Canada’s battery metals

By Ron Hall

Strategic global commodity markets research provider BloombergNEF (BNEF) recently hosted a special one-off Summit in Bali, Indonesia, ahead of both the Business 20 (B20) and G20 Summits. They ranked 30 leading countries’ lithium-ion battery supply chain performance based on 45 metrics across five key themes.

These include the availability and supply of key raw materials, manufacturing of battery cells and components, local demand for electric vehicles and energy storage, infrastructure, innovation, and industry and environmental, social and corporate governance (ESG) considerations.

Based on those measures, Canada ranked third, eighth, tenth, fourth and sixth, and although China leads the ranking in three of the five categories, Canada was 2nd in overall ranking. Canada is rich with deposits of all the necessary battery metals. Most resource-rich countries rank low overall because they generally lack domestic battery manufacturing capabilities and EV demand. Below are brief reviews of the various battery metals.

Canada has large lithium reserves and is home to both brine deposits (in the west) and spodumene hard rock deposits (in Québec and Ontario). It also has significant lithium in brines historically associated with oil and gas reservoirs.

The opportunity for brine lithium in Canada has been revolutionised by Direct Lithium Extraction (DLE). In DLE, raw brine goes straight to chemical production, rather than going to large evaporation ponds. DLE is faster and has a lower environmental impact than conventional extraction methods.

Canada has been a leading supplier of nickel for many years, producing 6.7% of the world’s nickel in 2020. This amounts to 170ktpa; however, at present, Canada does not process any battery-grade nickel. There are however several pathways from Canada’s sulphide ore deposits to producing battery metals. Currently, Canadian nickel from Vale’s Long Harbour facility in Newfoundland is mined and refined to Class 1 nickel metal and then shipped to Europe for further processing into battery-grade material.

Elsewhere, Vale’s Ontario and Manitoba operations produce nickel concentrate that is smelted to matte and refined to Class 1 nickel in Ontario. Glencore’s Ontario and Québec operations produce nickel concentrate that is smelted to matte in Ontario and shipped to Europe for refining to Class 1 metal. Sherritt International produces Class 1 nickel in Alberta from imported joint-venture feed materials. However, producing Class 1 metal may not be the most efficient route from mine to battery metals. Sherritt pioneered the use of hydrometallurgy for treating nickel concentrates from Manitoba in the 1950s, and Long Harbour has adopted a different hydrometallurgical route in Newfoundland. Modern hydrometallurgy can be a low-carbon alternative to traditional fossil fuel smelting.

Canada is home to significant copper production in Québec, Newfoundland, Ontario, and British Columbia. Teck Resources, a homegrown senior Canadian firm with a significant global footprint, supplies Canada’s needs in the near-term from its new Chilean project.

Canada is well stocked with rare earth elements (REEs), with promising demonstrations for mining, processing, and recycling. In 2022, the Avalon Advanced Materials Nechalacho deposit in the Northwest Territories began production under Australian miners, Cheetah Resources. The project mines material from the Nechalacho deposit and transports it to Saskatchewan for further processing.

Search Minerals has deposits in Labrador and is piloting a hydrometallurgical process for refining rare earths into oxides. Rio Tinto has a project to produce scandium in northern Québec. Additionally, GeoMega Resources is advancing REE magnet recycling and processing facilities; hence, contributing to the demand for battery-grade materials.

The Government of Saskatchewan has also invested in the supply chain through a $35m Rare Earths Processing Facility. In Phase 1, the facility will begin processing monazite ores. Then, in Phase 2, it will refine these into oxides and, ultimately, into neodymium and praseodymium metal. Canada is also home to Neo Performance Materials, which processes rare earths in China and Estonia, and manufactures REE powders and magnets in Thailand.

Cobalt is usually a by-product of nickel and copper mining with the notable exception of the silver-cobalt camp in northeast Ontario, and several firms are seeking to expand Canada’s processing capacity to produce the cobalt hydroxide and sulphate needed for the battery metals supply chain.

Manganese mining and production has not been developed in Canada, but the country is home to the largest deposits in North America and two junior miners, Manganese X and Canadian Manganese, have explored deposits suitable for producing battery metals.

