Silver X Mining Expands Resources and Production in Peru’s Richest Silver District

By Peter Kennedy

Silver X Mining Corp. [AGX-TSXV, AGXPF-OTCQB, AGX-F] is company that offers investors an opportunity to participate in the early stage of one of the fastest growing silver producers in the sector.

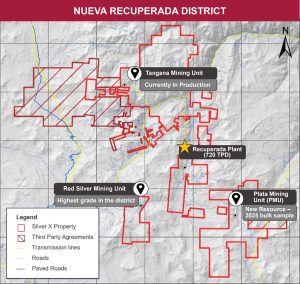

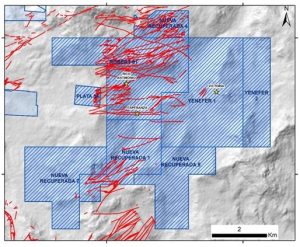

The company’s key asset is a fully permitted 20,472-hectare land package known as the Nueva Recuperada Silver Project. It covers a district-scale area in a prolific silver district located high in the Andes in Huachocolpa, Huancavelica. The deposit contains medium to high-grade silver-rich polymetallic mineralization in epithermal veins. This area boasts an exciting production, development, and exploration pipeline that positions Silver X to potentially achieve production of approximately 6.0 million ounces of silver-equivalent ounces by 2028.

The company’s key asset is a fully permitted 20,472-hectare land package known as the Nueva Recuperada Silver Project. It covers a district-scale area in a prolific silver district located high in the Andes in Huachocolpa, Huancavelica. The deposit contains medium to high-grade silver-rich polymetallic mineralization in epithermal veins. This area boasts an exciting production, development, and exploration pipeline that positions Silver X to potentially achieve production of approximately 6.0 million ounces of silver-equivalent ounces by 2028.

In 2024, global silver demand was estimated to rise 1% year-over-year to 1.21 billion ounces, marking the second-highest year on record. A critical material for the development of the green and digital economy, silver is a monetary investment that often serves as a hedge against economic uncertainty.

Silver X aims to become a premier silver mining company by consolidating assets, adding resources and increasing production in a historic mining district where key infrastructure includes road access, water supply and transmission lines. The strategy is led by CEO and director Jose Garcia, who has worked for over 20 years as a mining engineer with operation and production experience in Peru, Chile, Spain, Australia and Switzerland. He has previously worked for companies such as Anglo American Plc [AAUKF-OTCQX], Inmet and BHP Billiton Ltd. [BHP-NYSE].

For logistical and operational reasons, Silver X has separated the portfolio of vein systems on the Nueva Recuperada property into two main units: The producing Tangana Mining Unit (TMU) in the north and the Plata Mining Unit (PMU) in the south. Plata is expected to come online in 2026.

The Recuperada plant located between TMU and PMU was acquired from Buena Ventura who placed it on care and maintenance in 2014. Silver X commenced commercial production in January, 2023 and today is in ramping up towards nameplate capacity of 720 tonnes per day from 600 tpd, a move that is expected to facilitate annual production of 2.0 million AgEq ounces.

The Recuperada plant located between TMU and PMU was acquired from Buena Ventura who placed it on care and maintenance in 2014. Silver X commenced commercial production in January, 2023 and today is in ramping up towards nameplate capacity of 720 tonnes per day from 600 tpd, a move that is expected to facilitate annual production of 2.0 million AgEq ounces.

The Plata Mining Unit is strategically located just 15 kilometres from the Nueva Recuperada Plant, which provides critical operational logistics and support, including energy, and access to established infrastructure.

A preliminary economic assessment (PEA) released in February, 2023, outlined the growth potential of the Tangana Mining Unit with two milling facilities – a new mill at Tangana, along with the existing Recuperada mill that is producing mineral from Tangana and would eventually process material from the Plata Mining Unit, along with other mineralized areas in the district. The PEA envisioned a 12-year-mine life, at a capacity of 1,500 tonnes per day and average annual production of 4.2 million ounces.

