Doubling down on success, Endeavour Silver Corp sets to transform silver production with new mine

By Peter Kennedy

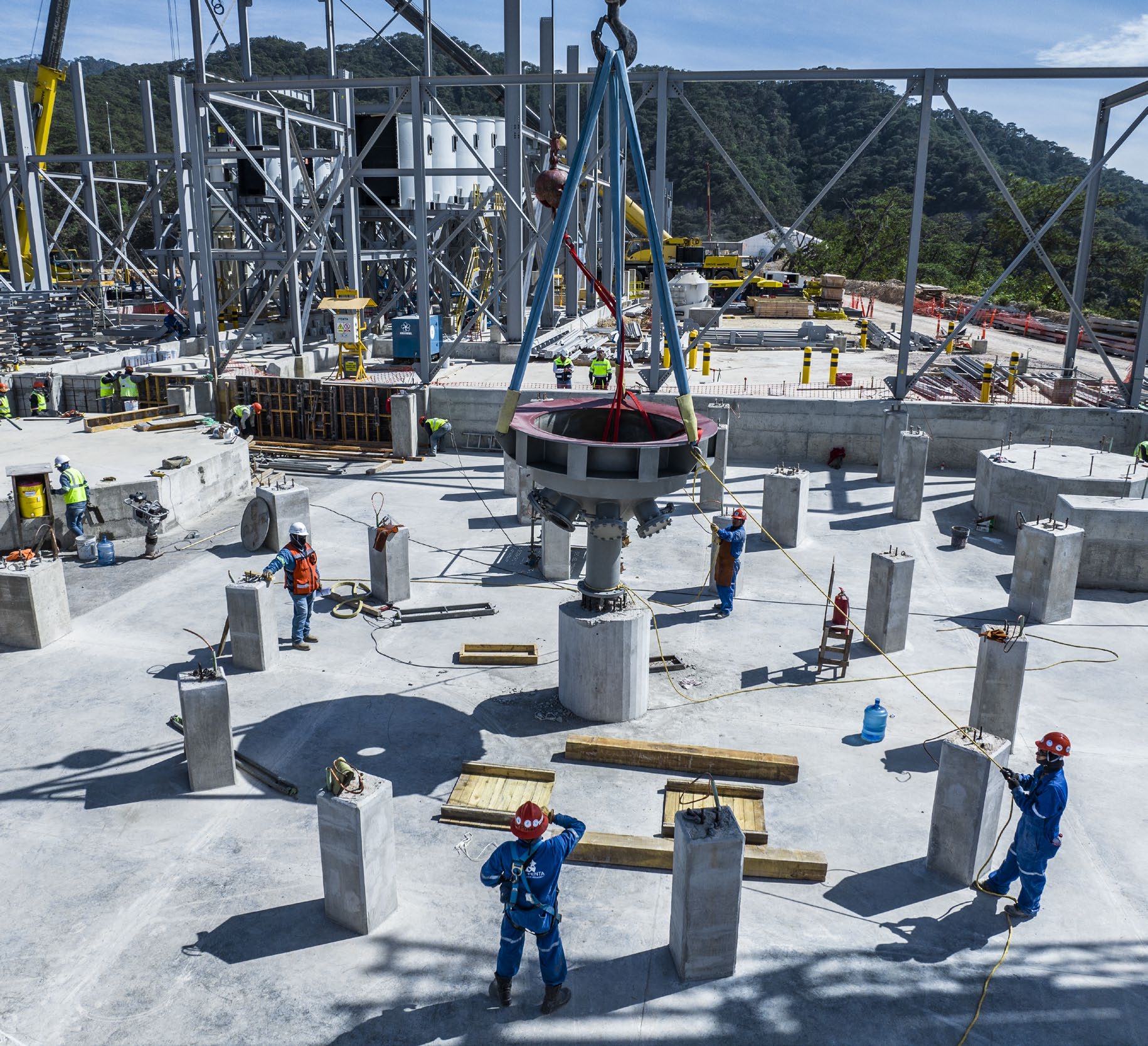

Endeavour Silver Corp. [EDR-TSX, EXK-NYSE], a silver producer in Mexico for 20 years, is commissioning a new mine that is expected to transform the company by roughly doubling its production while cutting costs in half.

Once up and running, the Terronera mine is expected to provide jobs for 550 in Jalisco State, Mexico and deliver US$170 million in tax payments over its lifespan.

Once up and running, the Terronera mine is expected to provide jobs for 550 in Jalisco State, Mexico and deliver US$170 million in tax payments over its lifespan.

Endeavour is a mid-tier precious metals mining company that operates two high-grade underground silver-gold mines in Mexico. They include the Guanacevi Mine in Durango and the Bolanitos Mine in Guanajuato.

In 2023 Endeavour produced 8.7 million ounces of silver equivalent (AgEq), in line with the company’s previous guidance, generating annual revenue of US$206 million.