Natural Resources Canada reported recently that in 2020, the direct contribution of Canada’s minerals and metals sector to Canada’s gross domestic product (GDP) was $70bn, which represented 3% of Canada’s total GDP. The indirect effects from the minerals and metals sector added a further $37bn to the GDP, for a total contribution of $107bn.

Battery metals and minerals are big business in Canada and with the energy transition well underway and the adoption of electric vehicles (EVs) outpacing even the best predictions, these numbers are expected to rapidly increase further, along with related investments and other opportunities in the industry.

Seeing this growth, and recognizing the greater potential for the industry, in January 2022, the Battery Metals Association of Canada (BMAC) took steps to help align the industry and co-ordinate efforts. Starting by hosting a series of interactive stakeholder workshops, followed by conducting leading industry research, this work culminated in the development of the in-depth industry analysis and overview that would become the roadmap for harnessing the maximum value of these resources through each step along the value chain – from extraction, processing, end-use, and recycling of these resources.

LithiumBank Resources Corp. [LBNK-TSXV, LBNKF-OTCQX, HT9-FSE] is an exploration and development company that is focused on advancing a large portfolio of lithium-enriched brine projects in western Canada.

LithiumBank Resources Corp. [LBNK-TSXV, LBNKF-OTCQX, HT9-FSE] is an exploration and development company that is focused on advancing a large portfolio of lithium-enriched brine projects in western Canada.

Its aim is to capitalize on rising demand for lithium, a key ingredient in the production of lithium-ion batteries, which are used in small electronic devices, including smart phones, laptops, and electric vehicles.

LithiumBank (LiBank) has acquired over 4.07 million acres of mineral titles in Western Canada, including 3.7 million in Alberta and 326,000 in Saskatchewan. The company says its mineral titles are strategically positioned over known brine reservoirs that provide a unique combination of scale, grade and exceptional flow rates that are necessary for a large-scale direct brine lithium production.

It intends to use DLE (Direct Lithium Extraction) technology to bring the lithium-enriched brine to surface, using traditional oil and gas infrastructure, including roughly 1,100 wells that were used to support decades of O&G production.

The process involves the production of a lithium concentrate which goes through traditional processes of polishing and electrolysis. The desired end product is a high purity lithium hydroxide, which can be produced on site.

The process involves the production of a lithium concentrate which goes through traditional processes of polishing and electrolysis. The desired end product is a high purity lithium hydroxide, which can be produced on site.

Brines (in salt ponds) and spodumene (in hard rock mines) represent the two main sources of commercial lithium production. By comparison, DLE leaves a much smaller environmental footprint as the lithium depleted brine is re-injected into the reservoir.

Test work results indicate that the selected DLE Ion Exchange technology can be a highly effective and scalable method of extracting lithium chloride from the brine on its flagship Boardwalk project in Alberta.

“The technology has been proven on a lab scale, but it is yet to be proven at commercial scale, said LiBank CEO Robert Shewchuk. “Making commercial viability both the risk and reward associated with this company.” However, he said DLE technology is also being tested by companies such as E3 Lithium Ltd. [ETL-TSXV, EEMMF-OTCQX, OW3-FSE], Standard Lithium Ltd. [SLI-TSXV, NYSE American, S5L-FRA], and Lake Resources [LKE-ASX, LLKKF-OTC]. A successful commercial scale DLE outcome from any of LiBank’s peers could lend to opportunities for commercial success for us all.

It is worth noting here that prices for lithium carbonate recently rallied to record highs on the back of booming electric vehicle demand in China.

Based on the assumption that electric vehicles make up around 40% of new passenger car sales by 2030, United Kingdom-based energy consultant Wood Mackenzie recently predicted that nearly 800,000 tonnes of additional Lithium Carbonate Equivalent (LCE) will be required to come online in the next five years to meet future demand.

Based on the assumption that electric vehicles make up around 40% of new passenger car sales by 2030, United Kingdom-based energy consultant Wood Mackenzie recently predicted that nearly 800,000 tonnes of additional Lithium Carbonate Equivalent (LCE) will be required to come online in the next five years to meet future demand.

