Hot Chili Reports New Results Boost Growth for Costa Fuego

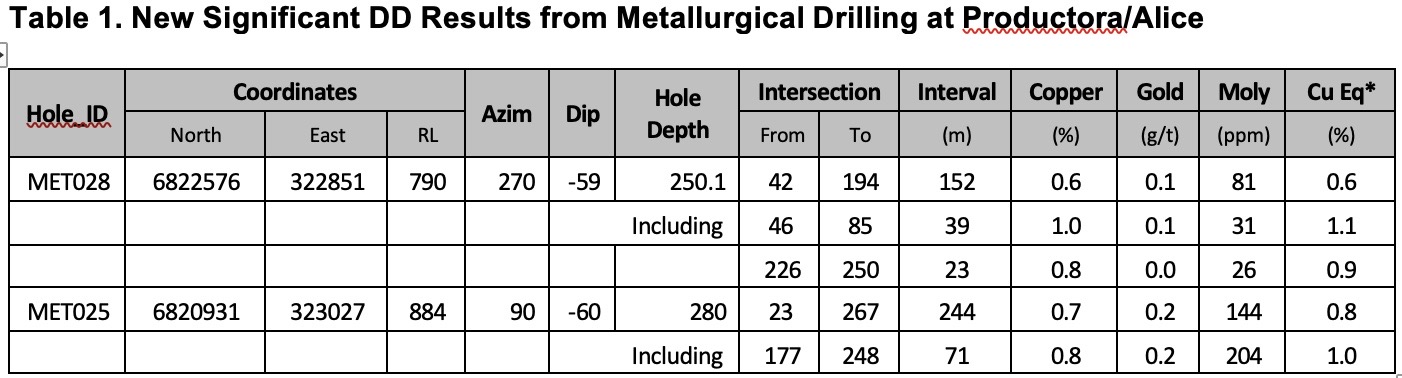

- New drill results deliver higher than expected copper grades from previously unsampled intervals of diamond core at Productora and Alice, part of the Cost Fuego senior copper development in Chile:

- 244m grading 0.8% CuEq (0.7% copper (Cu) & 0.2g/t gold (Au)) from 23m depth

including 71m grading 1.0% CuEq* (0.8% Cu, 0.2g/t Au) at Productora - 152m grading 0.6% CuEq (0.6% Cu & 0.1g/t Au) from 42m depth

including 39m grading 1.1% CuEq* (1.0% Cu, 0.1g/t Au)

and 23m grading 0.9%CuEq (0.8% Cu) from 226m to end of hole at Alice - Final drill results from Valentina confirm further high grade intersections ahead of planned expansion drilling, application for regulatory approval submitted:

– 6m grading 1.3% Cu from 10m depth downhole - Interesting silver assays returned from first-ever drilling at Santiago Z, follow-up programme being planned to test remaining sixty-five percent of the target area:

- Drill results pending and Pre-feasibility update expected shortly

* Copper Equivalent (CuEq) reported for the drillhole intersections were calculated using the following formula: CuEq% = ((Cu% * Cu price 1% per tonne * Cu_recovery)+(Mo ppm * Mo price per g/t * Mo_recovery)+(Au ppm * Au price per g/t * Au_recovery)+ (Ag ppm * Ag price per g/t *Ag_recovery)) / (Cu price 1% per tonne * Cu_recovery). The Metal Prices applied in the calculation were: Cu=3.00 USD/lb, Au=1,700 USD/oz, Mo=14 USD/lb, and Ag=20 USD/oz. The entirety of the intersection is assumed as fresh. The recovery and copper equivalent formula for eachdeposit is: Productora- Recoveries of 84% Cu, 47% Au, 47% Mo and 0% Ag (not reported). CuEq(%) = Cu(%) + 0.48 x Au(g/t) + 0.00026 x Mo(ppm).San Antonio and Valentina – Recoveries of 88% Cu, 72% Au, 88% Mo and 69% Ag. CuEq(%) = Cu(%) + 0.68 x Au(g/t) + 0.00047 x Mo(ppm) + 0.0076 x Ag(g/t)

Hot Chili Limited (ASX: HCH) (TSXV: HCH) (OTCQX: HHLKF) (“Hot Chili” or “Company”) is pleased to announce further strong results from drilling across the Company’s Costa Fuego coastal range copper-gold project in Chile.

