Avino Drills Best Intercept in Company History

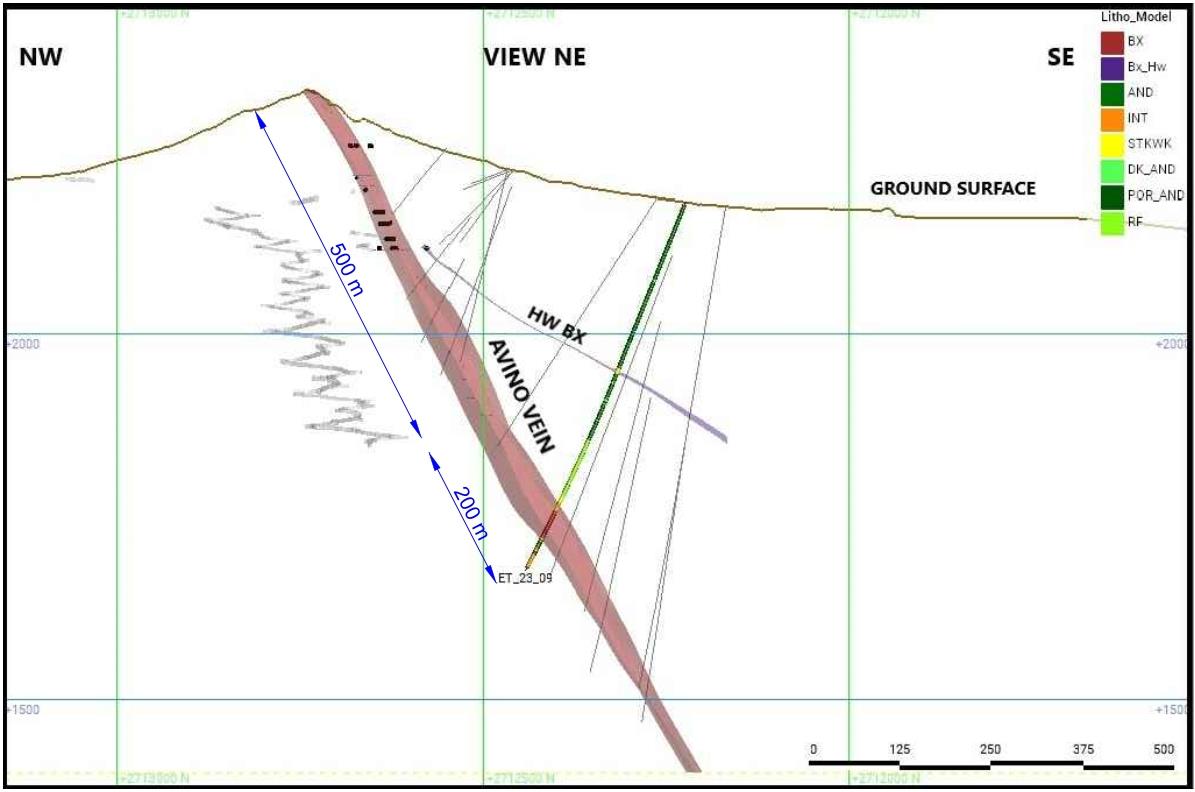

Avino Silver & Gold Mines Ltd. (ASM: TSX/NYSE American, GV6: FSE, “Avino” or “the Company”) releases the results of three drill holes from below Level 17, the current deepest workings at the Elena Tolosa (“ET”) Area of the Avino system. Previously, the Company reported the extension of the Avino Vein to a further 500 metres downdip below the lowest current production mining level. Drill Hole ET-23-09 shows 57 metres true width of mineralization and is a step out 50 metres to the west of Avino’s most westerly drill hole at 200 metres downdip below Level 17. This continuing exploration program is testing the continuity of the steeply dipping mineralization. Avino has enlisted several world-renowned consulting geologists to contribute to the geological theory to drive understanding of the mineralization characteristics. The depth extent of at least 750 metres of known mineralization is unusual in comparison with most Mexican epithermal deposits.

