Commodities Roundup

This year is shaping up favourably for a number of mineral commodities

By David Duval

Even in the face of a global pandemic, the United States’ trade deficit with China remains the highest on record – suggesting that U.S. consumer demand for cheap Chinese goods won’t end any time soon.

China accounts for over 30% of global copper imports, with heavy demand from its construction industry and energy transmission sectors exceeding more than the country can produce.

Following China’s Covid19 lockdown, the price of copper plummeted approximately 21% to US2.09 per lb., the lowest in four years. Â However, after China got the virus under control, copper recovered dramatically and its momentum is expected to pick up after the Chinese New Year as demand gradually overtakes supply, leaving the copper market with a substantial deficit.

With some new mine supply coming on stream this year, Chinese copper demand is projected to remain strong, the U.S. dollar weak because of growing deficits, the labour market is anticipated to be worse-than-expected, and the Fed will likely tolerate higher inflation while keeping interest rates low. In addition, demand for electric vehicles – a heavy consumer of copper – is growing exponentially in most advanced economies.

Nickel rebounded sharply this year as investor sentiment for the use of nickel in Electric Vehicle batteries surged. The rise is largely attributed to a recovery in Chinese stainless steel demand tied to an economic recovery, notes supply chain intelligence group, Roskill.

“This was combined with raw material shortage concerns following the Indonesian ore export ban (implemented at the beginning of the year), with disruptions to ore supply from the Philippines caused by COVID-19 suspensions and adverse weather,” the company added.

Consumption by the battery sector remains strong despite an overall drop in nickel demand and is expected to accelerate in 2021.

This year, nickel use for batteries is forecast to increase by about 11%; however, this amounts only to approximately 20,000 tonnes. For junior companies, emphasizing positive environmental, social and governance credentials that their projects may offer might well help facilitate their entry into this emerging market.

Silver has been in a breakneck rally and is projected to outperform gold in an emerging precious metals bull market. Demand via silver-backed exchange-traded products (ETPs) just about tripled in the first nine months of 2020 and the metal’s outlook remains bright as a new focus on green energy could increase silver demand for solar panels. In 2019, the photovoltaic sector accounted for 10% of total silver demand, comprising 98.7 million ounces within total demand of 991.8 million ounces, according to Metals Focus data.

Whether silver is being accumulated as a poor man’s safe haven or as a speculative trade on the assertion that it will outperform gold is the subject of considerable debate. Whatever the reality, there is strong support for physical silver, and should this trend continue the market could well see much higher prices including a possible all-time high later this year. Demand via silver-backed exchange-traded products (ETPs) just about tripled in the first nine months of 2020 and looks set to continue. In percentage terms, silver seems ready to outperform gold in this precious metals bull market.

Gold reached a record high last year but has since become range-bound and appears to be awaiting additional fiscal stimulus and movement in the US dollar. Monetary and fiscal stimulus is arguably one of the strongest catalysts for gold, not to mention the ramifications that can come from it.

Because gold is universally priced in U.S. dollars, the two are usually inversely correlated. As such, a weak U.S. dollar is supportive of higher gold prices. Ongoing stimulus efforts will keep the USD under pressure-and given the amount of fiscal expenditures expected this year, the dollar is likely to fall, which could push gold higher, notes Jeff Clark, Senior Analyst, GoldSilver.com.

Most analyst price forecasts for 2021 predict gold prices of US$2,000 an ounce or higher with CMP Group representing an outlier at US$1,922. “We expect prices to rise sharply at some point in the future, to new records significantly higher than $2,000. Such an increase would be expected to be caused by investors buying increased volumes of gold in a future economic and political crisis… the period 2023 – 2025 is perhaps the most likely time period to expect such,” it predicts.  Ross Norman, who has won first place in the LBMA gold price survey nine times, predicts gold will rise 20% this year.

The growing adoption of electric vehicles is driving rapidly increasing demand for rechargeable batteries and their input commodities including lithium, graphite and manganese. In 2021, Benchmark Mineral Intelligence is forecasting that total lithium demand for all applications will increase to over 400,000 tonnes lithium carbonate equivalent (LCE).

“Lithium carbonate demand is expected to increase by 23% year-on-year and hydroxide up by 33% year-on-year, with the increases almost down entirely to the surging needs of the battery sector.” While lithium prices have moved higher this year, the real test will be in longer-term contract prices in 2021, with latent mine capacity likely remaining a cap on significant price gains next year.