Aside from strong demand and high pricing, LiBank sees opportunity in the fact that North American lithium production represents 2% of current global demand. By comparison, Chile and Argentina account for 36.7% and 11.9% of global demand, respectively.

Shewchuk says he is aiming for commercial scale production as early as 2026.

Meanwhile, LiBank has already achieved a key milestone by announcing a 43-101-compliant mineral resource estimate for its Boardwalk project, which is located in west-central Alberta, 270 kilometres northwest of Edmonton. Boardwalk covers 572,237 acres.

It hopes to announce PEAs for two more projects (in Alberta and Saskatchewan) before the end of this year.

In a November, 2022, press release, the company said Boardwalk is estimated to host 393,000 tonnes of indicated lithium carbonate equivalent (LCE) at a grade of 71.6 mg/L and 5.8 million tonnes of inferred LCE at 68.0 mg/L lithium.

Shewchuk said this represents an historic achievement as it is the first lithium brine project in Canada where there is enough historical oil and gas well entry points, brine assaying and hydrogeological work to confidently classify a portion of the lithium resource as indicated in accordance with CIM Definition Standards (2014).

According to a hydrogeological study completed in October, 2022 the indicated resource is located within LiBank’s intended “Production Zone.’’ The study indicates that Boardwalk is capable of consistent, high-volume brine flow over 20 years within the “production zone.’’

Completing a PEA at Boardwalk is another key step that may impact the company’s equity value. On January 10, 2023, LiBank shares were trading at $1.24 in a 52-week range of $2.10 and 62 cents, leaving the company with a market cap of $46 million, based on around 37 million shares outstanding.

The company’s largest shareholder is director Paul Matysek. His experience in the lithium space includes a spell as Executive Chairman of Lithium X Energy Corp., which was sold to Nextview New Energy Lion Hong Kong Ltd. for $265 million. He was previously CEO of Lithium One, a company that merged with Australian company Galaxy Resources to create a multi-billion-dollar integrated lithium company.

LiBank plans to use the knowledge and experience derived from Boardwalk to develop other projects in its portfolio including the Park Place project, also located in Alberta and the Kindersley project in Saskatchewan.

It hopes to announce resource estimates for both Park Place and Kindersley in the first quarter of 2023. PEAs for Park Place and Kindersley are expected by the third quarter and fourth of quarter of this year, respectively.

LiBank expects to benefit from the fact that 70-years of oil and gas activities from various petroleum companies have developed a strong foundation of social and physical infrastructure in the area where LiBank’s properties are located, including networks of all-weather gravel roads, drill sites that can be easily accessed from provincial highways and electrical transmission lines that run through and adjacent to the project.

Mosaic Minerals Corp. [MOC-CSE] is a company that offers investors a low-risk window on early-stage exploration for nickel, lithium and other strategic minerals, in Quebec.

Mosaic Minerals Corp. [MOC-CSE] is a company that offers investors a low-risk window on early-stage exploration for nickel, lithium and other strategic minerals, in Quebec.

Mosaic believes that investing in exploration for minerals such as lithium and nickel, which are required to support the modern electrical industry, including electric vehicles, presents strategic opportunities for the appreciation of shareholder value in the short and medium term.

“Lithium and strategic minerals, including nickel, are in high demand for the foreseeable future,’’ said Jonathan Hamel, President and CEO of Mosiac. It is why he is working to position Mosiac in a sector which is increasingly mobilizing the attention of major players, including certain states as they seek to secure a supply chain for their military and high-tech industries.

Mosiac is gearing up for a strong start to 2023. Key plans include drilling for nickel at the company’s Gaboury project southwest of Rouyn-Noranda. Mosiac is also preparing an initial exploration program for the 2023 season that will target lithium and strategic minerals on its recently acquired projects in the Jamesie area of northern Quebec.

These projects cover nearly 20,000 hectares spread over six mining blocks. According to data from the Quebec Ministry of Energy and Natural Resources [MERN], they contain several geological indications that favour the presence of lithium and strategic minerals.

These projects cover nearly 20,000 hectares spread over six mining blocks. According to data from the Quebec Ministry of Energy and Natural Resources [MERN], they contain several geological indications that favour the presence of lithium and strategic minerals.