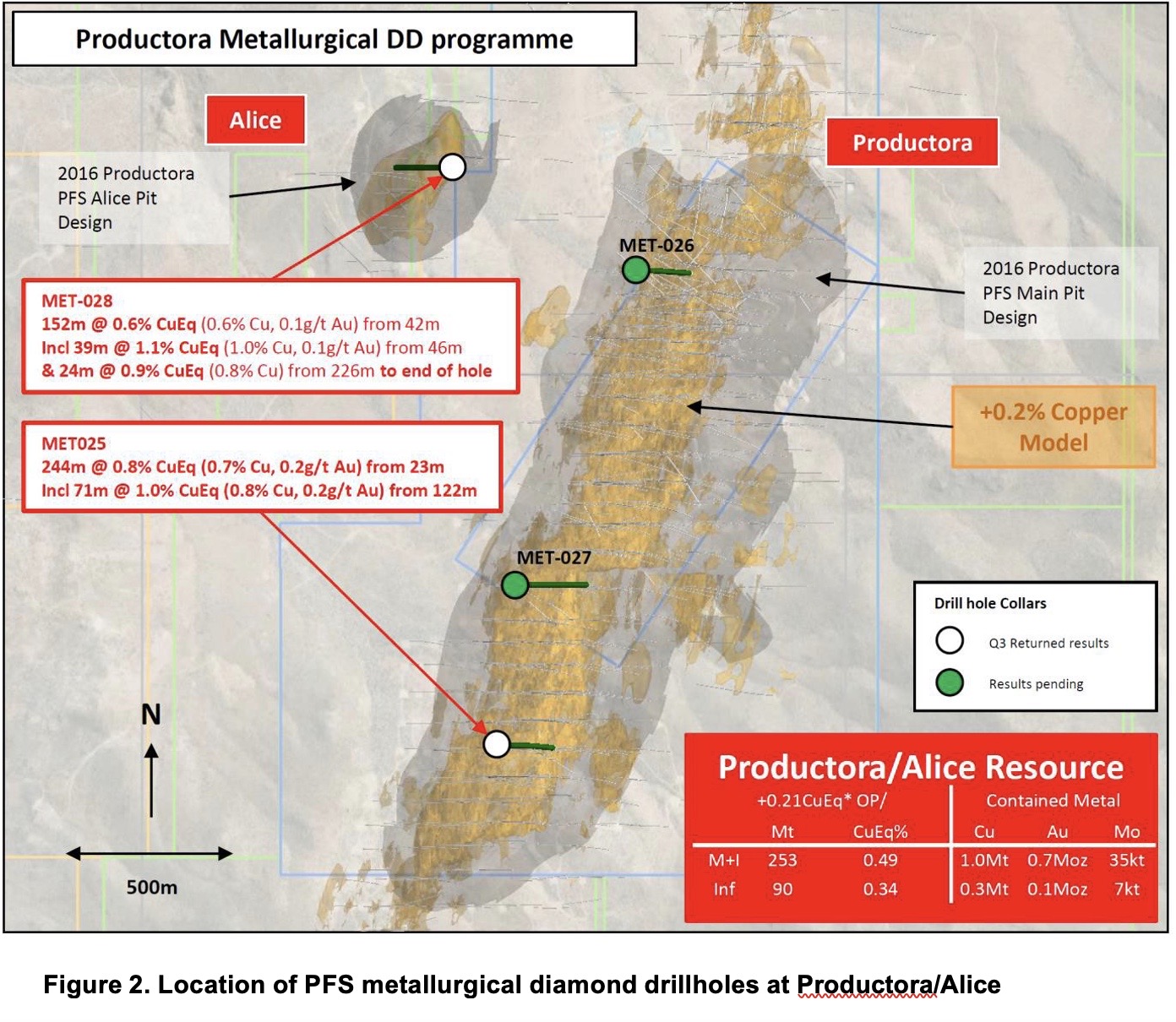

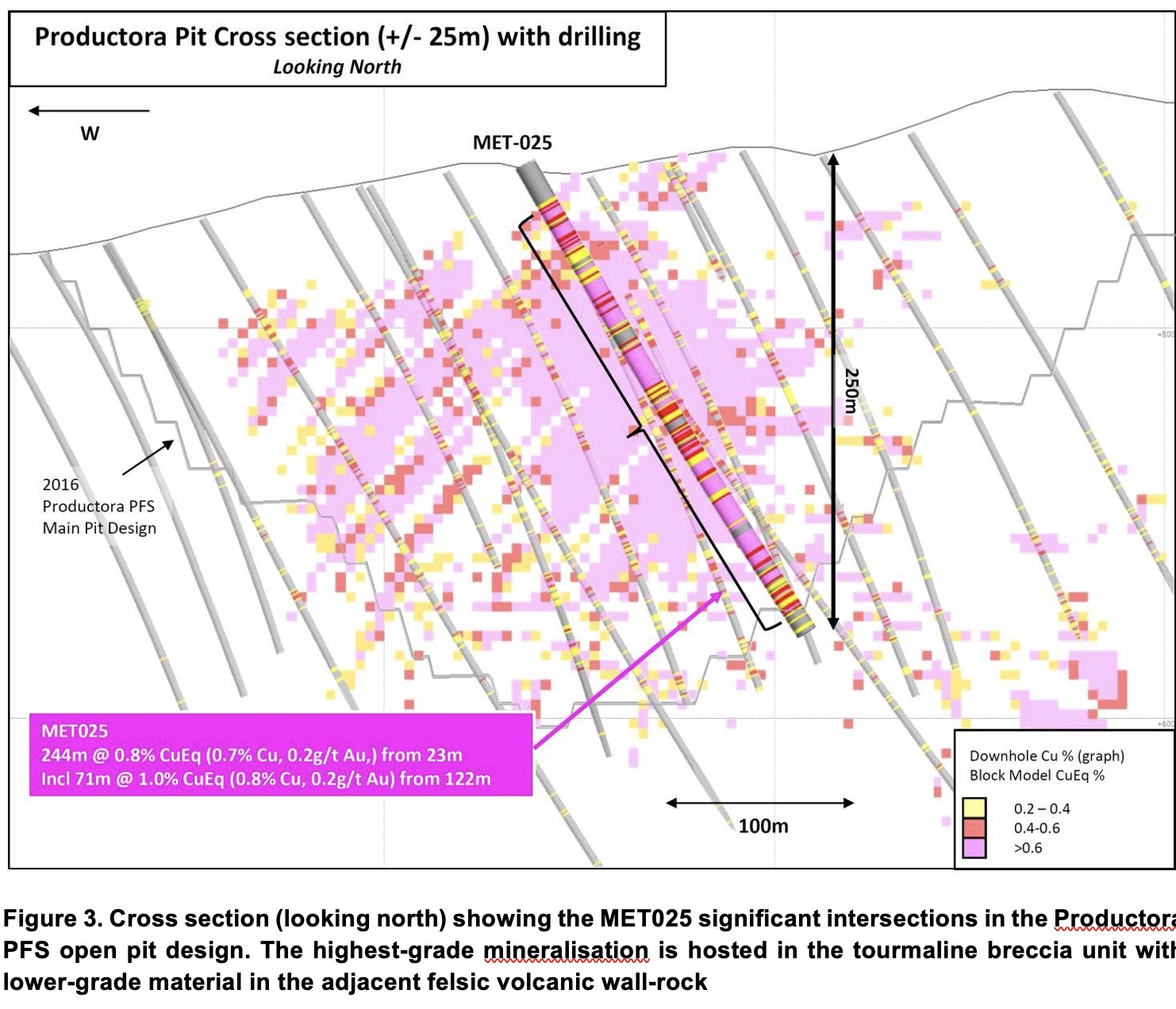

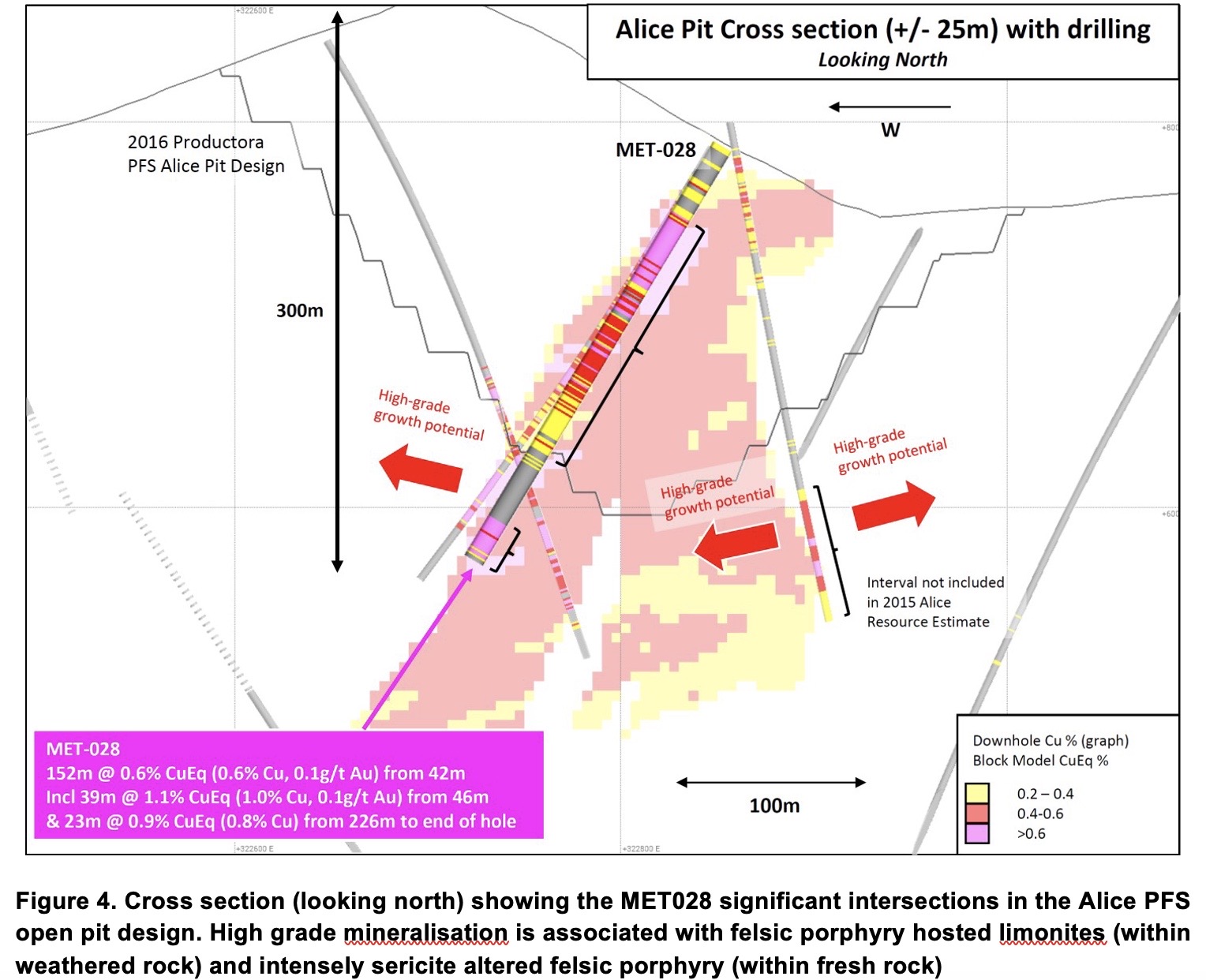

Assays from metallurgical testwork diamond drillholes have continued to exceed expectations, with near- surface, high grade intersections returned at the Productora and Alice porphyry deposits.

This is in addition to two new significant intersections at the Valentina high-grade satellite, which represents a potential front-end, open pit ore source for the combined Costa Fuego coastal copper super-hub.

First-ever drill results from the large-scale Santiago Z porphyry target have returned several wide silver and molybdenum intersections from shallow depths, however no significant copper-gold intersections were encountered. The results of this programme are being reviewed and a follow-up programme is being planned. Only thirty five percent of the target area at Santiago Z has been drill tested.

Further drill results are expected in the coming weeks and the Company looks forward to providing an update on resource upgrade and Pre-feasibility Study (PFS) work streams shortly.

Latest Drilling Results Outperform Productora Resource Estimate

MET025 (179.15m depth down-hole) – vein-hosted and disseminated chalcopyrite and pyrite in tourmaline breccia. The 179m to 180m interval graded 2.1% CuEq (1.9% Cu, 0.3% Au, 129ppm Mo)

Four diamond drill holes completed for metallurgical testwork across the Productora resource in Q2 this year have returned further wide zones of copper, following analysis of remaining unsampled core.

Strong visual intersections of mineralisation in each of the metallurgical drill holes provided encouragement to undertake sampling of all remaining unsampled diamond core intervals.

Results for the first two holes of the programme (Productora central pit area and Alice satellite pit area) have delivered better than expected copper grades, including:

- 244m grading 0.8% CuEq (0.7% Cu & 0.2g/t Au) from 23m depth (MET025 – Productora)

including 71m grading 1.0% CuEq* (0.8% Cu, 0.2g/t Au) - 152m grading 0.6% CuEq (0.6% Cu & 0.1g/t Au) from 42m depth (MET028 – Alice porphyry)

including 39m grading 1.1% CuEq* (1.0% Cu, 0.1g/t Au)

and 23m grading 0.9%CuEq (0.8% Cu) from 226m to end of hole

New results have added further high grade growth ahead of a planned resource upgrade for Costa Fuego. Productora and Alice have continued to demonstrate grade upside with in-fill drilling, providing positive reconciliation ahead of any future mining activities.

Entire hole results from the remaining two diamond holes at Productora (MET026 and MET027) are expected to be received in the coming weeks.

