Fokus Releases an Initial Mineral Resource Estimate on Galloway Gold Project

Fokus Mining Corporation (“Fokus” or the “Company”) (TSXV: FKM, OTCQB: FKMCF, FSE: F7E1) is pleased to announce an initial mineral resource estimate (MRE) prepared by the independent firm InnovExplo Inc. This MRE have been classified in accordance with CIM Definition Standards on Mineral Resources and Mineral Reserves (CIM, 2014) and follows the CIM Estimation of Mineral Resources and Mineral Reserves Best Practice Guidelines (CIM, 2019).

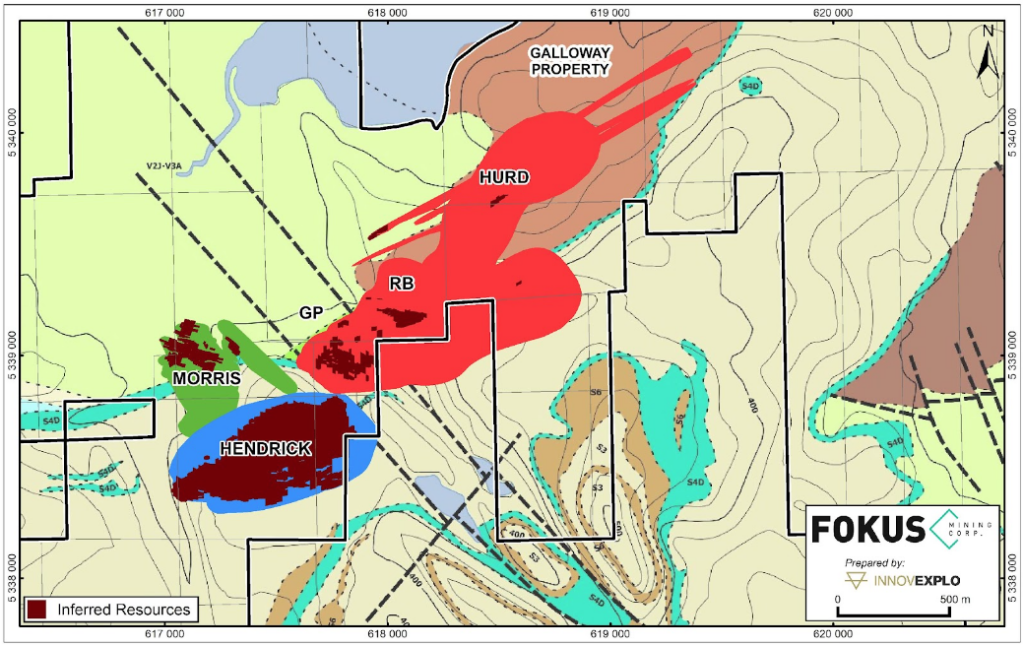

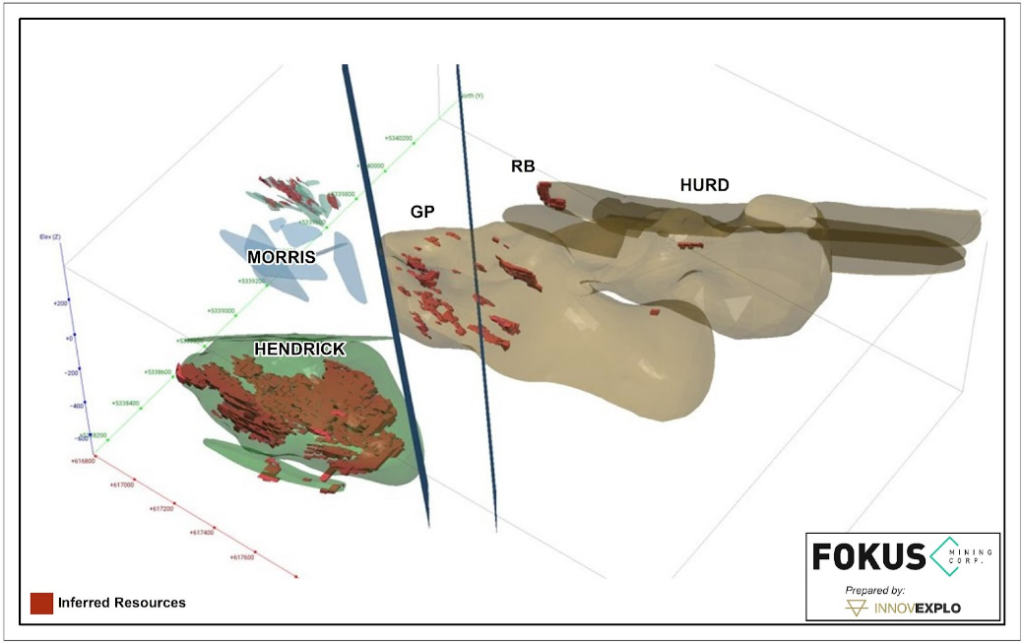

The initial MRE is based on recent exploration and drilling programs, mineralization modelling and metallurgical testing from the Moriss, Hendrick and GP gold deposits (Figure 1). It was prepared by InnovExplo and effective as of March 21, 2023, all in the Inferred Mineral Resource category.

