Copper Mountain acquires Aussie miner Altona

On 18 April this year, copper-gold producer Copper Mountain Mining Corp. [CMMC-TSX; C6C-ASX] completed a significant transaction by closing its acquisition of the Queensland focused Altona Mining Limited. Â

Copper Mountain Mining noted in its news release, April 18, “As a result of the acquisition, Copper Mountain has now added to the Copper Mountain Group 100% of Altona’s assets which include A$30 million in cash, a permitted development project in Queensland, Australia and a large mineral land tenure position in a highly prospective area in Queensland, a mining-friendly jurisdiction.” Former Altona Managing Director Dr. Alistair Cowden, a seasoned operator in the Australian mining and exploration scene, joins the Copper Mountain Board.

Copper Mountain can thank the crackdown by China on foreign investment by state-owned corporations last year because Altona Mining had previously announced a deal with the Sichuan Railway ÂInvestment Group. That deal was scheduled for completion in October last year but in July Altona Mining announced that the deal was off.

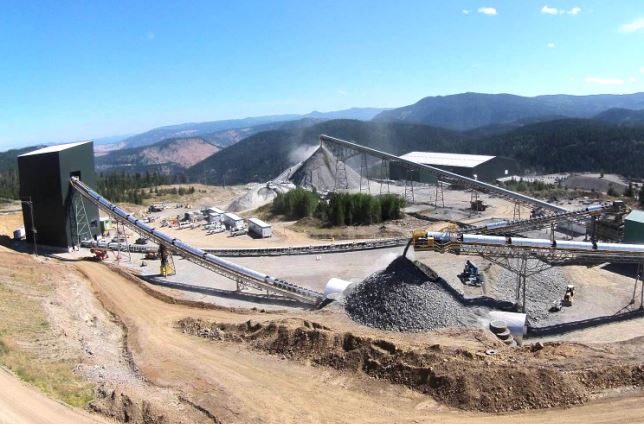

What does the Altona deal mean for this producer with its flagship asset, the 75%-owned Copper Mountain Mine near Princeton in southwestern British Columbia, Canada? The massive 397,000-hectare Cloncurry land package has extensive exploration potential. Nearby mines include MMG’s Dugald River zinc mine and Glencore’s Ernest Henry copper mine. Copper Mountain’s development-ready Eva Copper Project, an Iron Oxide Copper Gold deposit similar to the well-known Ernest Henry and Osborne mines, is only 90 km from Mount Isa’s Glencore Smelter.

Cloncurry hosts the Eva copper-gold deposit, which is the subject of a current Bankable Feasibility Study. Plans call for an open pit mining operation with Eva Copper and five smaller satellite pits (Turkey Creek, Bedford North and South, Lady Clayre and Ivy Ann) to feed a 7M tpy processing plant.

The Eva Copper Project reserves and resources have been updated in a 2017 JORC compliant technical report. Reserves stand at 86 million tonnes of 0.50% copper and 0.07 g/t gold. Measured and indicated resources are 163 million tonnes of 0.58% copper and 0.05 g/t gold. As noted, the production plan is for 7 million tpy for about 80 million pounds of copper and 17,000 ounces of gold annually. This could effectively double Copper Mountain’s copper production.

The 2017 study has delivered material improvements, Altona said. These include reserves up 14% from 375,000 tonnes copper to 426,000 tonnes copper; mine life up 27% from 11 years to 14 years;Â life-of-mine revenue up 24% from A$2.9 billion to A$3.6 billion; NPV (pre-tax) up 34% from A$346 to A$462 million IRR (pre-tax) up 24% from 29% to 36%.

Copper Mountain has wasted no time in releasing its 2018 exploration plans for Australia (May 24, 2018. www.cumtn.com).