Alpha Lithium shareholder slams takeover bid

Kyle Stevenson, a strategic advisor and major shareholder of Alpha Lithium Corp. [ALLI-NE0, APHLF-OTC, A3CUW1-German WKN] has issued an open letter to his fellow shareholders declaring his opposition to the price and structure of Tecpetrol Investments S.L.’s hostile bid for the company.

In a press release on May 23, 2023, Alpha said Tecpetrol is offering to pay a cash consideration of $1.24 per share for all of Alpha’s issued and outstanding shares.

On June 9, 2023, Alpha said it had received an unsolicited takeover bid from TechEnergy Lithium Canada Inc., a subsidiary formed five days earlier by Spanish firm Tecpetrol Investments S.L. In a press release, Alpha said its board of directors and its special committee of independent directors would review the offer and make recommendations to the company’s shareholders. On June 23, 2023, the Alpha said the board has unanimously determined that Tecpetrol’s hostile offer is not in the best interests of the company or its shareholders.

On Monday, Alpha shares were priced at $1.43 and trade in a 52-week range of $1.45 and 72 cents.

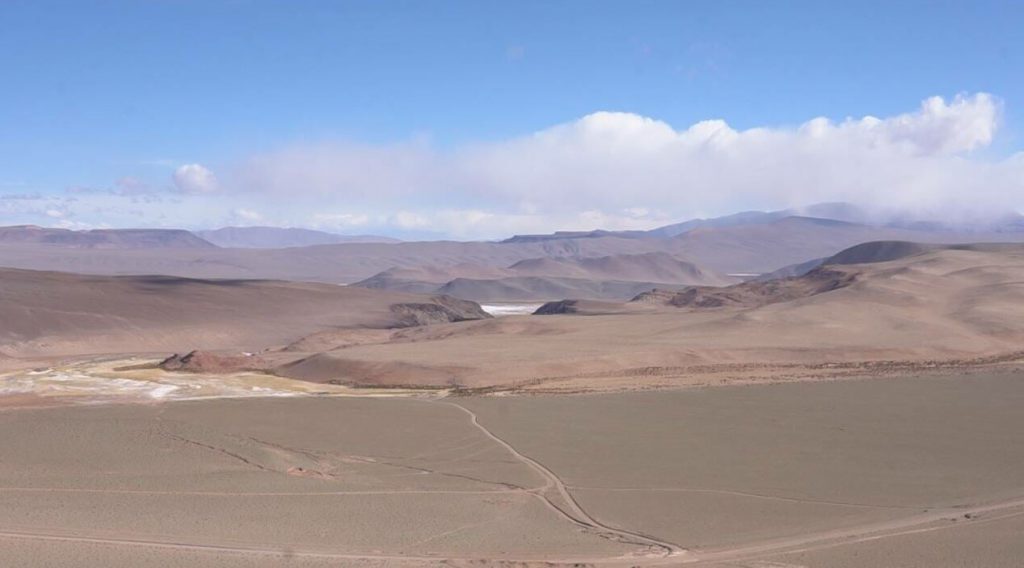

Alpha Lithium is focused on the development of the Tolillar and Hombre Muerto salars in Argentina. In Tolillar, the company said it owns what may be one of Argentina’s last undeveloped lithium salars, an asset that cover 27,500 hectares in the heart of the renowned Lithium Triangle. Hombre Muerto covers 5,000 hectares.

Alpha said it recently added a renowned group of lithium chemistry experts to its team for the purpose of examining and evaluating different Direct Lithium Extraction (DLE) techniques that have shown to economically extract lithium at concentrations lower than 100 mg/L.

In his open letter, Stevenson said he currently owns 9.2 million common shares of Alpha as well as securities that are convertible into an additional 1.3 million shares. “To the best of my knowledge, I am the single largest shareholder of Alpha Lithium,’’ he said.

“I have been heavily involved in the Argentina lithium exploration and development industry since 2016, when I became President, CEO and a director of Millennial Lithium Corp. We developed the Pastos Grandes lithium brine project in Argentina, approximately 70 kilometres northeast of Alpha’s Tolillar project. We sold Millennial to Lithium Americas Corp. [LAC-TSX, NYSE] in 2022, in a transaction valuing Millennial at approximately $491 million. This experience game me considerable insight into the exploration and development of Argentina lithium brine assets, and their value in strategic M&A transactions.’’

Stevenson went on to say that he is familiar with Alpha, its assets, and its management team. “In 2019, I had the opportunity to travel to Argentina with management and experience, first hand, the potential for Tolillar,’’ he said.

“I have carefully watched Tecpetrol’s attempt to acquire Alpha from its shareholders. I have reviewed Tecpetrol’s bid circular, as well as Alpha’s Directors Circular, and it is clear to me that the Tecpetrol bid is wholly inadequate, and I do not intend to tender any of my shares. In my opinion, the Tecpetrol bid is an opportunistic attempt to seize both Alpha’s Tolillar and Hombre Muerto assets at an indefensible discount to their true value, which I strongly oppose.’’