Arizona Metals Intersects 10.5 m grading 6.2% CuEq, 7.3 m grading 4.6 % CuEq, and 29 m grading 1.2% CuEq at the Kay Mine Deposit and Provides Update on Western Target Drilling

Arizona Metals Corp. (TSX: AMC) (OTCQX: AZMCF) (the “Company” or “Arizona Metals”), a leading exploration and development company, is pleased to announce the latest drilling results from the Kay Mine Deposit in Arizona. The results from five additional drill holes demonstrate the significant potential of the deposit and highlight the expansion opportunities within the broader property.

Highlights of the recent drilling include:

- Hole KM-23-103 intersected 10.5 meters grading 6.2% copper equivalent (CuEq), including 2.7 meters at 10.5% CuEq and 1.5 meters at 8.9% CuEq. This hole confirms the high-grade copper and gold mineralization previously encountered in hole KM-21-19. Moreover, it extends the mineralization 20 meters north of KM-21-19 and 70 meters north of KM-22-68. The presence of multi-gram gold assays suggests the potential for delineating a high-grade gold zone in the western portion of the Kay Mine Deposit.

- Hole KM-23-105 intercepted 7.3 meters grading 4.6% CuEq, (including 2.0 meters at 8.7% CuEq), starting at a depth of 553.2 meters. Furthermore, at 13.7 meters below, the hole intersected 28.8 meters grading 1.2% CuEq, including 2.3 meters at 5.9% CuEq. This hole confirms the excellent continuity, thickness, and grade of mineralization within a previously unexplored 50-meter gap in the central part of the Kay Mine Deposit.

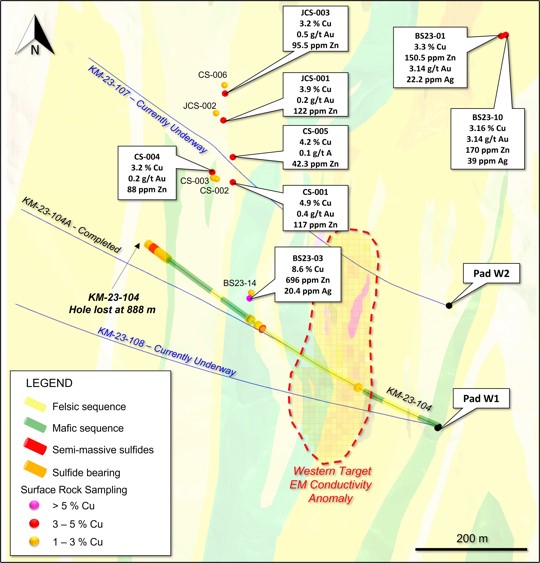

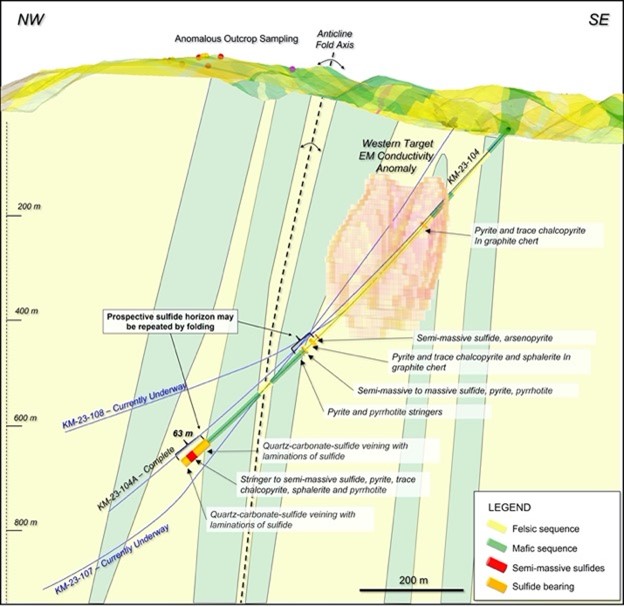

In addition to these promising results, drilling at the Western Target has been ongoing since February 2023. The first two holes, KM-23-104 and branch hole KM-23-104A, have been completed, and assays are currently pending. Hole KM-23-107 is underway to test for mineralization approximately 250 meters north of KM-23-104, while hole KM-23-108 is targeting an area approximately 125 meters south of KM-23-104. The Company has conducted downhole electromagnetic surveys on hole KM-23-104A and on 85% of hole KM-23-107, aimed at identifying extensions of previously observed conductors. The collected data are undergoing analysis and 3D inversion modeling.

