Erdene Significantly Increases Resource Estimate at the Altan Nar Gold-Polymetallic Project

Erdene Resource Development Corp. (TSX:ERD), is pleased to announce an updated mineral resource estimate (“Mineral Resource”) for its 100%-owned Altan Nar gold-polymetallic project in southwest Mongolia.

“We are extremely pleased with the significant increase in size and grade of today’s Altan Nar Resource and believe it will be an excellent complement to a Global Resource Estimate expected in Q3-2018 incorporating our near-surface, high-grade Bayan Khundii gold project, 16 kilometres to the southeast, where drilling continues,” said Peter Akerley, Erdene’s President and CEO. “It is important to recognize that while Altan Nar has expanded significantly this remains an early-stage discovery with multiple untested targets over the 5.6 kilometre Altan Nar trend, with limited drilling at depth. This reflects the fact that no modern exploration took place in this new district prior to the Erdene discoveries.”

Highlights of 2018 Mineral Resource at Reported Cut-Off Grade

- Indicated gold equivalent (“AuEq”) resource increased by 208% and Inferred AuEq resource increased by 172%, compared to the Company’s March 2015 Altan Nar maiden mineral resource estimate.

- Indicated Resource of 452,900 ounces (“oz”) AuEq averaging 2.8 g/t AuEq and Inferred Resource of 277,100 oz AuEq averaging 2.5 g/t AuEq, within a total resource of 5.0 million tonnes (“Mt”) Indicated and 3.4 Mt Inferred.

- Indicated Resource includes 317,700 oz gold (at 2.0 g/t gold), 31,600 tonnes (“t”) zinc, 29,000 t lead, and 2.35 million oz silver, while the Inferred Resource contains 185,700 oz gold (at 1.7 g/t gold), 23,700 t zinc, 22,300 t lead, and 865,900 oz silver.

- AuEq grade increased by 12% in the Indicated category, and 19% in the Inferred category.

- Gold grade increased by 18% in the Indicated category, and 13% in the Inferred category.

- Approximately 90% of the Mineral Resource is within 150 metres of surface with all zones open along strike and at depth.

- Multiple undrilled and scout-drilled prospects along the 5.6 kilometre Altan Nar trend have the potential for hosting additional gold-polymetallic resources.

Overview – Altan Nar Mineral Resource

Erdene announced a maiden resource estimate for Altan Nar in March 2015 incorporating results from 71 diamond drill holes totalling 10,819 metres. Subsequently, between Q3-2015 and Q4-2017, the Company completed an additional 51 diamond drill holes totaling 7,782 metres. Data from these additional holes are included in today’s updated Mineral Resource estimate.

The post-2015 drilling focused on expanding existing resource boundaries in the Discovery Zone (“DZ”) and Union North (“UN”) deposits, as well as expanding and exploring for additional mineralization within the remaining 16 target areas throughout the 5.6 kilometre trend. This work resulted in the discovery of a high-grade central core in the DZ area and outlined additional resources in the peripheral targets. The DZ drilling in particular has had a significant impact on the overall size and grade of the updated Mineral Resource.

Altan Nar is considered to be a carbonate-base metal gold (“CBMG”) deposit that is characterized by multiple, sub-parallel, moderately to steeply dipping, epithermal vein and breccia zones that in all cases remain open at depth and along strike throughout the 5.6 kilometre long Altan Nar trend, presenting a significant opportunity for resource expansion. Â Mineralized zones in typical CBMG deposits are commonly restricted to fault/breccia zones that can extend for more than 500 metres vertically. Â The average drill depth of the 122 holes completed at Altan Nar is 157 metres (angled, not vertical) with approximately 90% of the Mineral Resource within 150 metres of surface.

Statement of Mineral Resources

The reported Resource Report is based on information provided to RPMGlobal (“RPM”) by Erdene and verified where possible by RPM. All statistical analysis and mineral resource estimations were carried out by RPM.

