Avino Adds Significant Mineral Resources to Total 368 Million Silver Equivalent Ounces across All Properties

Avino Silver & Gold Mines Ltd. (ASM: TSX/NYSE American, GV6: FSE, “) has completed an updated mineral resource estimate (“MRE”) that includes the Elena Tolosa (“ET”) deposit, the San Gonzalo deposit, and the Oxide Tailings deposit. Inaugural MREs have also been included on the Guadalupe and La Potosina deposits.

Avino Property Highlights (Comparisons are to 2020 Mineral Resource Estimate on the Avino Property)

- 161 million measured and indicated silver equivalent ounces, an increase of 38%, made up of:

- 70 million silver ounces, an increase of 35%

- 136.7 thousand copper tonnes, an increase of 18%

- 596 thousand gold ounces, an increase of 23%, contained in:

- 34.7 million measured and indicated metric tonnes, increase of 28% overall, also

- 70 million inferred silver equivalent ounces, an increase of 90%

Oxide Tailings Highlights (Comparisons are to 2020 Mineral Resource Estimate on the Avino Property)

- 5.7 million tonnes of measured and indicated mineral resources, an increase of 407%

- 17.4 million measured and indicated silver equivalent ounces, an increase of 287%

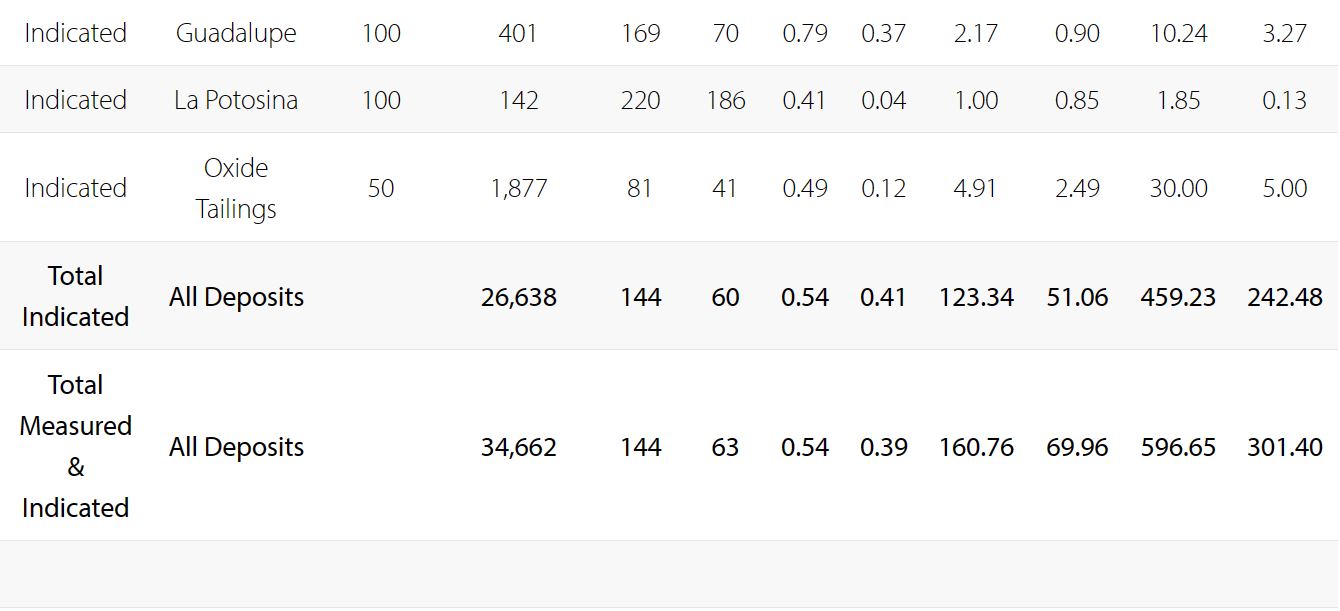

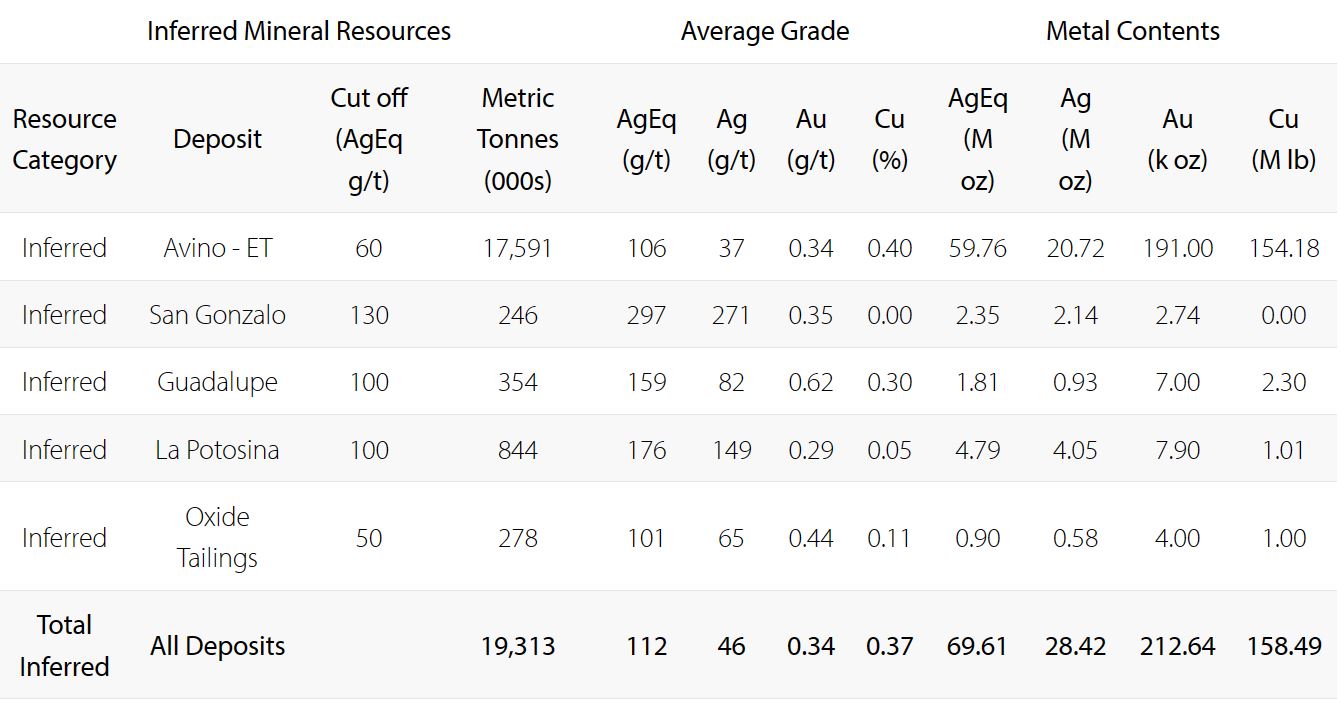

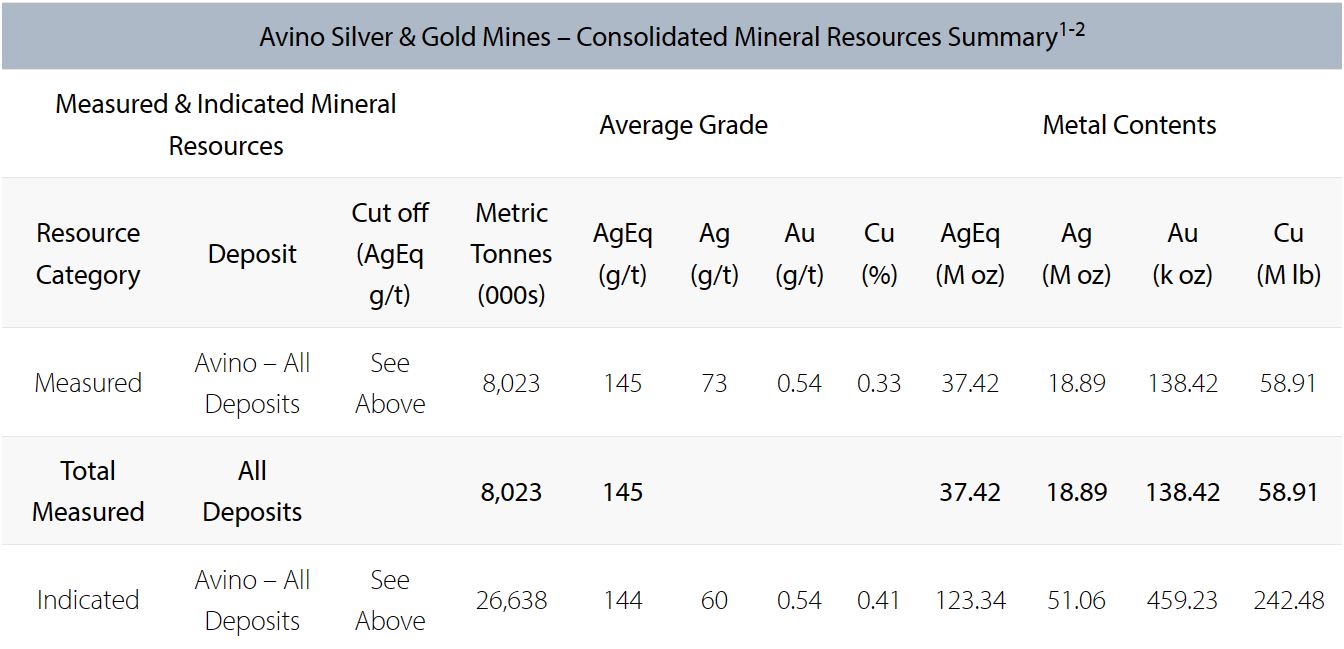