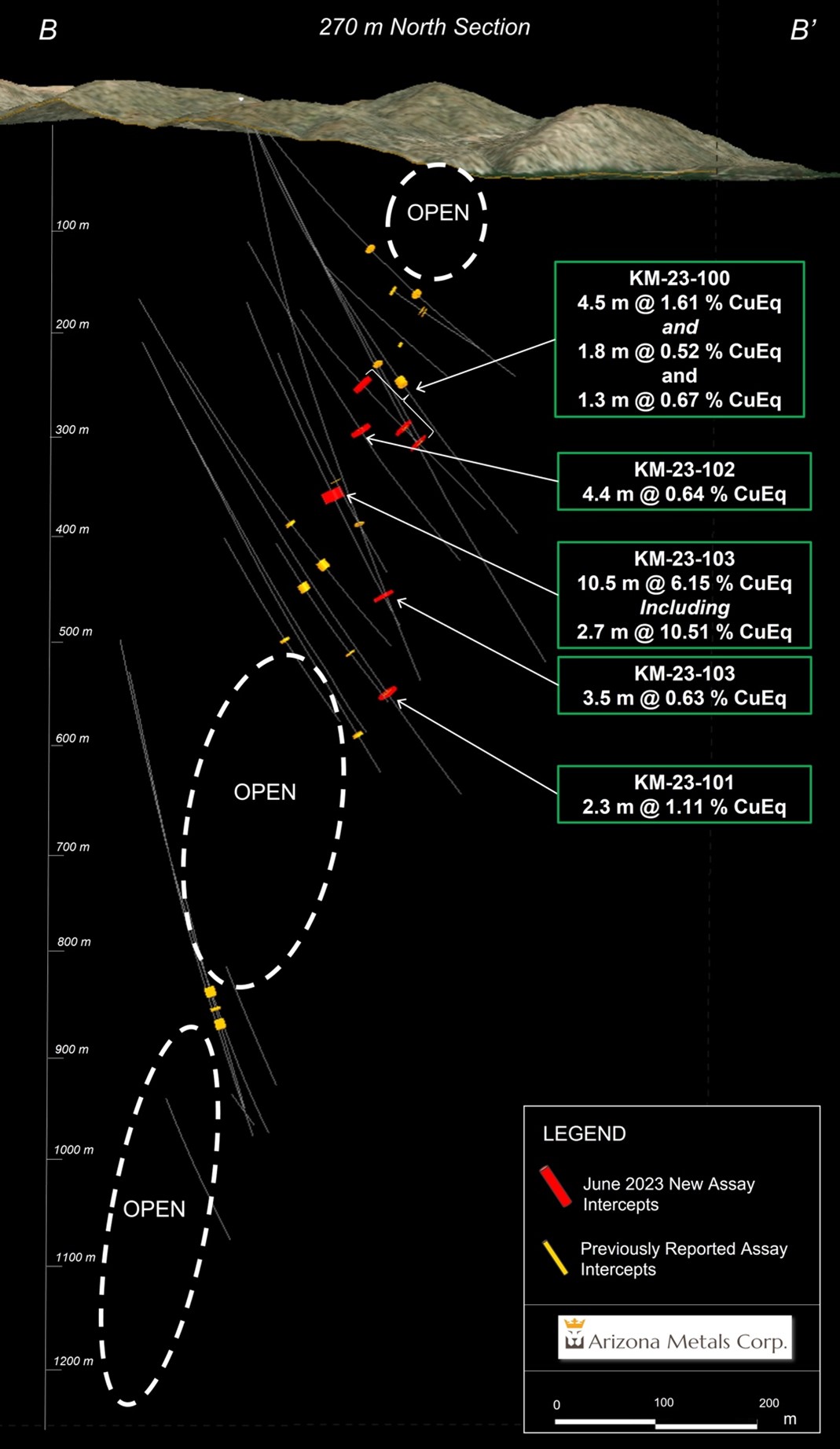

To further accelerate exploration efforts, Arizona Metals Corp. has mobilized a third drill rig specifically for targeting extensions of the high-grade mineralization encountered in hole KM-23-103. This rig will also focus on areas with lower drill density, including the northern part of the deposit and shallow areas above a depth of 200 meters (see Fig. 3).