Over 40,000 metres of diamond drilling has been completed in the last two years. The Company now plans to prioritize infill drilling and testing potential lateral extensions and will continue to drill the recently discovered RB mineralized zone in the near term.

Notes to the 2023 MRE1. The effective date of the 2023 MRE is March 21, 2023

2. The independent and qualified persons (as defined by NI 43-101) for the 2023 MRE are Olivier Vadnais-Leblanc, P.Geo., Marc R. Beauvais, P.Eng. from InnovExplo Inc, and David Le Tourneux, P.Eng., from Soutex.

3. The mineral resource estimate conforms to the CIM Definition Standards (2014) and follows the CIM MRMR Best Practice Guidelines (2019).

4. These mineral resources are not mineral reserves, because they do not have demonstrated economic viability. The results are presented undiluted and are considered to have reasonable prospects of economic viability.

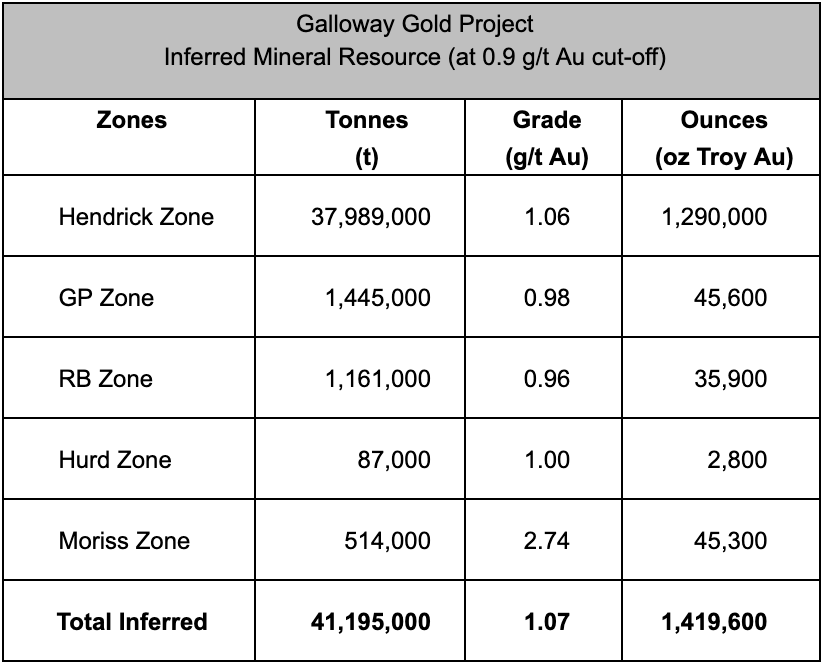

5. The estimate encompasses 5 mineralized zones. Hendrick, GP, RB and HURD are made only of 1 3D porphyry type solid each and Morris has 25 smaller vein type 3D solids.

