TRX Gold targets expansion in Tanzania

TRX Gold Corp. [TNX-TSX, TRX-NYSE American] on Monday announced positive assay results a 19-hole metallurgical variability sampling program on the Main Zone at its Buckreef Gold project in Tanzania, a country that ranks as the third largest gold producer in Africa.

Buckreef is expected to produce between 20,000 and 25,000 ounces of gold in fiscal 2023.

The company said the results are positive and significant as they continue to demonstrate continuity of mineralization down dip and along strike of the deposit, and excellent width and grade of mineralization.

Highlights include 123 metres of grade 2.69 g/t gold from 3.0 metres in hole BMMT020, and 106 metres of grade 4.19 g/t gold from 85 metres, including 77 metres of 3.09 g/t gold from 241 metres in hole BMMT022.

The Buckreef project is located in the Geita Region, south of Lake Victoria, approximately 110 kilometres south of the city of Mwanza and 45 kilometres west of Barrick Gold Corp.’s [ABX-TSX, GOLD-NYSE] Bulyanhulu gold mine and AngloGold Ashanti Ltd.’s [AU-NYSE] flagship Geita mine in north-central Tanzania.

TRX is rapidly advancing the Buckreef Gold Project, which currently hosts a NI 43-101-compliant measured and indicated resource of 35.8 million tonnes at 1.77 g/t gold, containing 2.03 million ounces. On top of that is an inferred resource of 17.8 million tonnes of 1.11 g/t gold or 635,540 ounces.

In the year ended August 31, 2022, Buckreef Gold poured 8,874 ounces of gold, enabling the company to recognize revenue of $15.1 million. That included 3,619 ounces in the fourth quarter of 2022, a new production record, the company said.

The 18 metallurgical holes reported (of 19 drilled) on Monday from Buckreef are designed to intersect gold mineralization between current oxide ore mining and deeper preliminary metallurgical drill holes in the sulphide deposit that were reported in a press release dated June, 2021.

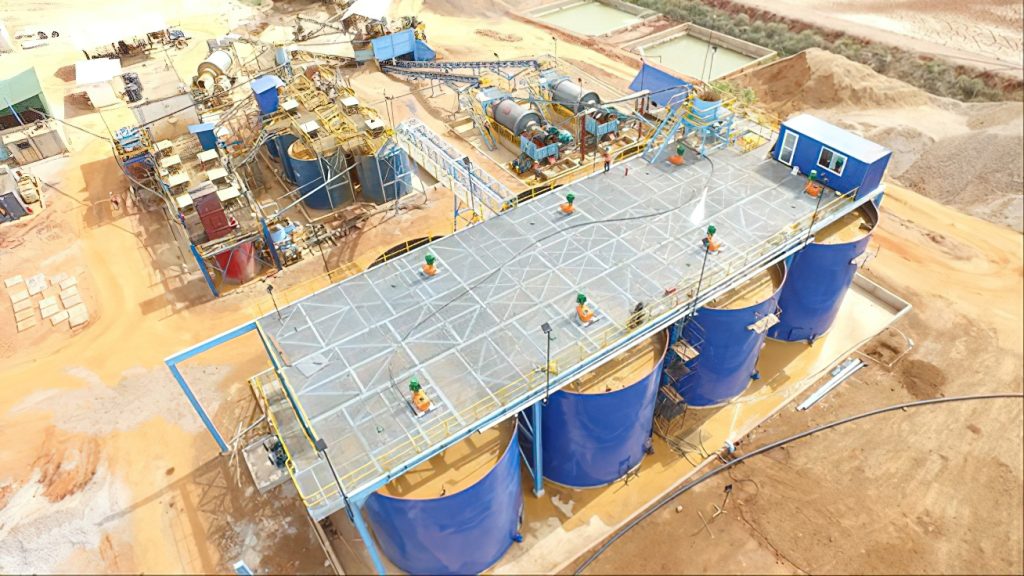

In September, 2022, Buckreef announced the successful commissioning of the second phase of the mill expansion to 1,000 tonnes per day. This marked the second mill expansion in the past 12 months. As a result, since the second quarter of 2022, the production of low cost, high margin gold ounces has steadily increased each month.

As part of an upcoming metallurgical variability study, using core from this program, the company will assess the amenability of the sulphide material to be processed through the existing processing plant, using its relatively simple flowsheet. In turn, this may have positive implications for potential plant expansions.

At the end of the fourth quarter of 2022, TRX had $8.5 million in cash, no debt and working capital of $5.4 million.

On December 9, 2022, TRX Gold shares closed at 43.5 cents and currently trade in a 52-week range of 71 cents and 35 cents.