Almadex Announces Acquisition of 100% of Logan Zn/Ag Project in Yukon Territory

Almadex Minerals Ltd. (“Almadex” or the “Company”) (TSX-V: “DEX“) is pleased to announce it has acquired 100% ownership of the Logan Zinc, Silver project (“Logan”, or the “Project”) located in the Yukon, Canada. As fully outlined below, a Company predecessor discovered the Logan Project in 1979. The project was then joint ventured, leaving Almadex’s predecessor a retained 40% interest carried to “Positive Production Decision”. The majority interest subsequently changed ownership, but the property was never the focus for the various operators. Almadex has been able to acquire 100% of the Logan project legally through a bankruptcy receivership, finally allowing for the project to be advanced. Key take aways for the Logan Project include:

- Located 38 km north of the Alaska Highway, accessed historically by 52 km long winter road;

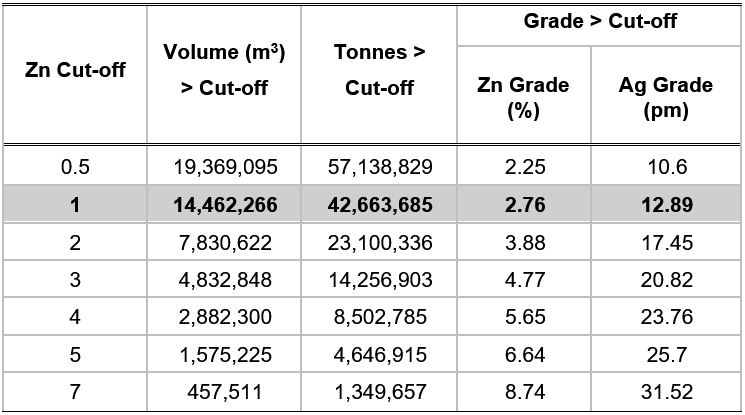

- Historic inferred resource prepared in 2012 for the Logan Main Zone reporting 42.7 Mt with average grades of 2.76% zinc and 12.89 ppm silver at a 1% zinc cut-off grade (see below for details and disclosure);

- Deposit remains open along strike and down dip.

Duane Poliquin, Chairman of Almadex, stated, “We have long been pushing to advance the Logan project but have been constrained by the joint venture agreement and the unresponsive nature of the prior majority owners. With this transaction we are now finally able to start the work necessary to surface the tremendous potential which exists at this project. We look forward to meeting and consulting with all rightsholders including the Ross River Dena Council and Liard First Nation to discuss exploration and development approaches that can meet the expectations of local people, the Indigenous owners, the Yukon government and other Company stakeholders.”