Selected Intercept Highlights:

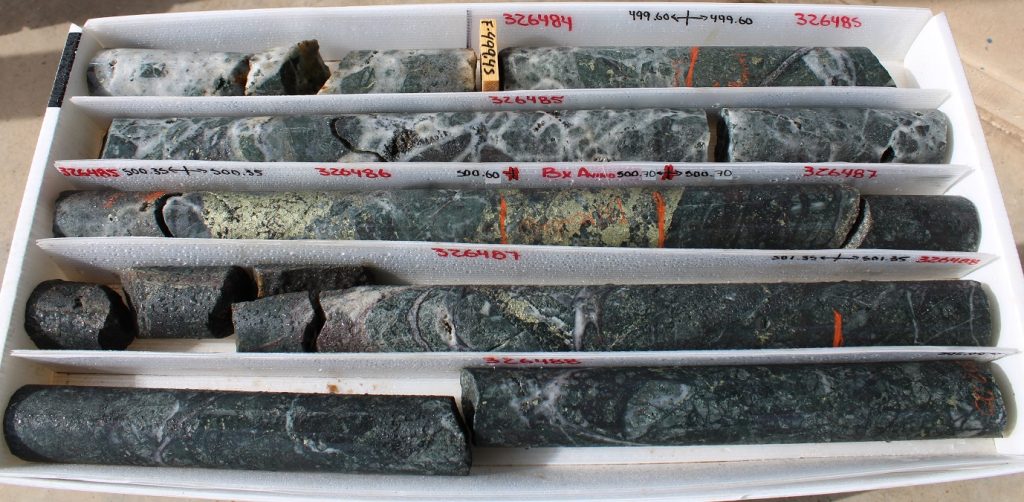

- Hole ET 23-09: 296 AgEq g/t over 57 metres true width, including 407 AgEq g/t over 37 metres true width and 2,866 AgEq g/t over 3.43 metres true width (To view images of the corresponding core, please click here)

- Hole ET 23-07: 230 AgEq g/t over 11 metres true width

Details are shown in the table and images below.

“We stepped out, at depth and along strike, with Hole ET-23-09 and were handsomely rewarded with the best drill hole in the Company’s 55-year history,” said David Wolfin, President and CEO. “The exceptionally wide and very high, silver, gold and copper grades are extremely encouraging for our continued exploration of the Avino vein and associated stockwork and breccia at depth and suggests a much more complex mineralization system. We are still open along strike and at depth and we will continue to try to understand the source of the mineralization as we explore for the source intrusive, porphyry or phreatomagmatic interface. The drill intercept widths are in line with our understanding of the Avino vein and represent minable areas to be contemplated for the future of the mine with grades that are almost 5 times the current cutoff grade.”

Avino is developing a geological model based on a “near porphyry” environment because of the increasing copper grades. The persistence of grade continuity from surface down a plunge distance of over 1,100 metres (800 metres) with this copper increase supports the possibility of a deeper mineralized system and may be linked to a porphyry centre.

Geological modelling is ongoing to determine the potential geometry and controls of the mineralization. Our drill program continues for the rest of 2023 with 2,100 more metres planned for the year to bring the total to 8,000 metres for the year.

Geological Description

The Property contains numerous low-sulphidation epithermal veins (including the Avino vein), breccias, stockworks, and silicified zones that grade into a possible “near porphyry” environment within a large caldera setting. This caldera has been uplifted by regional north-trending block faulting (a graben structure) exposing a window of andesitic pyroclastic rocks of a lower volcanic sequence within this caldera. The lower volcanic sequence is overlain by an upper volcanic sequence consisting of rhyolite to trachyte lava flows and extensive ignimbrites. The direction of the increasing copper grade plunges steeply towards the east in the Avino vein. The changing tenor of the mineralization could be reflecting a transition from epithermal to porphyry-style mineralization.

Below Level 17

Three holes were drilled below Level 17 in this latest drill campaign totalling 2,004 metres drilled. They were completed to investigate the continuity of mineralization in the central part of the ET Area of Avino system. All three holes intercepted mineralization within the vein and stockwork that have silver equivalent grades above the current cut off grade in the latest mineral resource estimate. The results and are reported below in Table 1.