The 2023 exploration work aims to confirm the presence of spodumene pegmatites and/or the presence of strategic minerals on Mosiac properties. In order to verify the data from the MERN, the planned work will include sampling, a set of geological, geochemical and spectrometric surveys, coupled with aerial magnetic surveys. The goal is to quickly identify targets where exploration crews can focus their efforts in the summer of 2023.

Any positive developments would likely impact the company’s shares, which were trading at 12 cents on January 6, 2023, in a 52-week range of 15 cents and $0.045, leaving the junior with a market cap of under $7 million, based on 57.52 million shares outstanding.

Prior to its recent pivot into lithium exploration, Mosiac was focused on nickel and held three projects where the base metal is the prime exploration target.

In early July 2022, Mosaic said it had struck a deal to acquire a 100% interest in both the Gaboury and the 113 North projects from Fokus Mining Corp. [FKM-TSXV] in exchange for 5.0 million common shares. Earlier option agreements gave Mosiac the right to earn a 50% in 113 North and 80% of Gaboury.

Under the updated agreement, Fokus retains a 2.0% net smelter royalty on both properties and owns about 10 million shares or a 16% stake in Mosaic.

Under the updated agreement, Fokus retains a 2.0% net smelter royalty on both properties and owns about 10 million shares or a 16% stake in Mosaic.

The Gaboury project consists of 114 mining claim cells covering 6,064 hectares and is located approximately 150 kilometres southwest of Rouyn-Noranda. The project is accessible via paved and gravel roads and is also located 11 kilometres east of the former Loraine Mine, which produced 600,000 tonnes of ore, grading 0.47% nickel and 1.08% copper.

Gaboury is a nickel-rich ultramafic intrusive that potentially stretches for over 9.0 kilometres, the company has said.

In the fourth quarter of 2021, Mosaic launched a drill program aimed at testing the lateral extension of the Pike Nickel showing, which was discovered in 2010. Mosaic was also aiming to test the depth extension of the original discovery.

Another objective was to confirm the presence of nickel all along a magnetic anomaly in the southern part of the property, which stretches for over 7.0 kilometres.

The company carried out a 1,500-metre drilling program in the fourth quarter of 2021 and was planning an additional 5,000 metres in 2002.

When it released assay back in August 2022, the company said drilling highlights include hole GA-22-10, which returned a grade of 0.23% nickel over a strike length of 120 metres.

In hole GA-21-07, the company intersected a 165-metre zone showing a grade of 0.26% nickel, including 121.5 metres at a grade of 0.32% nickel and 0.40% nickel over 15 metres. This hole was located in the Pike West area, approximately 1.8 kilometres west of the original Pike Nickel area.

The company is planning to complete another 1,500-metres of drilling at Gaboury. The program will consist of four holes and should begin around mid-January. The aim is to test different fold hinges associated with ultramafic units corresponding to a major EO magnetic anomaly of more than eight kilometres. Drilling will focus on the Pike Nickel West area.

The 113 North project is located in the southeastern part of the Abitibi Greenstone Belt and is comprised of 59 claims covering 3,010 hectares within a six to 12- kilometre-wide band made up of volcano-sedimentary rocks located between the granodiorite-tonalite batholiths of Josselin and Montgay.

The company said gold, copper, nickel, platinum and palladium showings were discovered in the geological environment near the project.

In early September 2022, Mosiac launched a 1,000-metre drill program at 113 North that is designed to test the possible continuity of an ultramafic associated with the Fortin Sill nickel copper showing on Quebec Nickel Corp’s [QNI-CSE, QNICF-OTCQB, 7LB-FSE] Ducros project, located approximately 300 metres south of the property boundary.

Drilling on the Fortin Sill has previously returned 0.82% nickel plus copper and 0.65 g/t platinum-palladium-gold over a core interval of 20.7 metres.

The company said a magnetic anomaly trending NNO-SSE seems associated with this showing. This, according to MERN data and results obtained by Quebec Nickel, would contain interesting nickel-copper-platinum and palladium and gold values.