Manganese production from new mines is expected to impact pricing in 2021. “Three are scheduled for Q1 or early Q2, and that supply will remain strong,” said Clare Hanna of CRU Group. “The cloud on the horizon remains Chinese port stocks. These have fallen since early December, but still remain high by historical levels.”

In regards to the consumption of manganese in batteries, there are about 20 million tonnes of contained manganese mined, with the battery market consuming around 30,000 tonnes. While an oversupply exists in the market place, “This could be changed by a stronger, faster recovery in demand outside of China and/or persistent strength in Chinese steel demand,” Hanna emphasized.

Benchmark Mineral Intelligence expects to see double-digit growth in demand for graphite from 2022 onwards for the battery segment. Alongside demand from energy storage applications, the battery industry is due to become the largest sector of demand for the graphite supply chain. In fact, the sector is seen aggressively increasing to around 15 times today’s demand by 2030. Supply chain intelligence group, Roskill sees the graphite industry becoming increasingly focused on the battery market, with growth opportunity for both synthetic and natural. Using Roskill’s base case scenario for lithium-ion battery growth, battery demand for (raw material) graphite could grow by around 19% per year.

Rare earths are used in the high-strength magnets found in various products including smartphones, wind turbines, and electric vehicles (EVs). They will be a primary focus for the resource sector well into the next decade as more countries in the west work to create supply chains less dependent on China. Supply and demand remain uncertain because of the Corona Virus but analysts remain optimistic.

In 2021, Adamas Intelligence is expecting demand to rebound strongly for nearly all end-use categories for rare earths, in particular permanent magnets, which drive around 90% of the rare earth oxide market’s overall value. In the meantime, Europe and Australia are putting considerable effort into building out supply chains for REEs. The EU is prepared to invest directly in the rare earth supply chain from exploration companies to metal and magnet producers. The Australians have announced plans to provide financial solutions, loan guarantees and bonds to companies in the strategic metals space.

While hardly a run-away market, uranium prices moved significantly higher into late 2020, with long-term prospects looking even better. Cameco’s temporary shuttering of the high grade, low-cost Cigar Lake mine in Saskatchewan was just one of the catalysts that helped send U3O8 prices to a four-year high. Looking into the New Year, sector participants and analysts see prolonged production constraints pushing prices higher. Global demand is also anticipated to grow in the coming years. According to the World Nuclear Association, there are more than a dozen nuclear reactors are slated to come online, followed by two years of steady rollouts. These developments are especially promising for junior companies.

The Platinum Group Metals Market is segmented by metal type, application and geography, with palladium currently accounting for the largest market share owing to growing demand from automotive, electrical and electronics industries around the world.

About 40% of overall platinum consumption is associated with jewelry manufacturing. The application of catalytic converters contributes to about 37% of the global demand. The rest of the global demand is attributable to various industrial applications.

Asia Pacific has accounted for the largest share in the market for platinum group metals with almost half of the global share and is expected to be the fastest-growing market. The global market for platinum group metals market is highly consolidated, as there are only a few players in the market and top five players in the market control nearly 88% share of the market.

Last year saw palladium add 18% to its value. It is currently trading at US$2,268 an ounce with about 80% used by the auto industry. A supply deficit caused by COVID-19 restrictions in South Africa has resulted in higher prices.

The Metallic Group of Companies is a collaboration of exploration/development companies focused on the acquisition and advancement of district-scale, brownfields properties in North American mining districts proven to host world-class deposits. Since its founding, the Metallic Group has secured large and highly prospective land packages adjacent to active producers of high-grade silver, copper, and platinum group metals, where each member is applying new exploration models and technology to their metals of focus.

The Metallic Group of Companies is a collaboration of exploration/development companies focused on the acquisition and advancement of district-scale, brownfields properties in North American mining districts proven to host world-class deposits. Since its founding, the Metallic Group has secured large and highly prospective land packages adjacent to active producers of high-grade silver, copper, and platinum group metals, where each member is applying new exploration models and technology to their metals of focus.

Headquartered in Vancouver, Canada, the Metallic Group’s member companies include Granite Creek Copper Ltd. [GCX-TSXV GCXXF-OTCQB], Group Ten Metals Inc. [PGE-TSXV; PGEZF-OTCQB] and Metallic Minerals Corp. [MMG-TSXV; MMNGF-OTCQB].

