Clean Air Metals Announces a Mineral Resource for the Thunder Bay North Project including a total Indicated Resource of 16,285,396 tonnes at an average grade of 3.5 g/t PdEq containing 1,834,158 ounces PdEq

And a total Inferred Resource of 9,852,138 tonnes at an average grade of 2.1 g/t PdEq containing 663,660 ounces PdEq

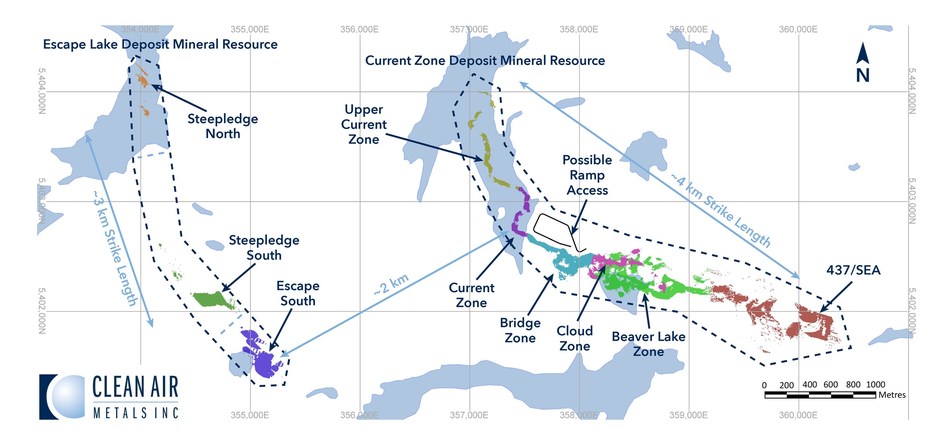

Clean Air Metals Inc. (“Clean Air Metals” or the “Company“) (TSXV: AIR; OTCQB: CLRMF; FRA: CKU) is pleased to announce that the Company has released an updated Indicated and Inferred mineral resource estimate prepared in accordance with National Instrument 43-101 (“NI 43-101″) for the Company’s 100%-owned Thunder Bay North Project (the “Project“) which includes both the Current Lake and Escape Lake deposits.

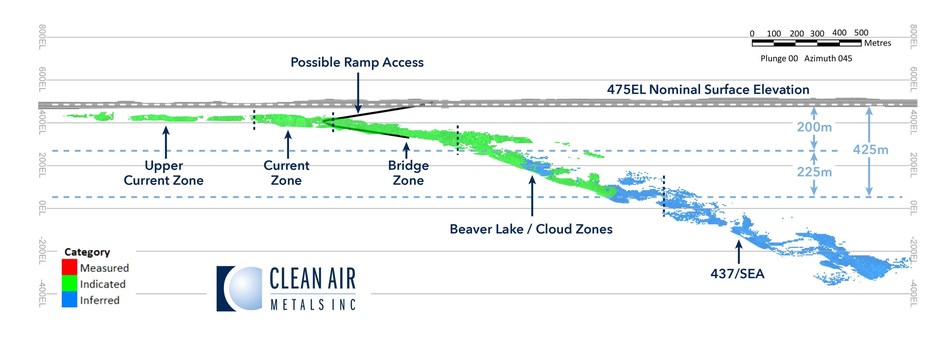

The mineral resource estimate was prepared by Nordmin Engineering Ltd. (“Nordmin“) and is based on an underground ramp-access constrained resource model with a cutoff value equating to 1.56 g/tonne PdEq (2.56 g/tonne PtEq) using 3-year trailing average metal prices for all metals except cobalt, which used a 2-year trailing average as described below in Table 8. A technical report will be filed on SEDAR within 45 days of the date of this news release.

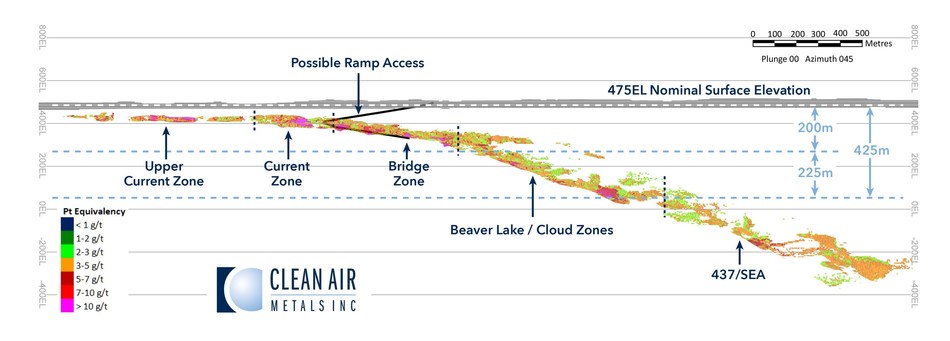

The Current Lake Deposit contains an Indicated mineral resource of 11,999,177 tonnes grading 3.44 g/t PdEq and an Inferred mineral resource of 6,406,960 tonnes grading 2.02 g/tonne PdEq (See Table 1; Figure 2)