Power Nickel Inc. [PNPN-TSXV, CMETF-OTCQB] says recent exploration results indicate that company is in the process of confirming Canada’s next nickel sulphide mine in Quebec.

Power Nickel Inc. [PNPN-TSXV, CMETF-OTCQB] says recent exploration results indicate that company is in the process of confirming Canada’s next nickel sulphide mine in Quebec.

Power Nickel is drilling its flagship Nisk project in a bid to become a supplier of low-carbon class 1 nickel to the developing North American electric vehicle supply chain. In keeping with that goal, the company plans to prepare a new mineral resource estimate in accordance with NI 43-101 standards of disclosure, identify additional high-grade mineralization, and develop a process to potentially produce nickel sulfates responsibly for batteries to be used in the electric vehicles industry.

A new resource estimate is due to be announced in the second quarter of 2023.

“Nickel has become really scarce and tough to find,” said Power Nickel CEO Terry Lynch in a recent interview. “So, if you have got high grade Class 1 nickel deposit of at least 8-10 million tonnes and can produce it in an environmentally friendly way, your ability to commercialize that will be a no brainer! I think we can get there in our next resource update and remember this is just one pod in what will be most probably a multiple pod development. Could we get to a Lynn Lake (22 Million Tonnes) or Voiseys Bay (+50 Million Tonnes) size; we think that’s certainly possible.

Back in February, 2021, Power Nickel (then called Chilean Metals) completed the acquisition of its option to acquire up to 80% of the Nisk project from Critical Elements Lithium Corp. [CRE-TSXV, CRECF-OTCQX, F12-FSE].

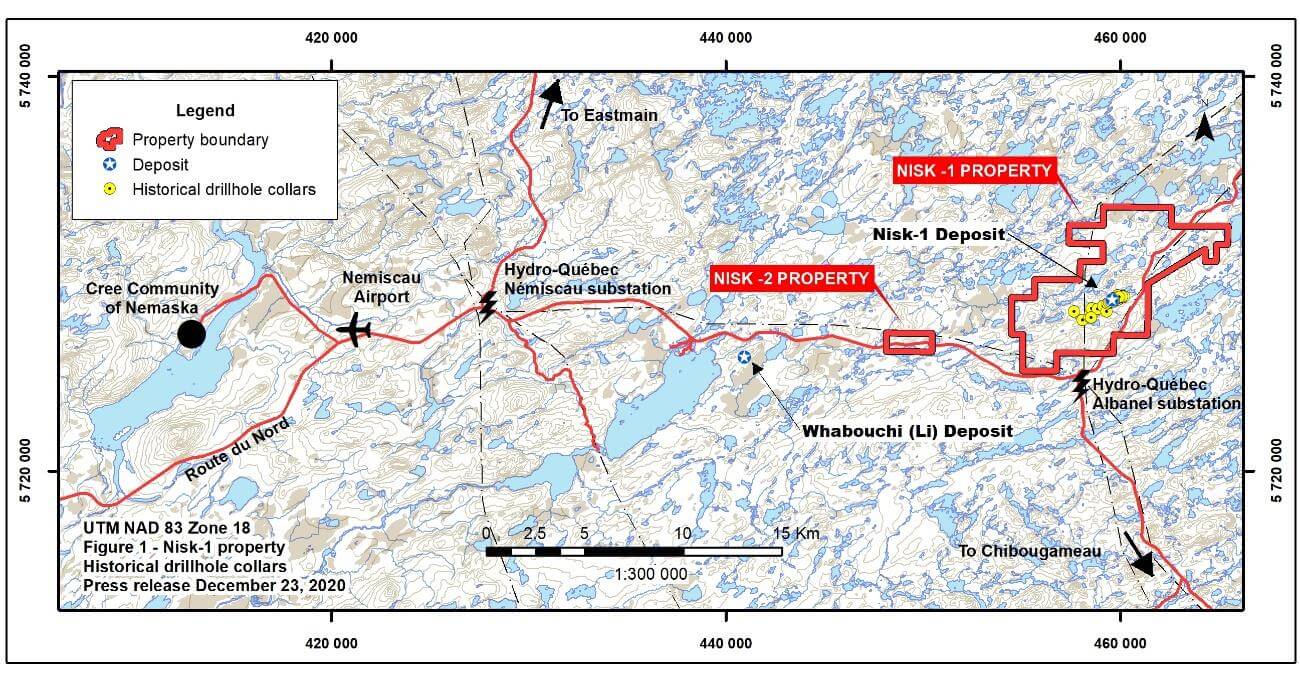

The Nisk property occupies a large land position with numerous high-grade nickel intercepts in the southern portion of the Eeyo Istchee James Bay territory, a region that hosts a number of mining projects and improving infrastructure.

