Japan Gold/Barrick alliance drills wide gold intervals of gold mineralization at the Mizobe, Japan

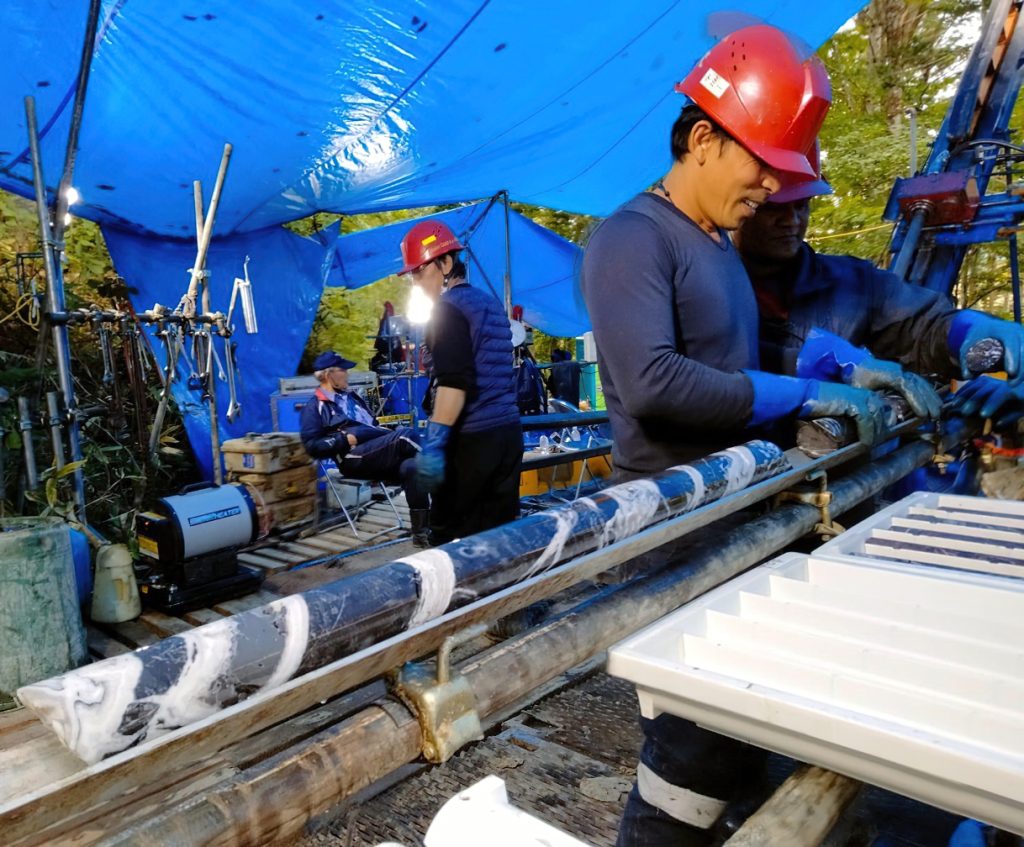

Japan Gold Corp. [JG-TSXV; JGLDF-OTCQB] and partner Barrick Gold Corp. [ABX-TSXV; GOLD-NYSE] reported results of its initial ‘framework’ drilling program at the Barrick Alliance Mizobe Project in Southern Kyushu, Japan. Drilling has encountered wide, and locally high-grade intervals in the initial, broad spaced framework drill program.

Highlights: Drill holes MZDD23-001, 002, and 003 successfully intersected gold mineralized intervals including the following notable results (all intervals are down-hole lengths).

MZDD23-003 returned 10.0 metres of 4.3 g/t gold and 6.6 g/t silver from 122.75 metres, including 4.0 metres of 6.2 g/t gold and 10.2 g/t silver) and 14.1 metres of 1.0 g/t gold and 4.8 g/t silver from 176.95 metres.

MZDD23-002 returned 6.1 metres of 1.4 g/t gold and 7.5 g/t silver from 126.7 metres, including 2.6 metres of 2.2 g/t gold and 10.6 g/t silver).

The Mizobe project is located within the Hokusatsu Region of Southern Kyushu, Japan’s largest gold producing district, with more than 11 million ounces of combined production from low-sulphidation epithermal deposits.

Within the Mizobe Project, historical mining activities focused on antimony-rich hydrothermal breccias at the Semari and Nakazon workings, prior to 1942. In 2000, the Metal Mining Agency of Japan (MMAJ) drill hole 12MAHT-2 was drilled 1 km southeast of the historical antimony workings, targeting a geophysical anomaly, the drill hole intersected a down-hole mineralized interval of 43.35 metres of 0.9 g/t gold, with an included interval of 20.3 metres of 1.2 g/t gold. No further drilling was completed around this mineralized intersection.

Sampling by the Alliance of discontinuous outcrop and quartz-vein / breccia float across a 2 by 2.5 km area showed strong anomalism with channel samples including 24.7 metres grading 1.0 g/t gold, and river float samples up to 18.9 g/t gold. The extent of gold and antimony anomalism was seen as highly encouraging considering much of the target area is concealed by a veneer of post-mineral volcanic ash.

The three initial, widely spaced frame-work drill holes at Mizobe targeted interpreted structural extensions below post-mineral volcanic ash on large step-outs between 600 to 1,000 metres from known surface mineralization and historical drilling data. Gold mineralization intersected includes both vein and breccia hosted styles. The significant widths of mineralization intersected in drilling below post-mineral cover, and the broad footprint of gold and pathfinder mineralization identified in channel sampling at surface indicate the potential of a significant gold-bearing hydrothermal system at Mizobe.

Next steps at Mizobe will include step-out drilling to further extend and define the geometry of the wide mineralized intervals. Further drilling will be scheduled at Mizobe around geophysical work programs already in progress on the high priority Aibetsu and Togi Alliance projects in Hokkaido and Honshu.

Japan Gold is a Canadian mineral exploration company focused solely on gold exploration across the three largest islands of Japan: Hokkaido, Honshu, and Kyushu. The company holds a portfolio of 34 gold projects which cover areas with known gold occurrences, a history of mining and are prospective for high-grade epithermal gold mineralization.

Japan Gold has a country-wide alliance with Barrick Gold Corporation to jointly explore, develop, and mine certain gold mineral properties and mining projects. The Barrick Alliance has completed a successful two-and-a-half-year country-wide screening program of 29 projects and has selected 6 with the potential to host Tier 1 or Tier 2 gold ore bodies for further advancement and 3 more recently acquired project areas and one recently acquired project, for initial evaluation.