- Figures may not add to totals shown due to rounding. All ounces are troy ounces.

- Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

- The Mineral Resource estimate is classified in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum’s (CIM) Definition Standards for Mineral Resources and Mineral Reserves incorporated by reference into National Instrument 43-101 (NI 43-101) Standards of Disclosure for Mineral Projects.

- Based on recent mining costs Mineral Resources are reported at AgEq cut-off grades of 60 g/t, 130 g/t, and 50 g/t for ET, San Gonzalo, and Oxide Tailings, respectively. The cut-off grades for Guadalupe and La Potosina are 100 g/t.

- AgEQ or silver equivalent ounces are notional, based on the combined value of metals expressed as silver ounces.

- The silver equivalent was back-calculated using the following formulas:

- ET, Guadalupe, La Potosina: AgEq (g/t) = Ag (g/t) + (71.43 x Au (g/t) + (113.04 x Cu (%))

- San Gonzalo: AgEq (g/t) = Ag (g/t) + (75.39 x Au (g/t))

- Oxide Tailings: AgEq (g/t) = Ag (g/t) + (81.53 x Au (g/t))

- Cut-off grades were calculated using the following consensus metal price assumptions: gold price of US$1,800/oz, silver price of US$21.00/oz, and copper price of US$3.50/lb.

- Metal recovery is based on operational results and column testing.

Avino President and CEO, David Wolfin commented: “We are thrilled to deliver this updated mineral resource representing another milestone for Avino on our path to transformational growth. This update is a significant boost to our overall consolidated mineral resources at the Avino property, with the new ounces coming in at a cost of $0.05 per discovered silver equivalent ounce – an incredible achievement. The updated mineral resource estimate provides us with a strong long-term outlook. We have increased the grade at ET, added significant silver and gold resources to both the measured and indicated category for the oxide tailings deposit, and put out an inaugural resource for the exciting recently explored areas. Together with the previously reported mineral resources on our new La Preciosa property, the consolidated mineral resources total 368 million silver equivalent ounces in the measured, indicated, and inferred categories. The Avino property is a long-life asset. Finally, I would like to express my appreciation to the entire Avino team for their contributions in this achievement of resource increase. The 2023 exploration program is underway with 8,000 metres of drilling planned.”

The total measured and indicated mineral resource tonnage in all deposits totals 34.6 million metric tonnes containing 160.8 million ounces of silver equivalent, comprised of 69.96 million ounces of silver, 596,650 ounces of gold, and 301.4 million pounds of copper.