Marc Pais, CEO, commented “The high-grade copper and gold drill results reported today continue to demonstrate the expansion potential of the Kay Mine Deposit, which we believe is part of a much larger property-wide mineralized system. We are also pleased to report that drilling of the third and fourth holes at the Western Target has commenced and we are now targeting the fifth drill hole in this area following up visual mineralization encountered in holes 104 and 104A. Downhole electromagnetic surveying of the first two Western Target holes has been completed and data are currently being analyzed. Surface outcrop sampling at the Western Target has returned significant grades of both copper and gold, extending the strike length of mineralization exposed at surface in this area to approximately 800 meters.”

Arizona Metals is fully-funded (with $49 million in cash as of March 31, 2023) to complete the remaining 1,250 meters planned for the Phase 2 drill program at the Kay Mine Deposit (budgeted at $526,000) as well as an additional 76,000 meters in the Phase 3 program (budgeted at $32 million), which will be used to test the numerous parallel targets heading west of the Kay Mine Deposit, as well as possible northern and southern extensions.

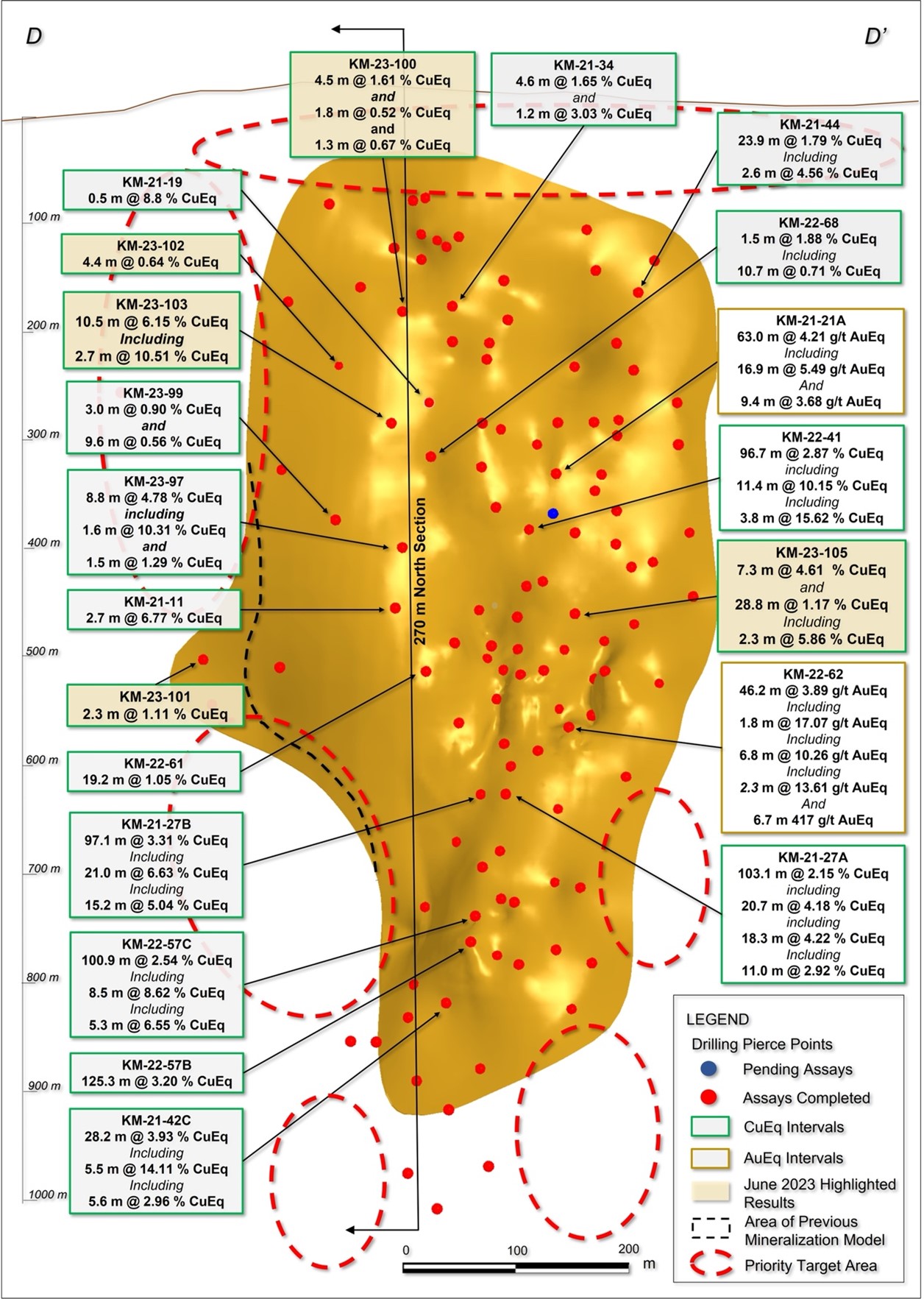

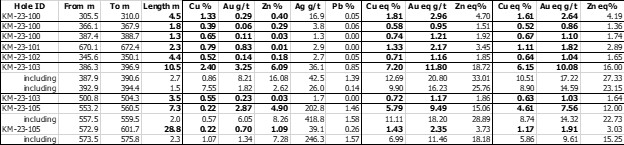

Figure 1. Long section displaying new drill holes reported in this release (labels highlighted yellow). See Tables 1-3 for additional details. The true width of mineralization in this area is yet to be determined. See Table 1 for constituent elements, grades, metals prices and recovery assumptions used for AuEq g/t and CuEq % calculations. Analyzed Metal Equivalent calculations are reported for illustrative purposes only.

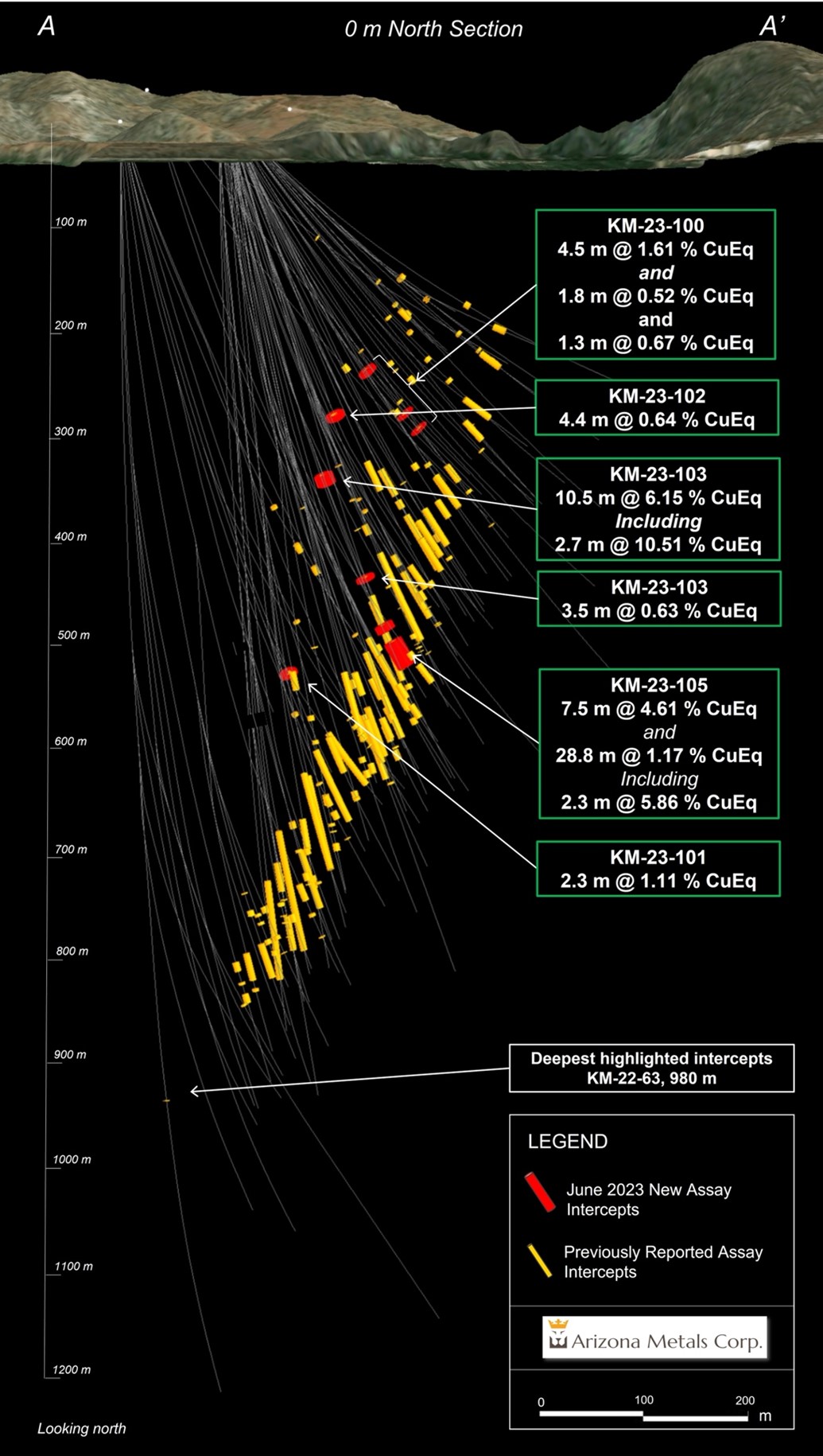

Figure 2. Cross-section view looking north at the Kay Mine Deposit, showing assay intervals in drilling reported in this release. See Tables 1-3 for additional details. The true width of mineralization is estimated to be 50% to 99% of reported core width, with an average of 76%.