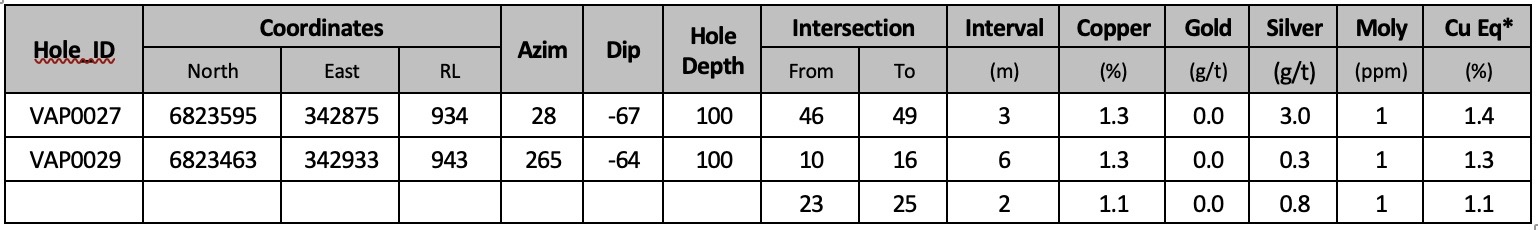

Results Returned from Valentina High Grade Satellite Resource Drilling

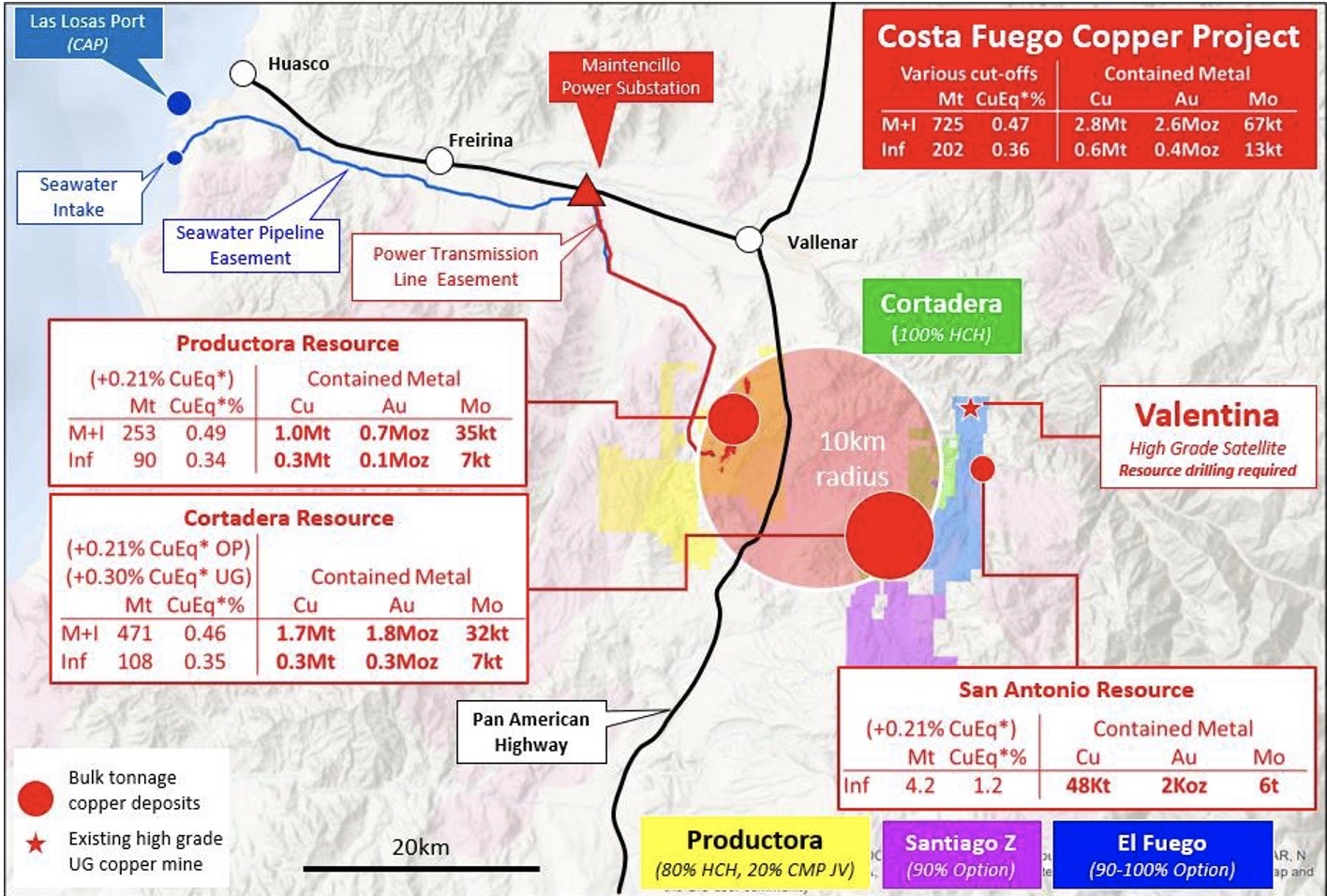

Valentina and its neighbouring San Antonio satellite copper deposit (Inferred resource of 4.2Mt grading 1.2%CuEq (1.1% Cu, 2.1g/t Ag) for 48kt Cu and 287koz Ag, reported March 2022) are located immediately to the east of Cortadera.

