Core Nickel Expands Exploration in World-Class Nickel Belt

By Peter Kennedy

Core Nickel Corp. [CNCO-CSE] is a company that offers investors an opportunity into early-stage exploration for critical minerals, largely focused on sulphide nickel, in the world-renowned Thompson Nickel Belt (TNB), in Manitoba.

The TNB ranks as the fifth largest sulphide nickel camp in the world, based on contained nickel endowment. The largest deposit within the TNB is the Thompson Nickel Mine, owned by Vale SA [VALE-NYSE], the Brazilian metals giant, which secured the asset via its 2006 acquisition of Inco Ltd.

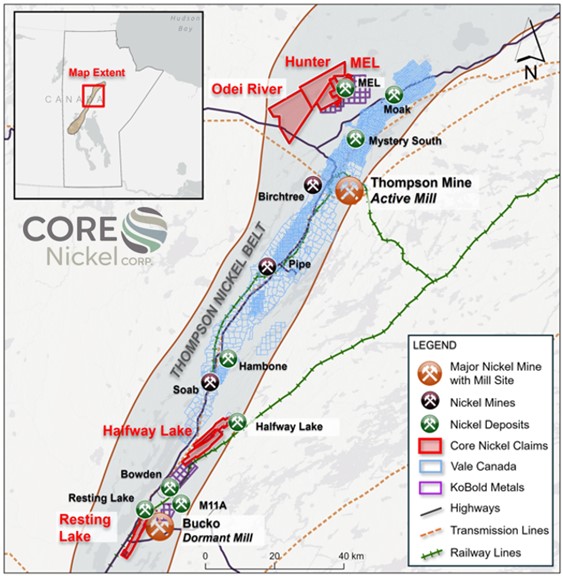

Core Nickel’s Properties in the Thompson Nickel Belt

It is a region that has already produced 5.5 billion pounds of nickel and continues to attract major players including KoBold Metals, a company financed by Bill Gates and Amazon founder Jeff Bezos. KoBold is exploring worldwide using artificial intelligence to help find critical metals that are required for the clean energy transition.

Led by CEO Misty Urbatsch, Core Nickel is confident that by using the most up to date exploration technology, it will uncover nickel deposits that were overlooked by its predecessors. Based in Saskatoon, Sask., Urbatsch previously worked as an exploration geologist, and later in marketing and sales with Cameco Corp. [CCO-TSX, CCJ-NYSE], one of the world’s leading producers of uranium.

Key investors at Core Nickel include Paul Reid, the co-founder and past Executive Chairman of Arizona Metals Corp. [AMC-TSXV], and Marc Pais, the co-founder and former CEO of Arizona Metals Corp. [AMC-TSXV]. Both Reid and Pais joined the Core Nickel Board of Directors in late 2024. Reid currently holds approximately 16% of the outstanding shares and Pais holds approximately 10% of the outstanding shares. Management and Directors participated in the recent financings and now own approximately 28% of the shares outstanding (~42% fully diluted). On January 6, 2025, the company’s shares traded at 16.5 cents in a 52-week range of 37.5 cents and 15 cents.

Core was spun out by CanAlaska Uranium Ltd. [CVV-TSXV, CVVUF-OTCQB, DH7N-Frankfurt] in November 2023. In return for 24.9 million shares, CanAlaska transferred five TNB projects to Core, including Halfway Lake, Resting Lake, Hunter, Mel and Odei River, plus $1.0 million in cash.

The spin out plan was designed to separate the nickel projects from CanAlaska’s uranium assets, allowing them to be explored and developed by a skilled and experienced management team. Caitlin Glew, who joined Core in February 2024 as Vice-President, Exploration, is a former District Geologist with CanAlaska Uranium, and was a pproject geologist at Cameco exploration for ten years where she worked on a variety of projects ranging from greenfield exploration to delineation.

“Additional nickel resources must be discovered, and the Thompson Nickel Belt in Manitoba is an underexplored tier 1 nickel jurisdiction primed for a major new discovery,’’ said CanAlaska CEO Cory Belyk, who is also a director of Core Nickel.

Stainless steel accounts for 65% of all nickel produced. However, Belyk said investment in nickel discovery is poised to rapidly accelerate as demand for clean electricity storage and delivery is predicted to exponentially grow on a global scale.

Nickel recently slumped to a four-year low of US$15,235 a ton, a move that has prompted Indonesia, the world’s leading producer, to consider deep cuts to its mining quotas.

Urbatsch has expressed the view that the nickel price is currently in the same situation as uranium was in 2017, when an oversupplied market sent the price of uranium below US$20 a pound.

However, the price of uranium has since staged a remarkable recovery, and Urbatsch believes a similar move is in store for nickel. “The price of nickel has “nowhere to go but up,’’ she said during an interview with Resource World Magazine.

