High uranium prices are breathing new life into old mines

Inkai uranium mine is owned 40% by Cameco and 60% by Kazatomprom, which is majority-owned by the Kazakh government.

Rejuvenated interest due to the pressing need for carbon-neutral energy sources, where nuclear power stands as a critical component.

By Editorial Assistant

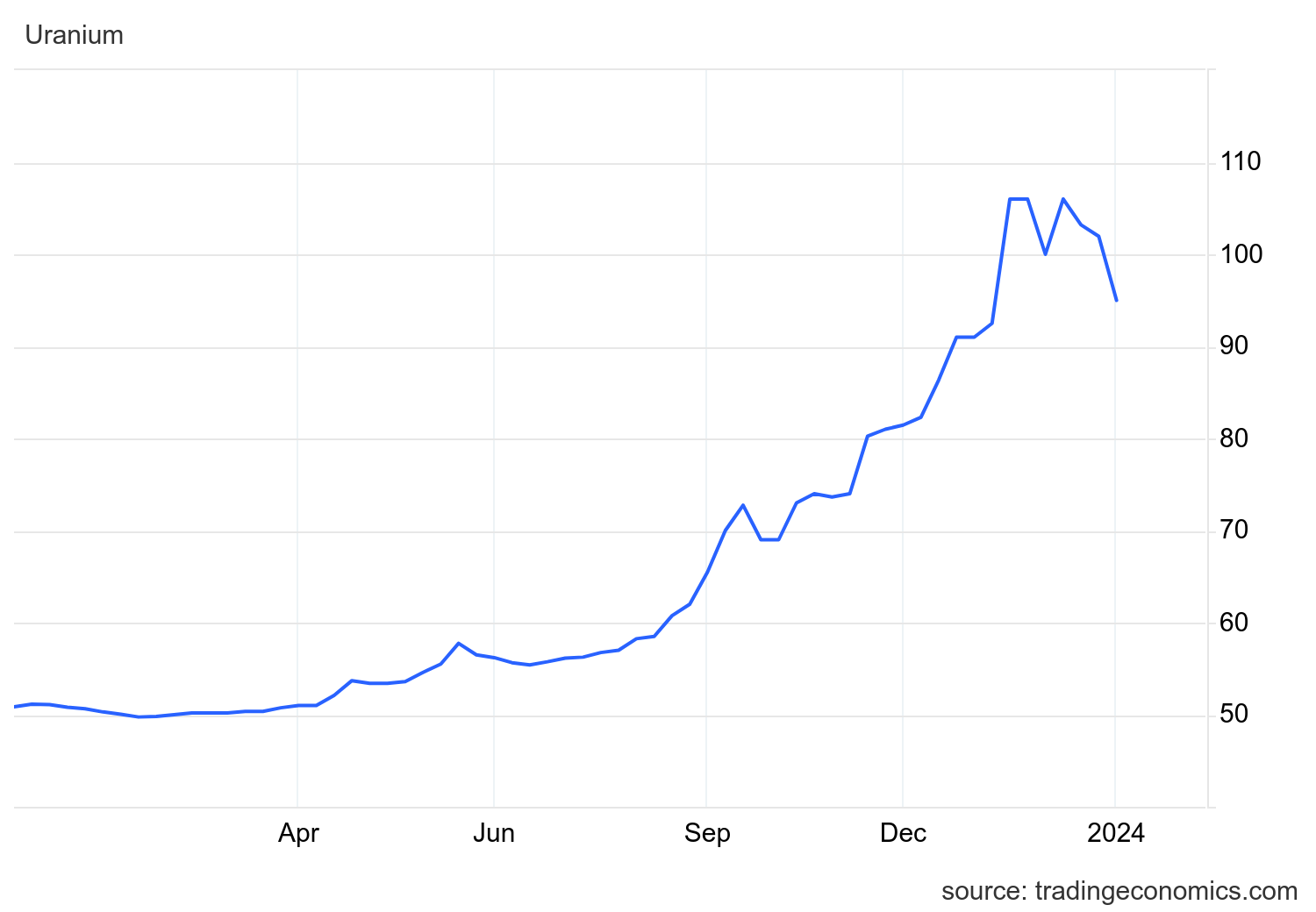

The global uranium market is currently experiencing a significant upturn, thanks to soaring demand and constricted supply chains. After years of stagnation and depressed prices, the industry sees a rush for uranium, whose prices have climbed to a 16-year peak, despite the recent pull back in late February where the price of Uranium dropped below $100 per pound for the first time in seven weeks, following the U.S. government’s decision to not include a ban on imports of Russian nuclear fuel in its most recent round of sanctions. This move alleviated worries about potential further supply risks in the international market.

The global uranium market is currently experiencing a significant upturn, thanks to soaring demand and constricted supply chains. After years of stagnation and depressed prices, the industry sees a rush for uranium, whose prices have climbed to a 16-year peak, despite the recent pull back in late February where the price of Uranium dropped below $100 per pound for the first time in seven weeks, following the U.S. government’s decision to not include a ban on imports of Russian nuclear fuel in its most recent round of sanctions. This move alleviated worries about potential further supply risks in the international market.

However, as uranium prices appreciate, the United States is witnessing a rekindling of its once dormant uranium mining sector. Mines that were previously left abandoned or on care and maintenance are now restarting activities. States like Wyoming, Texas, and Utah, which were known for uranium mining before the Fukushima incident that led to a global reassessment of nuclear power, have now positioned themselves at the forefront of the uranium surge, aiming to fill the widening gap between supply and demand.

Kyrgyzstan, whose uranium mining past remains overshadowed by a complex environmental legacy, is also poised to re-enter the uranium landscape. With officials calling for an overturn of the 2019 uranium mining ban, they envision economic revitalization through state-led production. This push is coinciding with discussions for a Russian-built nuclear plant, which further accentuates the country’s tilt towards nuclear energy amidst the increasing global uranium demand.

Nuclear power is increasingly being recognized as a key player in achieving climate goals due to its low carbon emissions. With countries striving to meet stringent emission targets, nuclear energy provides a reliable and steady supply of electricity, unlike the variable nature of solar and wind power. Uranium, as the primary fuel for nuclear reactors, therefore, commands a key role in the transition towards cleaner energy.

Supply risks, such as those caused by geopolitical tensions or operational setbacks faced by major producers, are adding fuel to the ascending uranium prices. The market’s dynamics have been altered by the production challenges of industry giants like Kazakhstan’s Kazatomprom and Canada’s Cameco, which have struggled to meet the uptick in uranium demand. These factors have contributed to a burgeoning supply deficit and escalating market interest in uranium as a commodity.