Gatos ups 2023 silver production target by 16%

Gatos Silver Inc. [GATO-TSX, NYSE] has increased its 2023 full year production targets after announcing its third quarter financial results after the close of trading on November 6, 2023.

“As a result of continued good operational performance in the first month of the fourth quarter along with recent optimization of the mine plan, we are increasing our 2023 full year silver and silver equivalent (AgEq) production guidance by 16% and 8.0% respectively, based on the midpoint of each guidance range,” the company said in a press release.

Gatos generated $14.3 million in free cash flow in the third quarter on silver equivalent production of 3.5 million ounces at an all-in-sustaining cost of US$17.64 an ounce (co-product basis).

In the first nine months of 2023, the company reported production of 10.45 million AgEq, down from 11.68 million in the same period in 2022.

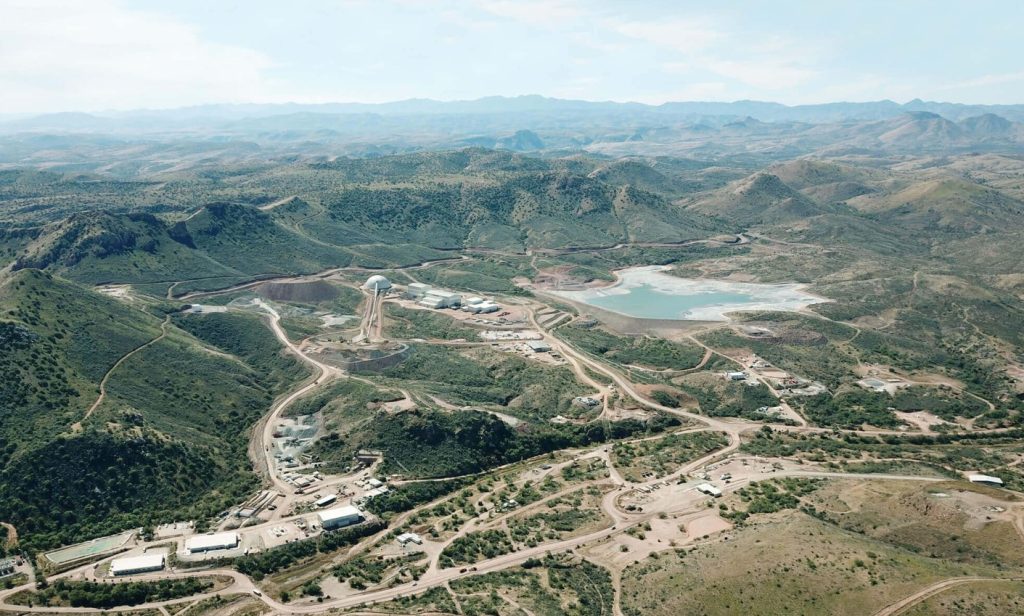

Gatos is a silver dominant exploration, development and production company that discovered a new silver and zinc-rich mineral district in southern Chihuahua State, Mexico.

Gatos has a 70% interest in the Los Gatos joint venture (LGJV), which in turn owns the Cerro Los Gatos mine in Mexico. Cerro Los Gatos achieved commercial production in 2019. The company is focused on operating the mine and on growth and development in the Los Gatos district. The LGJV consists of approximately 103,000 hectares of mineral rights, representing a highly prospective and under-explored district with numerous silver-zinc-lead epithermal mineralized zones identified as priority targets.

“The LGJV continues to generate robust cash flows with the CLG mine consistently producing high margin silver ounces,’’ said Gatos CEO Dale Andres.

He said the LGJV has returned $85 million to its partners in 2023, with the company receiving another cash distribution of $24.5 million.

In a press release on October 23, 2023, Gatos released an update on the drilling and exploration programs in the Los Gatos district. It said the update includes new intercepts of high-grade mineralization in the South-East Deeps zone that could provide additional mineral resources and reserves to extend the mine life.

“These drill intercepts, which are from areas located outside of our current mineral reserve, further support our target of extending the mine life by the third quarter of 2024,’’ Andres said.

He said definition drilling is identifying high-grade zones within the broader inferred resource. “We are prioritizing these zones for potential conversion to reserves,’’ he said. “We have also added an additional surface rig to advance drill testing of several high-priority near-mine and district exploration targets, which brings to 10 the number of active rigs on the property, including seven surface rigs and three underground rigs.’’

Drilling highlights include 3.9 metres (2.9 metres true width) at 550 g/t silver, 24.53% zinc, 13.74% lead, 0.46 g/t gold and 0.30% copper.

Gatos Silver shares eased 7.1% or 48 cents to $6.29 on volume of 271,000. The shares trade in a 52-week range of $10 and $4.45.