Japan Gold raising $5.0 million, boosts leadership team

Japan Gold Corp. [JG-TSXV, JGLDF-OTCQB] has announced details of a $5 million best efforts private placement offering of common shares. Under an agreement, the private placement is expected to consist of 41.7 million common shares priced at 12 cents per share.

The company said net proceeds of the offering will be used for exploration drilling and general corporate purposes.

Japan Gold also said it has strengthened its leadership team by appointing Jason Letto as Vice-President, Exploration, and Masanao Kusui as General Manager, Business Administration. The company said Fraser MacCorquodale has transitioned to Senior Technical Advisor. As well, Japan Gold has announced the retirement of Dr. Kotaro Ohga as Chief Engineer. It has also announced the departure of Andrew Rowe, who previously served as Exploration Manager.

On Tuesday, the shares eased 4.00% or $0.005 to 12 cents and trade in a 52-week range of 15 cents and $0.04.

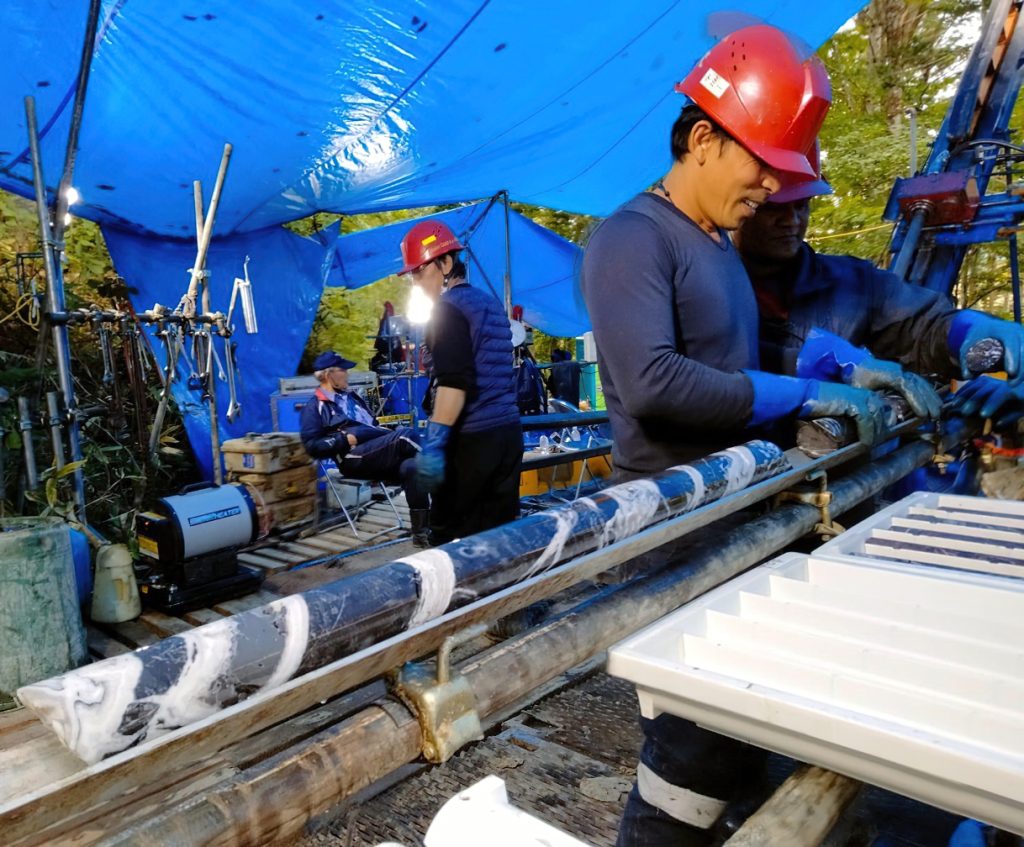

Japan Gold is a Canadian mineral exploration company with a focus on Japan’s three largest islands: Hokkaido, Honshu, and Kyushu. The portfolio of 34 gold projects cover areas with known gold occurrences and a history of mining. These projects are prospective for high-grade epithermal gold mineralization.

The Japan leadership and operational team of geologists, drillers and technical advisers have extensive experience exploring and operating in Japan and have a record of discoveries worldwide.

The company was recently in the news when it announced sale of a 1.5% net smelter return royalty on certain of the company’s properties and assets in Japan to Osisko Gold Royalties Ltd. (OR-TSX, OR-NYSE) for US$5.0 million in cash.

Japan Gold said the transaction with Osisko allows it to accelerate its exploration activities across Japan to unlock the significant mineral potential of our projects through a non-dilutive financing, As a first mover in Japan, the company has assembled a significant land position of 100%-owned permits in areas of past-producing gold mines and surrounding the Hishikari mine, a major gold deposit and one of the world’s highest grade gold producers. These districts have the geological potential to support significant discoveries, the company has said.

The company said the royalty, which Osisko has agreed to purchase, is outside of a country-wide alliance between Japan Gold and Barrick Gold Corp. [ABX-TSX, GOLD-NYSE] which was previously established to jointly explore, develop and mine certain gold mineral properties and mining projects.

The Barrick Alliance previously completed a successful two-and-a-half-year country-wide screening program of 29 projects and has selected six with the potential to host Tier 1 and Tier 2 gold ore bodies for further advancement, and two more recently acquired projects and three project extensions for initial evaluation.