Logan Project Details and Historic Mineral Resource Estimate

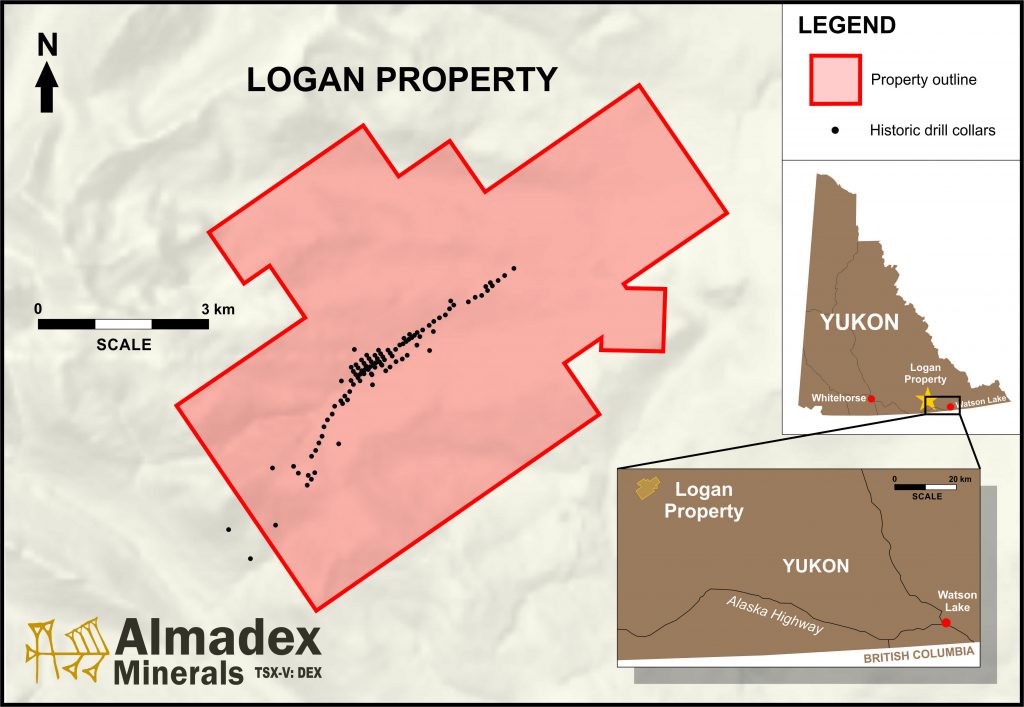

The Logan Project is located 108 km northwest of Watson Lake in south central Yukon. The Project consists of 156 contiguous quartz mining claims located in the Watson Lake Mining District, covering over 3,200 hectares. The Project is located on the traditional territory of the Ross River Dena Council and Liard First Nation, 38 km north of the Alaska Highway. Â Access for past major work programs was facilitated with a 52 km long winter road from the Alaska Highway. In 1987, a 700 m long by 20 m wide gravel airstrip was established on the Property; future use of the airstrip would require surface re-levelling, but small, short runway aircraft may be able to land at this time. The winter road permit was not renewed past 2009 and re-opening the road would require further permitting. Currently, the Project can be accessed via helicopter.

According to historic reports, Logan contains a zinc-silver deposit consisting of fracture and vein hosted zinc-silver mineralization within a granitic intrusion. The Main Zone occurs along an 8,000m long NE-trending fault-related structure. The Main Zone is tabular, dips 70 degrees to the NW, extends for 1,100m along strike, varies from 50m to 150m in width, and has been traced to depths of 275m and remains open. The mineralization is up to 90 metres thick in relatively gentle terrain and minimal overburden, making it attractive for open pit mining. In March, 2004, in its public filings prior to bankruptcy, Yukon Zinc Corp. noted that exploration defined low grade zinc mineralization in the East and West Zones of the deposit that require more drilling to better define resources, that historic drilling in the deeper parts of the Main Zone includes important intersections, such as 9 metres grading 10.07% zinc and 65.2 g/t silver, that could be amenable to underground mining, and that the deposit remains open at depth and along strike.

Logan has been explored by means of sequential programs of mapping, soil sampling, geophysics, and diamond drilling since the 1980s. The work conducted by or on behalf of Cordilleran Engineering, Getty Resources Ltd., Fairfield Minerals, Total Energold Minerals Inc., Expatriate Resources, and Yukon Zinc Corp. (Yukon Zinc) is briefly summarised as follows:

1979: Staking of Logan 1 to 36 quartz mining claims to cover new zinc-silver-tin-copper gossan. Geological mapping, soil and stream sediment geochemistry, hand trenching, and test IP, EM and magnetometer geophysical surveys.

1980-1985: Additional soil geochemistry, claim staking, hand trenching, and geophysical surveys were completed.

1986-1989: Exploration drilling of 103 holes totalling 16,438 metres. Fifteen trenches totalling 2,412 metres and ongoing soil geochemistry and geophysical surveys. Metallurgical testwork at Lakefield Research Laboratories under supervision of Strathcona Mineral Services Limited. Flotation of both high- and low-grade zinc samples indicated that recoveries of 93-95% zinc and 85-90% silver could be projected to a zinc concentrate.

2003: Additional staking and completion of a baseline environmental survey was conducted in and around the Logan property.

2006: Yukon Zinc Corp. retained Bell Geospace to conduct an Air Full Tensor Gravity (Air-FTG) survey.