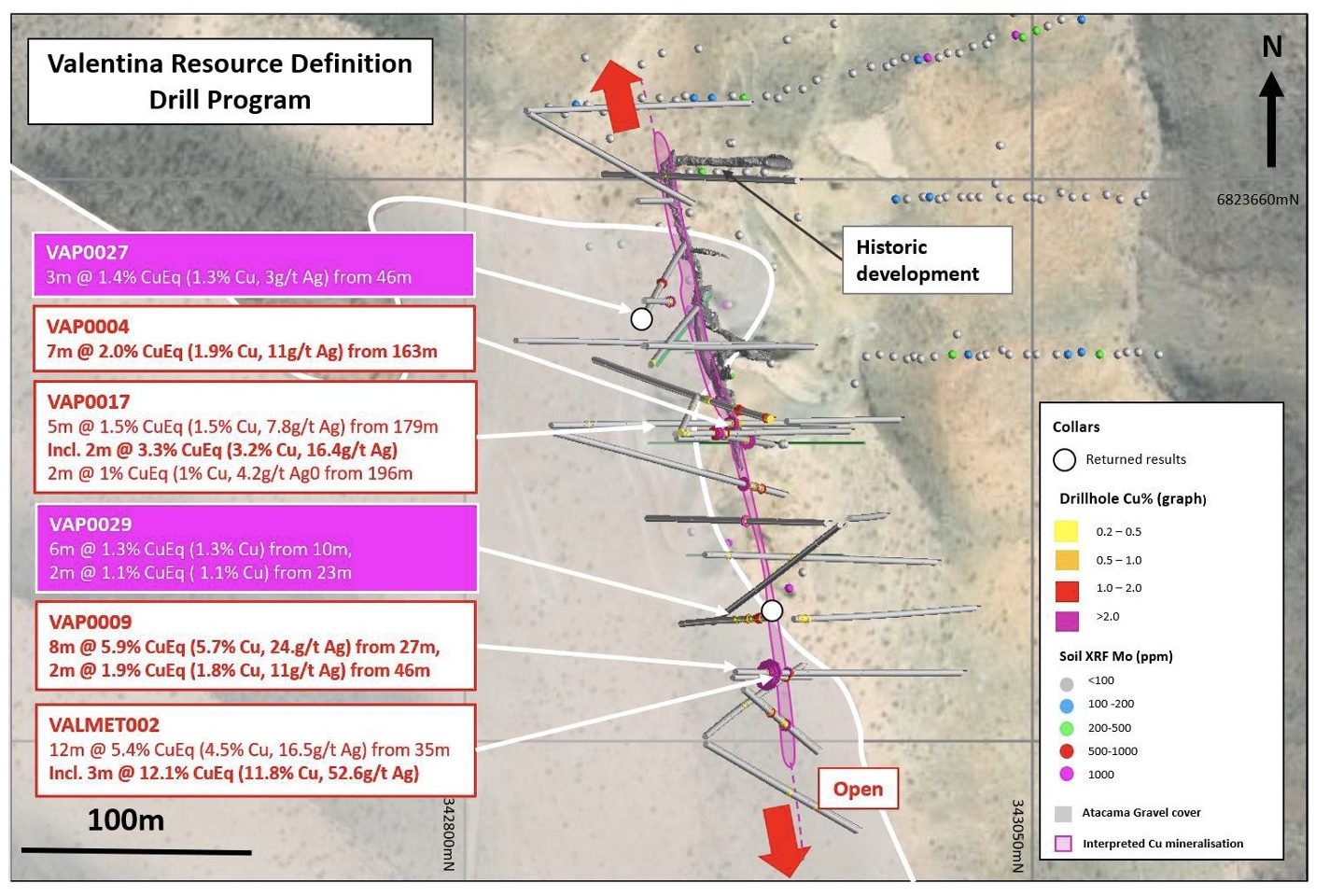

Results from an expanded drill program at Valentina have returned additional intersections of shallow copper sulphide and oxide mineralisation.

Highlights include:

- 3m grading 1.4% CuEq (1.3% Cu, 3.0g/t Ag) from 46m downhole (VAP0027)

- 6m grading 1.3% CuEq (1.3% Cu) from 10m downhole and 2m grading 1.1% CuEq (1.1% Cu) from 23m (VAP0029)

Of the four holes drilled in the expanded program, two recorded significant intersections, one intersected historic underground workings and one did not intersect the mineralised trend.

High grade copper-silver mineralisation at Valentina is currently defined over 300m and is open along strike and at depth.

A regulatory clearing application has been submitted to facilitate follow-up drilling at Valentina, which will expand resource drill definition across this potential high-impact future addition to Costa Fuego.