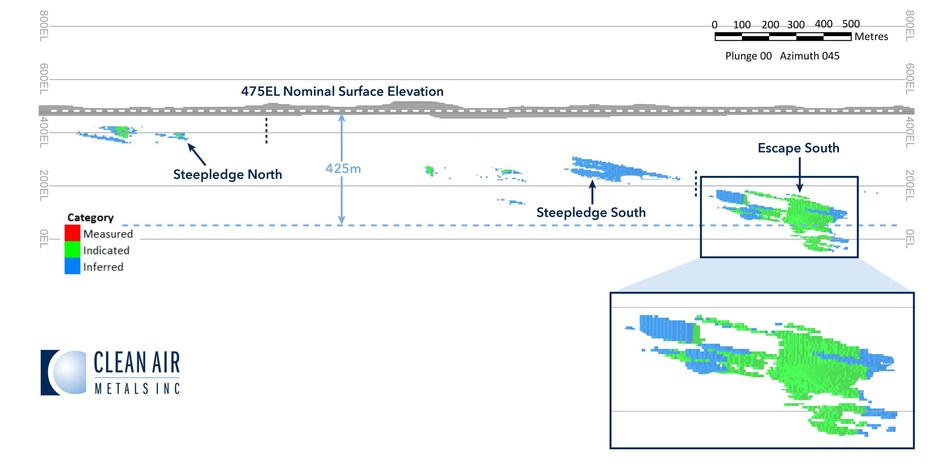

The Escape Lake Deposit contains an Indicated mineral resource of 4,286,220 tonnes grading 3.67 g/t PdEq and an Inferred mineral resource of 3,445,179 tonnes grading 2.23 g/tonne PdEq (See Table 2; Figure 3).

Highlights

- Indicated mineral resources at Thunder Bay North Project are approximately 1.33 million oz PdEq in the Current Lake Deposit and 0.50 million oz PdEq in the Escape Lake Deposit.

- Inferred mineral resources at Thunder Bay North Project are approximately 0.41 million oz PdEq in the Current Lake Deposit and 0.25 million oz PdEq in the Escape Lake Deposit.

- The underground resource at the Current Lake Deposit will now be the focus of a Preliminary Economic Assessment which will include specific work on geotechnical analysis and bench scale testing on a drilled bulk sample of mineralized material to verify metallurgical recoveries.

- The Indicated mineral resource is developed in multiple zones which exhibit a variable grade profile with highest grades occurring at relatively shallow depths, including the lower Current Zone and Bridge Zone in the Current Lake Deposit. (See Table 3; Figure1).

- The initial mineral resource at Escape Lake is geologically open and will be the target of an extensive systematic drilling program planned for 2021.

- Current Lake and Escape Lake are polymetallic deposits with a roughly 1:1 platinum to palladium ratio and comparable geological attributes and metal grades.

- Nickel and Copper contribute significant metal values and will be tested for metallurgical flotation and recovery potential.

- Gold, Silver, Cobalt and Rhodium are potentially valuable byproducts in the metal mix at Thunder Bay North Project.

Table 1: Thunder Bay North Project – Grade Summary

|

Grade |

|||||||||||||

|

Category |

Tonnes |

Pt (g/t) |

Pd |

Au |

Ag |

Rh |

Co |

Cu (%) |

Ni (%) |

PtEq |

PdEq |

||

|

Indicated – Current Lake |

11,999,177 |

1.48 |

1.40 |

0.07 |

1.32 |

0.04 |

137 |

0.28 |

0.17 |

5.79 |

3.44 |

||

|

Indicated – Escape Lake |

4,286,220 |

0.92 |

1.18 |

0.12 |

2.45 |

0.06 |

209 |

0.52 |

0.28 |

6.16 |

3.67 |

||

|

TOTAL INDICATED RESOURCE |

16,285,396 |

1.33 |

1.34 |

0.08 |

1.62 |

0.05 |

156 |

0.34 |

0.20 |

5.89 |

3.50 |

||

|

Inferred – Current Lake |

6,406,960 |

0.68 |

0.65 |

0.06 |

0.95 |

0.01 |

123 |

0.30 |

0.14 |

3.40 |

2.02 |

||

|

Inferred – Escape Lake |

3,445,179 |

0.64 |

0.73 |

0.07 |

1.13 |

0.00 |

173 |

0.33 |

0.18 |

3.75 |

2.23 |

||

|

TOTAL INFERRED RESOURCE |

9,852,138 |

0.67 |

0.68 |

0.07 |

1.01 |

0.01 |

140 |

0.31 |

0.15 |

3.52 |

2.10 |

||

|

Notes: See section “Input Parameters for Resource Calculation” below. Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. |