2012: Wardrop, a Tetra Tech Company (Tetra Tech) was retained by Yukon Zinc to prepare a Technical Report, including an historical mineral resource estimate, on the Logan Property in 2012. The 2012 Tetra Tech Technical Report is treated as a historical mineral resource. A Qualified Person has not done sufficient work to classify the historical estimate as a current mineral resource and Almadex is not treating this historical estimate as current mineral resources.

The 2012 Logan historical mineral resource estimate is considered to be relevant and reliable. The Tetra Tech historical estimate for the Logan Main Zone deposit, used sample assay data from 56 drillholes which intersect the deposit containing 4,314 zinc and silver assays. Samples were composited to 2 m lengths and no assay values were capped. The Logan Main Zone deposit was modeled as a single mineralized geological wireframe bounded by two faults (the hanging wall and footwall faults) striking southwest and dipping moderately northwest. Where the position of the upper and lower faults bounds is uncertain a grade cut-off of 0.5% zinc was used to constrain the model. Bulk density values of 2.95 and 2.7 were assigned to mineralization and waste rock based on 53 separate SG determinations from drill core pulp composite samples representing 556 m of diamond drill core. Interpolation was done using Ordinary Kriging on blocks 10 m x 10 m x 10 m in size. Only zinc and silver were consistently assayed throughout the three years of drilling, and therefore these were the only metals estimated. At a 1% zinc cut-off grade, the Logan Main Zone was estimated to contain 42.7 Mt at an average grade of 2.76% zinc and 12.89 ppm silver¹.

¹Harder, M. P.Geo. and O’Brien, M. Msc., Pr.Sci.Nat., FGSSA, FAusIMM, MSAIMM (2012) NI 43-101 Technical Report on the Logan Property, Yukon prepared for Yukon Zinc Corp., Effective Date May 30, 2012, Wardrop, Tetra Tech, pp. 95

The 2012 Tetra Tech historical estimate, reported at a % zinc cut-off grade, is summarized in Table 1. Â Â The entire resource was classified as an inferred historical resource, based on a lack of QA/QC and specific gravity (SG) data, a lack of original assay certificates to validate the data, and an inability to confirm the locations of any drillholes. The Logan Main Zone historical estimate was classified using the definitions set out in CIM Definition Standards for Mineral Resources and Mineral Reserves (2010), which was superseded by CIM (2014). Similarly, the Main Zone estimate predates CIM Estimation of Mineral Resources and Mineral Reserves Best Practice Guidelines (2019). To verify the historical estimate as a current mineral resource a Qualified Person would need to prepare an updated mineral resource estimate and NI 43-101 technical report with respect to the Logan Property.

Subject to permitting and stakeholder engagement, Almadex plans to commence an Independent QP review of the previous work towards the preparation of a new Technical Report and a QP site visit in the summer of 2022 after snow melt. Data review to date indicates that there is potential to enlarge the mineralised envelope of the historic resource as the deposit was generally drilled to 120-240m down dip (only one hole was drilled to 400m down dip), and the deposit remains open, particularly on the northeast side.

Table 1: Logan Main Zone Deposit Historical Inferred Resource Estimate – (Tetra Tech 2012)

Table 1 above illustrates the sensitivity of the historical mineral resource estimate to different cut-off grades for a potential open-pit operation scenario with reasonable outlook for economic extraction. The reader is cautioned that the figures provided in the above table, other than those relating to the 1.0% base case cut-off, should not be interpreted as a statement of historical or current mineral resources. Quantities and estimated grades for different cut-off grades are presented for the sole purpose of demonstrating the sensitivity of the historical resource model to the choice of a specific cut-off grade.

Transaction

Logan has been explored by multiple parties over the past forty years. Almaden Minerals Ltd. (“Almaden”) assumed ownership of a 40% joint venture interest in the Project through a joint venture agreement when it amalgamated with Fairfield Minerals in 2002. Under the joint venture agreement, Almaden was carried to a production decision, and both parties had certain rights and restrictions regarding ownership transfer. In its spinout by way of Plan of Arrangement in 2015, Almaden was not able to secure the necessary waivers of rights or restrictions from the majority joint venture owner to transfer the minority Logan interest to Azucar Minerals Ltd. (“Azucar”), but undertook to Azucar to do so once these were attained. Likewise, when Azucar completed its spinout by way of Plan of Arrangement in 2018 to create Almadex (the spinouts of 2015 and 2018 are collectively referred to as the “Spinout Arrangements” below), Azucar undertook to complete the spinout of the Logan interest to Almadex once Azucar was in a position to do so.