The Nisk property occupies a large land position with numerous high-grade nickel intercepts in the southern portion of the Eeyo Istchee James Bay territory, a region that hosts a number of mining projects and improving infrastructure.

It consists of two blocks, covering 46 square kilometres and a length of over 20 kilometres. The Route du North from Chibougamau runs inside the south border of the property. Nisk-1 is also traversed by a Hydro Quebec power line and road.

Nisk is a known nickel-PGE occurrence where historical work, including preliminary metallurgical test work, led to an evaluation of the resource potential of the Nisk-1 Main zone.

The Nisk-1 deposit is estimated to host a 3.1 million tonne “historic” resource, consisting of a measured resource of 1.25 million tonnes of grade 1.09% nickel, 0.56% copper, 0.07% cobalt, 1.11 g/t palladium and 0.20 g/t platinum. On top of that is another 783,000 tonnes of indicated material and 1.05 million tonnes of inferred. However, more work is required to bring the “historic resource” in line with NI 43-101 standards of disclosure.

After exercising the option to earn 80% Power Nickel completed a 2,400-metre drill program that was reported in March, 2022.

After exercising the option to earn 80% Power Nickel completed a 2,400-metre drill program that was reported in March, 2022.

It has been drilling since mid-September and has completed 14 holes of approximately 6,000 metres. However, the company has since expanded its drilling plans after recently raising $4.2 million from an over-subscribed non brokered private placement of 13.7 million flow-through units priced at 20 cents per unit and 14.4 million non-flow-through units priced at 10 cents each.

The company is now planning for another 9,000 metres of drilling in its spring (2023) campaign. The Company expects to report Assays every 3-4 weeks for the next six months.

On January 12, 2023, the company said the latest drilling results confirm the presence of high-grade nickel-copper-cobalt, platinum-group element mineralization in the Nisk Main zone and have extended the mineralization by an additional 150 metres at depth to the east and below the central portion.

Significant results in the latest batch of assay include 40.3 metres at 0.88% nickel, 0.56% copper, 0.06% cobalt, 1.64 ppm palladium and 0.15 ppm platinum in hole PN-22-009.

“We are confident that the upcoming Phase 3 drilling campaign will continue demonstrating the system’s robustness, with more results in line with our best hole to date, PN-22-009,” said Lynch.

On January 16, 2013, Power Nickel shares closed at 20 cents and currently trade in a 52-week range of 30 cents and $0.09.

Aside from the Nisk project, Power Nickel has a 100% interest in the Golden Ivan project near the heart of British Columbia’s Golden Triangle area. This property hosts two known mineral showings (gold ore and magee) and a portion of the past-producing Silverado mine, which was reportedly exploited between 1921 and 1939.

The company is also the 100% owner of five properties comprising over 50,000 acres strategically located in the prolific iron-oxide-copper-gold-belt of northern Chile. It also owns a 3% NSR royalty interest on any future production from the Copaquire copper-molybdenum deposit property located on property that borders Teck Resources Ltd.’s (TECK.B-TSX, TECK.A-TSX, TECK-NYSE) producing Quebrada Blanca copper mine.

The company is also the 100% owner of five properties comprising over 50,000 acres strategically located in the prolific iron-oxide-copper-gold-belt of northern Chile. It also owns a 3% NSR royalty interest on any future production from the Copaquire copper-molybdenum deposit property located on property that borders Teck Resources Ltd.’s (TECK.B-TSX, TECK.A-TSX, TECK-NYSE) producing Quebrada Blanca copper mine.