Table 2: Thunder Bay North Project – Contained Metal

|

Metal |

|||||||||||

|

Category |

Tonnes |

Pt (Oz) |

Pd (Oz) |

Au |

Ag (Oz) |

Rh (Oz) |

Co |

Cu |

Ni |

PtEq |

PdEq |

|

Indicated – Current Lake |

11,999,177 |

569,176 |

538,181 |

26,121 |

508,434 |

16,998 |

1,649 |

33,751 |

20,969 |

2,233,575 |

1,328,789 |

|

Indicated – Escape Lake |

4,286,220 |

127,090 |

162,337 |

16,928 |

337,946 |

8,009 |

896 |

22,390 |

12,016 |

849,481 |

505,369 |

|

TOTAL INDICATED RESOURCE |

16,285,396 |

696,266 |

700,517 |

43,050 |

846,380 |

25,008 |

2,544 |

56,141 |

32,985 |

3,083,056 |

1,834,158 |

|

Inferred – Current Lake |

6,406,960 |

140,400 |

133,333 |

12,888 |

195,484 |

1,836 |

785 |

19,155 |

9,113 |

700,621 |

416,810 |

|

Inferred – Escape Lake |

3,445,179 |

70,520 |

80,989 |

7,754 |

124,809 |

71 |

595 |

11,293 |

6,046 |

414,932 |

246,850 |

|

TOTAL INFERRED RESOURCE |

9,852,138 |

210,919 |

214,322 |

20,642 |

320,293 |

1,907 |

1,380 |

30,449 |

15,159 |

1,115,553 |

663,660 |

|

Notes: See section “Input Parameters for Resource Calculation” below. Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. |

Webinar

Clean Air Metals will be conducting a webinar to discuss the resource update with Amvest Capital on January 26th at 4:05pm EST. Please see the link below:

Link:Â https://attendee.gotowebinar.com/register/3724157345636755725?source=co

Executive Comments

Abraham Drost, P.Geo., CEO of Clean Air Metals stated, “We are very pleased for our shareholders and participating First Nations with this milestone mineral resource study. An underground ramp-access mine planning approach by Nordmin Engineering has been the key to unlock value at the Thunder Bay North Project. We look forward to a busy year ahead as we continue drilling with two drills in an effort to increase and upgrade mineral resources at the Escape Lake. We also plan on adding a drill at the Current Lake Deposit focused on upgrading Inferred material to Indicated and testing nearby greenfields exploration targets with massive sulphide potential.”

Jim Gallagher, P.Eng., Executive Chairman of Clean Air Metals stated, “The broad suite of metals contained in the Thunder Bay North deposits is quite unique and positions the Company well for participation in the transition to a low carbon transportation future. Tougher emissions standards worldwide have significantly increased loadings of Palladium and Rhodium in auto catalysts pushing prices to near record levels. Platinum prices have risen sharply in the last several months as hydrogen and fuel cells become a viable alternative especially in the trucking and long-distance transportation sectors. Nickel, Copper and Cobalt are key to the battery electric revolution and Gold and Silver provide a potential sweetener to a future revenue stream. Subject to future feasibility studies around economic viability, this could give Clean Air Metals a natural hedge against fluctuating metal prices regardless of which technology becomes dominant.”