The total inferred mineral resource tonnage in all deposits totals 19.3 million metric tonnes, consisting of 69.61 million ounces of silver equivalent comprised of 28.42 million ounces of silver, 212,640 ounces of gold, and 158.49 million pounds of copper.

Avino – ET

The ET deposit has been sampled in underground development below elevations of 360 metres to 470 metres below surface, and it has been discovered to be consistently mineralized between the hanging wall and footwall veins over a thickness of up to 45 metres. This broad zone has been proven by underground development and channel sampling down to an elevation of 1,849 metres above sea level and remains open below. The Mineral Resource at the ET deposit has been updated based on 3D models of underground development and stoping excavations less all production since the last resource update.

Our strategy of phased exploration drilling to deeper levels, followed by ramping and development continues to be cost effective and mitigates risk as the ET deposit is developed to deeper levels. Remarkably, the ET deposit continues to reveal mineralized extensions nearly five hundred years since the beginning of mining.

Oxide Tailings

The Oxide Tailings resource has been updated with the additional 127 drill holes drilled in 2022 which has added significant confidence in the block model and significantly increased mineral resources in all categories. Sonic drilling proved to be a very efficient tactic in confirming the tailings deposit. The Oxide Tailings deposit provides significant potential for future production, with detailed metallurgical test work already completed and an upcoming prefeasibility study to be started within 2023.

Guadalupe and La Potosina Deposits

These vein deposits are being included in the resource statement for the first time. The Guadalupe deposit is less than one kilometer from the Avino processing plant.

Method of Calculation

The definitive estimation methods used were substantially the same for all three deposits (Ordinary Kriging), providing a consistent baseline for strategic planning.

Mineral resources were estimated by ordinary kriging, optimized using kriging neighbourhood analysis and verified by means of nearest neighbour and inverse distance methods, swathplot comparisons of estimates and visual inspections. Block models were created for the San Gonzalo, and Avino Vein Systems ET, Guadalupe, La Potosina and the Oxide Tailings deposit, and estimates were made using industry standard techniques.

Fundamental changes since the previous mineral resource estimates in 2020 are (1) depletion due to mining (over 550 thousand tonnes milled), (2) new sampling and drilling information and (3) changes to the interpretation of the brecias and vein models at ET.

More sampling information does not always lead to direct increases in resource tonnages and contained metal. In some cases, the new information provides improved understanding (developed by variogram modelling and kriging neighborhood analysis) that may demote some portions of mineral resource from high confidence measured and indicated categories, to a lower confidence inferred category.

For the San Gonzalo and Avino Vein Systems, estimated blocks with average distances more than 80 metres from samples have been classified as inferred resources. For the San Gonzalo Deposit, estimated blocks with average distances more than 30 metres from samples have been classified as inferred resources.

For the Oxide Tailings, estimated blocks more than 60 metres from samples are not included in the indicated category resources.

For La Potosina and Guadalupe, estimated blocks more than 30 metres from samples are not included in the indicated category resources.

The mineral resources estimate is being included in an updated technical report prepared by Tetra Tech Inc. under National Instrument 43-101 (“NI-43-101”), which will be available on SEDAR (www.sedar.com) under the Company’s profile and filed on Form 6-K with the SEC within 45 days.

Consolidated Mineral Resources

- See Table 1 for Avino Mine Property details and footnotes, including individual deposit cutoff grades.

- La Preciosa Mineral Resource Estimate is effective dated October 27, 2021 – see Avino news release dated December 21, 2021, for assumptions and full details on AgEq calculations.

Qualified Person(s)

The Qualified Persons as defined by NI 43-101, who are responsible for the technical content of this news release are Michael O’Brien P.Geo., Senior Principal Consultant, Red Pennant Geoscience, and under the supervision of Peter Latta, P.Eng, Avino’s VP, Technical Services, both of whom are qualified persons within the context of NI 43-101.