In 2003, Expatriate Resources Limited acquired the majority 60% interest in the Logan joint venture agreement from Total Energold. At the time, Expatriate was investigating the Project as part of a broader evaluation of the combined resources of Logan and the Wolverine property, located approximately 100 kilometers to the north. In 2004, Expatriate re-organized its business and changed its name to Yukon Zinc Corp. (“YZC”), focused on the development of the Wolverine project. In 2008, YZC was acquired by Jinduicheng Canada Resources Corporation Limited (“JCR”), which is majority-owned by Jinduicheng Molybdenum Group, which in turn is wholly owned by Shaanxi Non-ferrous Metals Holding Group Co., Ltd.

YZC went on to construct and develop the Wolverine mine, which reached commercial production in 2012, but was put on care and maintenance in 2015. In 2019, PricewaterhouseCoopers Inc. was appointed Receiver over YZC. Almaden, acting on behalf of the Company under the terms of the Joint Venture Agreement and consistent with the Spinout Arrangements, was able to acquire the remaining 60% joint venture interest in the Project, dissolve the joint venture agreement, and transfer Logan to the Company for CAD$121,100 in cash, with the Company assuming all costs and obligations, including an indemnification to Almaden, related thereto.

Next Steps

Almadex is now focused on stakeholder mapping and data review. As noted above, Almadex recognizes and respects the Ross River Dena Council and Liard First Nation as traditional owners of the area within which the Project is located and hopes to have the opportunity to meet with them in the near term to understand their view of the Project and hopes for the area and to consult with them prior to any work programs. It is anticipated that future work programs would initially consist of a QP site visit which would direct a possible updated resource estimate and filing of a NI 43-101 Technical Report.

Qualified Persons

The scientific and technical information contained in this news release has been reviewed and approved by Kristopher J. Raffle, P.Geo. (BC) Principal and Consultant of APEX Geoscience Ltd. of Edmonton, AB, and an independent “Qualified Person” as defined in National Instrument 43-101 – Standards of Disclosure for Mineral Projects. Mr. Raffle verified the data disclosed which includes a review of the analytical and test data underlying the information and opinions contained therein.

About Almadex

Almadex Minerals Ltd. is an exploration company that holds a large mineral portfolio consisting of exploration projects and NSR royalties in Canada, the U.S., and Mexico. This portfolio is the direct result of many years of prospecting and deal-making by Almadex’s management team. The Company remains focussed on grassroots exploration, acquisition and drilling mineral projects, on its own and in partnership with others, with the goal of creating new mineral resources and royalty holdings. The Company owns several portable diamond drill rigs, enabling it to conduct cost effective first pass exploration drilling in house.

On behalf of the Board of Directors,

“J. Duane Poliquin”

Duane Poliquin, Chairman

Almadex Minerals Ltd.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release includes forward-looking statements that are subject to risks and uncertainties. All statements within it, other than statements of historical fact, are to be considered forward looking. Forward-looking statements in this news release relating to the Company include, among other things, the planned data review, stakeholder mapping and stakeholder development. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in forward-looking statements. Factors that could cause actual results to differ materially from those in forward-looking statements include market prices, exploitation and exploration successes, permitting, continued availability of capital and financing, equipment availability, relationships with third-party clientele and their willingness or ability to continue to use the Company’s drills for exploration, and general economic, market or business conditions. There can be no assurances that such statements will prove accurate and, therefore, readers are advised to rely on their own evaluation of such uncertainties. The Company does not assume any obligation to update any forward-looking statements, other than as required pursuant to applicable securities laws.

Contact Information:

Almadex Minerals Ltd.

Tel. 604.689.7644

Email: info@almadexminerals.com