6. No capping was applied on Hendrick, GP, RB and HURD (porphyry type). 5 m composites were calculated within the zones using the grade of the adjacent material when assayed or a value of zero when not assayed. For Moriss (veins part of the deposit), composite length was set at 1m. High-grade capping supported by statistical analysis was done on compositing and was set to 20 g/t Au on Moriss.

7. The estimate was completed using a sub-block model in Surpac. A 20m x 20m x 20m parent block size was used for Hendrick, GP, RB and HURD. Parent block size for Morris is 3m x 3m x3m.

8. Grade interpolation was obtained by Inverse Distance Squared (ID2) using hard boundaries.

9. A density value of 2.78 g/cm3 was assigned to all mineralized zones.

10. Mineral resource estimate is all classified as Inferred. The Inferred category is defined with a minimum of two (2) drill holes within the areas where the drill spacing is respectively less than 125 m for GP, RB and HURD, 400 m for Hendrick and 80 m for Moriss. Data must show reasonable geological and grade continuity.

11. The 2023 MRE is locally constrained within Deswik Stope Optimizer shapes using a minimal mining width of 25 m for a potential bulk underground mining scenario (potential block of 25m X 25m X 25m). It is reported at a rounded cut-off grade of 0.90 g/t Au using the bulk mining method. The cut-off grades were calculated using the following parameters: mining cost = C$35/t; processing cost = C$17.82/t; G&A = C$7.00/t; refining costs = C$5.00/oz; selling costs = C$5.00/oz; gold price = US$1,750.00/oz; USD:CAD exchange rate = 1.31; and mill recovery = 90.3%. The cut-off grades should be re-evaluated in light of future prevailing market conditions (metal prices, exchange rates, mining costs etc.).

12. The number of metric tonnes was rounded to the nearest thousand, following the recommendations in NI 43-101 and any discrepancies in the totals are due to rounding effects. The metal contents are presented in troy ounces (tonnes x grade / 31.10348) rounded to the nearest hundred. Numbers may not add up due to rounding.

13. The independent and qualified persons for the 2023 MRE are not aware of any known environmental, permitting, legal, political, title-related, taxation, socio-political, or marketing issues that could materially affect the Mineral Resource Estimate.

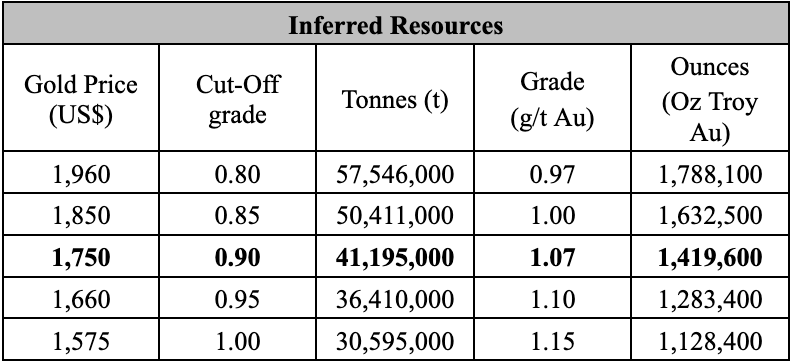

A sensitivity analysis was performed on the MRE to assess the variability to gold prices and found that the MRE has upside potential to higher gold prices while retaining over a million ounces at lower gold prices.