Table 3: Current Lake Deposit – Grade Summary

|

Grade |

||||||||||||

|

Category |

Area |

Tonnes |

Pt |

Pd |

Au |

Ag |

Rh |

Co |

Cu |

Ni |

PtEq |

PdEq |

|

Indicated – Current Lake |

Upper Current |

1,089,212 |

1.60 |

1.50 |

0.08 |

1.72 |

0.07 |

148 |

0.35 |

0.20 |

6.50 |

3.87 |

|

Current |

1,534,911 |

2.10 |

1.96 |

0.11 |

2.25 |

0.05 |

142 |

0.41 |

0.21 |

7.97 |

4.74 |

|

|

Bridge |

3,355,050 |

1.72 |

1.67 |

0.08 |

1.49 |

0.05 |

130 |

0.35 |

0.17 |

6.67 |

3.97 |

|

|

Beaver |

4,481,507 |

1.23 |

1.14 |

0.05 |

1.00 |

0.03 |

139 |

0.20 |

0.16 |

4.82 |

2.87 |

|

|

Cloud |

1,538,497 |

0.93 |

0.89 |

0.04 |

0.66 |

0.04 |

136 |

0.17 |

0.16 |

4.00 |

2.38 |

|

|

437-SE |

0 |

– |

– |

– |

– |

– |

– |

– |

– |

– |

– |

|

|

TOTAL INDICATED RESOURCE |

11,999,177 |

1.48 |

1.40 |

0.07 |

1.32 |

0.04 |

137 |

0.28 |

0.17 |

5.79 |

3.44 |

|

|

Inferred – Current Lake |

Upper Current |

0 |

– |

– |

– |

– |

– |

– |

– |

– |

– |

– |

|

Current |

0 |

– |

– |

– |

– |

– |

– |

– |

– |

– |

– |

|

|

Bridge |

0 |

– |

– |

– |

– |

– |

– |

– |

– |

– |

– |

|

|

Beaver |

1,735,331 |

0.80 |

0.75 |

0.05 |

0.79 |

0.02 |

146 |

0.20 |

0.18 |

3.72 |

2.21 |

|

|

Cloud |

0 |

– |

– |

– |

– |

– |

– |

– |

– |

– |

– |

|

|

437-SE |

4,671,629 |

0.64 |

0.61 |

0.07 |

1.01 |

0.01 |

114 |

0.34 |

0.13 |

3.28 |

1.95 |

|

|

TOTAL INFERRED RESOURCE |

6,406,960 |

0.68 |

0.65 |

0.06 |

0.95 |

0.01 |

123 |

0.30 |

0.14 |

3.40 |

2.02 |

|

|

Notes: See section “Input Parameters for Resource Calculation” below. |

Table 4: Current Lake Deposit – Contained Metal

|

Metal |

||||||||||||

|

Category |

Area |

Tonnes |

Pt |

Pd |

Au |

Ag |

Rh |

Co |

Cu |

Ni |

PtEq |

PdEq |

|

Indicated – Current Lake |

Upper Current |

1,089,212 |

56,185 |

52,487 |

2,692 |

60,154 |

2,342 |

161 |

3,800 |

2,150 |

227,801 |

135,523 |

|

Current |

1,534,911 |

103,563 |

96,875 |

5,220 |

111,114 |

2,677 |

218 |

6,328 |

3,259 |

393,310 |

233,986 |

|

|

Bridge |

3,355,050 |

185,255 |

179,929 |

8,702 |

160,257 |

5,079 |

436 |

11,851 |

5,832 |

720,020 |

428,351 |

|

|

Beaver |

4,481,507 |

177,932 |

164,879 |

7,292 |

144,294 |

4,842 |

625 |

9,168 |

7,343 |

694,657 |

413,262 |

|

|

Cloud |

1,538,497 |

46,241 |

44,010 |

2,216 |

32,615 |

2,058 |

209 |

2,604 |

2,385 |

197,787 |

117,667 |

|

|

437-SE |

0 |

– |

– |

– |

– |

– |

– |

– |

– |

– |

– |

|

|

TOTAL INDICATED RESOURCE |

11,999,177 |

569,176 |

538,181 |

26,121 |

508,434 |

16,998 |

1,649 |

33,751 |

20,969 |

2,233,575 |

1,328,789 |

|

|

Inferred – Current Lake |

Upper Current |

0 |

– |

– |

– |

– |

– |

– |

– |

– |

– |

– |

|

Current |

0 |

– |

– |

– |

– |

– |

– |

– |

– |

– |

– |

|

|

Bridge |

0 |

– |

– |

– |

– |

– |

– |

– |

– |

– |

– |

|

|

Beaver |

1,735,331 |

44,527 |

41,708 |

2,718 |

44,020 |

1,031 |

253 |

3,446 |

3,203 |

207,495 |

123,442 |

|

|

Cloud |

0 |

– |

– |

– |

– |

– |

– |

– |

– |

– |

– |

|

|

437-SE |

4,671,629 |

95,873 |

91,625 |

10,170 |

151,464 |

806 |

533 |

15,709 |

5,910 |

493,125 |

293,368 |

|

|

TOTAL INFERRED RESOURCE |

6,406,960 |

140,400 |

133,333 |

12,888 |

195,484 |

1,836 |

785 |

19,155 |

9,113 |

700,621 |

416,810 |

|

|

Notes: See section “Input Parameters for Resource Calculation” below. |

Table 5: Escape Lake Deposit – Grade Summary

|

Grade |

||||||||||||||

|

Category |

Area |

Tonnes |

Pt |

Pd |

Au |

Ag |

Rh |

Co |

Cu |

Ni |

PtEq |

PdEq |

||

|

Indicated – Escape Lake |

Steepledge North |