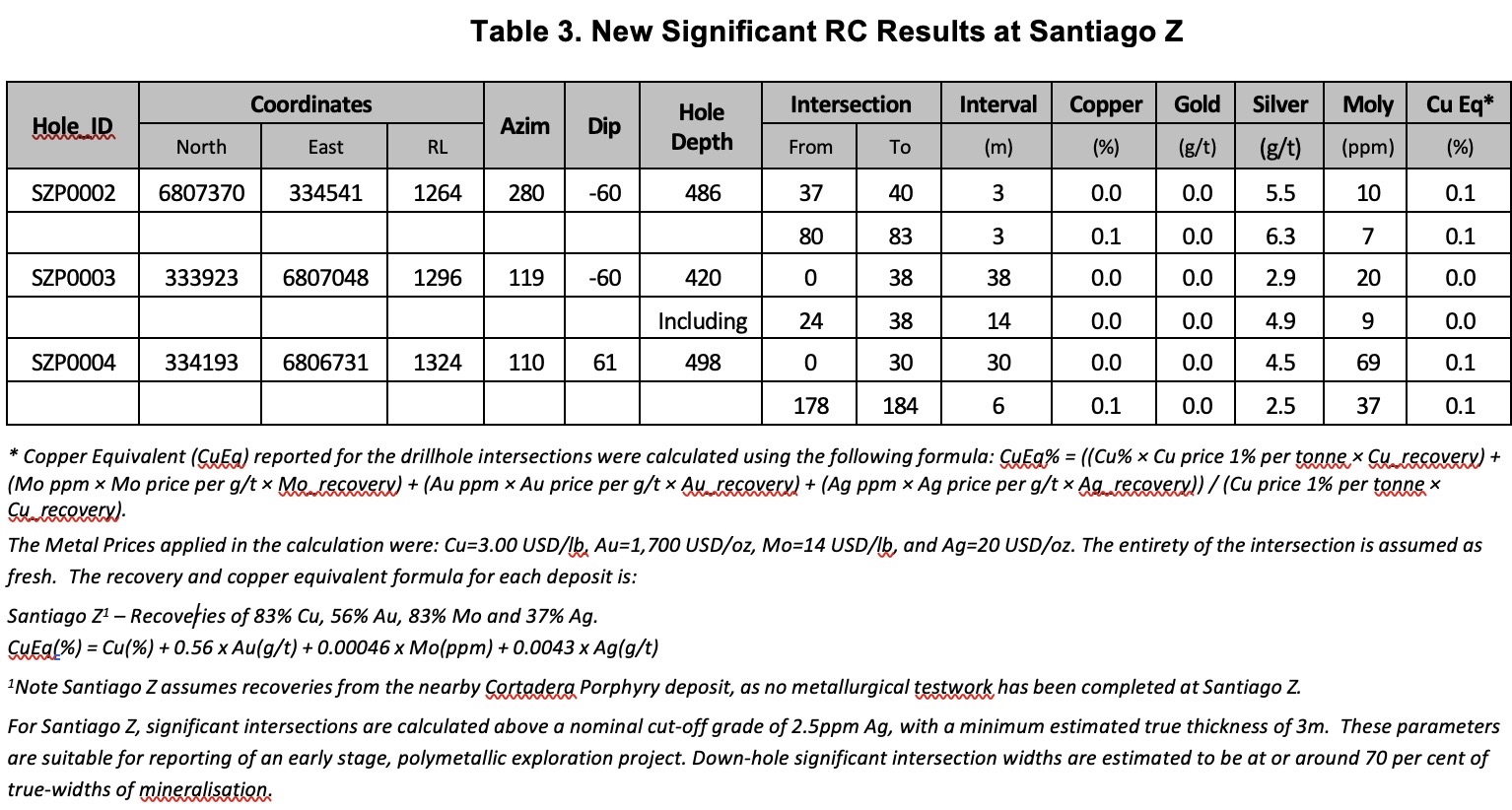

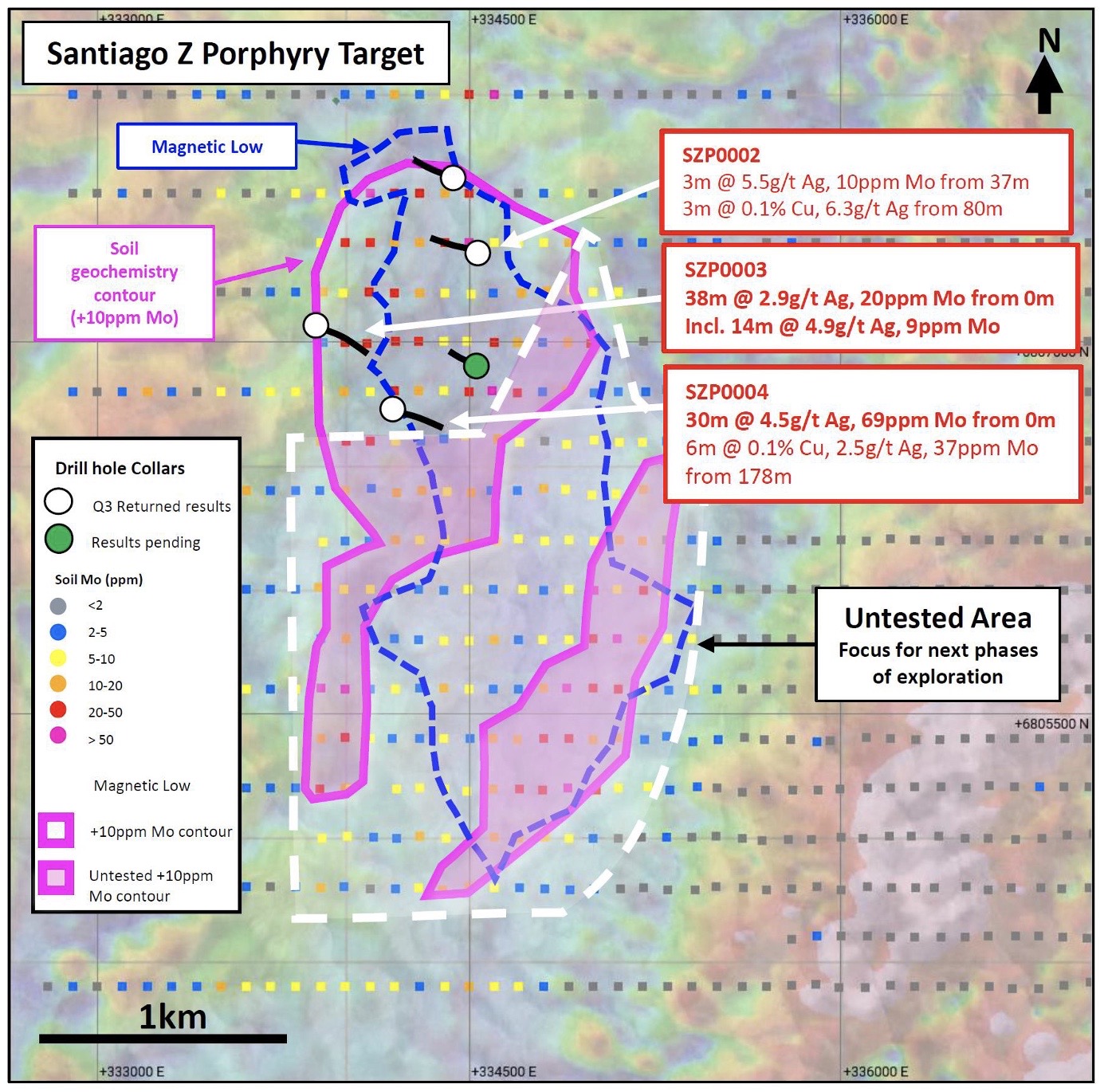

Phase One Drilling Complete at Santiago Z Intersects Wide Zones of Shallow Silver

Five deep Reverse Circulation (RC) drill holes for 2,146m were completed across the northern extent of the large-scale Santiago-Z porphyry target, lying approximately 5km south of the Cortadera resource (as reported to ASX 9th April 2021).

First-ever drilling on the 4km long by 2km wide porphyry footprint has not intersected any significant widths of copper mineralisation. However, drilling has recorded wide zones of silver mineralisation indicating a potential distal response to copper porphyry mineralisation.

Results for four of the five drill holes completed have been returned (results pending for SZP0005). Interesting drill results from Santiago Z so far include:

- 30m @ 4.5g/t Ag & 69ppm molybdenum (Mo) from surface (SZP0004) and 6m @ 0.1% Cu, 2.5g/t Ag, 37ppm Mo from 178m

- 38m @ 2.9g/t Ag, 20ppm Mo from surface (SZP0003)

including 14m @ 4.9g/t Ag & 9ppm Mo

Drilling encountered a sequence of intensely folded sandstones, limestones and carbonaceous limestone units with wide zones of significant pyrite mineralisation (1-2% pyrite logged) associated with hydrothermal breccias and thin tonalitic porphyry dykes (quartz-feldspar-phyric and typically 2 to 6m in down-hole width).

Molybdenum appears to be preferentially enriched over the area of drilling owing to the presence of carbonaceous limestone units, with higher grade silver mineralisation encountered toward the southern extent of drilling (SZP0003 and SZP0004).

An updated geological model is being created using RC chip logging and downhole multi-element geochemistry. This information will be used for any additional phases of exploration at the Santiago Z target.

Exploration will focus on the southern extent of the Santiago Z porphyry footprint in advance of any planned second-pass clearing and drilling activities.

Figure 1. Location of Cortadera, Productora, San Antonio and Valentina in relation to coastal range infrastructure of Hot Chili’s combined Costa Fuego copper-gold project, located 600km north of Santiago in Chile. Alice is included in the Productora Resource.

* Copper Equivalent (CuEq) reported for the resource were calculated using the following formula: CuEq% = ((Cu% * Cu price 1% per tonne *Cu_recovery) + (Mo ppm * Mo price per g/t * Mo_recovery) + (Au ppm * Au price per g/t * Au_recovery) + (Ag ppm * Ag price per g/t * Ag_recovery)) / (Cu price 1% per tonne * Cu_recovery).

