Filo unveils $100 million investment by BHP

Filo Mining Corp. [FIL-TSXV, NASDAQ First North] on Monday announced a $100 million strategic investment by BHP Western Mining Resources International Pty. Ltd., a unit of BHP Billiton Ltd. [BHP-NYSE, BHPLF-OTCPK]. The funds will be used to advance Filo’s 100%-owned Filo del Sol project, which straddles the border of Region 111, Chile and San Juan Province, Argentina.

Under the transaction, BHP will invest $100 million by way of a non-brokered private placement in Filo, which will issue 6.27 million common shares at $15.95 per share. That represents a 12% premium to the 20-day volume weighted average trading price of the shares on the TSX, ending February 25, 2022, when the shares closed at $14.30. The 52-week range for the shares is $16.50 and $2.20.

Upon closing of the private placement, BHP will own approximately 5% of Filo Mining’s issued and outstanding common shares. Closing is expected to occur by March 11, 2022.

“This secures the next leg of funding required for us to rapidly expand our exploration plans at Filo del Sol as we define this remarkable deposit, said Filo President and CEO Jamie Beck.

Under the deal, BHP will be granted certain participation top-up rights, allowing it to maintain its ownership interest in Filo. In addition the companies will form a joint advisory committee to share exertise, exploration concepts, and discuss the future of the project.

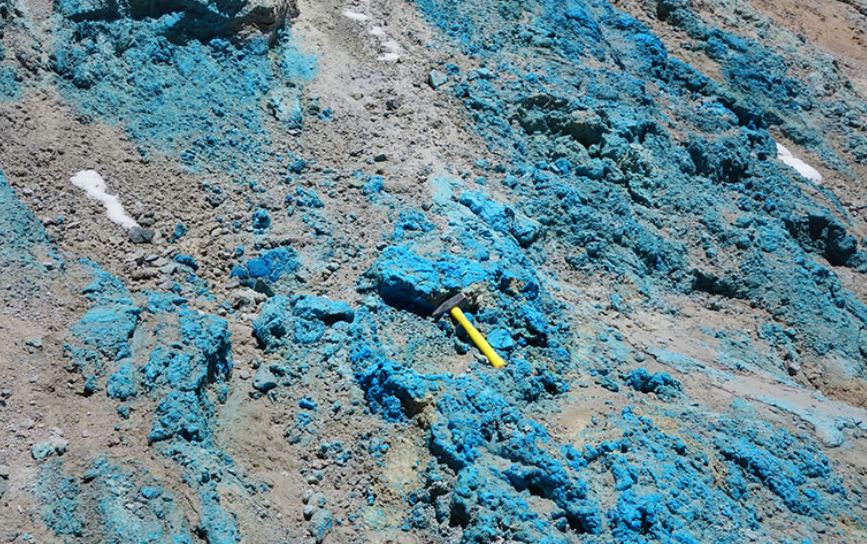

Filo Mining is a member of the Lundin Group of companies. The Filo del Sol project is a high-sulphidation epithermal copper-gold-silver deposit associated with one or more large porphyry gold system.

Filo del Sol is located in the Andes Mountains, 140 kilometres southeast of the Chilean city of Copiapo and was recently the subject of a pre-feasibility study that is based on proven and probable reserves of 259.1 million tonnes, grading 0.39% copper, 0.33 g/t gold, 15.1 g/t silver, or 2.2 billion pounds of copper, 2.7 million ounces of gold and 126 million ounces of silver.

The prefeasibility study envisages annual production of approximately 67,000 tonnes of copper (including copper as a precipitate), 159,000 ounces of gold and 8.6 million ounces of silver at a cost of US$1.23 per pound of copper equivalent.

The pre-production capital cost is estimated at $1.27 billion. Over a 14-year mine life (including pre-stripping) the operation is expected to produce almost 1.75 billion pounds of copper as cathode, and 1.92 million ounces of gold and 104 million ounces of silver as dore over a 13-year leach feed schedule.

The company has said it is convinced that Filo Del Sol will turn out to be one of the most important copper-gold-silver discoveries in recent years.

Filo recently reported assay results from one of the best holes drilled so far at the Filo del Sol.

The company said drill hole FSDHO54 returned 1,224 metres of 1.26% copper equivalent (CuEq) from a depth of 146 metres, including 592 metres at 2.04% CuEq, and 171 metres at 3.22% CuEq.

This intersection lies completely outside the current mineral resource and the high-grade zone remains open to the west, east, north and at depth.