135,650 |

0.71 |

0.81 |

0.06 |

1.28 |

0.01 |

157 |

0.28 |

0.18 |

3.87 |

2.30 |

||

|

Steepledge South |

45,180 |

0.87 |

1.02 |

0.05 |

1.14 |

0.00 |

141 |

0.28 |

0.17 |

4.25 |

2.53 |

|||

|

Escape South Perimeter |

1,754,080 |

0.48 |

0.58 |

0.08 |

1.45 |

0.03 |

176 |

0.37 |

0.21 |

3.78 |

2.26 |

|||

|

Escape South High-Grade Zone |

2,351,310 |

1.27 |

1.65 |

0.16 |

3.29 |

0.08 |

238 |

0.66 |

0.34 |

8.11 |

4.82 |

|||

|

TOTAL INDICATED RESOURCE |

4,286,220 |

0.92 |

1.18 |

0.12 |

2.45 |

0.06 |

208.95 |

0.52 |

0.28 |

6.16 |

3.67 |

|||

|

Inferred – Escape Lake |

Steepledge North |

148,609 |

0.44 |

0.52 |

0.05 |

0.53 |

0.00 |

150 |

0.26 |

0.21 |

3.14 |

1.87 |

||

|

Steepledge South |

2,287,589 |

0.74 |

0.84 |

0.07 |

1.15 |

0.00 |

173 |

0.32 |

0.16 |

3.96 |

2.36 |

|||

|

Escape South Perimeter |

915,422 |

0.43 |

0.53 |

0.08 |

1.13 |

0.00 |

173 |

0.35 |

0.19 |

3.35 |

1.99 |

|||

|

Escape South High-Grade Zone |

93,559 |

0.43 |

0.34 |

0.09 |

1.45 |

0.01 |

191 |

0.38 |

0.20 |

3.29 |

1.96 |

|||

|

TOTAL INFERRED RESOURCE |

3,445,179 |

0.64 |

0.73 |

0.07 |

1.13 |

0.00 |

173 |

0.33 |

0.18 |

3.75 |

2.23 |

|||

|

Notes: See section “Input Parameters for Resource Calculation” below. |

Table 6: Escape Lake Deposit – Contained Metal

|

Metal |

||||||||||||

|

Category |

Area |

Tonnes |

Pt |

Pd |

Au |

Ag |

Rh |

Co |

Cu |

Ni |

PtEq |

PdEq |

|

Indicated – Escape Lake |

Steepledge North |

135,650 |

3,087 |

3,545 |

266 |

5,577 |

43 |

21 |

383 |

238 |

16,897 |

10,053 |

|

Steepledge South |

45,180 |

1,258 |

1,485 |

79 |

1,653 |

0 |

6 |

125 |

76 |

6,175 |

3,673 |

|

|

Escape South Perimeter |

1,754,080 |

27,083 |

32,687 |

4,689 |

81,633 |

1,970 |

308 |

6,458 |

3,617 |

213,401 |

127,264 |

|

|

Escape South High-Grade Zone |

2,351,310 |

95,662 |

124,619 |

11,894 |

249,083 |

5,996 |

560 |

15,424 |

8,085 |

613,007 |

364,380 |

|

|

TOTAL INDICATED RESOURCE |

4,286,220 |

127,090 |

162,337 |

16,928 |

337,946 |

8,009 |

896 |

22,390 |

12,016 |

849,481 |

505,369 |

|

|

Inferred – Escape Lake |

Steepledge North |

148,609 |

2,119 |

2,462 |

255 |

2,508 |

0 |

22 |

394 |

309 |

14,985 |

8,915 |

|

Steepledge South |

2,287,589 |

54,498 |

61,920 |

4,869 |

84,680 |

0 |

396 |

7,321 |

3,771 |

291,351 |

173,329 |

|

|

Escape South Perimeter |

915,422 |

12,884 |

15,314 |

2,353 |

33,246 |

42 |

158 |

3,226 |

1,775 |

98,690 |

58,709 |

|

|

Escape South High-Grade Zone |

93,559 |

1,019 |

1,293 |

276 |

4,375 |

29 |

18 |

353 |

190 |

9,905 |

5,896 |

|

|

TOTAL INFERRED RESOURCE |

3,445,179 |

70,520 |

80,989 |

7,754 |

124,809 |

71 |

595 |

11,293 |

6,046 |

414,932 |

246,849 |

|

|

Notes: See section “Input Parameters for Resource Calculation” below. |

2021 Exploration Update

A 2021 drill program on the initial resource at the Escape Lake Deposit will commence immediately with two drills, expanding the Escape Lake South high-grade zone area, upgrading Inferred material and filling in the gaps along the 3 km long conduit where geological potential for resource growth exists.

A third drill, commencing in Q2, 2021 will mobilize to the Current Lake Deposit area and upgrade Inferred material in the Beaver Lake Zone. Drilling will also test certain geophysical anomalies identified in last year’s work in the Feeder Zone area underlain by the Escape Lake Fault at the southern base of the Current Lake intrusion. The target in this area is the source of certain narrow, high grade massive sulphide lenses, found injected further up in the Current Lake conduit.