This trio of companies is led by a team of highly successful explorationists who previously worked for such leading names as NovaGold Resources Inc. [NG-TSX, NYSE American], Placer Dome (now Barrick Gold Corp. [ABX-TSX; GOLD-NYSE] and Sibanye-Stillwater [SBSW-NYSE American; SSW-JSE]. The Group brings a track record of value creation through the process of strategic acquisitions, resource development and expansion, and project advancement and de-risking. The Metallic Group looks to replicate the model of value creation that was so successful for NovaGold in the last metal price cycle and that drove NovaGold’s share price from 10 cents at the low part of the metals cycle to over $20 at its peak.

That strategy is already playing out at Group Ten Metals, which is working to define initial platinum group element and battery metals resources at its Stillwater West PGE-Ni-Cu-Co + Au project in Montana, USA. The Stillwater Complex is recognized as one of the top producing regions in the world for platinum group elements (PGE) as the world’s highest-grade major PGE producer and the largest outside Africa and Russia.

Sibanye-Stillwater has produced over 14 million ounces of PGEs to date, along with nickel, copper, and rare PGEs such as rhodium from three mines and a smelter-refinery complex. Below that high-grade reef deposit is a broadly disseminated magmatic package rich in PGEs, nickel, copper, gold and cobalt controlled by Group Ten. Geologically, this setting is comparable to the Bushveld Complex of South Africa where enormous deposits such as Ivanhoe’s Flatreef mine and Anglo American’s Mogolakwena mines, are situated in similar layered stratigraphy.

Drilling by Group Ten in 2019 and 2020 confirmed the presence of multiple “Platreef-style” horizons at Stillwater West and the company is now incorporating those results and its 31,000-meter drill core database into a maiden mineral resource estimate it expects to announce in mid-2021.

Granite Creek Copper, the newest member of the group, was launched in 2019 as a copper focused exploration play through the acquisition of the Stu Copper-Gold-Silver Project, located in Yukon’s prolific high-grade Minto Copper District. Within 24 months, the company was able to combine the exploration potential of its Stu Project with existing resources in the adjacent Carmacks deposit through the acquisition of neighbouring Copper North. This combination provides Granite Creek a two-pronged approach to resource growth via expansion of existing resource tonnage plus the addition of potential new discoveries.

Results from Granite Creek’s inaugural 2020 drill campaign confirmed that potential by intercepting significant mineralization in all holes drilled on both target areas. Planning is currently underway for a much larger 2021 program at the newly regional-scale land package – now referred to as the Carmacks and Carmacks North Project – with the intent of increasing its in situ copper towards 1 billion pounds, plus.

Founding member Metallic Minerals is focused on its flagship Keno Silver Project, located in the Keno Hill silver district of Canada’s Yukon Territory, directly adjacent to Alexco Resource’s Keno Hill operations, which rank as one of the world’s highest grade primary silver mines. Metallic Minerals has consolidated the second largest land position in the district with its holdings including eight shallow, high-grade past producing deposits as well as the eastern portion of the district which has only seen limited historic exploration due to previously fragmented land ownership, vegetation cover and lack of road access. Metallic Minerals has quickly advanced six target areas along the main productive trends towards development of initial mineral resources and has identified 12 new multi-kilometre-scale targets on the greenfields parts of the Keno district.

Drilling by Metallic in 2020 has confirmed the discovery of both high-grade Keno-style and bulk-tonnage silver systems similar in style to Newmont’s huge Peñasquito deposit. The reconnaissance drill tests of the first of these multi-kilometre-scale soil and geophysical targets at East Keno have expanded the Keno Hill silver district by at least 10 kilometres to the east -opening a huge new area of prospective terrain controlled by Metallic Minerals in this prolific high-grade silver district. Planning is underway for a significantly expanded exploration program in 2021 to drill the remaining untested targets as well as to extend on these newly discovered zones through step out core and RC drilling.