Jean Rainville, President and CEO, stated: “We are delighted to cross this initial milestone and demonstrate the potential for a multi-million once resource on the western portion of the Galloway property. While this MRE was completed with underground mining assumptions, there exist areas of gold mineralization on GP, RB and the Hurd sector that may have open pit potential. (Hurd is located north-east of RB). Hence, although timing is uncertain, a revisited MRE is in the cards as we now have a better understanding of the three mineralized zones included in the MRE where more drilling is required: 1) to get a better handle on the gold grade to find out if in fill drilling can support an increase in the MRE; and 2) to examine the potential for lateral extensions and depth potential on those same mineralized zones (Figure 2). As well, other areas such as the RB zone have only received limited work to date but our planned exploration program aims to leverage all the information we now have for maximum impact on continuing to advance the Galloway project. “

On a different note, regarding Galloway property, the Company now expects to be able to release the results of the four holes drilled on the RB Zone in January shortly and will be able to provide more details on this recently discovered mineralized sector. Fokus is also reviewing the results of the analysis of the geological study prepared by ALS-Goldspot on the entire Galloway property.

Figure 2

QUALIFIED PERSONS STATEMENT

THE MRE was prepared by Olivier Vadnais-Leblanc, P. Geo. and Marc R. Beauvais, P.Eng. from InnovExplo Inc, and David Le Tourneux, P.Eng., from Soutex. Mr. Vadnais-Leblanc, Beauvais and Le Tourneux have reviewed and approved the technical contents of this news release as it relates to the MRE.

Gilles Laverdiere, Director of the Company, P.Geo and Qualified Person under National Instrument 43-101 has also reviewed and approved the press release for Fokus.

ABOUT FOKUS MINING

Fokus Mining Corporation is a mineral resource company actively acquiring and exploring precious metal deposits located in the province of Québec, Canada. In implementing this major undertaking within the Canadian mining industry, we are determined to unlock the secret of the Galloway gold project.

The Galloway property covers an area of 2865.54 hectares and is located just north of the Cadillac-Larder Lake deformation which extends laterally for more than 100 kilometres. Numerous gold deposits are related to that structure and its subsidiaries. The current work focuses on a small western portion of the mineral claims where several mineral occurrences have been identified. For more information, visit our website: fokusmining.com.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

For further information:

Jean Rainville, President & Chief Executive Officer

Tel.: (514) 918-3125, Fax: (819) 762-0097

Email: jrainville@fokusmining.com

Caution Regarding Forward-Looking Statements

This press release contains statements that may constitute “forward-looking information” within the meaning of applicable Canadian securities legislation. Forward-looking information may include, among others, statements regarding the future plans, costs, objectives or performance of the Company, or the assumptions underlying any of the foregoing. In this press release, words such as “may”, “would”, “could”, “will”, “likely”, “believe”, “expect”, “anticipate”, “intend”, “plan”, “estimate” and similar words and the negative form thereof are used to identify forward-looking statements. Forward-looking statements should not be interpreted as guarantees of future performance or results, and will not necessarily be accurate indications of whether, or the times at or by which, such future performance will be achieved. No assurance can be given that any events anticipated by the forward-looking information will transpire or occur, including the future impact of Mosaic’s performance on the Company and its diversification into strategic minerals, the timing and the impact of the release the results of the four holes drilled on the RB Zone in January 2023, the timing for completing the review of the geological models and the completion of the compilation of historical data of the entire Galloway property by ALS Goldspot, the results of the initial NI 43-101 resource estimate for three of the mineralized zones: Hendrick, Morriss, and GP, including the timing for its completion, and what benefits the Company will derive from all the foregoing and the Galloway Property. Forward-looking information is based on information available at the time and/or management’s good-faith belief with respect to future events and are subject to known or unknown risks, uncertainties, assumptions and other unpredictable factors, many of which are beyond the Company’s control. These risks, uncertainties and assumptions include, but are not limited to, those described under “Financial Risk Management Objectives and Policies” in the Company’s Annual Report for the fiscal year ended December 31, 2021 and under “Risk and Uncertainties” of the Management’s Discussion & Analysis of the Company for the fiscal year ended December 31, 2021, copies of which are available on SEDAR at www.sedar.com, and could cause actual events or results to differ materially from those projected in any forward-looking statements. The Company does not intend, nor does the Company undertake any obligation, to update or revise any forward-looking information contained in this news release to reflect subsequent information, events or circumstances or otherwise, except if required by applicable laws.