Social Engagement

Clean Air Metals and its wholly-owned subsidiary Panoramic PGMs (Canada) Limited acknowledge that the Escape Lake Property and the Current Lake Property, which collectively make up the Thunder Bay North Project, are on the traditional territories of the Fort William First Nation, Red Rock Indian Band and Biinjitiwabik Zaaging Anishinabek. The parties have entered into a Memorandum of Agreement as Cooperating Participants and are committed to ongoing updates and dialogue around the Thunder Bay North Project.

Input Parameters for Resource Calculation

Mining Cutoff Grade

The cutoff value used for the mineral resource is US$77/tonne (CA$101/tonne) insitu contained value, 1.58g/tonne Palladium Equivalent (PdEq) (US$77 / (US$1,516.82/31.10305)) or 2.65g/tonne Platinum Equivalent (US$77 / (US$902.38/31.10305)). The cutoff value is calculated based on estimations as follows: direct mining operating cost, onsite milling operating cost, tailings management facility operating cost, indirect operating cost, general and administration (G&A) cost, onsite milling metal recoveries, offsite smelting metal recoveries, and smelter metal payable percentages. A total estimated operating cost of CA$66.91/tonne of mill feed is comprised of;

- Direct mining operating cost for underground mining of CA$35.88/tonne mill feed, consisting of the weighted average; 75% longhole open stope mining CA$30.45/tonne mill feed and 25% drift and fill mining CA$52.19/tonne mill feed,

- Onsite milling and tailings management facility operating cost of CA$18.00/tonne mill feed,

- Total indirect operating cost and G&A cost of CA$13.03/tonne mill feed.

Onsite estimated mill metal recoveries, offsite estimated smelting metal recoveries and estimated smelter payable percentages used for mineral resource cutoff grade calculations are summarized in Table 7. For resource cutoff calculation purposes, a mining recovery of 100.0% and 0.0% mining dilution were applied. The applicable metal prices are summarized in Table 8.

Table 7:Â Contained Metals Parameters of Mineral Resource Cutoff Grade Calculations

|

Parameter |

Pd |

Pt |

Ag |

Au |

Cu |

Ni |

Co |

Rh |

|

Onsite Mill Metal Recoveries |

75.00% |

75.00% |

50.00% |

50.00% |

90.00% |

90.00% |

90.00% |

75.00% |

|

Offsite Smelting Metal Recoveries |

85.00% |

85.00% |

85.00% |

85.00% |

85.00% |

90.00% |

50.00% |

85.00% |

|

Smelter Payable Percentages |

98.00% |

98.00% |

85.00% |

97.00% |

100.00% |

100.00% |

100.00% |

98.00% |

|

Note:Â Values taken from Panoramic Resources “AMEC Technical Report dated 6 October 2010”. |

Geological Domaining

Nordmin examined and modelled the mineralization within the Current Lake and Escape Lake deposits for the purpose of grade concentration and isolation of composites, while including lithological, geochemical, and structural correlations between rock types that are influencing the mineralization at each respective deposit.

Domain wireframes were modelled for seven grade elements, including combined Platinum (“Pt”) and Palladium (“Pd”), Gold (“Au”), Silver (“Ag”), Copper (“Cu”), Nickel (“Ni”), Cobalt (“Co”), and Rhodium (“Rh”). Each domain was built using geology, mineralization, and grade bin for a combination of Background grade (“BG”), Low Grade (“LG”), Medium Grade (“MG”), and High Grade (“HG”). Background grades were isolated through applying the overall conduit wireframe. The criteria include:

Current Lake Deposit

- Platinum and Palladium: Platinum and Palladium grades were summed and the resulting total used to model with the following criteria: BG Pt+Pt < 2 g/t, LG Pt+Pt 2 g/t to 6 g/t, MG Pt+Pd 6 g/t to 12 g/t, HG Pt+Pd > 12 g/t

- Gold:Â BG Au < 0.25 g/t, HG Au > 0.25 g/t

- Silver: BG Ag < 5 g/t, HG Ag > 5 g/t

- Copper: BG: < 1% Cu, LG 1% to 2% Cu, MG 2% to 4% Cu, HG > 4% Cu

- Nickel BG < 0.25% Ni, LG 0.25% to 0.5% Ni, MG 0.5% to 1% Ni, HG > 1% Ni

- Cobalt: BG Co < 250 g/t, LG Co 250 g/t to 500 g/t, HG Co > 500 g/t

- Rhodium: BG Rh < 0.25 g/t, LG Rh 0.25 g/t to 0.5 g/t, MG Rh 0.5 to 1.0 g/t, HG Rh > 1.0 g/t

