Doubleview Gold Corp. Targets District-Scale Polymetallic Deposit in Golden Triangle

By Peter Kennedy

Doubleview Gold Corp. [DBG-TSXV, DBLVF-OTCQB, A1W038-FSE] is a company that offers unique exposure to precious and critical minerals including, cobalt and scandium, the key ingredients in the transition to a low carbon economy.

The company’s 100%-owned Hat polymetallic porphyry deposit is one of a small number of North American deposits that contains significant amounts of scandium, a rare metal that is deemed critical for economic and national security by the Canadian and American federal governments.

“These are metals that the world needs, and we have them,’’ said Doubleview President and CEO Farshad Shirvani during a recent interview with Resource World.

It is why the value of Doubleview shares surged 24% when the company recently announced a maiden resource estimate (MRE) for the Hat project.

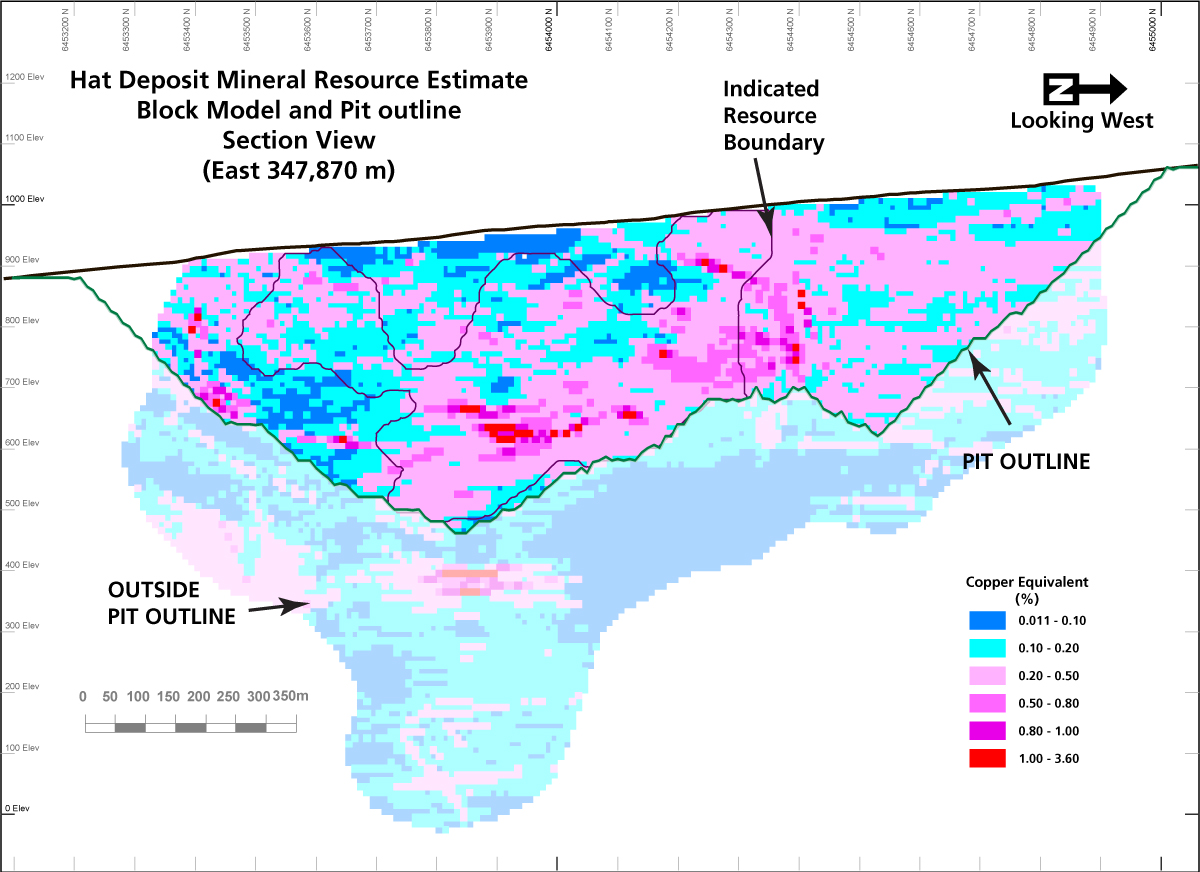

Highlights include an indicated resource of 150 million tonnes (at a 0.2% CuEq cut-off grade) containing 1.35 billion pounds of copper equivalent (CuEq) at 0.408% CuEq, including 733 million pounds of copper, 28 million pounds of cobalt, 929,000 ounces of gold and 2.0 million ounces of silver.

Highlights include an indicated resource of 150 million tonnes (at a 0.2% CuEq cut-off grade) containing 1.35 billion pounds of copper equivalent (CuEq) at 0.408% CuEq, including 733 million pounds of copper, 28 million pounds of cobalt, 929,000 ounces of gold and 2.0 million ounces of silver.

On top of that is an inferred resource of 477 million tonnes (at a 0.2% CuEq cut-off grade) containing 3.62 billion pounds of CuEq at 0.344% CuEq, including 1.94 billion pounds of copper, 91 million pounds of cobalt, 2.3 million ounces of gold and 7.57 million ounces of silver.

According to the MRE, The Scandium potential for the Hat Deposit is estimated to be 300 to 500 million tonnes at an average grade of 40 ppm (0.004%) Sc203, material that is confined solely to the resource blocks that meet a cut-off grade of 0.2% CuEq within the open pit shell that defines the extent of the mineral resource estimate.