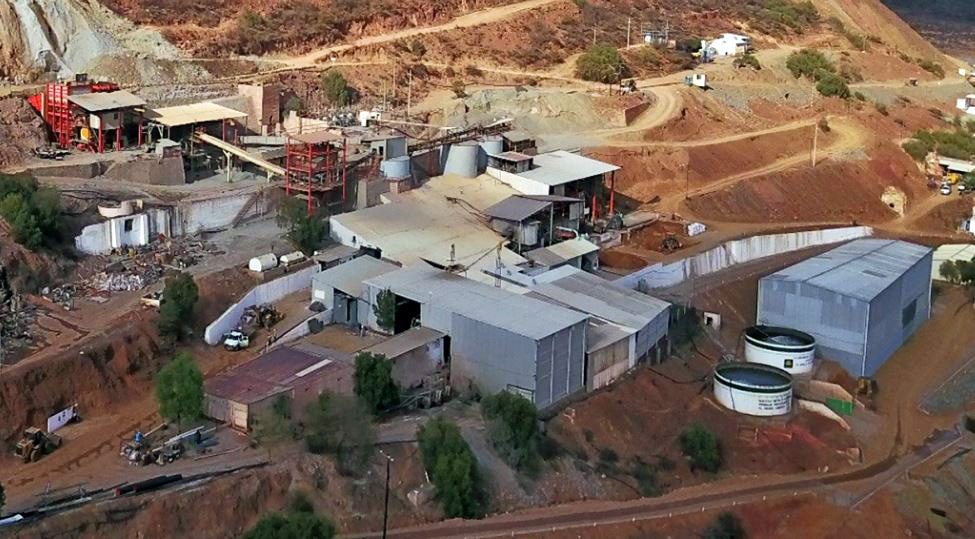

Avino Silver and Gold Mines Ltd. [ASM-TSX, NYSE American] is an established primary silver producer and explorer in its 53rd year of operation with over 36 years of production history (1974-2001) and 2011 to present. The property is located on the east flank of the prolific Sierra Madre Silver Belt, with mining in the area dating back some 500 years.

Avino Silver and Gold Mines Ltd. [ASM-TSX, NYSE American] is an established primary silver producer and explorer in its 53rd year of operation with over 36 years of production history (1974-2001) and 2011 to present. The property is located on the east flank of the prolific Sierra Madre Silver Belt, with mining in the area dating back some 500 years.

The mine and mill are easily accessible being a one-hour drive on paved roads from Durango – a major city of 650,000 people. The property is located in the heart of Durango farmland, and the local communities provide the company’s skilled labour force.

The recent AgEq production profile at the Avino mine has ranged from just under one million silver equivalent ounces to over 3,000,000 million silver equivalent ounces since 2012.

In 2018, an expansion was completed to the processing plant with the addition of a fourth bulk flotation circuit (Mill Circuit 4) rated at 1,000 tonnes per day, which increased the combined throughput capacity at the plant to 2,500 tpd.

2021 will be a busy year for Avino, as the company will push forward after 2020 saw a temporary shutdown from COVID-19, and a 12-week strike which halted production.

The company recently announced an updated mineral resource estimate which resulted in a 60% increase in silver equivalent ounces, up to 75.9 million ounces, as well as increase in gold and copper grades by 6% and 11%, up to 0.67 g/t and 0.41% respectively. Overall, there is an increase in tonnage of 90% to 20.3 million tonnes.

The Avino property is very unique, with 20 named veins on the property and over 50 additional unnamed veins providing an abundance of potential exploration targets.

Avino just announced that the 2021 drill program has started with 12,000 metres of drilling planned. The program will be focused on the El Trompo Vein, the Santiago Vein, Avino ET area (below Level 17) and the Avino West (below Levels 9 and 17).

The dry stack tailings project is well underway for its permitted tailings storage facility which is referred to as TSF#2. This project should be completed during Q3 2021 and will add an additional 8-10 years of tailings capacity based on the current mill throughput rate. Avino chose dry stack tailings for its environmental, safety and economic advantages with the high solids content. This significantly improves safety and stability and reduces the need to extract water from local sources by recycling the water removed from tailings. In addition, it requires less land which in turn results in a smaller environmental footprint. During the year, Avino also expects to make various metallurgical improvements to Circuit 4 in 2021 to improve recovery rates.

Avino Silver has 100% interests in a number of exploration-stage projects in Mexico, including the Ana Maria, Eagle, El Hueco, Aranjuez, La Potosina, El Fuerte, El Laberinto, and Potosina, and in British Columbia, the Olympic and Minto prospects.

Avino has granted option agreement to Silver Wolf Exploration Ltd. [SWLF-TSXV] that holds 100% options on the Ana Maria polymetallic property and the El Laberinto silver-gold property, both in Durango State.

Avino Silver and Gold is headed by David Wolfin, President and CEO, who took over management from his father, Louis, who founded the company.

The company recently filed a new prospectus with Cantor Fitzgerald & Co., H.C. Wainwright & Co., LLC, Roth Capital Partners, LLC, and A.G.P./Alliance Global Partners to raise US$25.0 million. Avino’s cash on hand is $12.5 million. Due to COVID-19 and the strike, revenues in Q3 2020 were lower than planned at $2.7 million with an EBITDA of -$4.3 million. Cash cost per silver equivalent payable ounces was $12.56.