Escape Lake Deposit

- Platinum and Palladium: Platinum and Palladium grades were summed and the resulting total used to model with the following criteria: BG Pt+Pt < 2 g/t, LG Pt+Pt 2 to 6 g/t, MG Pt+Pd 6 to 12 g/t, HG Pt+Pd > 12 g/t

- Gold:Â BG Au < 0.25 g/t, HG Au > 0.25 g/t

- Silver: BG Ag < 2.5 g/t, LG Ag 2.5 g/t to 5 g/t, HG Ag > 5 g/t

- Copper: BG: < 1% Cu, LG 1% to 2% Cu, HG > 2% Cu

- Nickel BG < 0.25% Ni, LG 0.25% to 0.5% Ni, MG 0.5% to 1% Ni, HG > 1% Ni

- Cobalt: BG Co < 250 g/t, LG Co 250 g/t to 500 g/t, HG Co > 500 g/t

- Rhodium: BG Rh < 0.25 g/t, LG Rh 0.25 g/t to 0.5 g/t, MG Rh 0.5 g/t to 1.0 g/t, HG Rh > 1.0 g/t

Wireframes were initially created on 10 m to 20 m plan sections and adjusted on vertical section views to edit and smooth each wireframe where required. When not cut off by drilling, the wireframes terminate at the contact of the conduit or due to lack of drilling, whichever was most appropriate. No wireframe overlapping exists within a given domain, but all domains are independent of each other.

The use of explicit modelling allows for mineralization in context with the deposit geology and associated geochemistry to be considered. It is Nordmin’s opinion that the explicit modelling approach minimizes risks compared to using implicit modelling for each deposit.

Compositing

Compositing of samples is a technique used to give each sample a relatively equal length to reduce the potential for bias due to uneven sample lengths; it prevents the potential loss of sample data and reduces the potential for grade bias due to the possible creation of short and potentially high-grade composites that are generally formed along the zone contacts when using a fixed length.

The raw sample data was found to have a relatively narrow range of sample lengths. Samples captured within all zones were composited to 1.0 m regular intervals based on the observed modal distribution of sample lengths, which supports a 5.0 m x 5.0 m x 5.0 m block model (with sub-blocking). An option to use a slightly variable composite length was chosen to allow for backstitching shorter composites that are located along the edges of the composited interval. All composite samples were generated within each mineral lens with no overlaps along boundaries. The composite samples were validated statistically to ensure there was no loss of data or change to the mean grade of each sample population.

Block Model Resource Estimation

A “soft boundary” was used for the application of composites for all mineralized domains except for the background domains, as follows:

- Background Grade: Selected composites include only background domain composites.

- Low Grade: Selected composites included background and low-grade domain composites.

- Medium Grade (where applicable): Selected composites included medium and low-grade domain composites.

- High Grade (where applicable): Selected composites included high grade and medium grade domain composites.

A series of upfront test modelling was completed to define an estimation methodology to meet the following criteria:

- Representative of the deposit geology and structural models.

- Accounts for the variability of grade, orientation, and continuity of mineralization.

- Controls the smoothing (grade spreading) of grades and the influence of outliers.

- Accounts for most of the mineralization.

- Is robust and repeatable within the mineral domains.

- Supports multiple domains.

Multiple test scenarios were evaluated to determine the optimum processes and parameters to use to achieve the stated criteria. Each scenario was based on Natural Neighbour (NN), Inverse Distance Squared (ID2), Inverse Distance Cubed (ID3), and Ordinary Kriging (OK) spatial interpolation and weighted averaging methods.

All test scenarios were evaluated based on global statistical comparisons, visual comparisons of composite samples versus block grades, and the assessment of overall smoothing. Based on results of the testing, it was determined that the final resource estimation methodology would constrain the mineralization by using hard wireframe boundaries to control the spread of high to grade and low to grade mineralization. OK was selected as the best representative interpolation method.

Equivalency

Equivalency formulas were calculated and used for reporting purposes. The derivation of the equivalency formulas is based on accepted industry practices. All equivalencies are reported as in-situ grades and are calculated using the trailing average commodity price deck referenced in Table 8.

Platinum equivalency (“Pt Eq”) and Palladium Equivalency (“Pd Eq”) was calculated for each deposit through the following formulas, using components from platinum (“Pt”), palladium (“Pd”), gold (“Au”), silver (“Ag”), copper (“Cu”), nickel (“Ni”), cobalt (“Co”), and rhodium (“Rh”):

Notes:

- All percentage grades referenced in the formulas for Cu and Ni are numeral percentage rather than decimal percentages (i.e., 2% is 2.0, not 0.02).

- 0.06857 is used for troy ounce and pound conversion.

- 2204 is used for tonne and pound conversion.

- 10,000 is used to convert from numerical percentage to grams.

