tend to be coarse-textured, massive, grayish-white quartz with irregular masses, bands and disseminations of fine-grained iron sulfide. Ore zones were reported to occur as generally flat lenses that pinch-and-swell near the footwall.

Historic descriptions of the mine state that the Congress vein itself was considered a peculiar formation as it was characterized as a “dike of green stone trap” and the mined ore ran through this dike with the most valuable mineralization found lodged on, or near, the footwall. The current geological interpretation is that the Congress and Niagara quartz veins cut Precambrian aged coarse grained biotite granite and are usually related to dikes that have been variably identified as aplitic, pegmatitic, andesitic, mafic and greenstone. The veins are reported to have been traced for an estimated 1,800 feet, or 549 metres. Multiple sub-parallel veins and off shoots were identified and partially exploited with the largest being the Niagara vein.

After being idle for several decades and prior to Casa’s purchase, the property saw limited development work by Echo Bay Mines who drove a decline down to the 2200 level in the mid 1980’s. As a result of this work, Echo Bay Mines reported a “current ore reserve” on the Niagara vein of 400,000 to 500,000 tons grading 0.3 ounces of gold per ton. As the calculation pre-dates National Instrument 43-101, the company is treating this as an historic resource as it has not performed sufficient work to confirm or verify it. Subsequently, Malartic Hygrade U.S. Inc., an affiliate of Republic Goldfields Inc., purchased the property in 1989 and continued where Echo Bay Mines left off. Poorly preserved records indicate that the mine may have produced 75,000 ounces from those combined operations. The last documented work on the property was performed in 1992.

After being idle for several decades and prior to Casa’s purchase, the property saw limited development work by Echo Bay Mines who drove a decline down to the 2200 level in the mid 1980’s. As a result of this work, Echo Bay Mines reported a “current ore reserve” on the Niagara vein of 400,000 to 500,000 tons grading 0.3 ounces of gold per ton. As the calculation pre-dates National Instrument 43-101, the company is treating this as an historic resource as it has not performed sufficient work to confirm or verify it. Subsequently, Malartic Hygrade U.S. Inc., an affiliate of Republic Goldfields Inc., purchased the property in 1989 and continued where Echo Bay Mines left off. Poorly preserved records indicate that the mine may have produced 75,000 ounces from those combined operations. The last documented work on the property was performed in 1992.

Since purchasing the Congress property, Casa has compiled all available technical data and is working on a comprehensive geological model for the property. The company entered several of the historic stopes and inspected waste material with the eye on evaluating the mineralization that would have been uneconomic back in the early 1900’s. This work resulted in the conclusion that there were several gold, silver and copper exploration targets proximal to the historic working both laterally and along strike. In addition, the company believes that there are multiple other targets on the property that warrant additional work.

The company has recently completed a first-phase diamond drill program that totaled 6,828 feet (2081 metres) of HQ sized core. This initial drill program was designed to corroborate historic data and to generate updated information on the geology and mineralization of the gold bearing structures. Additionally, the drilling program was designed to investigate nearby underexplored areas that were identified to have geological characteristics similar to the Congress and Niagara veins.

The drilling intersected the formerly productive Congress and Niagara veins as well as successfully discovering new, previously unreported vein structures.

“We are very encouraged by the completion of this first phase of drilling. The Company’s objective is to advance the Congress Mine with multi-stage exploration and development programs. This initial drilling advances Casa toward re-establishing the Congress Gold Mine as a potentially producing gold mine.” commented Mr. Shirvani.

The highest gold intercepted assay results were holes CCG-004 at 14.9 g/t over 1.5 meters, as part of a larger intercept of 3.5 g/t over 10.7 meters and CCG-004 9.3 g/t over 3 meters.

In addition to Congress, the company has two wholly owned projects located in British Columbia: Pitman/Paddy Mac and Keaper; as well as a 75% interest in the Arsenault Project. The company plans to explore their Canadian projects in 2023.

In addition to Congress, the company has two wholly owned projects located in British Columbia: Pitman/Paddy Mac and Keaper; as well as a 75% interest in the Arsenault Project. The company plans to explore their Canadian projects in 2023.

The Pitman/Paddy Mac property is 5,505 hectares in size and is located approximately 25 kilometres north of Terrace. Casa extensively sampled this project between 2005 to 2017 and developed a sizeable silver-copper-molybdenum porphyry target. Recent sampling returned very high-grade results from a series of previously unrecognized veins: 2-foot-wide vein returned assays of 574.42 g/t gold and 109 g/t silver plus 0.1% copper, 1.56% lead and 0.23% zinc; 3-foot-wide vein assayed 268.86 g/tonne gold and 127 g/tonne silver plus 0.2% copper, 2.95% lead and 0.04% zinc; and a 1-foot-wide vein assayed 50.83 g/tonne gold, trace copper, 0.21% lead and 0.02 % zinc.

The Pitman molybdenite occurrence was recognized in 1957 by Joe Bell. Exploration for molybdenum took place in the following decades, including work by Canex Canadian Exploration (later Placer Development) and in 1979 a drill program by E & B Exploration Ltd. which resulted in assays varying from 0.002% MoS2 to 0.25% MoS2, including 6m of 0.119% MoS2. Current strength in molybdenum prices make this an attractive exploration target.

The Arsenault property is located at the northern border of British Columbia southeast of Swift River, Yukon. It is a Beshi-type volcanogenic massive sulphide target that is drill ready as it has had extensive soil and rock surveys conducted by previous operators, and further soil, rock and airborne electro-magnetic surveys performed by the company since 2006. Highlight assays from the VMS1 zone include 1.74% copper, 0.98 g/t gold and 24.1 g/t silver, along with copper in soil as high as 0.54%