Can We Meet the Critical Minerals Demand?

By Danae Voormeij, MSc, PGeo

Critical minerals (CMs) are essential for our electric and digital future. There are currently 31 CMs, with six considered the most important: Cu, Co, Mn, Li, Ni and Rare Earth Elements.

What makes these minerals critical?

CMs have no substitutes and face potential disruption in supply. In efforts to reduce the level of greenhouse gases in the atmosphere, governments worldwide are securing large supplies of CMs to build electric vehicles, electronics, solar panels and wind farms towards a green future.

The price of copper is rising; it has increased 25% since the beginning of 2024 and the price already has touched $5 per pound. Electricity flows through copper because it is highly conductive and thus copper is a key player in electrification.

Besides copper, electric vehicles (EVs) require large (more than 1,000 pounds) batteries that are made up of lithium, cobalt, manganese, nickel and steel.

Manganese is used in steelmaking, as an alloy that converts iron into steel. Manganese resources in seabed deposits of ferromanganese nodules and crusts are larger than those on land. The USGS states that current global reserves of land-based manganese deposits are adequate to meet global demand for several decades, so before we start mining the seafloor, there are plenty of opportunities to discover land-based Mn deposits to meet our demand.

Tellurium and silver are integral to solar panel manufacturing. Wind turbines need manganese, platinum, and rare earth magnets like Indium. Rare-earth elements (REE) are necessary components of high-tech consumer products, such as cellular telephones, computer hard drives and flat-screen monitors and televisions. REEs also have significant defense applications, including missile guidance systems, lasers, and radar and sonar systems. (USGS)

What is our government doing to help meet CM demand?

The Canadian government has created teams dedicated to finding ways to improve upon the processes that approve a mine to operate and speed up the permitting process.