Figure 3. Cross section view looking north showing assay intervals and areas open for expansion in the northern part of the Kay Mine Deposit. See Tables 1-3 for additional details. The true width of mineralization is estimated to be 50% to 99% of reported core width, with an average of 76%.

Figure 4. Core from hole KM-23-103 between 392.2 m and 395.1 m downhole, which includes an interval of 1.5 m grading 7.6% copper, 1.8 g/t gold, 2.6% zinc, and 26 g/t silver. This is part of a broader interval of 10.5 m grading 6.2% CuEq. See Table 1 for constituent elements, grades, metals prices and recovery assumptions used for CuEq % calculations. Analyzed metal equivalent calculations are reported for illustrative purposes only.

Drilling Details—Kay Mine Deposit

Drill holes KM-23-100 through 103, described below, extended mineralization northward or filled in large gaps in mineralization along the northern portion of the deposit, in its upper half. Collectively, they confirmed mineralization in an area approximately 175 m in strike and 300 m in depth.

- 4.5 m @ 1.6% CuEq, 1.8 m @ 0.5% CuEq, and 1.3 m @ 0.7% CuEq

- This hole confirmed continuity of mineralization 40 m north of hole 34 and added mineralization in two deeper intervals in the footwall of the main deposit in this area.

- 2.3 m @ 1.1% CuEq

- A large step-out hole, this extended mineralization approximately 65 m north of hole 22, and suggests mineralization potential in the ~200 m gap north of hole 11.

- 4.4 m @ 0.6% CuEq

- This hole confirmed mineralization in a large gap along the northern edge of the deposit: it extended mineralization almost 100 m north of hole 69 and 50 m north of hole 19 and indicates further potential in this area of the deposit.

- 10.5 m @ 6.2% CuEq (including 2.7 m @ 10.5% CuEq), and 3.5 m @ 0.6% CuEq

- Hole 103 confirmed the high Cu and Au grades drilled in hole 19, and extended mineralization 20 m north of hole 19 and 70 m north of hole 68.

- Hole 103 included numerous multi-gram Au assays, suggesting potential for tracing a steeply dipping, relatively high-Au zone within the western portion of the deposit.

- 28.8 m @ 1.2% CuEq, including 2.3 m @ 5.9% CuEq

- 7.3 m @ 4.6% CuEq, including 2.0 m @ 8.7% CuEq

- Hole 105 confirmed excellent continuity, thickness, and grade of mineralization in a 50-m gap in the central portion of the deposit.

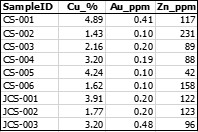

Recent surface mapping and sampling on the West target (Figure 5) has extended the mineralized horizon that was drilled in holes 104 and 104A and previously sampled at surface, where it returned 8.6% Cu. Nine new surface samples all returned percent-grade Cu, up to 4.9% Cu, and averaging 2.9% Cu. These samples also contained anomalous Au, up to 0.5 g/t Au. The surface strike length of mineralization exposed at surface in this area is now approximately 800 m. These surface samples suggest increasing intensity of mineralization to the north; along with data gathered in the drill holes completed and underway, these results will be used to refine drill targeting on the West Target.

Figure 5. Plan view displaying drill holes completed and underway at the Western Target, as well as results of recent outcrop surface sampling north of the Western Target EM Conductivity Anomaly. See Table 5 below of sample assay details.

Figure 6. Cross section of the Western Target looking north, showing current and completed drill holes and mineralization intersected in drill hole KM-23-104.

Kay Mine Project Phase 2 Drill Program Update

With the assayed holes released today, the Company has completed a total of 82,200 meters at the Kay Mine Project since inception of drilling. The Company is fully-funded to complete the remaining 1,250 meters planned for the Phase 2 program with the priority focus areas for upcoming drilling (shown in Figure 1 above) as well as an additional 76,000 meters currently planned for the upcoming Phase 3 program.