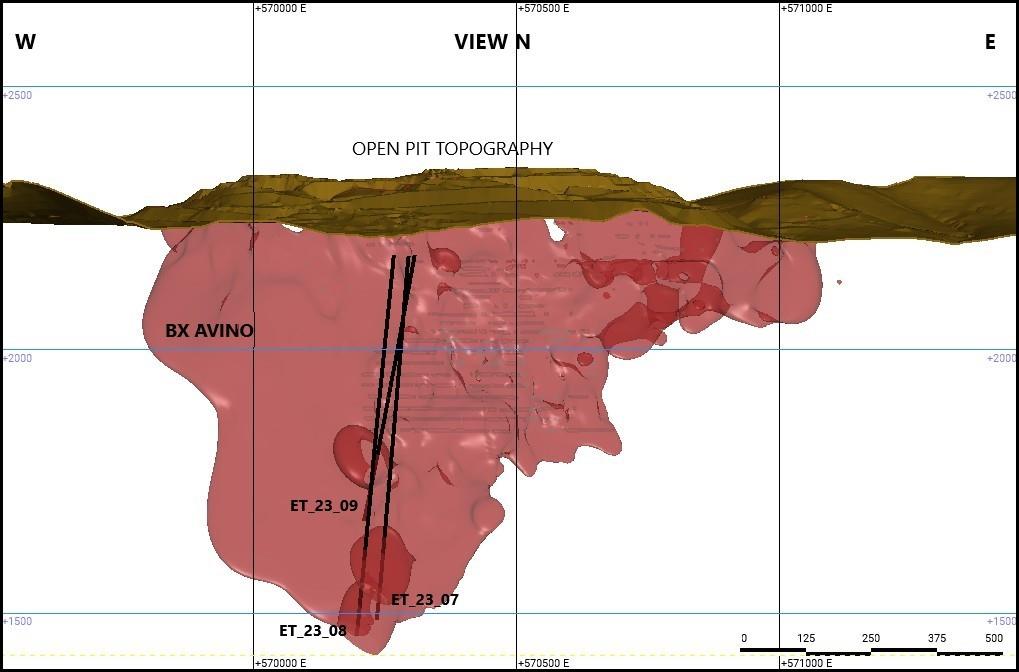

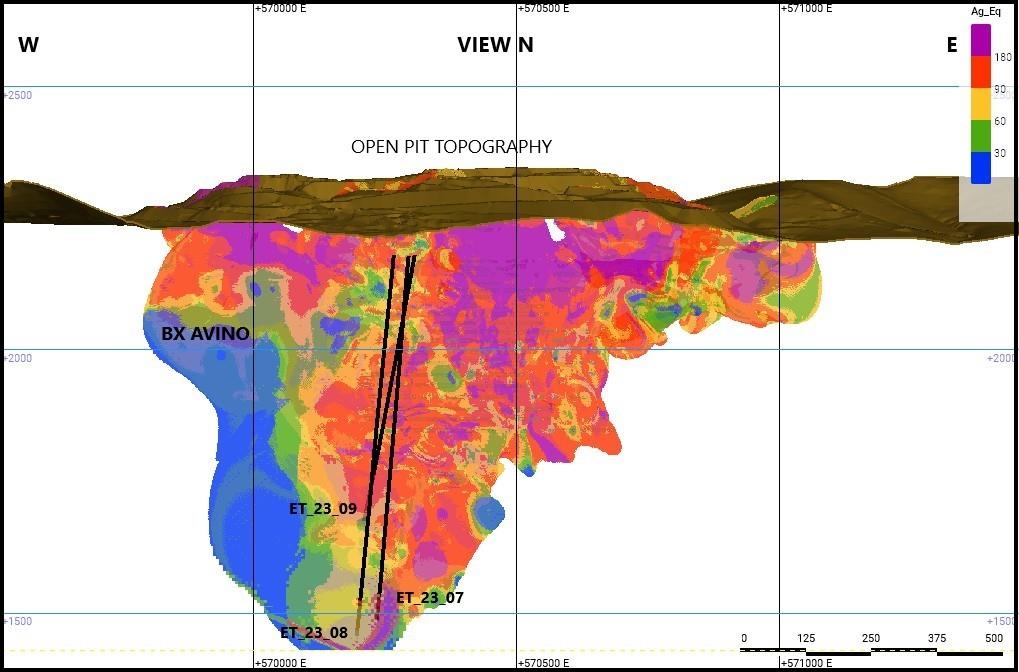

Vein-type mineralization and stockwork containing silver, gold and copper are found along the contacts between intrusive rocks and an andesite. This provides opportunities within the ET Area for the identification and delineation of additional mineral resources that remain open on strike and dip (see Figure 1 for the projections of the resource relative to the drilled holes). This recent drilling confirms that mineralization persists to the west along strike at depth and that there is the potential for high grade silver within the increasing copper grades that have been drilled at depth.