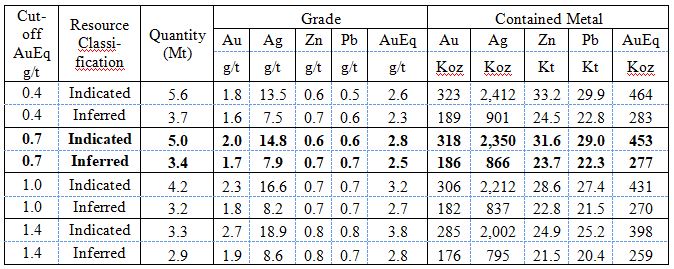

Table 1 below shows the Indicated and Inferred Mineral Resource estimate for Altan Nar as at May 7, 2018. The Mineral Resource was completed by RPM in accordance with the recommended guidelines of the CIM Definition Standards referenced in NI 43-101. RPM calculated the Altan Nar Mineral Resources for a number of AuEq cut-offs, however RPM recommends reporting the Mineral Resource at a 0.7 g/t AuEq cut-off for open pit resources, and 1.4 g/t AuEq below the same pit shell (see “Statement of Reportable Cut-off Grade” below). Table 1 shows the variation in tonnage and metals content with variable cut-off grades above the pit shell (0.4 g/t AuEq, 1.0 g/t AuEq and 1.4 g/t AuEq cut-off grades), while keeping the 1.4 g/t AuEq below the pit shell consistent.  The Company will file a NI 43-101 Mineral Resource Estimate and Technical Report on SEDAR within 45 days of this news release.

Table 1- Altan Nar Project – Mineral Resource Estimate Summary, May 7, 2018

1. The Mineral Resources have been constrained by topography and a cut-off of 0.7 g/t AuEq above a pit and 1.4 g/t AuEq below the same pit shell.

2. The Mineral Resource Estimate Summary has been compiled under the supervision of Mr. Jeremy Clark who is a full-time employee of RPM and a Member of the Australian Institute of Geoscientists. Mr. Clark has sufficient experience that is relevant to the style of mineralization and type of deposit under consideration and to the activity that he has undertaken to qualify as a Qualified Person as defined in the CIM Standards of Disclosure.

3. All Mineral Resource figures reported in the table above represent estimates as at May 7, 2018. Mineral Resource estimates are not precise calculations, being dependent on the interpretation of limited information on the location, shape and continuity of the occurrence and on the available sampling results. The totals contained in the above table have been rounded to reflect the relative uncertainty of the estimate. Rounding may cause some computational discrepancies.

4. Mineral Resource grades are reported in accordance with the CIM Standards.

5. Mineral Resources reported on a dry in-situ basis.

6. No dilution or ore loss factors have been applied to the reported Resource Estimate.

7. No allowances have been made for recovery losses that may occur should mining eventually result.

8. Gold Equivalent (“AuEq”) calculations assume metal prices of US $1,310 per ounce gold, US $18 per ounce silver, and US $2,400 per tonne lead and US $3,100 per tonne zinc and processing recoveries as per below.

Statement of Reportable Cut-off Grade

RPM’s statement of Mineral Resources has been constrained by topography and a cut-off grade of 0.7 g/t AuEq for potential open pit resources above a pit shell, and 1.4 g/t AuEq below the same pit shell.

A pit shell was utilized to determine the maximum depth of potential open pit mining, within which the above cut-off grades were utilized to report the Mineral Resource using a US $1,570 per ounce gold price (20% above the US $1,310 per ounce optimization price) and the costs and recoveries listed below.