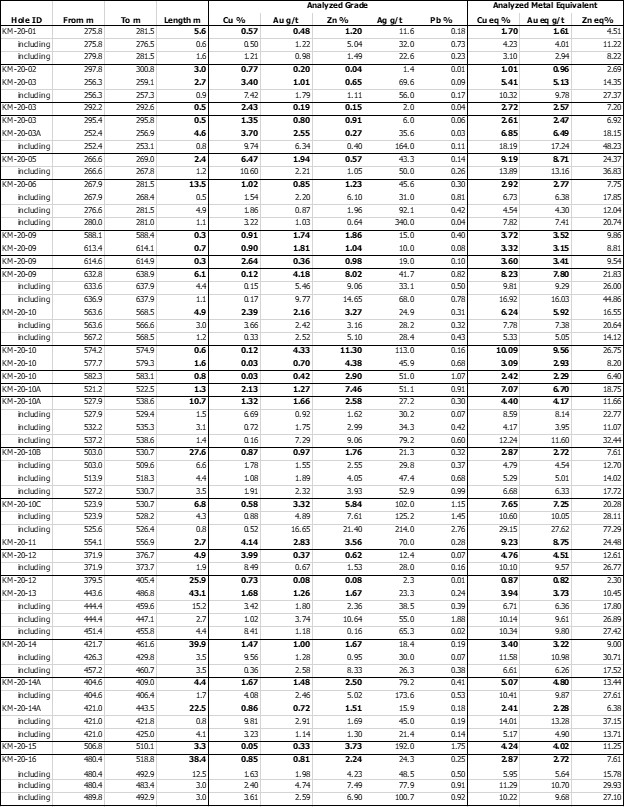

Table 1. Results of Phase 2 Drill Program at the Kay Mine Project, Yavapai County, Arizona announced in this news release.

The true width of mineralization is estimated to be 50% to 99% of reported core width, with an average of 76%. (2) Assumptions used in USD for the copper and gold metal equivalent calculations were metal prices of $4.63/lb Copper, $1937/oz Gold, $25/oz Silver, $1.78/lb Zinc, and $1.02/lb Pb. Assumed metal recoveries (rec.), based on a preliminary review of historic data by SRK and ProcessIQ[1], were 93% for copper, 92% for zinc, 90% for lead, 72% silver, and 70% for gold. The following equation was used to calculate copper equivalence: CuEq = Copper (%) (93% rec.) + (Gold (g/t) x 0.61)(72% rec.) + (Silver (g/t) x 0.0079)(72% rec.) + (Zinc (%) x 0.3844)(93% rec.) +(Lead (%) x 0.2203)(93% rec.). The following equation was used to calculate gold equivalence: AuEq = Gold (g/t)(72% rec.) + (Copper (%) x 1.638)(93% rec.) + (Silver (g/t) x 0.01291)(72% rec.) + (Zinc (%) x 0.6299)(93% rec.) +(Lead (%) x 0.3609)(93% rec.). Analyzed metal equivalent calculations are reported for illustrative purposes only. The metal chosen for reporting on an equivalent basis is the one that contributes the most dollar value after accounting for assumed recoveries.

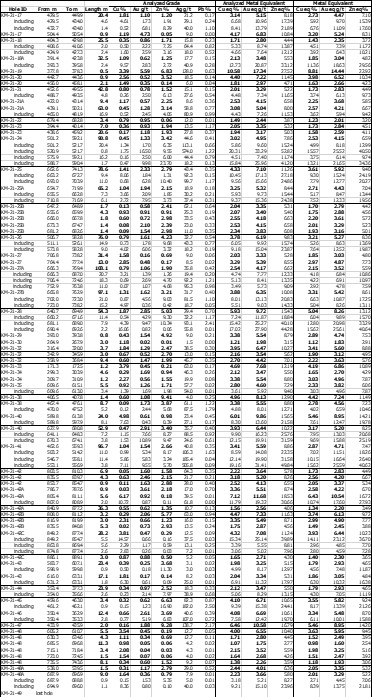

Table 2. Full results of Phase 2 Drill Program at the Kay Mine Deposit, Yavapai County, Arizona.