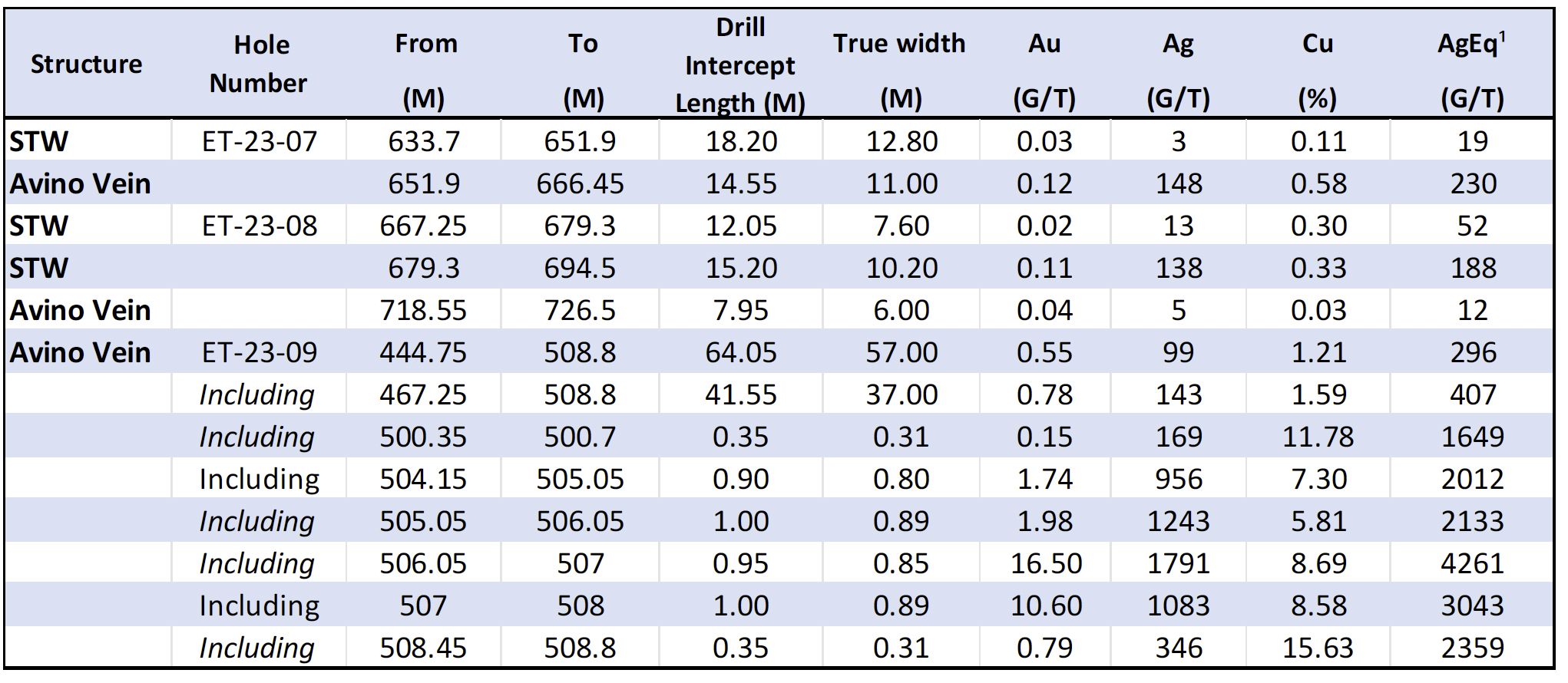

Table 1 – Summary Drill Results

- AgEq in drill results below assumes $22.00 oz/ Ag and $1,850/ oz Au and $4.00/ lb. Cu, and 100% metallurgical recovery.

- STW = Stockwork Veins

Figure 1 –Longitudinal view of the Avino Vein showing the drill hole locations and a projection of the mineralization in red.

Figure 2 –Longitudinal view of the Avino Vein showing the drill hole locations and the block model in AgEq.

Figure 3 –Cross-Section of ET-23-09 and the extent of the down-dip extension from the current mine workings.