About Avino

Avino is a silver producer from its wholly owned Avino Mine near Durango, Mexico. The Company’s silver, gold and copper production remains unhedged. The Company’s mission and strategy is to create shareholder value through its focus on profitable organic growth at the historic Avino Property and the strategic acquisition of the La Preciosa property. Avino currently controls mineral resources, as per NI 43-101, that total 368 million silver equivalent ounces, within our district-scale land package. We are committed to managing all business activities in a safe, environmentally responsible, and cost-effective manner, while contributing to the well-being of the communities in which we operate. We encourage you to connect with us on Twitter at @Avino_ASM and on LinkedIn at Avino Silver & Gold Mines. To view the Avino Mine VRIFY tour, please click here.

On Behalf of the Board

“David Wolfin”

________________________________

David Wolfin

President & CEO

Avino Silver & Gold Mines Ltd.

This news release contains “forward-looking information” and “forward-looking statements” (together, the “forward looking statements”) within the meaning of applicable securities laws and the United States Private Securities Litigation Reform Act of 1995, including the amended mineral resource estimate for the Company’s Avino Property located near Durango in west-central Mexico (the “Avino Property”) with an effective date of November 30, 2022, and the Company’s updated mineral resource estimate for La Preciosa with an effective date of October 27, 2021, prepared for the Company, and references to Measured, Indicated, Inferred Resources referred to in this press release. These forward-looking statements are made as of the date of this news release and the dates of technical reports, as applicable. Readers are cautioned not to place undue reliance on forward-looking statements, as there can be no assurance that the future circumstances, outcomes or results anticipated in or implied by such forward-looking statements will occur or that plans, intentions or expectations upon which the forward-looking statements are based will occur. While we have based these forward-looking statements on our expectations about future events as at the date that such statements were prepared, the statements are not a guarantee that such future events will occur and are subject to risks, uncertainties, assumptions and other factors which could cause events or outcomes to differ materially from those expressed or implied by such forward-looking statements. No assurance can be given that the Company’s Avino Property nor the La Preciosa Property have the amount of the mineral resources indicated in their reports or that such mineral resources may be economically extracted. Such factors and assumptions include, among others, the effects of general economic conditions, the price of gold, silver and copper, changing foreign exchange rates and actions by government authorities, uncertainties associated with legal proceedings and negotiations and misjudgments in the course of preparing forward-looking information. In addition, there are known and unknown risk factors which could cause our actual results, performance or achievements to differ materially from any future results, performance or achievements expressed or implied by the forward-looking statements. Known risk factors include risks associated with project development; the need for additional financing; operational risks associated with mining and mineral processing; the COVID-19 pandemic; volatility in the global financial markets; fluctuations in metal prices; title matters; uncertainties and risks related to carrying on business in foreign countries; environmental liability claims and insurance; reliance on key personnel; the potential for conflicts of interest among certain of our officers, directors or promoters with certain other projects; the absence of dividends; currency fluctuations; competition; dilution; the volatility of the our common share price and volume; tax consequences to U.S. investors; and other risks and uncertainties. Although we have attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. We are under no obligation to update or alter any forward-looking statements except as required under applicable securities laws. For more detailed information regarding the Company including its risk factors, investors are directed to the Company’s Annual Report on Form 20-F and other periodic reports that it files with the U.S. Securities and Exchange Commission.

References to Measured & Indicated Mineral Resources and Inferred Mineral Resources in this press release are terms that are defined under Canadian rules by National Instrument 43-101 (“NI 43-101”). On October 31, 2018, the US Securities and Exchange Commission adopted Item 1300 of Regulation S-K (“Regulation SK-1300”) to modernize the property disclosure requirements for mining registrants, and related guidance, under the Securities Act of 1933 and the Securities Exchange Act of 1934. All registrants are required to comply with Regulation SK-1300 for fiscal years ending after January 1, 2021. Regulation SK-1300 uses the Committee for Mineral Reserves International Reporting Standards (“CRIRSCO”) based classification scheme for mineral resources and mineral reserves, that includes definitions for inferred, indicated, and measured mineral resources. U.S. Investors are cautioned not to assume that any part of the mineral resources in these categories will ever be converted into probable or proven mineral reserves within the meaning of Regulation S-K 1300.