The true width of mineralization is estimated to be 50% to 99% of reported core width, with an average of 76%. (2) Assumptions used in USD for the copper and gold metal equivalent calculations were metal prices of $4.63/lb Copper, $1937/oz Gold, $25/oz Silver, $1.78/lb Zinc, and $1.02/lb Pb. Assumed metal recoveries (rec.), based on a preliminary review of historic data by SRK and ProcessIQ[2], were 93% for copper, 92% for zinc, 90% for lead, 72% silver, and 70% for gold. The following equation was used to calculate copper equivalence: CuEq = Copper (%) (93% rec.) + (Gold (g/t) x 0.61)(72% rec.) + (Silver (g/t) x 0.0079)(72% rec.) + (Zinc (%) x 0.3844)(93% rec.) +(Lead (%) x 0.2203)(93% rec.). The following equation was used to calculate gold equivalence: AuEq = Gold (g/t)(72% rec.) + (Copper (%) x 1.638)(93% rec.) + (Silver (g/t) x 0.01291)(72% rec.) + (Zinc (%) x 0.6299)(93% rec.) +(Lead (%) x 0.3609)(93% rec.). Analyzed metal equivalent calculations are reported for illustrative purposes only. The metal chosen for reporting on an equivalent basis is the one that contributes the most dollar value after accounting for assumed recoveries.

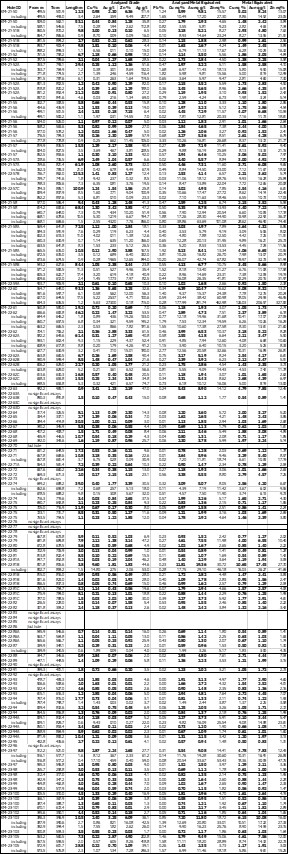

Table 3. Full results to date of Phase 2 Drill Program at the Kay Mine Deposit, Yavapai County, Arizona. See Table 2 for width and metal equivalency notes.

Table 4. Results of Phase 1 Drill Program at the Kay Mine Deposit, Yavapai County, Arizona. The true width of mineralization is estimated to be 50% to 99% of reported core width, with an average of 80%.

Table 5. Western Target surface outcrop sampling results

About Arizona Metals Corp

Arizona Metals Corp owns 100% of the Kay Mine Project in Yavapai County, which is located on a combination of patented and BLM claims totaling 1,300 acres that are not subject to any royalties. An historic estimate by Exxon Minerals in 1982 reported a “proven and probable reserve of 6.4 million short tons at a grade of 2.2% copper, 2.8 g/t gold, 3.03% zinc, and 55 g/t silver.” (Fellows, M.L., 1982, Kay Mine massive sulfide deposit: Internal report prepared for Exxon Minerals Company, November 1982, 29 p.) The historic estimate at the Kay Mine Deposit was reported by Exxon Minerals in 1982. The historic estimate has not been verified as a current mineral resource. None of the key assumptions, parameters, and methods used to prepare the historic estimate were reported, and no resource categories were used. Significant data compilation, re-drilling and data verification may be required by a “qualified person” (as defined in National Instrument 43-101 – Standards of Disclosure for Mineral Projects) before the historic estimate can be verified and upgraded to be a current mineral resource. A qualified person has not done sufficient work to classify it as a current mineral resource, and Arizona Metals is not treating the historic estimate as a current mineral resource.

The Kay Mine Deposit is a steeply dipping VMS deposit that has been defined from a depth of 60 m to at least 900 m. It is open for expansion on strike and at depth.

The Company also owns 100% of the Sugarloaf Peak Property, in La Paz County, which is located on 4,400 acres of BLM claims. Sugarloaf is a heap-leach, open-pit target and has a historic estimate of “100 million tons containing 1.5 million ounces gold” at a grade of 0.5 g/t (Dausinger, 1983, Westworld Resources).

The historic estimate at the Sugarloaf Peak Property was reported by Westworld Resources in 1983. The historic estimate has not been verified as a current mineral resource. None of the key assumptions, parameters, and methods used to prepare the historic estimate were reported, and no resource categories were used. Significant data compilation, re-drilling and data verification may be required by a qualified person before the historic estimate can be verified and upgraded to a current mineral resource. A qualified person has not done sufficient work to classify it as a current mineral resource, and Arizona Metals is not treating the historic estimate as a current mineral resource.