Sampling and Assay Methods

Following detailed geological and geotechnical logging, selected drill core areas were cut in half. One half of the core was submitted to the SGS Laboratory facility in Durango, Mexico, and the other half was retained on-site for verification and reference. Gold is assayed by fire assay with an AA finish. Any samples exceeding 3.0 gold grams/tonne are re-assayed and followed by a gravimetric finish. Multi-element analyses are also completed for each sample by SGS ICP14B methods. Any copper values exceeding 10,000 ppm (1%) are assayed using ICP 90Q. Silver is fire assayed with a gravimetric finish for samples assaying over 100 grams/tonne. Avino uses a series of standard reference materials, blank reference materials, and duplicates as part of their QA/QC program during assaying.

Qualified Person(s)

Avino’s projects in Durango, Mexico are under the geoscientific oversight of Michael F. O’Brien, P.Geo., Senior Principal Consultant, Red Pennant Communications, and under the supervision of Peter Latta, P.Eng, Avino’s VP, Technical Services, who are both qualified persons within the context of NI 43-101. Both have reviewed and approved the technical data in this news release.

About Avino

Avino is a silver producer from its wholly owned Avino Mine near Durango, Mexico. The Company’s silver and gold production remains unhedged. The Company’s mission and strategy is to create shareholder value through its focus on profitable organic growth at the historic Avino Property and the strategic acquisition of the La Preciosa property. Avino currently controls mineral resources, as per NI 43-101, that total 368 million silver equivalent ounces, within our district-scale land package. We are committed to managing all business activities in a safe, environmentally responsible and cost-effective manner, while contributing to the well-being of the communities in which we operate.

We encourage you to connect with us on Twitter at @Avino and on LinkedIn at Avino Silver & Gold Mines. To view the Avino Mine VRIFY tour, please click here.

Note: All Avino Silver & Gold Mines Ltd. drill results are detailed in separate news releases and these releases are available on our website at www.avino.com and on our SEDAR profile at www.sedar.com.

On Behalf of the Board

“David Wolfin”

________________________________

David Wolfin

President & CEO

Avino Silver & Gold Mines Ltd.

This news release contains “forward-looking information” and “forward-looking statements” (together, the “forward looking statements”) within the meaning of applicable securities laws and the United States Private Securities Litigation Reform Act of 1995, including the amended mineral resource estimate for the Company’s Avino Property located near Durango in west-central Mexico (the “Avino Property”) with an effective date of January 13, 2021, and as amended on December 21, 2021, and the Company’s updated mineral resource estimate for La Preciosa with an effective date of October 27, 2021, prepared for the Company, and references to Measured, Indicated, Inferred Resources referred to in this press release. These forward-looking statements are made as of the date of this news release and the dates of technical reports, as applicable. Readers are cautioned not to place undue reliance on forward-looking statements, as there can be no assurance that the future circumstances, outcomes or results anticipated in or implied by such forward-looking statements will occur or that plans, intentions or expectations upon which the forward-looking statements are based will occur. While we have based these forward-looking statements on our expectations about future events as at the date that such statements were prepared, the statements are not a guarantee that such future events will occur and are subject to risks, uncertainties, assumptions and other factors which could cause events or outcomes to differ materially from those expressed or implied by such forward-looking statements. Such factors and assumptions include, among others, the effects of general economic conditions, the price of gold, silver and copper, changing foreign exchange rates and actions by government authorities, uncertainties associated with legal proceedings and negotiations and misjudgments in the course of preparing forward-looking information. In addition, there are known and unknown risk factors which could cause our actual results, performance or achievements to differ materially from any future results, performance or achievements expressed or implied by the forward-looking statements. Known risk factors include risks associated with project development; the need for additional financing; operational risks associated with mining and mineral processing; the COVID-19 pandemic; volatility in the global financial markets; fluctuations in metal prices; title matters; uncertainties and risks related to carrying on business in foreign countries; environmental liability claims and insurance; reliance on key personnel; the potential for conflicts of interest among certain of our officers, directors or promoters with certain other projects; the absence of dividends; currency fluctuations; competition; dilution; the volatility of the our common share price and volume; tax consequences to U.S. investors; and other risks and uncertainties. Although we have attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. We are under no obligation to update or alter any forward-looking statements except as required under applicable securities laws. For more detailed information regarding the Company including its risk factors, investors are directed to the Company’s Annual Report on Form 20-F and other periodic reports that it files with the U.S. Securities and Exchange Commission.