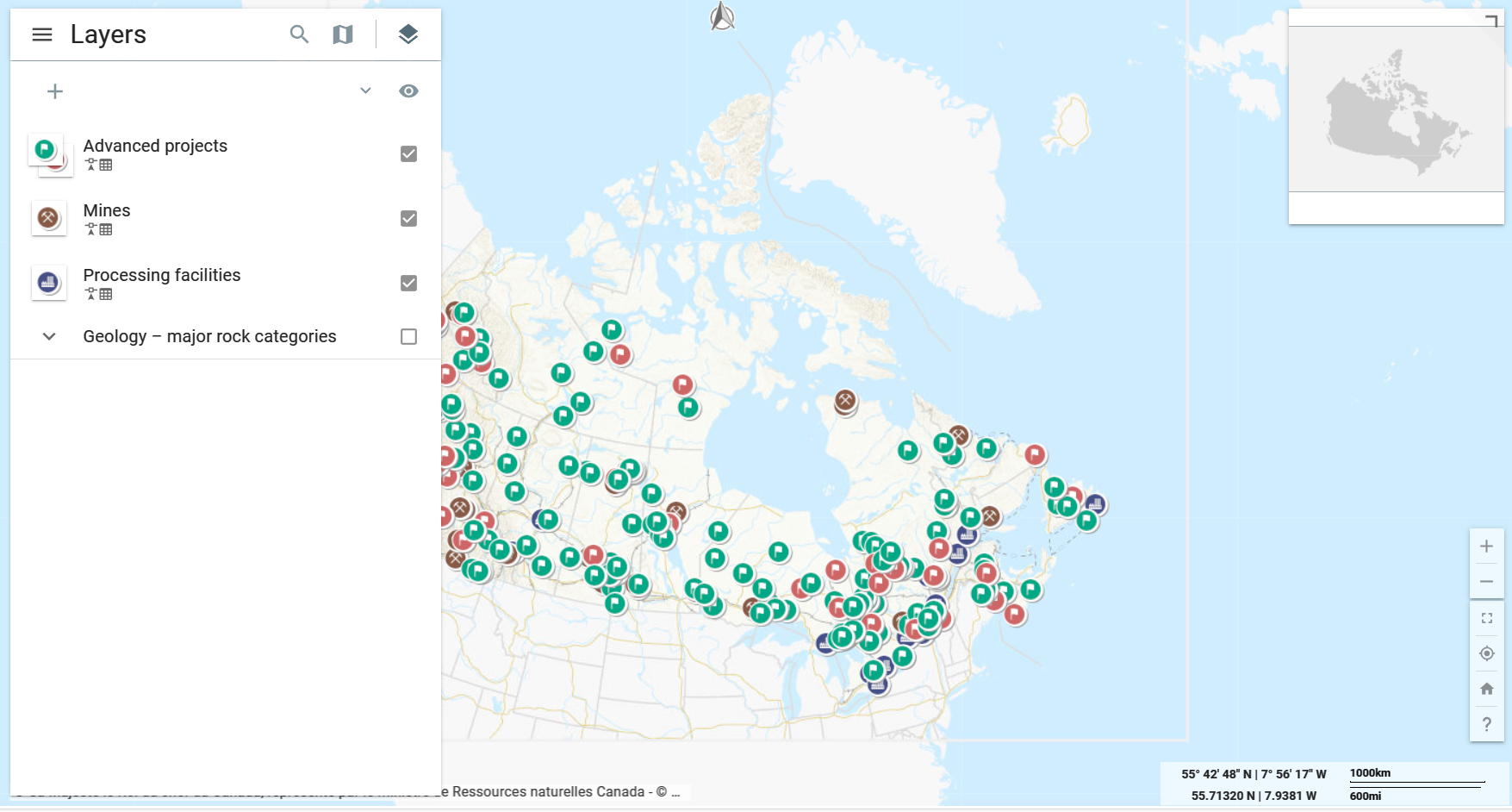

There is an online map showing CM mines and advanced projects across Canada. It shows most of Canada’s CM projects are still in development stage. Refer to https://atlas.gc.ca/critical-minerals/en/

Government funded and industry sponsored NRCan’s Critical Minerals Centre of Excellence leads the development and coordination of Canada’s policies and programs on CMs, in collaboration with industry, provincial, territorial, Indigenous, non-governmental and international partners. Backed by a $4Bn budget in 2022, it is supposed to set a course for Canada to become a global supplier for CMs.

In BC, a CM advisory committee has been established. According to the BCGS, British Columbia has made significant progress in the last few years on exploration-permitting timelines, including a reduction in the backlog of permits.

To increase investment attraction and promote BC businesses, the new Energy and Mines Digital Trust project (EMDT) has been set up to provide a transparent platform for companies to manage credentials for ESG strengths. This allows companies to demonstrate to investors that their products meet the highest global standards throughout the CM supply chain. If widely adopted, this technology has the potential to improve regulatory efficiency and transparency, leading to new market opportunities for BC’s natural-resource industry.

In many parts of our resource-rich country, there are still mineral deposits waiting to be developed, if only the infrastructure was there! There are numerous gold and copper-rich greenstone belts in NWT, Canada, for example. It is too expensive to conduct exploration when the project is located too far from an airport to get helicopter or float plane support.

Perhaps NRCan’s Critical Minerals Centre of Excellence could define mineral-rich zones in remote regions, in collaboration with local First Nations, as high priority areas, for new roads and power lines. Building infrastructure and creating new CM frontiers would significantly increase the chances of discovering multiple CM projects and turning them into producing mines.

What can geologists and mineral exploration companies do to help meet the CM demand?

It takes between 7 and 15 years to go from prospect to an operating mine. If it proves to be economic, can we speed that up?

Faster turnaround times are needed in geochemistry work. Soil, rock, and drill core samples are shipped from field project sites to the lab for analysis. These assay results drive decisions in moving forward, which is the nature of mineral exploration. Each sample batch takes anywhere from 3 weeks to 3 months before sample prep and analysis is complete.

In Canada, the field season is short and improving detection limits on handheld field analyzers would add speed and efficiency to exploration programs. Drilling could be in real time if elemental field analyzers could be used in mineral resource estimations. Laboratories would remain useful for select samples as part of external QAQC, Round Robin programs.

Core logging is a slow process, and each geologist sees something different. Drill core logging and sampling needs to be automated and consistent, so that the data can be directly imported into advanced 3D modelling software.

New advances in core logging include CoreScan and geoLOGr, which scan the outside of the drillcore with high-resolution photography and hyperspectral analysis. HyperSpectral analysis of drill core sees so much more than the human eye; and is capable of identifying individual mineral grains.

Embracing AI applications in mineral exploration will help geologists deal with the massive amounts of imagery, structural, mineral, chemical and geophysical data coming out of these core scans and use it to advance the project rapidly.