The 2023 PEA was based on a measured and indicated resource of 3.6 million tonnes and 11.9 million tonnes of inferred resource

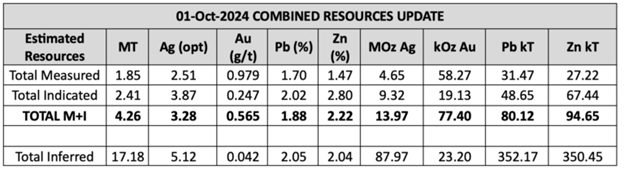

In a press release on February 26, 2025, the company updated its mineral resource estimate for the Nueva Recuperada property. According to the resource update, overall Nueva Recuperada property measured and indicated resources grew to 4.3 million tonnes, an 18% increase from the earlier 3.6 million tonnes estimate. Property inferred resources increased from 11.0 million tonnes to 17.2 million tonnes, a 45% increase.

Included in the updated estimate is an indicated recoverable resource of 0.951 tonnes at 6.11 opt Ag, 4.24% zinc, and 2.44% lead at PMU, where the total amount of contained indicated silver now stands at 5.81 million ounces.

On top of that is a recoverable inferred resource of 5.39 million tonnes at 4.82 opt Ag, 3.35% zinc, and 1.98% lead. That amounts to an inferred resource for the Plata Mining Unit of 26 million ounces of silver.

“The Plata Mining Unit stands out as a high-grade project where we have managed to identify 6.35 million tonnes on 19 veins out of the 171 that are mapped in the area,’’ the company said in a press release. “As a producing company, we envision an opportunity to combine fast-track production with a growing resource in a good silver market,’’ it said. “Nueva Recuperada will accomplish that organic growth over the next few years.’’

Meanwhile, in the third quarter of 2024, the company reported production of 257,635 AgEq ounces, compared to 117,536 in the same period in 2023. Revenue of $5.0 million in the third quarter was up from $2.1 million in the third quarter of 2023.

In the first nine months of 2024, the company produced 839,710 silver equivalent ounces, an increase of 29% from 648,637 AgEq ounces in the first nine months of 2023.

Commenting on the company’s third quarter financial results, Garcia said: “I am pleased to see our mine developing in the right way, accessing new ore-shoots, expanding the orebody both horizontally and at depth, and opening up the terrific potential of our Tangana veins.” “The team is making significant improvements at the operation and despite some of our challenges, we manage to compete with much larger operations,’’ he said. “We are convinced our performance will improve substantially in 2025.’’

Silver X recently announced the execution of a loan agreement with Trafigura PTE Ltd., a global leader in commodity trading. Under the loan facility, an amount of up to US$1.4 million is available to Recuperada S.A.C., a unit of Silver X, with a tenor of up to 25 months interest payable to Trafigura based on the secured overnight financing rate (SOFR) plus 6.0% per annum. The funds will be used for capital expenditures and working capital.

Silver X recently announced the execution of a loan agreement with Trafigura PTE Ltd., a global leader in commodity trading. Under the loan facility, an amount of up to US$1.4 million is available to Recuperada S.A.C., a unit of Silver X, with a tenor of up to 25 months interest payable to Trafigura based on the secured overnight financing rate (SOFR) plus 6.0% per annum. The funds will be used for capital expenditures and working capital.

As part of the loan facility, Silver X will also issue a loan bonus of 1.5 million common share purchase warrants to an affiliate of Trafigura, Urion Holdings (Malta) Ltd. The warrants are subject to a hold period that expires four months and one day from the date of issuance, exercisable for an equivalent of common shares for 25 months at a 25% premium to the 20-day VWAP of Silver X’s shares on the TSXV as of the day before announcing the signing date.

More recently, the company said it is aiming to raise $3.0 million from a private placement of up to 17.6 million units priced at 17 cents each. Each Unit will consist of one Common Share and one Common Share purchase warrant. The warrant entitles the holder to purchase one common share for 25 cents at any time on or before 36 months after the closing date of the private placement.