Marathon Gold drills 1.47 g/t gold over 111 metres at Valentine Gold Project

Marathon Gold Corp. [MOZ-TSX; MGDPF-OTCQX] reported drill results from recent exploration drilling at the 100%-owned Valentine Gold Project in central Newfoundland. These latest results represent fire assay data from 13 drill holes completed within the 6-km long Sprite Corridor, including the new Berry Zone. Highlights include:

VL-20-838 intersected 1.47 g/t gold over 111 metres, including 35.02 g/t gold over 1 metre and including 14.92 g/t gold over 2 metres;

VL-20-839 intersected 14.39 g/t gold over 9 metres, including 60.13 g/t gold over 2 metres, and 4.25 g/t gold over 15 metres, including 13.34 g/t gold over 4 metres;

VL-20-837 intersected 8.24 g/t gold over 5 metres, including 36.21 g/t gold over 1 metre; and

VL-20-844 intersected 4.38 g/t gold over 8 metres;

All quoted intersections comprise uncut gold assays in core lengths.

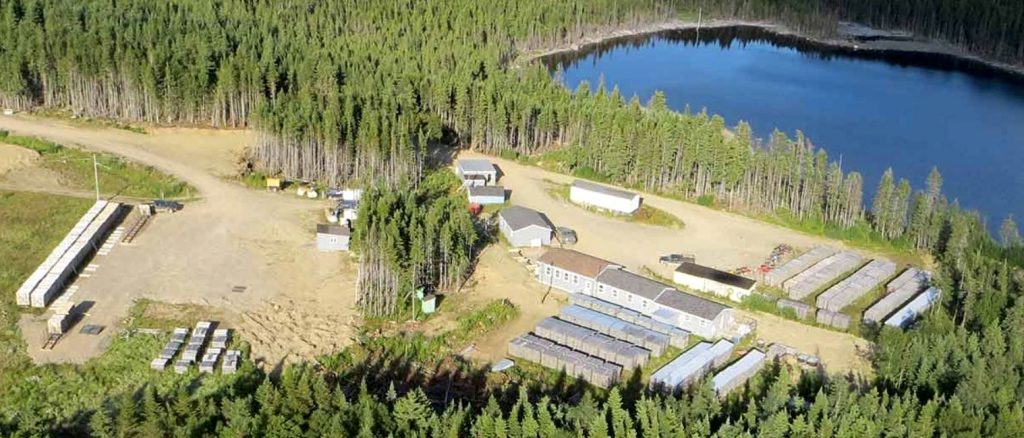

Matt Manson, President and CEO, commented: “These most recent assay results from the Valentine Gold Project represent exploration drill holes located both within the new Berry Zone, and step-out holes extending northeastwards towards the Frozen Ear Pond (FEP) Road area. Well-developed quartz-tourmaline-pyrite-gold vein mineralization is now being consistently intersected over the 650-metre strike extent of the Berry Zone between sections 13350E and 14000E. We currently have four exploration rigs active at Valentine: the first is conducting exploration step outs toward the FEP Road, moving north-eastwards from Berry; the second is moving south-westwards toward the FEP Road from the margin of the Marathon Deposit; the third is conducting the recently announced 8,000-metre in-fill program at Berry; and a fourth rig has been mobilized to the Narrows prospect, located northeast of the Marathon Deposit, to conduct scout drilling in an area of recent promising trenching results. The 2020 Exploration program at Valentine is discovery-oriented and focused on areas with little previous drilling. The success achieved to date at Berry has allowed us to add an in-fill program aimed at delineating potential mineral resources. We expect to be releasing the results of both the in-fill and greenfield drilling steadily through the fall as it comes available.”

An April 2020 Pre-Feasibility Study outlined an open pit mining and conventional milling operation over a 12-year mine life with a 36% after-tax rate of return.