Qualified Person and Quality Assurance/Quality Control

All of Arizona Metals’ drill sample assay results have been independently monitored through a quality assurance/quality control (“QA/QC”) protocol which includes the insertion of blind standard reference materials and blanks at regular intervals. Logging and sampling were completed at Arizona Metals’ core handling facilities located in Phoenix and Black Canyon City, Arizona. Drill core was diamond sawn on site and half drill-core samples were securely transported to ALS Laboratories’ (“ALS”) sample preparation facility in Tucson, Arizona. Sample pulps were sent to ALS’s labs in Vancouver, Canada, for analysis.

Gold content was determined by fire assay of a 30-gram charge with ICP finish (ALS method

Au-AA23). Silver and 32 other elements were analyzed by ICP methods with four-acid digestion (ALS method ME-ICP61a). Over-limit samples for Au, Ag, Cu, and Zn were determined by ore-grade analyses Au-GRA21, Ag-OG62, Cu-OG62, and Zn-OG62, respectively.

ALS Laboratories is independent of Arizona Metals Corp. and its Vancouver facility is ISO 17025 accredited. ALS also performed its own internal QA/QC procedures to assure the accuracy and integrity of results. Parameters for ALS’ internal and Arizona Metals’ external blind quality control samples were acceptable for the samples analyzed. Arizona Metals is not aware of any drilling, sampling, recovery, or other factors that could materially affect the accuracy or reliability of the data referred to herein.

The qualified person who reviewed and approved the technical disclosure in this release is David Smith, CPG, a qualified person as defined in National Instrument43-101–Standards of Disclosure for Mineral Projects. Mr. Smith supervised the preparation of the scientific and technical information that forms the basis for this news release and has reviewed and approved the disclosure herein. Mr. Smith is the Vice-President, Exploration of the Company. Mr. Smith supervised the drill program and verified the data disclosed, including sampling, analytical and QA/QC data, underlying the technical information in this news release, including reviewing the reports of ALS, methodologies, results, and all procedures undertaken for quality assurance and quality control in a manner consistent with industry practice, and all matters were consistent and accurate according to his professional judgement. There were no limitations on the verification process.

For further information, please contact:

Morgan Knowles

Vice President of Investor Relations

(647) 202-3904

mknowles@arizonametalscorp.com

or

Marc Pais

President and CEO Arizona Metals Corp.

(416) 565-7689

mpais@arizonametalscorp.com

https://twitter.com/ArizonaCorp

Disclaimer

This press release contains statements that constitute “forward-looking information” (collectively, “forward-looking statements”) within the meaning of the applicable Canadian securities legislation, All statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as at the date of this news release. Any statement that discusses predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as “expects”, or “does not expect”, “is expected”, “anticipates” or “does not anticipate”, “plans”, “budget”, “scheduled”, “forecasts”, “estimates”, “believes” or “intends” or variations of such words and phrases or stating that certain actions, events or results “may” or “could”, “would”, “might” or “will” be taken to occur or be achieved) are not statements of historical fact and may be forward-looking statements. Forward-looking statements contained in this press release include, without limitation, statements regarding drill results and future drilling and assays, completion of the Phase 2 drill program, commencement and anticipated costs of the Phase 3 drill program, and the potential existence and size of VMS deposits at the Kay Mine Project. In making the forward- looking statements contained in this press release, the Company has made certain assumptions. Although the Company believes that the expectations reflected in forward-looking statements are reasonable, it can give no assurance that the expectations of any forward-looking statements will prove to be correct. Known and unknown risks, uncertainties, and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. Such factors include, but are not limited to: availability of financing; delay or failure to receive required permits or regulatory approvals; and general business, economic, competitive, political and social uncertainties. Accordingly, readers should not place undue reliance on the forward-looking statements and information contained in this press release. Except as required by law, the Company disclaims any intention and assumes no obligation to update or revise any forward-looking statements to reflect actual results, whether as a result of new information, future events, changes in assumptions, changes in factors affecting such forward- looking statements or otherwise.

NEITHER THE TSX VENTURE EXCHANGE (NOR ITS REGULATORY SERVICE PROVIDER) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE

Not for distribution to US newswire services or for release, publication, distribution or dissemination directly, or indirectly, in whole or in part, in or into the United States

[1] SRK Consulting (Canada) Inc., March 2022, Updated Metallurgical Review, Kay Mine, Arizona. Report 3CA061.004

[2] SRK Consulting (Canada) Inc., March 2022, Updated Metallurgical Review, Kay Mine, Arizona. Report 3CA061.004