The Metal Prices applied in the CuEq calculation were: Cu=3.00 USD/lb, Au=1,700 USD/oz, Mo=14 USD/lb, and Ag=20 USD/oz. Metallurgical recovery averages for each deposit consider Indicated + Inferred material and are weighted to combine sulphide flotation and oxide leachingperformance. The recovery and copper equivalent formula for each deposit is:

Cortadera and San Antonio – Weighted recoveries of 82% Cu, 55% Au, 82% Mo and 37%Ag. CuEq(%) = Cu(%) + 0.56 x Au(g/t) + 0.00046 x Mo(ppm) + 0.0043 x Ag(g/t)

Productora – Weighted recoveries of 84% Cu, 47% Au, 47% Mo and 0% Ag (not reported)CuEq(%) = Cu(%) + 0.46 x Au(g/t) + 0.00026 x Mo(ppm)

Costa Fuego – Weighted recoveries of 83% Cu, 53% Au, 69% Mo and 23% AgCuEq(%) = Cu(%) + 0.52 x Au(g/t) + 0.00039 x Mo(ppm) + 0.0027 x Ag(g/t)

Total Resource reported at +0.21% CuEq for open pit and +0.30% CuEq for underground.

* Copper Equivalent (CuEq) reported for the drillhole intersections were calculated using the following formula: CuEq% = ((Cu% * Cu price 1% per tonne *Cu_recovery)+(Moppm*Mopriceperg/t*Mo_recovery)+(Auppm*Au priceperg/t*Au_recovery)+(Agppm*Agpriceperg/t*Ag_recovery))/(Cuprice 1% per tonne * Cu_recovery).x

The Metal Prices applied in the calculation were: Cu=3.00 USD/lb, Au=1,700 USD/oz, Mo=14 USD/lb, and Ag=20 USD/oz. The entirety of the intersection is assumed as fresh. The recovery and copper equivalent formula for each deposit is:

Productora – Recoveries of 84% Cu, 47% Au, 47% Mo and 0% Ag (not reported).

CuEq(%) = Cu(%) + 0.48 x Au(g/t) + 0.00026 x Mo(ppm)

For Productora, significant intersections are calculated above a nominal cut-off grade of 0.2% Cu. Where appropriate, significant intersections may contain up to 30m down-hole distance of internal dilution (less than 0.2% Cu). Significant intersections are separated where internal dilution is greater than 30m down-hole distance. The selection of 0.2% Cu for significant intersection cut-off grade is aligned with marginal economic cut-off grade for bulk tonnage polymetallic copper deposits of similar grade in Chile and elsewhere in the world. Down-hole significant intersection widths are estimated to be at or around true-widths of mineralisation.

* Copper Equivalent (CuEq) reported for the drillhole intersections were calculated using the following formula: CuEq% = ((Cu% × Cu price 1% per tonne ×

Cu_recovery) + (Mo ppm × Mo price per g/t × Mo_recovery) + (Au ppm × Au price per g/t × Au_recovery) + (Ag ppm × Ag price per g/t × Ag_recovery)) / (Cu price 1%

per tonne × Cu_recovery).

The Metal Prices applied in the calculation were: Cu=3.00 USD/lb, Au=1,700 USD/oz, Mo=14 USD/lb, and Ag=20 USD/oz. The entirety of the intersection is assumed

as fresh. The recovery and copper equivalent formula for each deposit is:

San Antonio and Valentina – Recoveries of 88% Cu, 72% Au, 88% Mo and 69% Ag.

CuEq(%) = Cu(%) + 0.68 x Au(g/t) + 0.00047 x Mo(ppm) + 0.0076 x Ag(g/t)

For San Antonio and Valentina, significant intersections are calculated above a nominal cut-off grade of 0.5% Cu, with a minimum estimated true thickness of 1.5m.

These parameters are aligned with marginal economic cut-off grades for narrow, high-grade polymetallic copper deposits of similar grade in Chile and elsewhere in

the world. Down-hole significant intersection widths are estimated to be at or around 70 per cent of true-widths of mineralisation.

Figure 5. Location of drill holes and new significant drill results at the Valentina high grade copper deposit. Valentina is open at depth, as well as along strike to the north and to the south (underneath a 10 to 15m deep cover of gravel). New intersections in purple text boxes.

Figure 6. Location of drill holes and new significant drill results at the Santiago Z exploration target. Phase Two drilling is currently being planned to intersect high-potential exploration targets in the untested area to the south of the Phase One drillholes.

Refer to ASX Announcement “Hot Chili Delivers Next Level of Growth” (31st March 2022) for JORC Code Table 1 information related to the Costa Fuego JORC-compliant Mineral Resource Estimate (MRE) by Competent Person Elizabeth Haren, constituting the MREs of Cortadera, Productora and SanAntonio (which combine to form Costa Fuego).

* Copper Equivalent (CuEq) reported for the resource were calculated using the following formula: CuEq% = ((Cu% * Cu price 1% per tonne *Cu_recovery) + (Mo ppm * Mo price per g/t * Mo_recovery) + (Au ppm * Au price per g/t * Au_recovery) + (Ag ppm * Ag price per g/t * Ag_recovery)) / (Cu price 1% per tonne * Cu_recovery).

The Metal Prices applied in the CuEq calculation were: Cu=3.00 USD/lb, Au=1,700 USD/oz, Mo=14 USD/lb, and Ag=20 USD/oz. Metallurgical recoveryaverages for each deposit consider Indicated + Inferred material and are weighted to combine sulphide flotation and oxide leaching performance. The recovery and copper equivalent formula for each deposit is:

Cortadera and San Antonio – Weighted recoveries of 82% Cu, 55% Au, 82% Mo and 37% Ag.CuEq(%) = Cu(%) + 0.56 x Au(g/t) + 0.00046 x Mo(ppm) + 0.0043 x Ag(g/t)

Productora – Weighted recoveries of 84% Cu, 47% Au, 47% Mo and 0% Ag (notreported) CuEq(%) = Cu(%) + 0.46 x Au(g/t) + 0.00026 x Mo(ppm)

Costa Fuego – Weighted recoveries of 83% Cu, 53% Au, 69% Mo and 23% AgCuEq(%) = Cu(%) + 0.52 x Au(g/t) + 0.00039 x Mo(ppm) + 0.0027 x Ag(g/t)

** Reported on a 100% Basis – combining Mineral Resource Estimates for the Cortadera, Productora and San Antonio deposits. Figures are rounded, reported to appropriate significant figures, and reported in accordance with the JORC Code, CIM and NI 43-101. Metal rounded to nearest thousand, or if less, to the nearest hundred.