Endeavour Silver CEO Dan Dickson described the new Terronera mine as “a very important strategic asset for our company and our stakeholders,” boasting an expected 10-year mine life and nearly 90 million silver equivalent ounces in reserves.

Located about 50 kilometres from the Mexican port city of Puerto Vallarta, it is expected to produce 4.0 million ounces of silver and 38,000 ounces of gold per year (7.0 million ounces of AgEq) over its lifespan.

With an updated initial capital cost of US$271 million, the new underground mine will become Endeavour Silver’s flagship operation and rank as one of the lowest cost silver mines in the world. Once in production, it will take the company one step closer to becoming a premier, senior silver producer

When the company released its first quarter results on May 9, 2024, the company said overall project progress had reached 53% and the project remains on track for commissioning in the fourth quarter of 2024.

As per requirements under a US$120 million senior secured debt facility, the company must self-fund development from cash on hand before drawing on the facility.

As per requirements under a US$120 million senior secured debt facility, the company must self-fund development from cash on hand before drawing on the facility.

Bringing Terronera online is a key part of Endeavour’s plan to capitalize on an expected rise in the price of silver, which was trading at US$30.56 an ounce on June 3, 2024. In a recent interview with Resource World, Dickson said he believes the precious metal will soon push above the US$50 an ounce level. “It is just a matter of time,” he said.

His optimism is based on the crucial role that silver is expected to play as the world transitions to a more sustainable future via increased production of electric vehicles and renewable power sources, including solar panels.

It is worth noting that battery-powered electric vehicles require twice as much silver as internal combustion engines. It is one reason why Dickson said, “Supply and demand fundamentals look very frothy for silver.’’

He also expects silver to play ‘catch up’ with gold, which has been trading recent a record-highs. “We have seen all-time highs for gold, but we haven’t seen that yet for silver,’’ he said.

Dickson was promoted to the role of CEO in May, 2021. He was previously the company’s chief financial officer and has been with Endeavour since 2007.

This year, the company is highly focused on Terronera and getting that mine into production.

This year, the company is highly focused on Terronera and getting that mine into production.

Pitarrilla is the next project in the pipeline and is expected to be another cornerstone asset in Endeavour’s growth plans. Located in Durango State, Mexico, it is one of the largest silver deposits, with nearly 600 million ounces of silver defined.

In January, 2022, the company said it had struck a deal to acquire the Pitarrilla project from SSR Mining Inc. [SSRM-TSX, NASDAQ, SSR-ASX] for US$70 million and a 1.25% net smelter returns royalty. Pitarrilla is a large undeveloped silver, lead and zinc project located 160 kilometres north of Durango City in northern Mexico.

The payable amount consisted of US$35 million in Endeavour shares and US$35 million in cash.

The property covers 4,950 hectares across five concessions and has significant infrastructure in place with direct access to utilities. The company says a 2012 technical report details a feasibility study outlining a large, mainly open pit operation and a mineral resource estimate which has been published by SSR.

The total indicated mineral resource (open pit and underground) at Pitarrilla stands at 158.6 million tonnes, containing 491.6 million ounces of silver, grading 96.4 g/t, 1.1 billion pounds of lead, grading 0.31%, 2.6 billion pounds of zinc grading 0.74% for a total of 693 million ounces of AgEq grading 136 g/t.

On top of that is an inferred resource (open pit and underground) totaling 35.4 million tonnes, containing 99.4 million ounces of silver, grading 87.2 g/y, 281 million pounds of lead, grading 0.36%, 661 million pounds of zinc grading 0.85% for a total of 151.2 million ounces of AgEq, grading 132.7 g/t.

However, due to the opposition to the development of open pit mines in Mexico, Endeavour is conceptualizing an underground operation at the site that would focus on the extraction of high-grade core of the deposit. The company is mindful of the fact that SSR Mining published two technical reports, consisting of a prefeasibility study in 2009 focused on a high-grade underground mine scenario and a feasibility study in 2012, which evaluated an open-pit concept.

The 2009 pre-feasibility study envisaged a 4,000 tonne-per-day operation with a 12-year lifespan that would target sulphides beyond the limits of a conceptual open pit mine.

It is worth noting that a number of key permits are already in place for underground mining and development, including permits for water use and discharge, general use of explosives, change of soil use and underground mining and development.

When it acquired the Pitarrilla project from SSR, Endeavour agreed to incur a minimum of US$10 million in exploration expenses on Pitarrilla over five years.

This year, the company said it will spend $5.1 million on drilling, development and fortification costs to advance a 1.0-kilometre-long tunnel that will be used as a drill platform. The company plans to drill 5,000 metres to better understand the geology surrounding the Underground manto zone and feeder structures.

On June 6, 2024, Endeavour Silver shares were trading at $5.38 in a 52-week range of $5.73 and $1.94.