Alamos Gold acquires Carlisle Goldfields

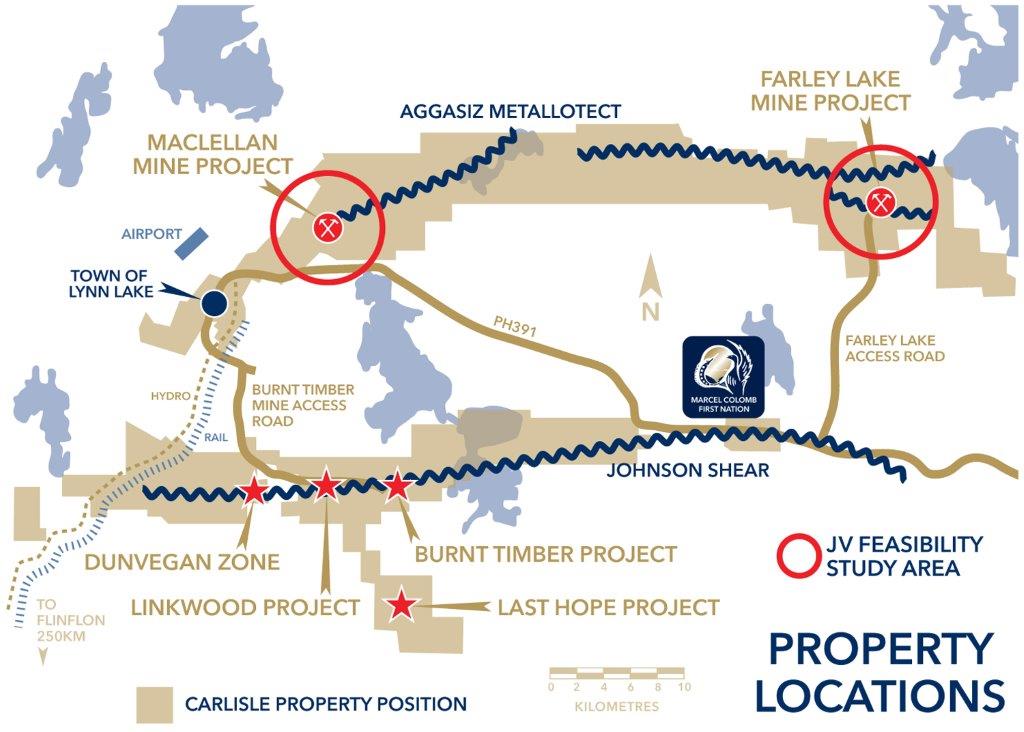

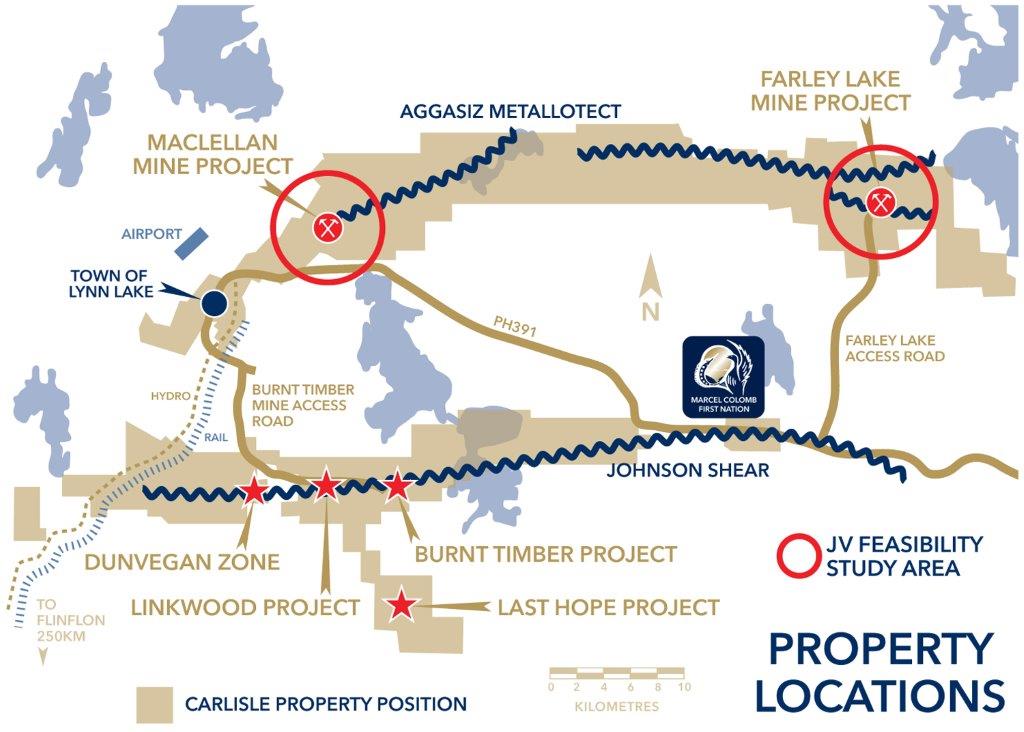

Carlisle Gold's land position in the Lynn Lake mining Camp, Manitoba. Source: Carlisle Goldfields Ltd.

Alamos Gold Inc. [AGI-TSX, NYSE] and Carlisle Goldfields Ltd. [CGJ-TSX; CGJCF-OTCQX] have entered into a definitive agreement pursuant to an offer made by Alamos to acquire all issued and outstanding shares of Carlisle by way of a court-approved plan of arrangement.

Under terms of the agreement, Carlisle shareholders will receive: 0.0942 of an Alamos common share for each Carlisle common share held, plus 0.0942 of a warrant good to buy Alamos common shares at an exercise price of $10 with an expiration date of three years from closing. Not including the Alamos warrant, the share consideration represents a value of 60 cents for each Carlisle common share based on Alamos’s closing price on Oct. 14, 2015, on the TSX, a premium of 62% to Carlisle’s closing price on Oct. 14, 2015, and a 117% premium to its 30-day volume-weighted average price. Alamos currently owns 10.9 million shares of Carlisle, representing approximately 19.9% of Carlisle’s basic common shares outstanding. Excluding Alamos’s existing 19.9% ownership of Carlisle, and net of Carlisle’s current cash, total consideration for the acquisition is approximately US $22.1-million (CDN $28.5-million).

The number of shares to be issued by Alamos as part of the agreement is approximately 5.4 million, assuming conversion of in-the-money options and warrants, approximately 2% of Alamos’s current basic common shares outstanding. In addition, Carlisle shareholders will be issued approximately 5.4 million warrants in aggregate. Alamos will apply to list the warrants on the TSX.