In keeping with that view, Core has assembled a property portfolio covering 27,000 hectares of highly prospective exploration ground in the TNB.

Highway 6 to Thompson with Powerlines that Provide Northern Manitoba with Nearly 100% Clean Hydroelectricity

All of its five properties are located in close proximity to key infrastructure, including highways, railways, mills with capacity, and nearly 100% clean electricity provided by Manitoba’s major hydroelectric transmission lines.

Core has a large contiguous land package in the northern part of the TNB, (20 kilometres from Thompson, a city that was named after former Inco Chairman John Thompson), consisting of Mel, Hunter and Odei River. The company also holds two properties (Halfway Lake and Resting Lake) in central TNB near Wawboden.

Rail Line Running Through Wabowden

The company’s flagship asset is the 100%-owned Mel Deposit, potentially one of the highest-grade undeveloped nickel deposits in North America (historical mineral resource consisting of indicated resource of 4.28 million tons grading 0.875% nickel (Ni), and inferred resource of 1.01 million tons grading 0.839% Ni, at a cut-off of 0.5% Ni, which requires more work to bring it into compliance with NI 43-101 standards of disclosure. The Mel Deposit is located only 25 kilometres from Vale’s 12,000 tonne per day Thompson mill.

It is worth noting that the Mel deposit was discovered in 1961 and historical drilling at the Mel deposit over the last 50 years has focused on depths averaging only 200 metres, largely based on testing of EM conductors identified to a depth of approximately 100 metres. Its relatively shallow depth made it accessible to earlier exploration methods but deposits deeper than 100 metres would have been overlooked with older EM techniques. For reference, the Thompson mine operates at a depth greater than 1,000 metres in a similar geological setting.

From 1999 to 2004, ground-based UTEM and AMT surveys were conducted across the Mel, Hunter and Odei River properties, revealing numerous targets at depths greater than 100 metres. However, these targets were left untested by previous owners.

Core Nickel plans to carry out a VTEM survey over the Mel and Odei River properties in the winter of 2025. The company said this would assist in identifying new EM targets and refine those identified in the historical AMT and UTEM.

Helicopter at Thompson, MB Airport Preparing for Mel and Odei River VTEM Survey

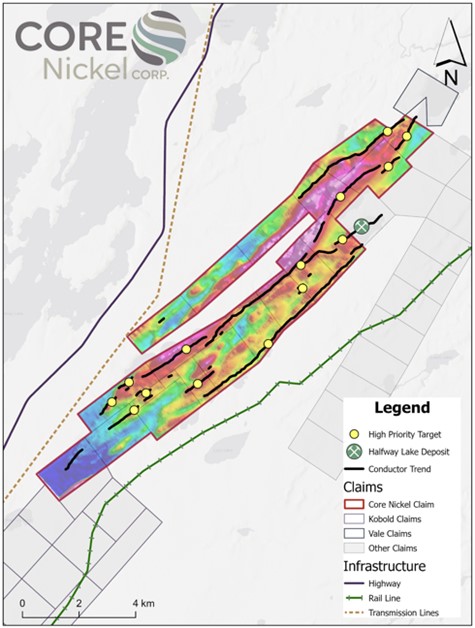

Core recently released that it identified 14 high priority targets on its 100%-owned Halfway Lake project, successfully delineating several electromagnetic and magnetic anomalies on the Halfway Lake and Resting Lake projects.

“The high priority targets further demonstrate the potential for discovering high-grade massive sulphide deposits on our claims,’’ said Urbatsch

Map Outlining High-Priority VTEM Targets on Halfway Lake

“The high priority targets identified from the VTEM survey show similar signatures to known deposits in the Thompson Belt and are all located within 35 kilometres from the past-producing Bucko Mill and 90 kilometres from Vale’s operating Thompson Mill.’’

They include a target, which confirms the extension of the conductive trend interpreted to host the Halfway Lake nickel deposit (historic estimate of 900,000 tonnes, grading 1.2% nickel), which is located 600 metres northeast of the Halfway Lake project.

Another target was identified 150 metres north of the W62 Zone, where the company focused its inaugural drill program in the Winter of 2024, successfully intersecting 91 metres at 0.37% nickel from a vertical depth of approximately 120 metres.

First Drill Set up on Halfway Lake 2025 Drill Campaign

Having recently raised nearly $3.5 million, Core is well funded to begin drill testing these targets in early 2025. Helicopter-borne geophysical surveys, including time domain electromagnetics (VTEM) and horizontal magnetic gradiometer, were completed in July, 2024. The surveys covered the entire Halfway Lake and Resting Lake properties with a 100-metre line spacing, to obtain new coverage and refine historical EM survey results.

Meanwhile, the company remains optimistic that modern exploration techniques will uncover new discoveries on its other properties.