In December 2019, Avino received $8.7 million and 15 million shares when it sold its Bralorne gold property in British Columbia to Talisker Resources Ltd.

With the recent rise in the price of silver coupled with current production, known resources and many prospective exploration targets, Avino Silver and Gold expects to have free cash flow for 2021, no debt, and is in a strong position for continued success. The company has 89,568,682 shares outstanding.

Bear Creek Mining Corp. [BCM-TSXV; BCEKF-OTCQX; BCM-BVL] is a silver exploration and development company with a long track record of exploration success in Peru.

Bear Creek Mining Corp. [BCM-TSXV; BCEKF-OTCQX; BCM-BVL] is a silver exploration and development company with a long track record of exploration success in Peru.

The company’s wholly-owned Corani silver-lead-zinc deposit is the one of the largest, fully-permitted silver deposits in the world, one that is highlighted by its substantial base metal credits, its location in a mining friendly jurisdiction and overwhelming community support.

As a result, the company is highly leveraged not only to the price of silver, which recently traded close to an eight-year high of US$29.41 an ounce, but also to the price of lead and zinc.

The management team at Bear Creek has a substantial depth of experience in discovering, advancing, financing, developing and operating mines in Latin America. Bear Creek Chair Catherine McLeod-Seltzer, for example, has helped raise over $600 million in working capital for mining exploration in the past 20 years and has stewarded numerous successful mining ventures in addition to Bear Creek, including Kinross Gold, Arequipa Resources, Peru Copper, and Lucara Diamonds.

CEO Anthony Hawkshaw was a key contributor to the vision, strategy and growth of Rio Alto Mining, a company with assets in Peru that was acquired by Tahoe Resources Inc. (subsequently acquired by Pan American Silver Corp. [PAAS-TSX, NASDAQ]) in 2015 in a deal worth US$1.12 billion.

Strong investor interest in Bear Creek was underlined recently when the company raised $34.5 million from a bought deal offering of 11.5 million common shares priced at $3 per share. Net proceeds are earmarked for ongoing development, including early works construction activities at the Corani Project, and for general corporate purposes.

It is also working with financial institutions to arrange a US$ 400 million senior secured credit facility and has said it will consider a production decision pending financing and favourable market conditions

Proven and probable reserves in the Corani deposit currently stand at 229 million ounces of silver, 2.74 billion pounds of lead and 1.7 billion pounds of zinc.

That material is expected to support average annual payable metal production of 9.6 million ounces of silver, 98 million pounds of lead and 69 million pounds of zinc over a 15-year life, with an average of over 16 million ounces of silver expected to be produced in each of the first three years of operation.

The project has received all key permits required to commence construction. Total capital expenditures are forecast at US$600 million, including US$234 million for the processing plant.

The all-in-sustaining cost per ounce of silver is currently estimated at US $1.36 for the first three years of production and US$4.55 life of mine.

Ore production will be from three open pits – the Este, Minas and Main pits. The Este Pit contains the highest silver grade and will account for the majority of ore produced in the first three years of operation.

Bear Creek has a long track record in Peru and the Corani Project enjoys of the support of local communities in the sparsely populated Andean mountain area of southern Peru.

In a September 2020 press release, Bear Creek said it would shortly commence construction of several capital projects in the Corani region to support the long-term health, education and economy of local communities and provide early construction infrastructure for the Corani mine including upgrades to the Corani access road and construction of a powerline. These activities are currently underway. Community projects include construction of an Alpaca Research Center to house the numerous initiatives, advanced in partnership with Corani-area communities to enhance animal health and farming methods and the Center for Technical Innovation to research, create and produce unique and innovative products from local resources.

Bear Creek has also said it is nearing completion of the Antapata electrical substation, which is expected to provide power to the town of Macusani and eventually direct electricity to the Corani site.

This is in line with the company’s stated Corporate Social Responsibility goal, which is to contribute to the sustainable development, growth, and quality of life of local communities while respecting the traditions, customs, and ancestral relationships of the Corani area population in accordance with their geographic and cultural realities.

On February 18, 2021, Bear Creek shares were trading at $2.32 in a 52-week range of $4.17 and 75 cents, leaving the company with a market cap of $287.5 million, based on 123.9 million shares outstanding.