Doubleview shares reacted to the MRE, announced on July 26, 2024, by jumping from 33 cents to a high of 45 cents. By August 8, 2024, the shares had slipped back to 40.5 cents leaving the company with a market cap of $77.4 million based on 191.2 million shares outstanding. The shares are currently trading in a 52-week range of 68 cents and 31 cents.

Believing that Hat can become an important source of critical minerals, Doubleview has said it aims to develop a district-scale polymetallic deposit, in a move that will benefit key stakeholders, including First Nations, local communities and shareholders.

It is a strategy led Shirvani, a geologist with more than 27 years of mineral exploration experience in Canada. He is currently the President of Terracad Geoscience Services Ltd. Prior to taking Doubleview public on the TSX Venture Exchange, Shirvani served as a director of several junior mining companies, including Barkerville Gold Mines Ltd.

The Hat project is located in B.C.’s Golden Triangle, a region that is known for its rich and diverse geology, one that has the potential to host several types of the world’s most profitable deposits, including high-grade gold and silver veins, large scale porphyries and volcanogenic massive sulphides.

Hat covers 5, 200 hectares and is located 95 kilometres southwest of Dease Lake and 190 kilometres south of Atlin. It is also located 10 kilometres north of the Golden Bear mine road. Current access is via fixed-wing aircraft or helicopter from Dease Lake or Whitehorse. The recently completed Northwest Transmission Line brings electric power to within 120 kilometres, and Highway 37, an all-weather hard surfaced road, is 95 kilometres to the east.

Hat covers 5, 200 hectares and is located 95 kilometres southwest of Dease Lake and 190 kilometres south of Atlin. It is also located 10 kilometres north of the Golden Bear mine road. Current access is via fixed-wing aircraft or helicopter from Dease Lake or Whitehorse. The recently completed Northwest Transmission Line brings electric power to within 120 kilometres, and Highway 37, an all-weather hard surfaced road, is 95 kilometres to the east.

Doubleview discovered the Hat deposit in early 2014 from a greenfield prospect in the first drilling season. Following the drilling of six holes with marginal but encouraging success, a more aggressive drilling campaign in 2014 resulted in the discovery of the Lisle Zone of gold-copper mineralization.

The Lisle Zone is an alkalic-type-gold-copper porphyry discovery closely similar in genesis, host rock types, alteration and mineralization to several important British Columbia mines, including Copper Mountain, Mt. Polley, Mt. Milligan and Red Chris.

In a press release on February 26, 2024, the company said it completed almost 11,000 metres of drilling during the 2023 exploration season, work that explored and extended the Lisle deposit to the west, south and southwest, enabling a new interpretation of the deposit orientation and model, and revealing a new gold-silver-cobalt-rich area. It said several previously unconnected mineral zones were joined and over-all dimensions were increased.

Highlights from the February 26, 2024, news release included a 4.0-metre section of hole H067 which returned a remarkable 6.94% copper and 8.29 g/t gold (11.27% copper equivalent calculated, excluding Scandium content).

“The discovery of a deposit with potential deliverables of scandium, cobalt, copper and gold by Doubleview is a significant achievement for the company, its shareholders and North America as a whole,’’ Shirvani has said.

“The discovery of a deposit with potential deliverables of scandium, cobalt, copper and gold by Doubleview is a significant achievement for the company, its shareholders and North America as a whole,’’ Shirvani has said.

“Of particular significance is the potential for scandium, as the USA imports 100% of scandium needed,’’ he said.

Scandium is utilized in various industries due to its unique properties, especially when alloyed with aluminum. Applications take advantage of scandium’s ability to enhance the strength, durability, and thermal resistance of aluminum, making the resultant alloy ideal for aerospace, military and automotive industries.

Additionally, scandium finds applications in the manufacturing of solid oxide fuel cells, where it serves as a critical component due to its electrical conductivity and heat resistance. These fuel cells are used in power generation with high efficiency and low emissions.

“This landmark discovery [at the Hat project] has the potential to expand the use of scandium in a variety of applications, one of which is the ability to enhance the energy capacity, stability and safety of nickel-metal hydride (NiMH) batteries commonly used in electric vehicles and consumer electronics,’’ Shirvani said.

Doubleview said tests have shown that scandium can be extracted from tailings using sulphuric acid at elevated temperatures as a lixiviant. Tests also show that scandium can be separated into an intermediate scandium – aluminum product that can be processed further for the recovery of a scandium oxide product. Separation of scandium and aluminum is the focus of the next phase of test work.

Doubleview said tests have shown that scandium can be extracted from tailings using sulphuric acid at elevated temperatures as a lixiviant. Tests also show that scandium can be separated into an intermediate scandium – aluminum product that can be processed further for the recovery of a scandium oxide product. Separation of scandium and aluminum is the focus of the next phase of test work.

Meanwhile, drilling has resumed at the Hat project, as per the Company’s news release in late July, 3,460 metres of drilling was completed already.

The company said the main objectives of the 2024 drilling program are to improve grade and further explore mineralization trends identified by statistical and geological models. Another objective is to conduct infill drilling in areas where drill holes are sparce or overly widespread and better define he deposit’s envelope.

Drill crews will also target areas of shallower mineralization to improve grade and tonnage prior to a future “Version 2” mineral resource estimate. “Several opportunities to improve the maiden resource were identified which we want to realize promptly during this year’s field season, including very targeted drilling,’’ Shirvani said.

“Year by year, the size of the deposit has increased by very targeted drilling, bringing it to a footprint of about 1.5 kilometres by 1.38 kilometres,” he said.