Total Resource reported at +0.21% CuEq for open pit and +0.30% CuEq for underground.

** Note: Silver (Ag) is only present within the Cortadera Mineral Resource estimate.

Competent Person’s Statement- Exploration Results

Exploration information in this Announcement is based upon work compiled by Mr Christian Easterday, the Managing Director and a full- time employee of Hot Chili Limited whom is a Member of the Australasian Institute of Geoscientists (AIG). Mr Easterday has sufficient experiencethat is relevant to the style of mineralisation and type of deposit under consideration and to the activity which he is undertaking to qualify as a’Competent Person’ as defined in the 2012 Edition of the ‘Australasian Code for Reporting of Exploration Results, Mineral Resources and OreReserves’ (JORC Code). Mr Easterday consents to the inclusion in the report of the matters based on their information in the form and context in which it appears.

Competent Person’s Statement- Costa Fuego Mineral Resources

The information in this report that relates to Mineral Resources for Cortadera, Productora and San Antonio which constitute the combined Costa Fuego Project is based on information compiled by Ms Elizabeth Haren, a Competent Person who is a Member and Chartered Professional ofThe Australasian Institute of Mining and Metallurgy and a Member of the Australian Institute of Geoscientists. Ms Haren is a full-time employee of Haren Consulting Pty Ltd and an independent consultant to Hot Chili. Ms Haren has sufficient experience, which is relevant to the style of mineralisation and types of deposits under consideration and to the activities undertaken, to qualify as a Competent Person as defined in the2012 Edition of the ‘Australasian Code of Reporting of Exploration Results, Mineral Resources and Ore Reserves’. Ms Haren consents to theinclusion in the report of the matters based on her information in the form and context in which it appears. For further information on the Costa Fuego Project, refer to the technical report titled “Resource Report for the Costa Fuego Technical Report”, dated December 13, 2021, which is available for review under Hot Chili’s profile at www.sedar.com.

Reporting of Copper Equivalent

Copper Equivalent (CuEq) reported for the resource were calculated using the following formula: CuEq% = ((Cu% * Cu price 1% per tonne *Cu_recovery) + (Mo ppm * Mo price per g/t * Mo_recovery) + (Au ppm * Au price per g/t * Au_recovery) + (Ag ppm * Ag price per g/t *Ag_recovery)) / (Cu price 1% per tonne * Cu_recovery). The Metal Prices applied in the CuEq calculation were: Cu=3.00 USD/lb, Au=1,700 USD/oz, Mo=14 USD/lb, and Ag=20 USD/oz. Metallurgical recovery averages for each deposit consider Indicated + Inferred material and are weighted to combine sulphide flotation and oxide leaching performance. The recovery and copper equivalent formula for each deposit is:

Cortadera and San Antonio – Weighted recoveries of 82% Cu, 55% Au, 82% Mo and 37% Ag. CuEq(%) = Cu(%) + 0.56 x Au(g/t) + 0.00046 x Mo(ppm) + 0.0043 x Ag(g/t)

Productora – Weighted recoveries of 84% Cu, 47% Au, 47% Mo and 0% Ag (not reported) CuEq(%) = Cu(%) + 0.46 x Au(g/t) + 0.00026 x Mo(ppm)

Costa Fuego – Weighted recoveries of 83% Cu, 53% Au, 69% Mo and 23% Ag CuEq(%) = Cu(%) + 0.52 x Au(g/t) + 0.00039 x Mo(ppm) + 0.0027 x Ag(g/t)

Contact Details

Investor Relations

Graham Farrell

+1 416-842-9003

Graham.Farrell@harbor-access.com

Managing Director

Christian Easterday

Investor Relations

Jonathan Paterson

+1 475-477-9401

Jonathan.Paterson@harbor-access.com

Company Website

https://www.hotchili.net.au/investors/

About Hot Chili

Hot Chili Limited is a mineral exploration company with assets in Chile. The Company’s flagship project, Costa Fuego, is the consolidation into a hub of the Cortadera porphyry copper-gold discovery and the Productora copper-gold deposit, set 14 km apart in an excellent location – low altitude, coastal range of Chile, infrastructure rich, low capital intensity. The Costa Fuego landholdings, contains an Indicated Resource of 725Mt grading 0.47% CuEq (copper equivalent), containing 2.8 Mt Cu, 2.6 Moz Au, 10.4 Moz Ag, and 67 kt Mo and an Inferred Resource of 202 Mt grading 0.36% CuEq containing 0.6Mt Cu, 0.4 Moz Au, 2.0 Moz Ag and 13 kt Mo, at a cut-off grade of +0.21% CuEq for open pit and +0.30% CuEq for underground. The Company is working to advance its Costa Fuego Project through a preliminary feasibility study (followed by a full FS and DTM), and test several high-priority exploration targets.

Certain statements contained in this news release, including information as to the future financial or operating performance of Hot Chili and its projects may include statements that are “forward-looking statements” which may include, amongst other things, statements regarding targets, estimates and assumptions in respect of mineral reserves and mineral resources and anticipated grades and recovery rates, production and prices, recovery costs and results, and capital expenditures and are or may be based on assumptions and estimates related to future technical, economic, market, political, social and other conditions.These forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable by Hot Chili, are inherently subject to significant technical, business, economic, competitive, political and social uncertainties and contingencies and involve known and unknown risks and uncertainties that could cause actual events or results to differ materially from estimated or anticipated events or results reflected in such forward-looking statements.

Hot Chili disclaims any intent or obligation to update publicly or release any revisions to any forward-looking statements, whether as a result of new information, future events, circumstances or results or otherwise after the date of this news release or to reflect the occurrence of unanticipated events, other than as may be required by law. The words “believe”, “expect”, “anticipate”, “indicate”, “contemplate”, “target”, “plan”, “intends”, “continue”, “budget”, “estimate”, “may”, “will”, “schedule” and similar expressions identify forward-looking statements.

All forward-looking statements made in this news release are qualified by the foregoing cautionary statements. Investors are cautioned that forward-looking statements are not a guarantee of future performance and accordingly investors are cautioned not to put undue reliance on forward-looking statements due to the inherent uncertainty therein.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.