Carlisle’s primary asset is the Lynn Lake gold project located in the past-producing gold camp in Lynn Lake, Manitoba. Lynn Lake comprises five near-surface deposits which contain total measured and indicated resources of 40.5 million tonnes grading 2.11 g/t gold for 2.75 million oz gold and total inferred resources of 51.8 million tonnes grading 1.37 g/t for 2.28 million oz. In February 2014, a positive preliminary economic assessment (PEA) was completed on the two primary deposits, the MacLellan Mine and the Farley Lake Mine, which detailed average annual production of 145,000 oz gold at all-in sustaining costs of $644/oz over a 12-year mine life. The PEA outlined attractive economics with an after-tax IRR of 26% at US $1,100/oz.

As part of the November 2014, agreement with Carlisle, AuRico Gold (a predecessor to Alamos) acquired a 19.9% interest in Carlisle and a 25% interest in the Lynn Lake project with an option to earn up to a 60% interest in the project by spending $20 million and delivering a definitive feasibility study on the project within a three-year period.

“The Lynn Lake project represents an attractive, low-risk growth opportunity as a high-grade, open-pit project located in one of the best mining jurisdictions in the world. Given its potential for strong economics, the structure of the existing earn-in agreement and our commitment to advancing Lynn Lake, we are pleased to be able to consolidate our ownership of the project through our acquisition of Carlisle. This is a win for shareholders on both sides,” said John A. McCluskey, President and CEO of Alamos.

“The proposed transaction represents a significant premium and mitigates substantial dilution risk for Carlisle shareholders in current markets,” said Abraham Drost, Carlisle’s President and CEO. “With the Alamos share and listed warrant consideration, Carlisle shareholders gain exposure to a dynamic, producing gold miner with a varied and promising international development portfolio that now, subject to the Carlisle shareholder vote, will also include the feasibility-level Lynn Lake development assets and exploration portfolio.”