Additional

- The Independent and Qualified Person responsible for the Mineral Resource Estimate is Glen Kuntz, P.Geo. of Nordmin Engineering Ltd., Thunder Bay, Ontario, and the effective date of the estimate is January 18, 2021.

- CIM Definition Standards on Mineral Resources and Reserves were used for the Thunder Bay North Project mineral resource estimate.

- 3-year trailing average prices were used for all calculations with the exception of cobalt which used a 2-year trailing average price as itemized in Table 8.

- Resource excludes all material immediately below Current Lake, above a minimum crown pillar thickness of 20m which is assumed to be not recoverable by underground methods.

- Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. The estimate of mineral resources may be materially affected by environmental, permitting, legal, marketing, or other relevant issues.

- Minor variations may occur during the addition of rounded numbers.

- Calculations used metric units (meters (m), tonnes (t) and grams/tonne (g/t).

Table 8: Commodity Prices Used in Resource Calculation

|

Commodity |

Units |

Assumption |

|

Palladium |

per oz |

$ 1,516.82 |

|

Platinum |

per oz |

$ 902.38 |

|

Silver |

per oz |

$ 17.35 |

|

Gold |

per oz |

$ 1,469.60 |

|

Copper |

per lbs |

$ 2.87 |

|

Nickel |

per lbs |

$ 6.15 |

|

Cobalt |

per tonne |

$ 34,839.16 |

|

Rhodium |

per oz |

$ 4,910.67 |

|

Note:Â 3-year trailing average except Cobalt is 2-year trailing average. |

Qualified Persons

The Mineral Resource estimate was independently prepared under the supervision of Mr. Glen Kuntz, P.Geo. (Ontario) of Nordmin Engineering Ltd., a “Qualified Person” under National Instrument 43-101 Standards of Disclosure for Mineral Projects. Verification included a site visit to inspect drilling, logging, density measurement procedures and sampling procedures, and a review of the control sample results used to assess laboratory assay quality. In addition, a random selection of the drill hole database results was compared with original records.

About Clean Air Metals Inc.

Clean Air Metals’ flagship asset is the Thunder Bay North Project, a platinum, palladium, copper, nickel project located near the City of Thunder Bay, Ontario and the Lac des Iles Mine owned by Impala Platinum Holdings. The Clean Air Metals project hosts the Current Lake Deposit and magma conduit and the Company is actively exploring the Escape Lake Deposit, a twin structure to the Current Lake Deposit. Executive Chairman Jim Gallagher, P.Eng. and CEO Abraham Drost, P.Geo. lead an experienced team of geologists and engineers who are using the Norilsk magma conduit stratigraphic and mineral deposit model to guide ongoing exploration and development studies. As the former CEO of North American Palladium Ltd. which owned the Lac des Iles Mine prior to the sale to Impala Platinum in December, 2019, Jim Gallagher and team are credited with the mine turnaround and creation of significant value for shareholders.

ON BEHALF OF THE BOARD OF DIRECTORS

“Abraham Drost”

Abraham Drost, Chief Executive Officer of Clean Air Metals Inc.

For further information, please contact:

Abraham Drost, Chief Executive Officer of Clean Air Metals Inc.

Phone:Â 807-252-7800

Email:Â adrost@cleanairmetals.ca

Website:Â www.cleanairmetals.ca

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note

The information contained herein contains “forward-looking statements” within the meaning of applicable securities legislation, including statements regarding the potential of the Thunder Bay North Project and the Escape Lake and Current Lake deposits and timing of technical studies and mineral resource estimates. Forward-looking statements relate to information that is based on assumptions of management, forecasts of future results, and estimates of amounts not yet determinable. Any statements that express predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance are not statements of historical fact and may be “forward-looking statements.” Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to differ from those reflected in the forward-looking statements, including, without limitation: political and regulatory risks associated with mining and exploration; risks related to the maintenance of stock exchange listings; risks related to environmental regulation and liability; the potential for delays in exploration or development activities or the completion of feasibility studies; the uncertainty of profitability; risks and uncertainties relating to the interpretation of drill results, the geology, grade and continuity of mineral deposits; risks related to the inherent uncertainty of production and cost estimates and the potential for unexpected costs and expenses; results of prefeasibility and feasibility studies, and the possibility that future exploration, development or mining results will not be consistent with the Company’s expectations; risks related to commodity price fluctuations; and other risks and uncertainties related to the Company’s prospects, properties and business detailed elsewhere in the Company’s disclosure record. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking statements. Investors are cautioned against attributing undue certainty to forward-looking statements. These forward-looking statements are made as of the date hereof and the Company does not assume any obligation to update or revise them to reflect new events or circumstances, except in accordance with applicable securities laws. Actual events or results could differ materially from the Company’s expectations or projection.