The selected pit shell was generated using the following parameters, which are based on RPM’s internal cost pricing within Mongolia and the preliminary metallurgical study:

- Metal Prices (RPM notes this is based on eventual extraction at a future date and not the long-term consensus forecast):

- Gold: US $1,310 per ounce

- Silver: US $18 per ounce

- Lead: US $2,400 per tonne

- Zinc: US $3,100 per tonne

- Mining Cost of US $6 per tonne rock;

- A block model using 10x5x5 metre blocks, which is considered the selective mining unit, with 5% dilution and 10% ore loss, was applied;

- Processing costs of US $20 per tonne milled; and

- Processing recoveries of:

- Gold: 88%

- Silver: 81%

- Lead: 81%

- Zinc: 60%

RPM highlights that the pit optimizations were used to define the depth of the various cut-off grades to report the Mineral Resource, however, the cut-off grades applied were estimated based on a gold price of US $1,570 per ounce. Furthermore, it is noted that, given the long strike length and variation in grade, the potential open pit depth varies, as such, the application of a consistent depth is not appropriate and the use of a pit optimization to define variable depths is suitable.

A gold price of US $1,570 per ounce was selected to determine the maximum depth of potential open pit mining based on historical prices (last 5 years). RPM notes that this price is above the current long-term forecast, however, RPM notes that the gold price was significantly higher in the past 5 years and, as such, has utilized a higher price to determine the maximum depth of potential open cut mining.

To determine the potential underground mining cut-off grade an open stoping method was assumed resulting in a total mining cost of US $35 per tonne.

While a detailed schedule and option analysis has not been completed to confirm the optimal mining method, given the sub-vertical continuous style of mineralization within sheet-like shears occurring near-surface within the currently defined resource areas, open pit mining is likely to be appropriate, pending the option analysis. Additional mining design along with more detailed and accurate cost estimate mining studies and testwork are required to confirm viability of extraction.

RPM notes that these pit shells were completed to report the contained Mineral Resources in order to demonstrate the reasonable prospect for eventual economic extraction, and highlights that capital expenditure has not been included, and that these pits do not constitute a scoping study or a detailed mining study which, along with additional drilling and testwork, is required to be completed to confirm economic viability. RPM has utilized operating costs based on in-house databases of similar operations in the region and processing recoveries based on preliminary metallurgical test work, along with the commodity prices noted above, in determining the appropriate cut-off grade. Given the above analysis, RPM considers both the open pit and material below the pit demonstrates reasonable prospects for eventual economic extraction, however, highlights that additional studies and drilling are required to confirm economic viability.

Erdene Q2-Q4 2018 Technical Program

With the updated Mineral Resource now established at Altan Nar, Erdene will work toward completing a maiden mineral resource estimate at its neighboring, 100%-owned Bayan Khundii gold project, 16 kilometres southeast of Altan Nar. Erdene intends to announce a Global Resource Estimate, for both Bayan Khundii and Altan Nar, in Q3-2018. The Company is currently completing a drill program at Bayan Khundii to follow-up on high priority structural targets in advance of the maiden resource estimate.

Qualified Person and Sample Protocol

The Resource Estimate included in this press release was prepared under the supervision of Jeremy Clark, RPMGlobal, Hong Kong. Mr. Clark is a Qualified Person within the meaning of such term under NI 43-101; Mr. Clark is a Member of the Australian Institute of Geoscientists (MAIG) Membership No 3567. Mr. Clark has reviewed this press release and consents to the inclusion in this release of the matters disclosed based on Resource Estimate documents provide to the Company by RPM. A NI 43-101 Mineral Resource Estimate and Technical Report will be filed on Erdene’s SEDAR page within 45 days of this news release.

Michael MacDonald, P.Geo. (Nova Scotia), Vice President Exploration for Erdene, is the Qualified Person as that term is defined in National Instrument 43-101 and has reviewed and approved the non-Resource Estimate technical information contained in this news release on behalf of Erdene. All samples have been assayed at SGS Laboratory in Ulaanbaatar, Mongolia. In addition to internal checks by SGS Laboratory, the Company incorporates a QA/QC sample protocol utilizing prepared standards and blanks.